Saxo Bank's Outrageous Outlook for 2021: Future Becomes Present

Saxo Bank has published 10 Shocking Predictions for 2021. This is a series of unlikely, but often underrated, events, the materialization of which could shake the financial markets. Here they are:

- Amazon is "buying" Cyprus

- Germany is granting financial aid to France

- Blockchain eliminates fake news

- The new Chinese digital currency is shaking capital flows

- Nuclear fusion takes humanity into a world of energy wealth

- Unconditional basic income decimates big cities

- The innovative dividend leads to the creation of the Civic Technology Fund

- An effective Covid-19 vaccine is hitting businesses

- Silver solar success due to the demand for photovoltaic installations

- New technologies provide turbo charging for frontier and emerging markets

Please note that these are not Saxo's official market forecasts for 2021. It is rather a warning against the potential mismanagement of risk by investors who assume only 19% probability of the described events. Outrageous Outlooks are designed to consider all possible situations, even if they are not very likely - this is particularly important in the context of this year's unexpected Covid-XNUMX crisis. The events with the strongest impact (and therefore significantly "shocking") usually turn out to be the ones that surprise the consensus.

Steen Jakobsen, Director of Investments in Saxo Bank, comments on the Shock Predictions for 2021:

- The Covid-19 pandemic and the painful electoral cycle in the United States have brought what might have seemed like a distant future, drastically accelerating almost every key social and technological trend. In short, the traumas of 2020 make the future the present in 2021.

- We saw the fastest slump and economic recovery in history, and central bank balance sheets and fiscal deficits exploded at an unprecedented pace. Therefore, our not-so-shocking forecast is that 2021 will start the process of verifying whether "dragging and pretending" can go on indefinitely, even if markets already include this expectation in their valuations.

- Covid-19 has accelerated all key trends, especially the structural transformation of the labor market, but at the same time the entire economic cake will grow even more - even per capita. An unconditional basic income is coming, which will create new ways of living and new priorities. It will also require new methods of redistributing the economic pie, without which all resources would endlessly and in a restrictive way be concentrated in the hands of monopolists and rentiers. A key driver for this future is the increase in the amount of available energy per capita, with almost no negative impacts on natural resources and with enough additional power to take advantage of Artificial Intelligence and quantum computing. It would bring us closer to fighting cancer, preventing the consequences of possible future pandemics, and tackling fake news with turbocharged blockchain technology.

The full text of the Shocking Forecasts for 2021 is available at Saxo Bank website. Below is a summary of the individual parts.

1. Amazon "buys" Cyprus

In 2021, Amazon and other internet monopolies and IT giants will watch with increasing concern when governments try to limit their influence. These corporations have become too powerful and are taxed very low. They have long employed an army of lobbyists, and some have even been employed virtually-governmental approach. An example is Microsoft, which opened a representative office to the United Nations and in New York hired a diplomat to maintain relations with European governments. Facebook, in turn, established a "Supreme Court" to deal with complaints and other issues.

In 2021, as the temperature at headquarters rises, Amazon will take steps to move its EU headquarters to Cyprus. Having experienced a hard hand in the EU during the 2010-2012 sovereign debt crisis, the country would be delighted to welcome the Internet giant and its associated tax revenues, which will reduce the debt-to-GDP ratio by almost 100%.

Amazon consultants will "help" Cyprus reform its tax code to resemble the Irish version, but with even lower rates of income tax and other corporate claims. All this with the approval of the country's authorities and society in the context of future profits and lower tax rates.

However, EU regulators will quickly understand the situation and take action against Amazon, forcing the corporation to change practices, and Cyprus and other member states to harmonize tax laws. The United States and other countries will also start fighting monopolies in 2021, and the arrogance of these companies will be punished.

Investments: sale of shares of monopoly technology companies, in particular AMZN.

2. Germany grants France financial assistance

France will be one of the most indebted European countries in the coming years. Before the Covid-19 pandemic, public debt was almost 100% of GDP, and private debt was soaring to almost 140% of GDP - exceeding the debt of Italy (106%) and Spain (119%). Pandemic bailouts have only accelerated this process - France's public debt is expected to exceed 2021% of GDP in 120.

Despite an enormous EUR 100 billion fiscal stimulus package and a program where the state guarantees up to 90% of loans to companies, France will not be able to avoid a wave of bankruptcies as many service sector companies will be powerless to face the continuing and revoked lockdowns. Investors will be increasingly pessimistic about the future profitability of equity and, as a result, will start selling out shares of French mega-banks. Net incomes will decline and loan reserves soar, bringing French banks' capitalization and price-to-book value to unprecedented levels. Given the dire state of public finances and the exceptionally high level of debt, France will have no choice but to humbly ask Germany to allow the ECB to print enough euros to save French banks and avoid the collapse of the entire system.

Investments: it is probably safer to buy French bank stocks after a bailout than to sell them in advance, but both are possible.

3. Blockchain eliminates fake news

In 2021, the growing threat of disinformation and the erosion of trust in even well-known news services will reach a critical level, and a response from the entire industry will be required. The largest media companies and social media platforms will be forced to counteract fabricated and misleading information. The solution will be an extensive blockchain network focused on spreading the message unchanged, with the possibility of verifying both content and source. Due to its structure, the introduced changes would be immediately visible to everyone, and each piece of information would enable the identification of its source, which would eliminate fake news.

Twitter or Facebook would definitely invest in such technology, driven mainly by the self-preservation instinct, as the risk of tightening surveillance observed for several years will increase significantly. Alternative news sites disseminating conspiracy theories such as QAnon, spreading disinformation about the coronavirus pandemic, disseminating alleged evidence of electoral fraud, etc. will unexpectedly cease to be available on major social media platforms. Reality will prevail and the "echo chambers" will fail.

Investments: buying stocks of Verizon, IBM and social media.

4. The new Chinese digital currency is shaking up capital flows

Digital Currency Electronic Payment (DCEP) will be a blockchain-based digital version of the yuan (CNY). In 2019, 80% of all payments in China were made through the WeChat Pay and AliPay apps. The People's Bank of China will want to go a step further and, as part of this process, improve the effectiveness of monetary and fiscal policy through an increasingly cashless society and to increase financial inclusiveness.

Giving foreigners full access to Chinese capital markets will remove the main concern of foreign investors regarding transactions and investments in CNY, i.e. the liquidity of this currency and direct access to own investments in China. At the same time, the stability of the Chinese currency and the traceability and supervision integrated with it thanks to blockchain technology will literally eliminate the risk of capital flight or illegal transfers of funds outside China.

This idea will be part of the Chinese dual circulation system, improving transparency in the territory of the Middle Kingdom, while increasing the use of CNY abroad as an attractive alternative to the US dollar in transactions. As a government sponsored centralized currency it will continue to be seen as "fiat money", but from a Chinese perspective, it will simply be a feature of the digital yuan as it will allow negative interest rates on "cash" and the nominal GDP target will be much easier to achieve.

Opening a Chinese capital account and creating a currency that can compete with the US dollar for reserve status will help boost consumption in China, finance a new Chinese pension system and deepen China's capital markets.

Investments: selling the US dollar and investing heavily in Chinese government bonds and equities at the expense of other countries' securities.

5. Nuclear fusion takes humanity into a world of energy wealth

If our economy is to continue to grow at a rate even close to its historic one, the world will need much more energy. Most of the alternative technologies and green energy are not yet a solution. The world urgently needs a breakthrough in this area.

Here comes 2021, when Artificial Intelligence is resolving the nonlinear complexities of plasma physics, paving the way for commercial fusion energy. The MIT's SPARC fusion reactor project, which was approved in 2020 as a viable route to less costly fusion energy, will be significantly improved with the new AI model. Engineers are adjusting the SPARC design and new models will show an energy gain factor of 20, leading to the biggest paradigm shift in energy technology since nuclear power. More importantly, massive investment from the public and private sectors would allow a new fusion project to be implemented in just a few years.

Mastering fusion energy will open up the perspective of a world whose progress, thanks to desalination and vertical agriculture, will no longer be hampered by water or food scarcity. It will be a world with cheap transport and fully developed robotics and automation, making the current youngest generation the last "working" out of necessity. Best of all, fusion power will allow almost any country to become independent of food and energy supplies and will ensure the fastest and greatest increase in living standards in history.

Investments: The political and investment climate will no longer favor "traditional" green energy, and the wind energy ETF FAN will go down by 2021% in 50.

6. Unconditional basic income decimates big cities

The Covid-19 pandemic has only accelerated the K-shaped recovery that has so far led to inequality and a tear in the fabric of society. The financialization of the economy means that one income is no longer sufficient to support a family. Technology is an additional factor here - the increasing deflationary impact on wages of forces such as software, AI and automation will lead to the erosion of more and more jobs in various industries. The risk that societies will be completely torn apart will make us realize that the Covid-19 activity was not a mere panic reaction, but the beginning of a new and lasting reality in the form of an unconditional basic income.

In the new era, urban office space will become 100% (or more) overestimated. The reason will be the reduction of jobs by automation and more frequent work from home, widespread during the Covid-19 pandemic. The value of commercial office properties will plummet, and with it, the value of commercial properties earmarked for restaurants and shops serving employees of nearby businesses.

Unconditional basic income will also change the approach to work-life balance, enabling many young people to stay in the communities in which they grew up. At the same time, specialists and support staff will start to leave large cities, as work opportunities will decrease and life in small, overpriced apartments in dangerous neighborhoods will lose its attractiveness.

Investments: sale of real estate fund units from large cities, such as SL Realty Trust (SLG), investing exclusively in Manhattan's New York office buildings, or Vornado Realty Trust (VNO), investing in Chicago, San Francisco and New York.

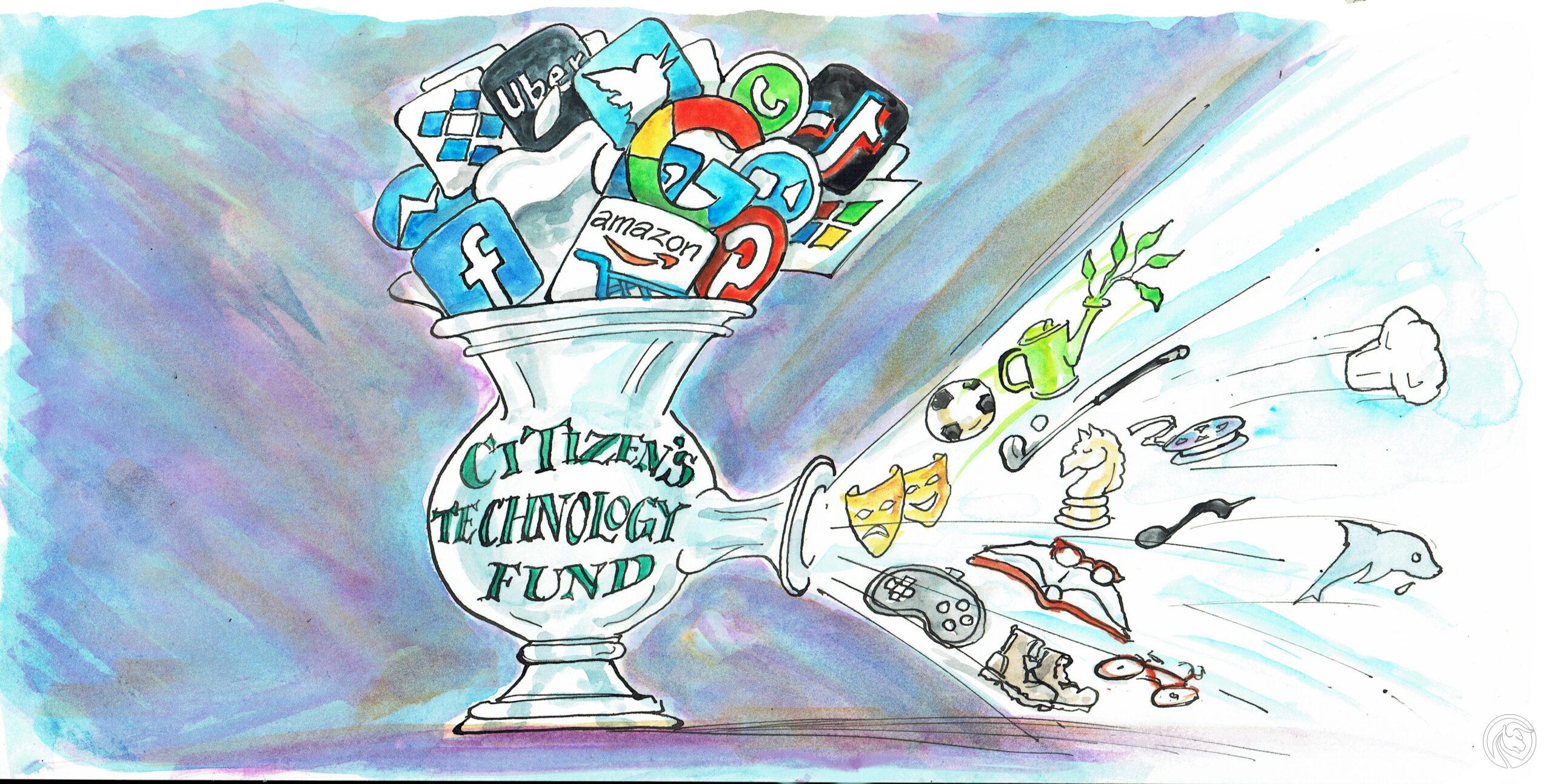

7. The innovative dividend will lead to the creation of the Civic Technology Fund

The march of new technologies, combined with reliance on the existing principles of the free market economy, is already undermining the social contract and even destroying the very fabric of society. Covid-19 has only accelerated these trends. In 2021 and beyond, our society will have to find a new path to avoid deepening injustice, but also political upheaval, social unrest and systemic risk.

A major policy review will take place in 2021, culminating in a new approach to reducing inequalities that will go beyond just a revision of the tax code.

There will be a Civic Technology Fund that will transfer some ownership of capital assets to every citizen and an additional share will go to the redundant workers, enabling them and everyone else to contribute to the economic growth of the digital age. This policy will be presented as the "Innovation Dividend" and will greatly contribute to alleviating the economic and social concerns of those who have not been involved in economic development in recent years. It will free up enormous entrepreneurship on an individual and society scale, as millions of people will have more time and energy without having to do repetitive and stressful work.

Investments: purchase of shares in companies from the education, arts, crafts and hobby sectors, but also digital, virtual reality, games and e-sports.

8. An effective Covid-19 vaccine is hitting businesses

The Covid-19 pandemic significantly accelerated the dangerous leverage of the global economy launched by the financial crisis of 2008-2009. The policy of providing near-infinite liquidity and easing financial conditions at all costs has led to historically low returns on investment-grade corporate and government bonds worldwide and has forced investors to take positions in riskier assets.

Investors' approach to risk is justified by the prospect of introducing an effective vaccine to the market, which would lead to economic recovery. In retrospect, it will be seen that the economy was over-stimulated during the pandemic, and the sharp recovery following the vaccine's launch will quickly lead to overheating. Inflation will pick up and unemployment will fall so quickly that the Fed will allow long-term government bond yields to soar, and with them the yields of riskier bonds.

The Federal Reserve will eventually make a political mistake. It will allow financial conditions to tighten too quickly through higher long-term interest rates, without introducing yield curve control - it was too distracted by the unexpected specter of 4-5% annual inflation and 6-8% annual wage growth through QXNUMX. Business bankruptcies will reach their highest level in years, and the first to go bankrupt are the most indebted companies operating in physical retail spaces, which were struggling with problems before - before the pandemic, when the economy was still in good shape.

Investments: sale ETF corporate HYG and JNK with high profitability.

9. Silver solar success in connection with the demand for photovoltaic installations

In 2021, silver will strengthen as a hard asset / precious metal as the US dollar depreciates and investors will face the harsh reality of not having any relief from negative real interest rates. Soaring inflation will worsen the situation and politicians will be slow to react to offer maximum support to their still recovering economies. With the Covid-19 vaccine, which will be introduced to the market by mid-year at the latest, excessive liquidity and overly loose policies will attract numerous buyers for any hard assets.

Turbocharging the increase in the price of silver in 2021, even in relation to gold, will result from the rapidly growing demand in industrial applications. In fact, there could be a real collapse in the supply of silver in 2021, affecting political support for solar investment, including under Biden's Presidency, Europe's Green New Deal, and China's 2060 carbon neutrality target.

Another supply-side challenge is the fact that more than half of the silver mined is a by-product of zinc, lead and copper mining, making it difficult for mining companies to meet the increasing, excessive, proportional demand for silver.

Investments: Buying silver as it will hit a record high of $ 2021 an ounce in 50.

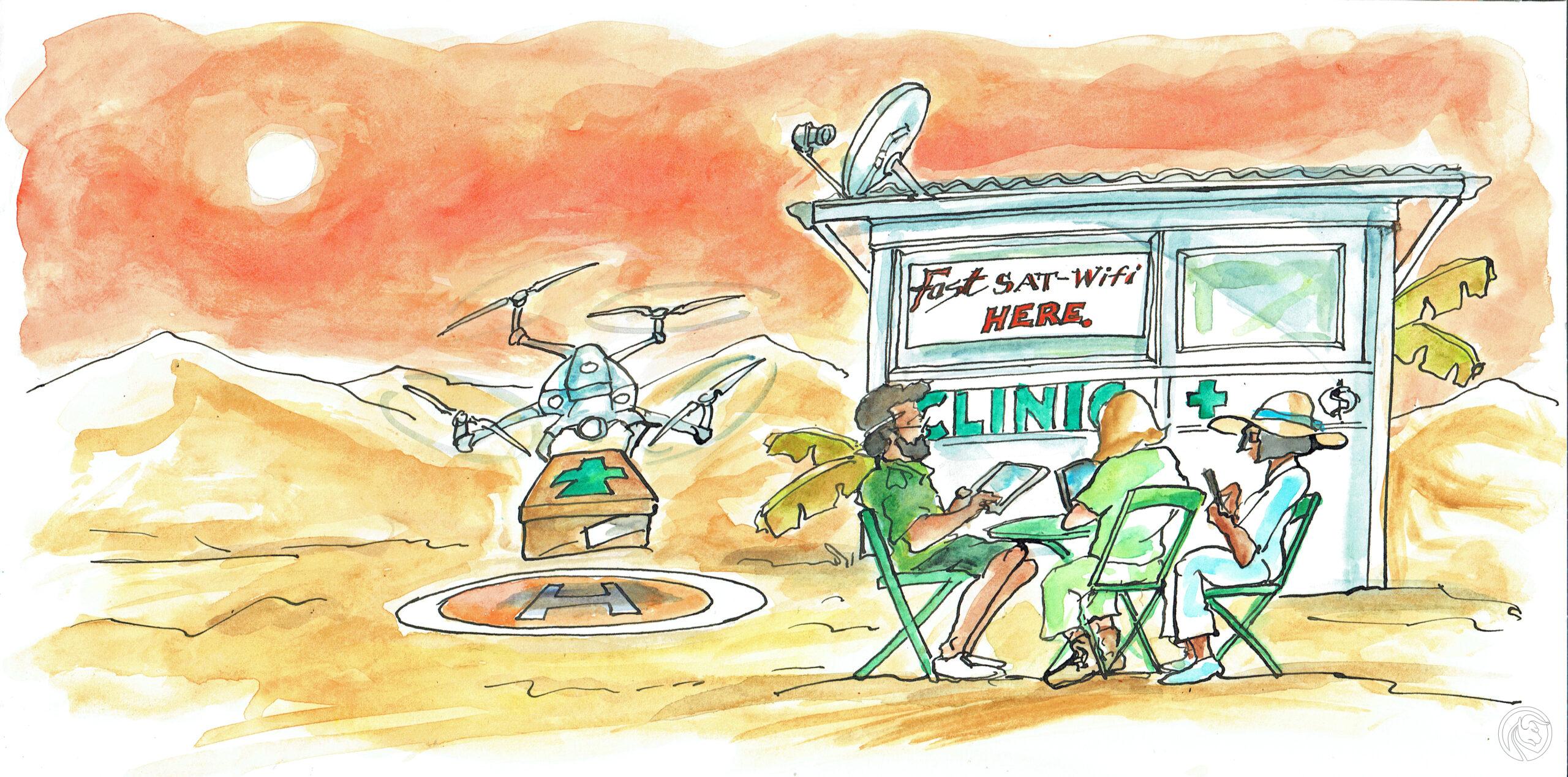

10. New technologies will provide turbo charging for frontier and emerging markets

In 2021, economists will discover that growth rates in many frontier and emerging markets have been greatly underestimated in recent years. Closer analysis will show that technologies can be at the heart of accelerating private-sector productivity growth far beyond what has been observed in developed markets in recent decades.

The first technology is the emergence of satellite Internet delivery systems, the aim of which is to reduce the cost of access and - importantly - increase the download speed by an order of magnitude. Starlink SpaceX will be the first to be used, and 2021 satellites will be operational by the end of 1500, benefiting education and business productivity in emerging and frontier markets. Second, there is a fintech revolution in payment solutions and banking systems that has already enabled billions of people to access the digital economy through mobile devices.

Finally, drones will revolutionize delivery systems and reduce the disadvantages and costs of living away from the largest cities. Combined with automation, they will also find application in agriculture - many underdeveloped rural areas around the world can benefit greatly from this type of technological solutions that increase productivity.

Investments: purchases of emerging market currencies due to forecast exceptional economic growth.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)