Tesla in ever-increasing trouble: stocks reach a new low

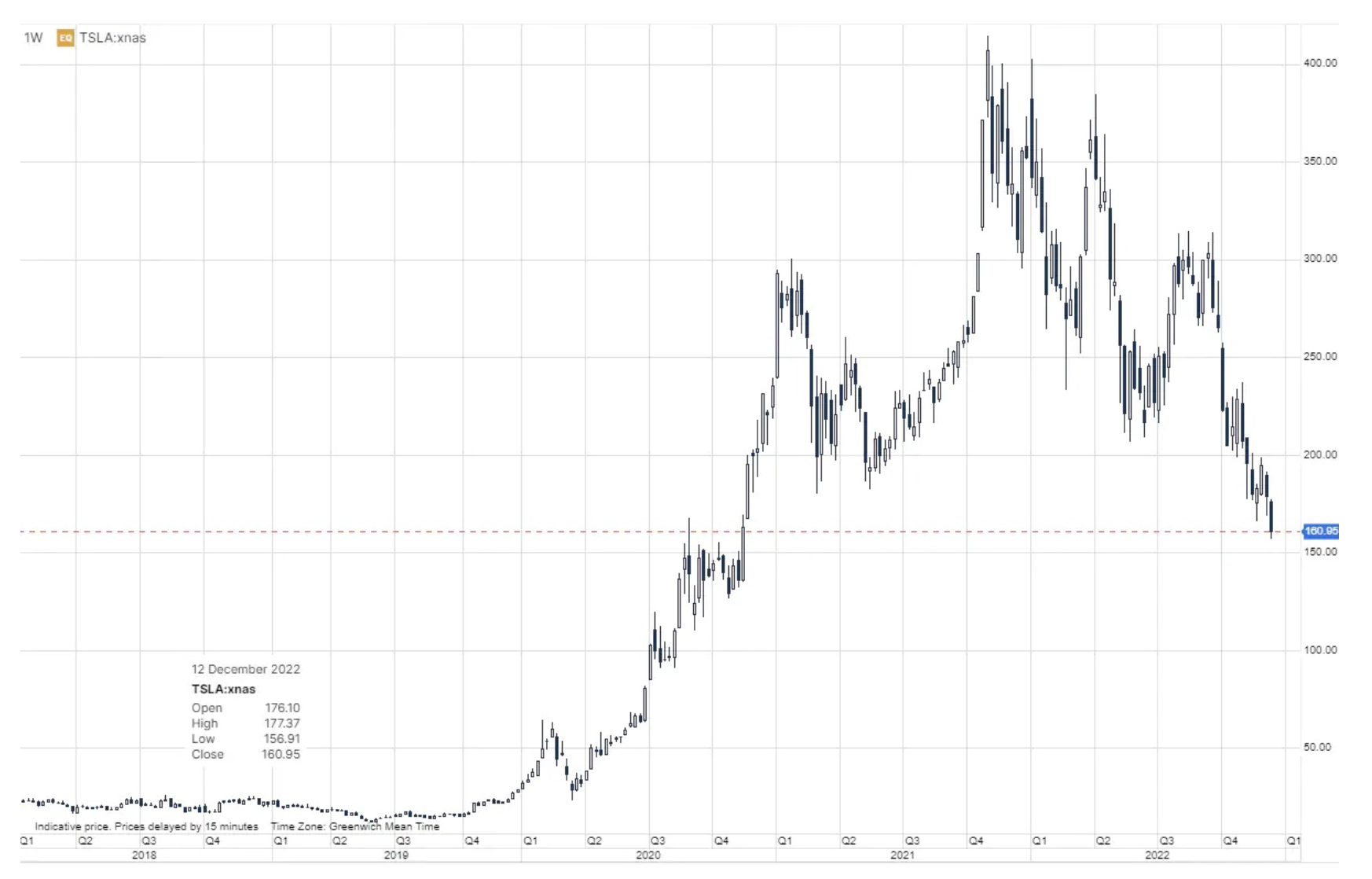

Just three months ago growth forecasts Tesla seemed certain, but since then the company's share price has fallen by 48%, reflecting growing nervousness over falling demand in China and Europe, the world's two largest electric vehicle markets. In addition, higher interest rates will continue to negatively impact equity valuations and financing costs as the automotive industry remains one of the most capital-intensive industries in the world.

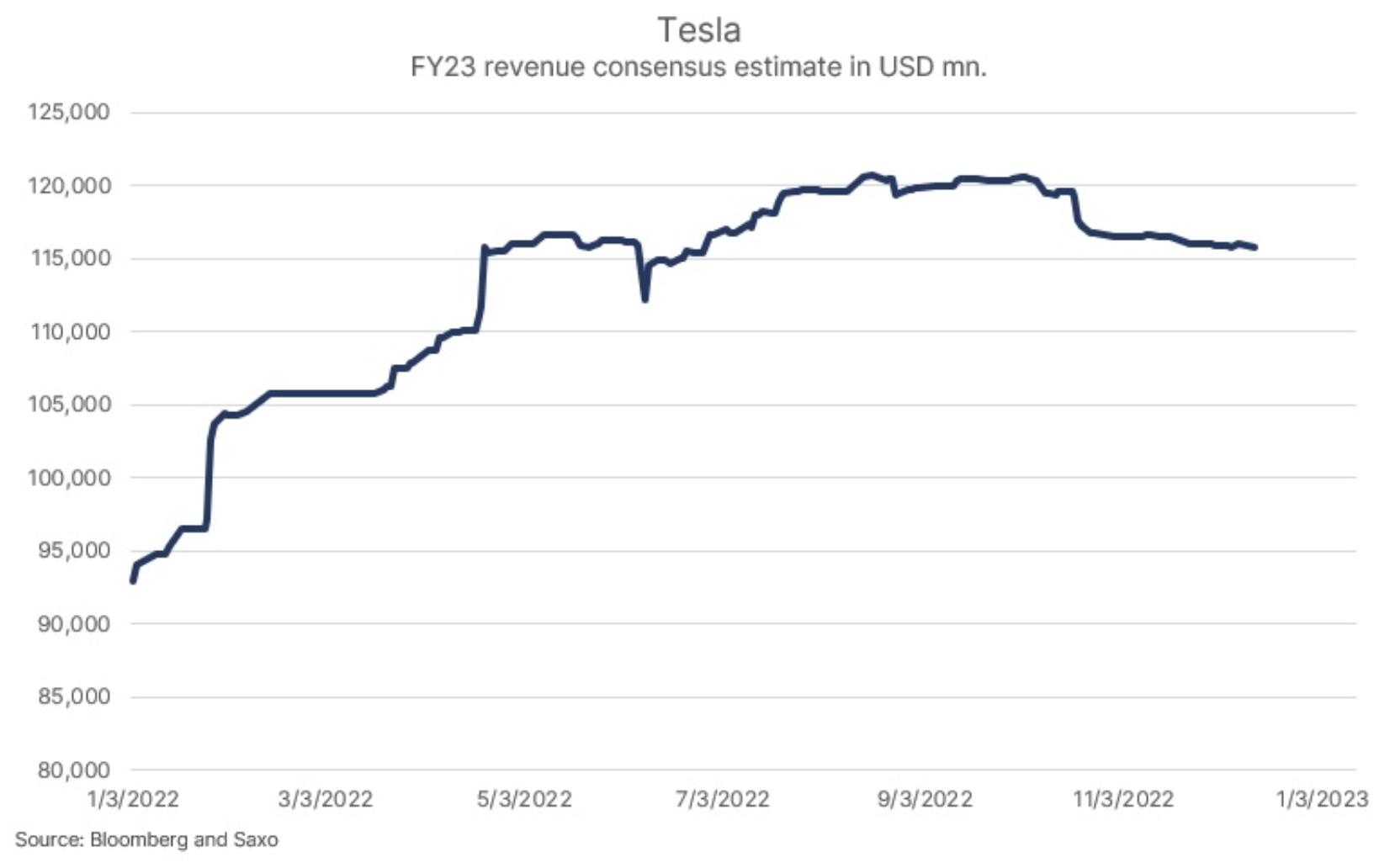

Tesla's growth forecasts are getting less and less realistic

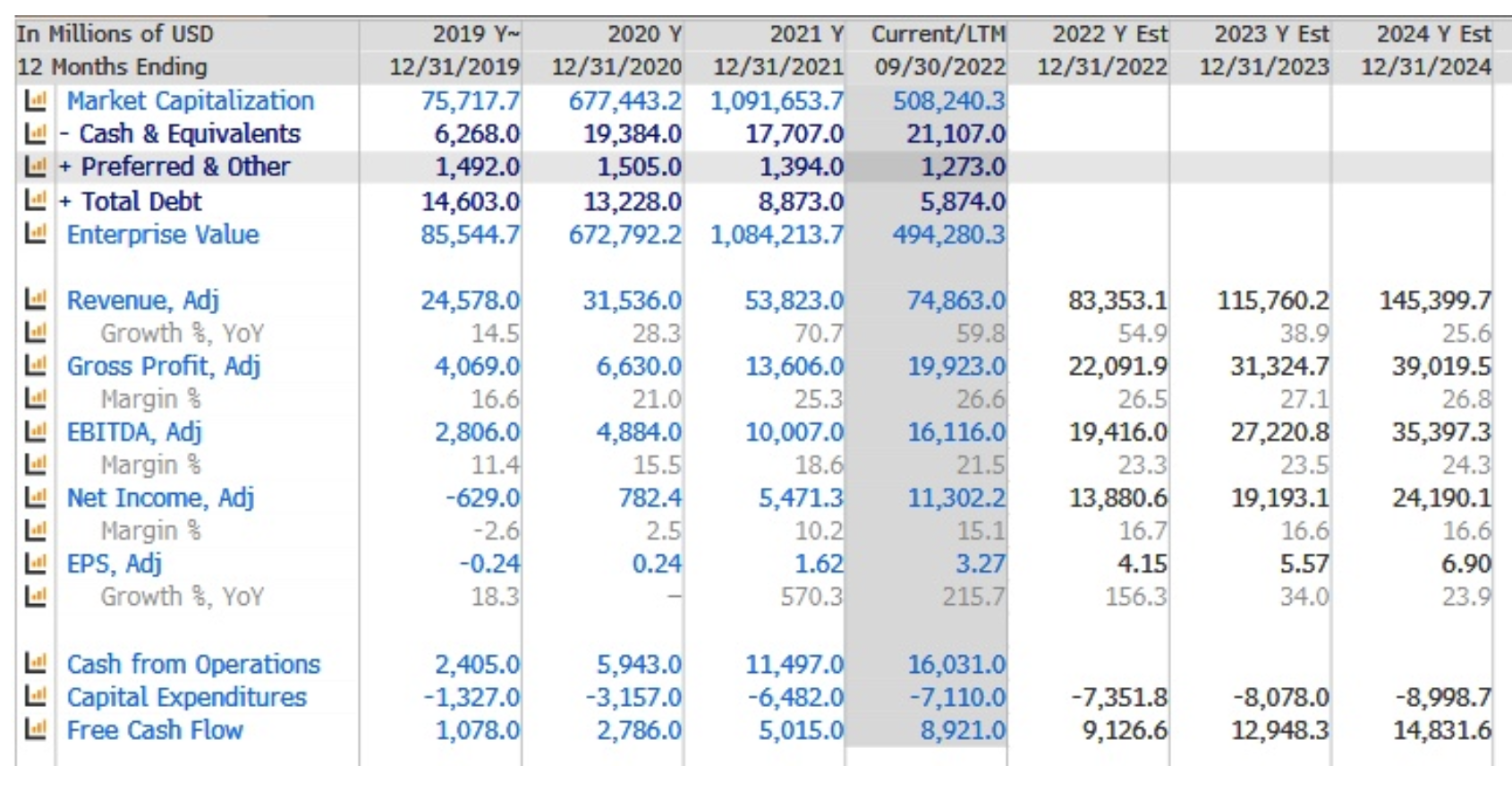

Elon Musk is famous for making exaggerated promises and so far it has cost him little - his most optimistic estimates assume increase in deliveries by 50% in a long-term perspective. However, Tesla shares are increasingly struggling, with the price down 61% from its peak in early November 2021. The initial revaluation of Tesla stock prices was driven by a rise in interest rates affecting not only capital-intensive industries but also companies with overpriced stocks, a category Tesla has been in for many years. Tesla shares have fallen 48% over the past three months, and with interest rates roughly flat over the period, it has failed to respond to the cost of capital. Instead, the market is now starting to factor in the deteriorating demand outlook for electric cars.

The fact that the demand for electric vehicles in China has decreased is nothing new and has been the theme since the beginning of the year, which was also reflected in the shares of Chinese electric vehicle manufacturers. To make matters worse, Thomas Schmall, general manager of VW's components division, reported this week that rising electricity prices in Europe are hurting demand in the regionand the increased prices of battery materials keep the prices of electric cars high. According to Schmall, only the US market still looks promising compared to expectations from a few months ago due to the US Inflation Control Act, but the US is also the smallest of the three major electric vehicle markets. Tesla's expected high growth rate assumes that electricity production can expand rapidly and prices will remain low; at present, this key assumption appears to be based on shaky grounds.

Rising energy prices are an obstacle

In the longer term, a slowdown in the transition to electric vehicles due to rising energy prices will mean competitors are able to catch up in design and manufacturing processes, offsetting some of Tesla's lead as an industry pioneer. Given the global slowdown, which is now also translating into the adoption of electric vehicles, it is difficult to understand the consensus on revenue in 2023 estimated at USD 116 billion, which would be an increase of 39%. Such expectations seem detached from reality, including the incoming information and the decline in share prices.

Tuesday's decline in Tesla stock was interesting given the positive stock market situation; in relation to customers Sax we observed that retail investors were net buyers of the company's shares. Assuming Saxo's customer base is a good indicator of overall retail investor behavior, we have a situation where institutional investors are becoming realistic about electric vehicle makers like Tesla, while retail investors are still driven by Elon Musk's hopes and dreams .

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)