Swiss surveillance broke the rules of the game

Acquisition transaction Credit Suisse negotiated over the weekend by the Swiss government broke all the rules, leaving money to shareholders while eliminating holders of Additional Tier 1 (AT1) capital. The move disrupted the capital structure and sent the $1 billion AT250 market down yesterday morning. The decision by the Swiss regulator could have long-term consequences for European banks as the cost of capital will increase. So let's explain how the AT1 market works and why it is important for European banks.

Credit Suisse takeover project sends shockwaves through AT1 bonds

Carried out by the Swiss government forcibly the nuptials of UBS and Credit Suisse, as a result of which Credit Suisse shareholders received one UBS share for 22,48 Credit Suisse shares, valued the bank at approximately USD 2,8 billion. While shareholders received something in return, holders of Additional Tier 1 (AT1) capital were deprived of a nominal value of CHF 16 billion, an unprecedented event in the context of bailouts so far. This move is also against the order of the capital structure as AT1 capital is above equity, which means that shareholders should always absorb all losses before they reach the holders of AT1 capital.

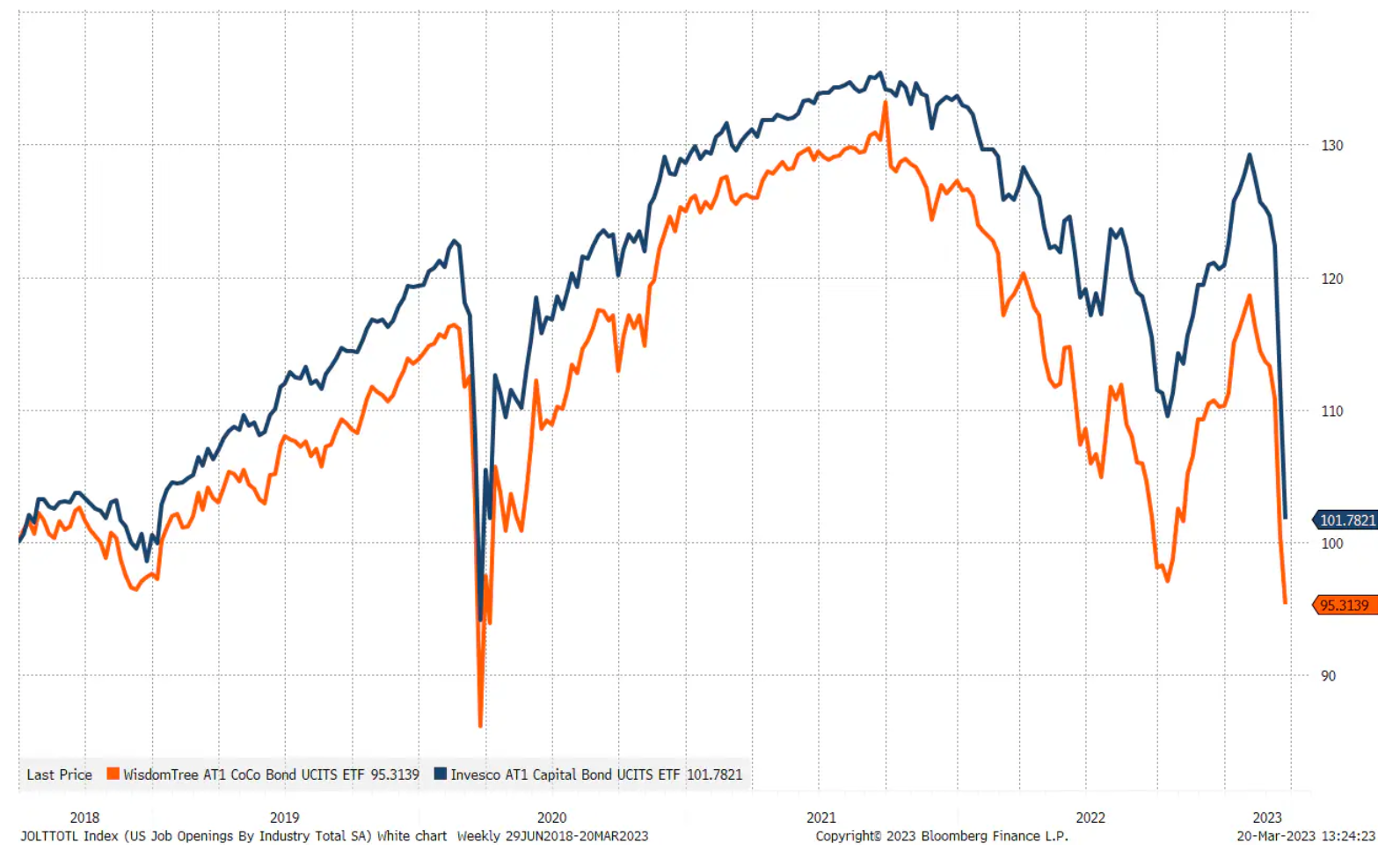

Markets reacted negatively to the takeover project, sending AT1 bonds down as much as 17,5% to an intraday low. To stem a further decline in confidence, EU banking supervisors reiterated that Common Equity Tier 1 (CET1) capital continues to suffer losses ahead of AT1 capital holders. The announcement calmed the market down and AT1 bonds rose by 8% from the lows.

The two largest exchange-traded funds monitoring CoCo (part of the Tier 1 capital structure) and all AT1 bonds.

Just as we still do not know the long-term consequences of the SVB rescue, which included a full guarantee for uninsured deposits, we do not know the long-term consequences of the Credit Suisse bailout. Last night's event could cause lasting damage to the AT1 capital market and thus negatively impact long-term funding and the cost of capital for European banks. In any case, the jump in risk for banks in the last two weeks will mean that the risk appetite in the system will decrease, and thus the cost of capital for the economy will increase.

What is AT1 Capital?

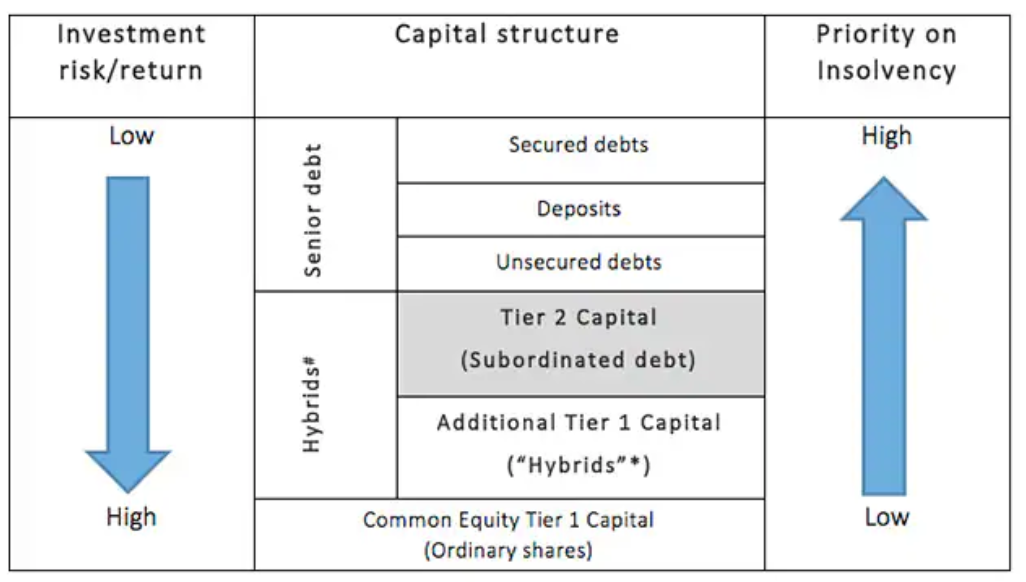

The structure of AT1 bonds was created after the global financial crisis under the new ones Basel III rules as a new layer of capital to act as a shock absorber in the event of stress or bank failure. The chart below presents a simplified capital structure of a financial institution and it can be seen that AT1 bonds are characterized by almost the highest risk - only Common Equity Tier 1 capital holders (shareholders) are exposed to higher risk.

One of the key criteria for AT1 bonds is that they are perpetual, meaning they do not expire to ensure that they are permanent capital. Some of the AT1 bonds can be converted into shares if the bank's leverage ratio falls below a certain threshold. These types of AT1 bonds are called conditionally convertible bonds or so-called "CoCo" (eng. Contingent convertible bonds) and account for approximately 40% of the outstanding AT1 bonds. The value of the AT1 market is approximately USD 254 billion, with 97% of the issues being issued by banks, and 80% of all AT1 bonds are issued by European banks.

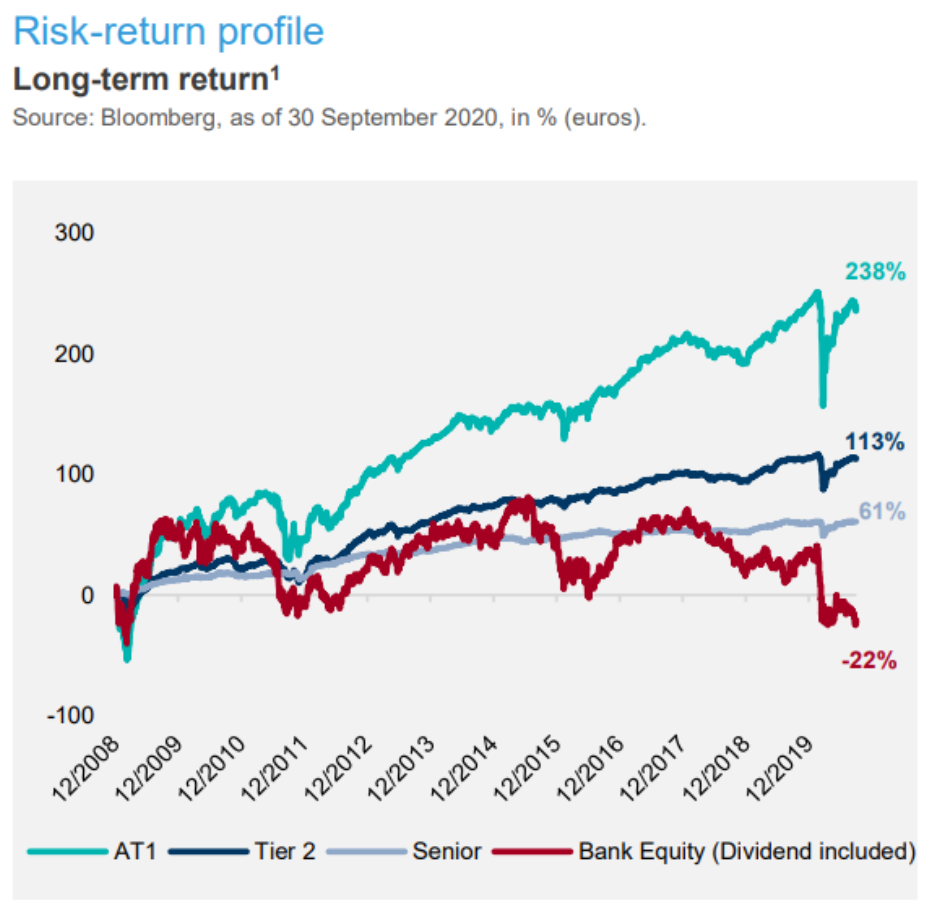

One of the reasons why European banks became the main issuers of AT1 bonds is that the share capital return profile was so dismal that it was not a viable source of capital unless the bank was willing to issue capital at a high cost. AT1 bonds functioned as a bridge and tool for creating Tier 1 capital. Investors willingly invested in AT1 bonds, in particular global systemically important banks, in the belief that governments would not allow anyone other than shareholders to lose their entire investment. The risk/reward ratio was therefore seen as quite favorable for AT1 bondholders. Lazard Asset Management's return chart shows that the return profile of the capital structure has been distorted. Banks' equity, as the riskiest element of the capital structure, should have generated a higher return than AT1 bonds – but it did not, which indicates that the European banking system is structurally unhealthy from the investors' point of view.

For those who would like to learn even more about AT1 capital, we can recommend the following two Lazard Asset Management short notes:

It should be noted that in May 2022, Fitch Ratings published a memo on the existential crisis in Europe in relation to AT1 bonds, because European supervisory authorities are discussing the redesign of the capital structure, with a focus on Common Equity Tier 1 capital. In other words, EU supervisors acknowledge that the current system is not optimal. But how to increase the emphasis on Common Equity Tier XNUMX capital, when the return on equity of European banks is so low relative to its cost?

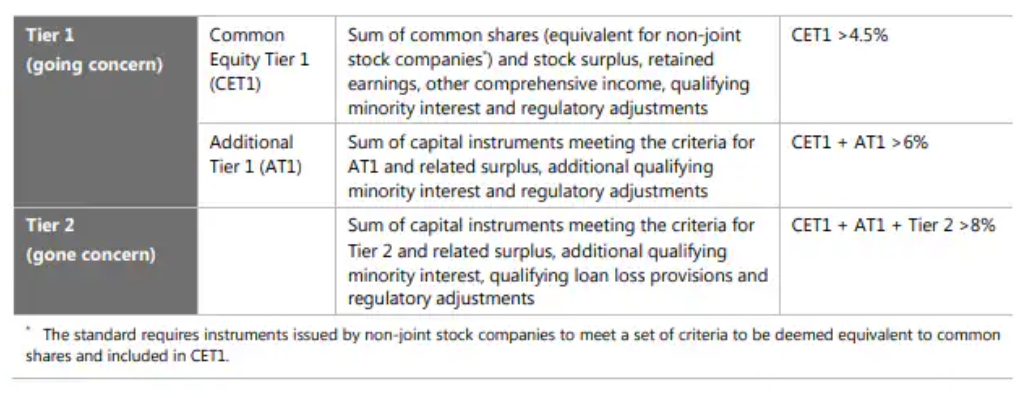

European banks are at the greatest risk

In accordance with the Basel III regulations, the leverage ratio for banks is defined as the ratio of the capital measure (Tier 1 capital) to the exposure measure (risk-weighted assets). Total regulatory capital includes Tier 1 capital (CET1 + AT1) and Tier 2 capital and should be at least 8%, implying a maximum leverage of 12x, but of course assuming that the risk weighting framework is set up correctly and works linearly across all risk scenarios; we argue that this is not the case, and therefore the system has hidden risks.

The entire Basel III system is based on tiered regulatory capital followed by a risk-weighted approach to assets on the balance sheet. Under current regulations, Treasury bonds have the lowest risk weight – and it makes sense. However, if we add the interest rate shock and accounting for held-to-maturity securities, which only works under the assumption of stability of liabilities, then regulators introduce highly non-linear risk into the system. Because, as we have seen with SVB and other banks, the risk weight was clearly too low in a context where liabilities were not stable. This is the fundamental risk in the banking system. If the general public finds that the value in use of deposits is too low compared to alternatives such as short-term treasury bonds, gold, bitcoinstocks, etc., the banking system could easily contribute to a further decline in accumulated deposits, depriving banks of the cheapest source of funding and potentially increasing pressure on forced asset sales.

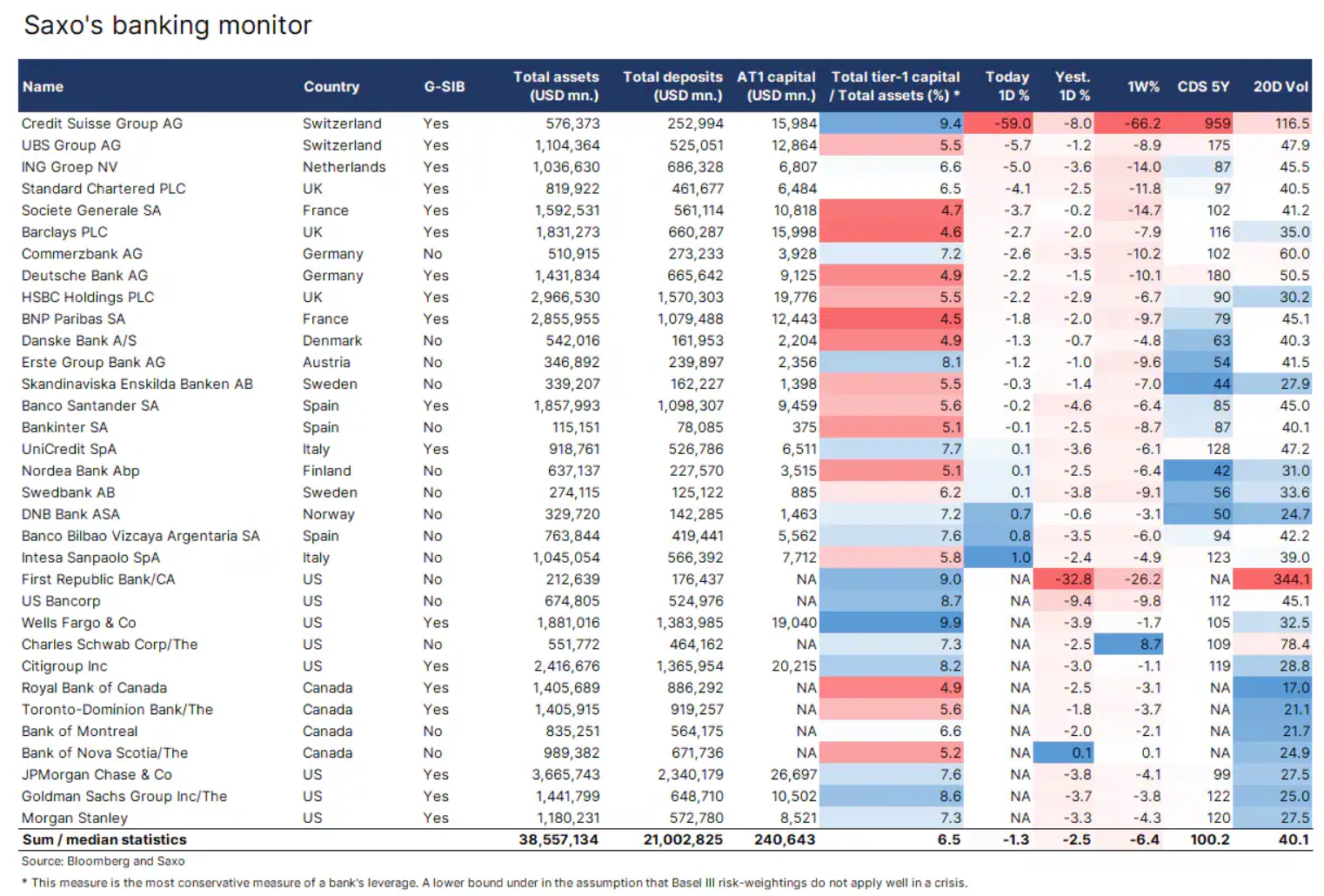

We've updated our bank monitor to include Canadian banks and added AT1 Equity so our customers can see which banks have the highest AT1 Equity reference amount. In addition, we calculated the leverage floor by dividing Tier 1 capital by total assets. This is naturally the most conservative measure of risk for banks, as all assets carry the same risk in this case. With this assumption, it becomes quite clear that US banks have a better capital structure than European and Canadian banks.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)