Raw materials - decreasingly on the macro scale, increasing on the micro scale

Commodities trade was calmer last week as global macroeconomic developments continued to be in the spotlight, in some cases reducing the impact of fundamentally price-supporting microeconomic developments such as the decline in stocks of a number of commodities. Overall, however, we are not changing our long-term view of raw materials and their ability to strengthen over time, including due to underinvestment, urbanization, green transformation, sanctions imposed on Russia, as well as deglobalization.

The dollar strengthened again and bond yields rose, while the month-long rebound in the bearish US stock market began showing signs of exhaustion.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The representatives' comments turned out to be the impulse Federal Reservewho reiterated their stance on continuing interest rate hikes until inflation returned to the as yet unrevised higher long-term target of around 2%. These comments dispelled expectations that the recent series of weak economic data would encourage the Fed to slow down the expected pace of future rate hikes.

As a result of these developments, the risk of a global economic slowdown is gaining momentum as the fight against inflation remains far from winning, particularly given the risk of sustained high energy prices, from gasoline and diesel to coal and especially gas. This is a clear sign that there is an ongoing battle between macro- and microeconomic developments that is likely to result in an extended period of uncertainty about short- and medium-term forecasts.

In general, however, these events do not affect our long-term views on raw materials and their ability to strengthen over time. In my quarterly webinars I highlighted some of the reasons why we predict the so-called old economy, or tangible assets, will perform well in the coming years, fueled by underinvestment, urbanization, green transition, sanctions on Russia, and deglobalization.

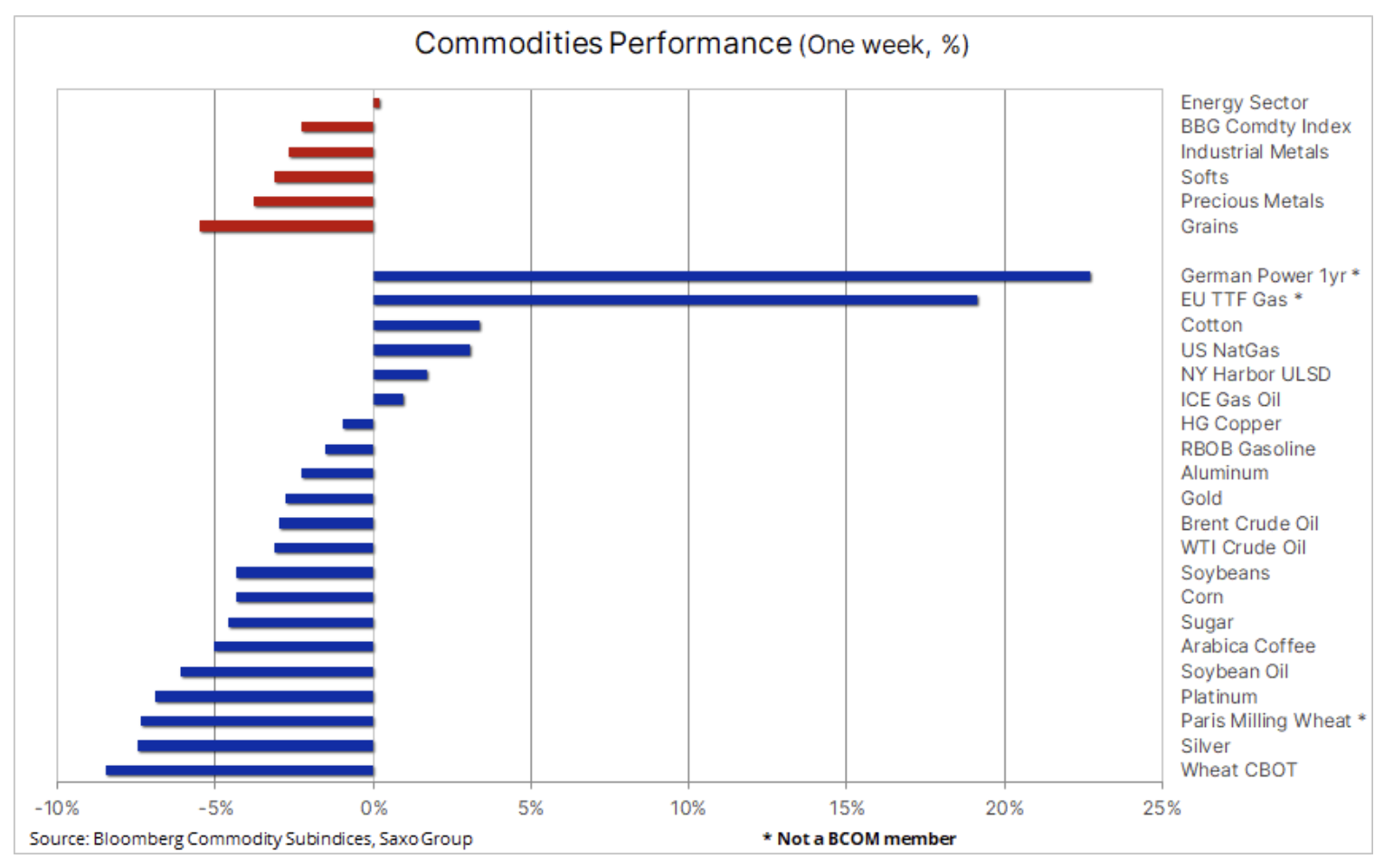

Returning to the results, the 2,3% decline seen above on the Bloomberg Commodity Index was in line with the dollar's rise as it strengthened against all ten currencies, including the Chinese Renminbi, represented on the index. It is worth noting that the EU's TTF contracts for gas and electricity, which prices jumped 23% and 20% respectively, and the contract for milling wheat listed on the Paris Stock Exchange, the price of which has plunged significantly, are not included in the above commodity index .

Overall increases in energy, led by refined diesel products and US natural gas, were more than offset by losses in other sectors, in particular the cereals sector, which saw world wheat prices plummet as well as the precious metals sector, which suffered due to the aforementioned strengthening of the dollar and an increase in profitability.

The focus is on the fight against inflation and its impact on economic growth

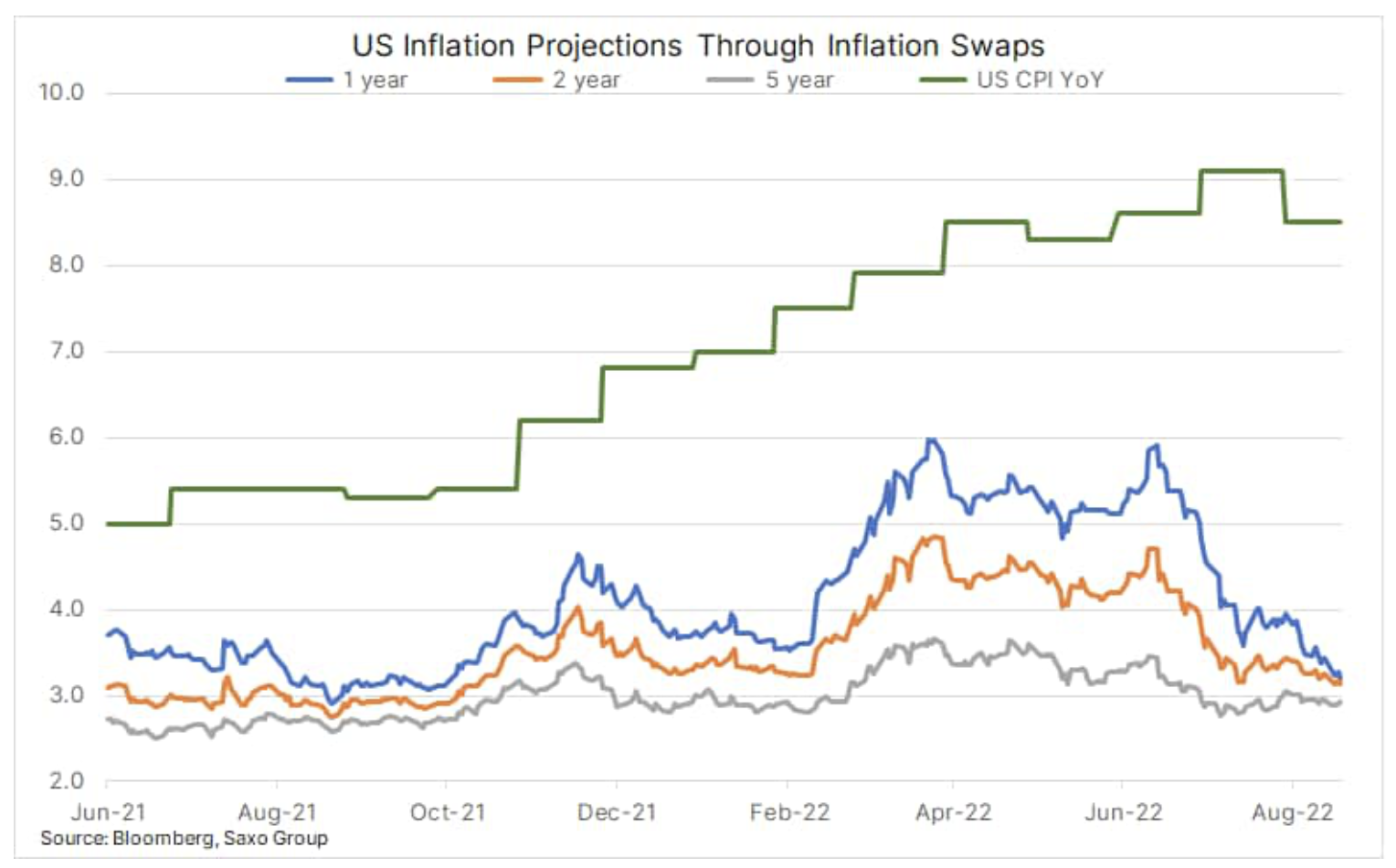

Aside from the projected economic slowdown in China due to its 'zero Covid' policy and the housing crisis that struck industrial metals, the most important factor in commodity prices was that macroeconomic outlook was influenced by the way central banks around the world made efforts to curb galloping inflation, forcing a decline in economic activity through aggressive monetary policy tightening. The process is ongoing, and the longer it takes, the greater the risk of an economic collapse. US inflation expectations have slumped dramatically over the course of the year, yet medium to long-term expectations remain anchored around 3%, which is still well above the Fed's 2% target.

Even reaching the 3% mark at this point seems a challenge, especially given the increased production costs due to energy prices. Failure to hit inflation remains the biggest short-term risk to commodity prices, with higher rates killing growth while reducing risk appetite as stock markets continue to decline. These phenomena, however, are one of the reasons why we believe that gold, and ultimately silver as well, is attractive as a hedge against the so-called. a policy error.

A sharp fall in world wheat prices

The prospect of a record harvest in Russia and a further influx of Ukrainian grain, along with a stronger dollar, contributed to a decline in prices on the Paris and Chicago stock exchanges. More than 500 tonnes of cereals have so far been transported from Ukraine via the recently opened corridor from Ukraine this month, and although this is still well below normal pace, this has nevertheless brought some relief as other regions have diversified due to unfavorable weather . The Chicago wheat futures contract fell to its January low after breaking the support at $ 000 / bu, while the Paris milled wheat contract (EBMZ7,75) hit its lowest price since March. After the elimination of most of the uncertainty that caused the purchasing panic in March, the market situation should normalize, the biggest unknown being the war in Ukraine, and with it the country's ability to produce and export key food products, from corn and wheat to sunflower oil.

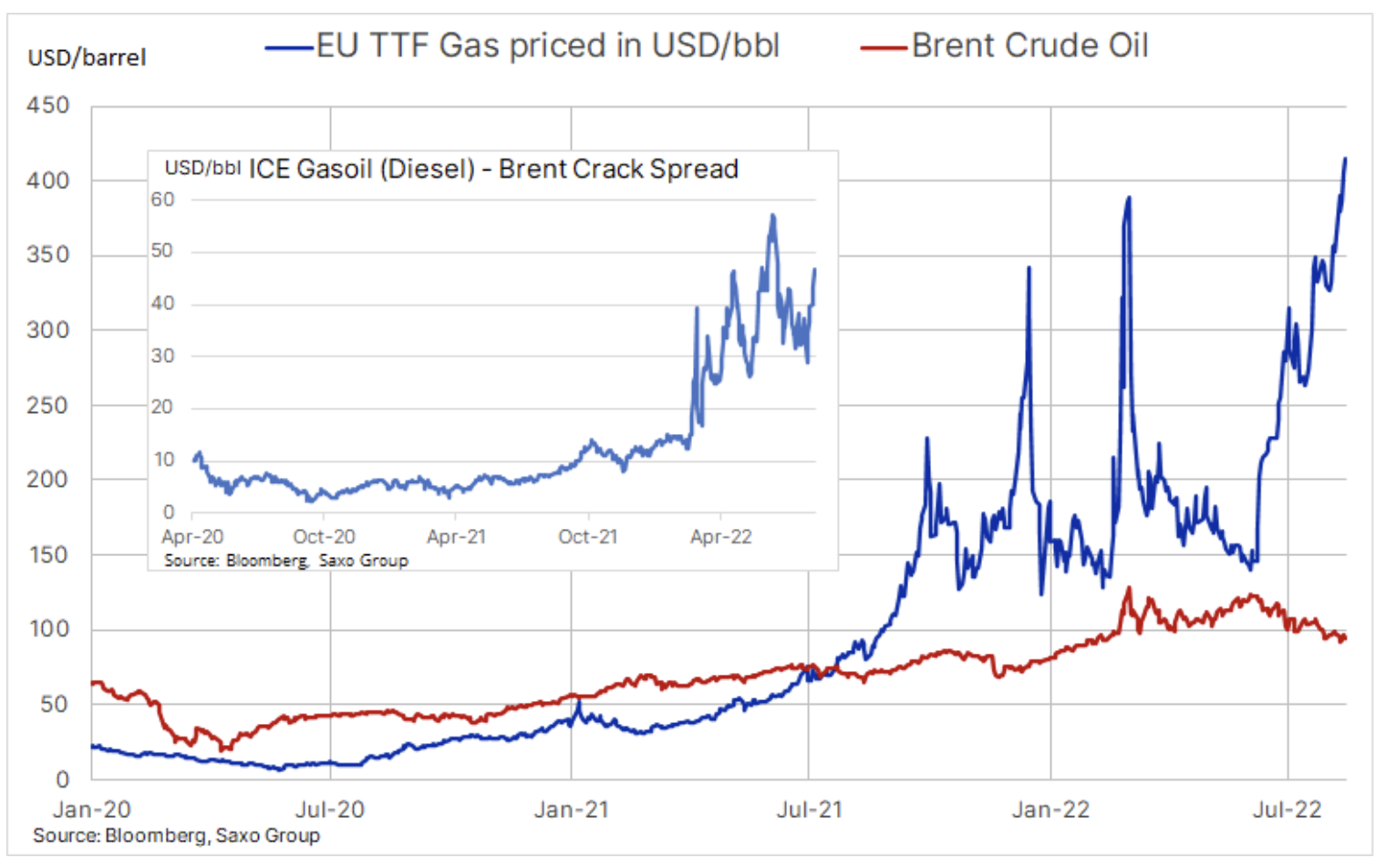

Gas price in the EU reaches 73 USD / MMBtu or 415 USD per barrel of oil equivalent

Natural gas in Europe saw its longest series of weekly gains this year, exacerbating the plight of industrial and household sectors while increasingly threatening to push economies across the region into a recessionary zone. The recent rise in already high gas and electricity prices as a result of the decline in supplies from Russia was the result of the August heatwave, which increased demand and, at the same time, contributed to lowering the water level in the Rhine. Increasingly, this prevents the safe passage of barges carrying coal, diesel and other essential raw materials, and refineries such as Shell in the Rhineland have been forced to cut production. In addition, European zinc and aluminum production capacities have halved, providing additional support for these metals prices at a time when the market is concerned about the demand forecast.

Heavy rains and cooler temperatures may offset the recent price increases in the short term, but overall the coming winter months remain a serious supply problem. This problem is related to, inter alia, with the risk of increased competition from Asia for LNG supplies.

The increase in refining margins provides new support for crude oil

Petroleum, which has been in a downtrend since June, is showing signs of sales fatigue: the technical forecast has become more price-friendly and the latest fundamentals have also provided some support. Concerns about an economic slowdown amid China's controversial methods to combat Covid outbreaks and problems in the real estate sector, as well as rapidly rising interest rates, have been the main drivers of the sell-off in other commodity sectors since March, and finally arrived in mid-June. to the oil market. Brent crude oil has since revised downward overall by $ 28.

Although the macroeconomic forecast is still in doubt, recent developments in the oil market - the so-called micro-events - increased the risk of rebound. The aforementioned energy crisis in Europe continues to worsen, resulting in soaring gas prices, making fuel products more attractive. This type of transition from gas to fuel was mentioned by the IEA in a recent report as the reason for an increase in the forecast of global oil demand growth in 2022 by 380 tonnes. barrels per day to the level of 2,1 million barrels per day. Since the publication of this report, the tendency to switch energy sources has increased even more, which has increased the pressure on the increase in refining margins.

While there have been niches of weaker demand in recent months, we do not expect them to have a significant impact on our broadly upward trend. Supply-side uncertainty remains too great to ignore, especially given the looming deadline for the release of oil from US strategic reserves and the imposition of an EU embargo on Russian oil. In addition, to this must be added the above-mentioned increased demand for fuel products intended to replace expensive gas. With this in mind, we maintain our forecast for the third quarter (USD 95-115).

Problems of gold and silver caused by the increase in the dollar and profitability

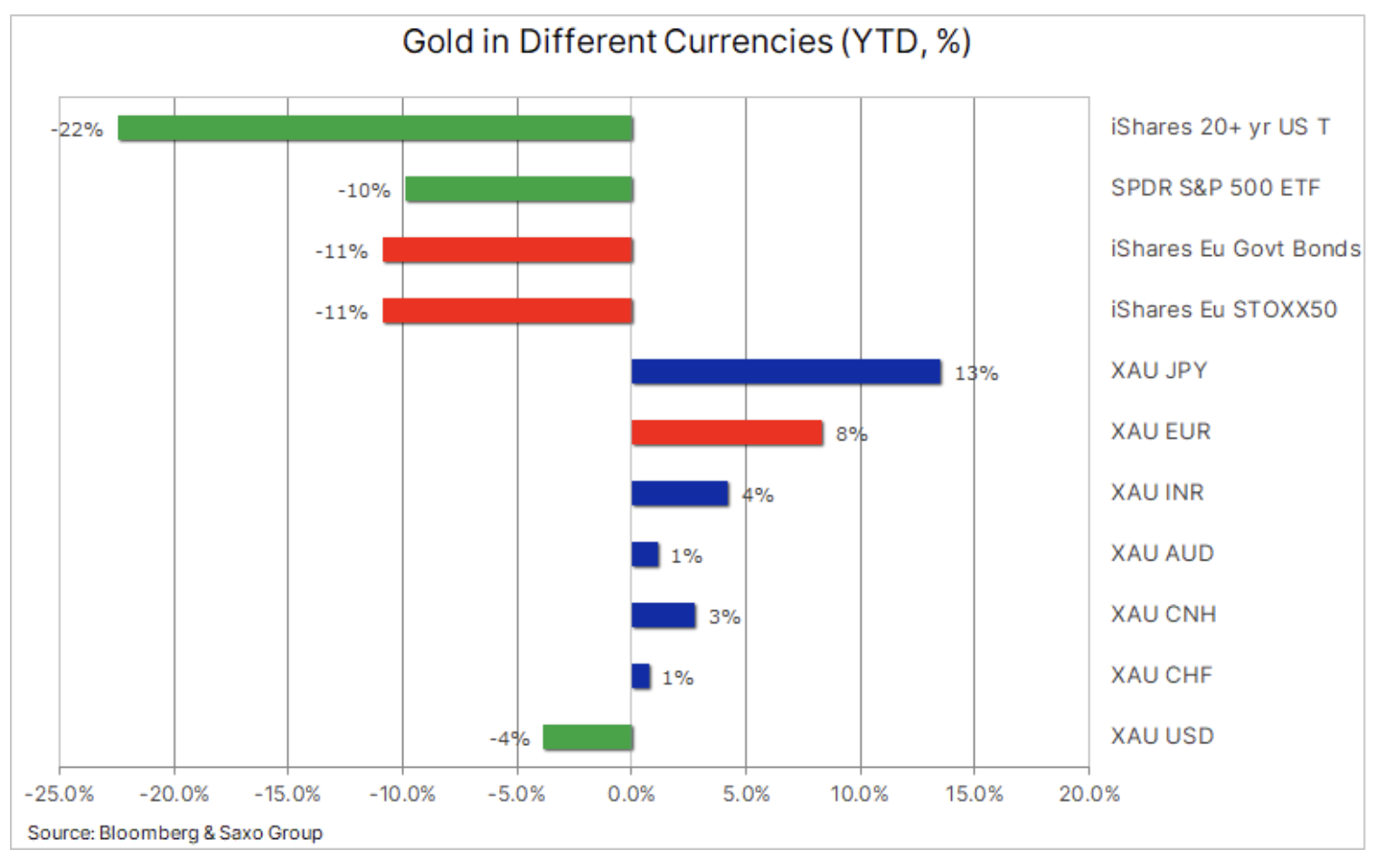

Both metals, silver in particular, showed a loss on a weekly basis after aggressive comments from several FOMC members contributed to the strengthening of the dollar and a simultaneous increase in ten-year US bond yields to around 3%. The revival in recent weeks has been, among others, as a result of stagnation in the markets for these metals, and since at the same time the stock markets also recorded an increase, the demand for gold mainly speculative investors following the momentum in the futures market.

Due to the positioning of these investors, the return last week was due to the need to reduce bullish positions after a two-week buy wave that increased the net long position in futures by 63k. lots, or 6,3 million ounces, which was the fastest pace of buying in six months. Meanwhile, stocks in exchange-traded funds have dropped to the six-month minimum, which indicates that investors so far have faith in the ability to FOMC to lower inflation in a relatively short time. Investors in doubt should maintain a long position as a hedge against policy error.

Some investors may feel hurt by gold's dollar-denominated YoY negative performance, but given that gold had to cope with the biggest spike in real yields since 2013 and a soaring dollar, its performance, in particular for non-dollar investors, they are acceptable compared to losses in the equity and bond markets. In other words, hedging with gold against policy error or other unforeseen geopolitical events has so far been almost costless.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)