The risk of Nvidia's optimistic prospects

Government actions could potentially disrupt the AI boom in the US stock market. The US government is considering extending controls introduced in October 2022 to AI chips exported to China. Nvidia shares fell 4.5% yesterday in pre-market trading, and the trend could quickly spread to other US tech stocks. Nvidia's revenue by geographic region shows that China was by far the biggest driver of its growth in FY2024 Q30 (ending April 2023, XNUMX) as Chinese tech companies aim to catch up with US growth artificial intelligence. Expanded export controls on AI chips are by far the biggest risk to Nvidia's optimistic outlook in May, so investors should consider their exposure to risk.

READ: Nvidia - Learn the history of the company that rules Wall Street and Nasdaq

The Biden administration is considering new restrictions on AI chips

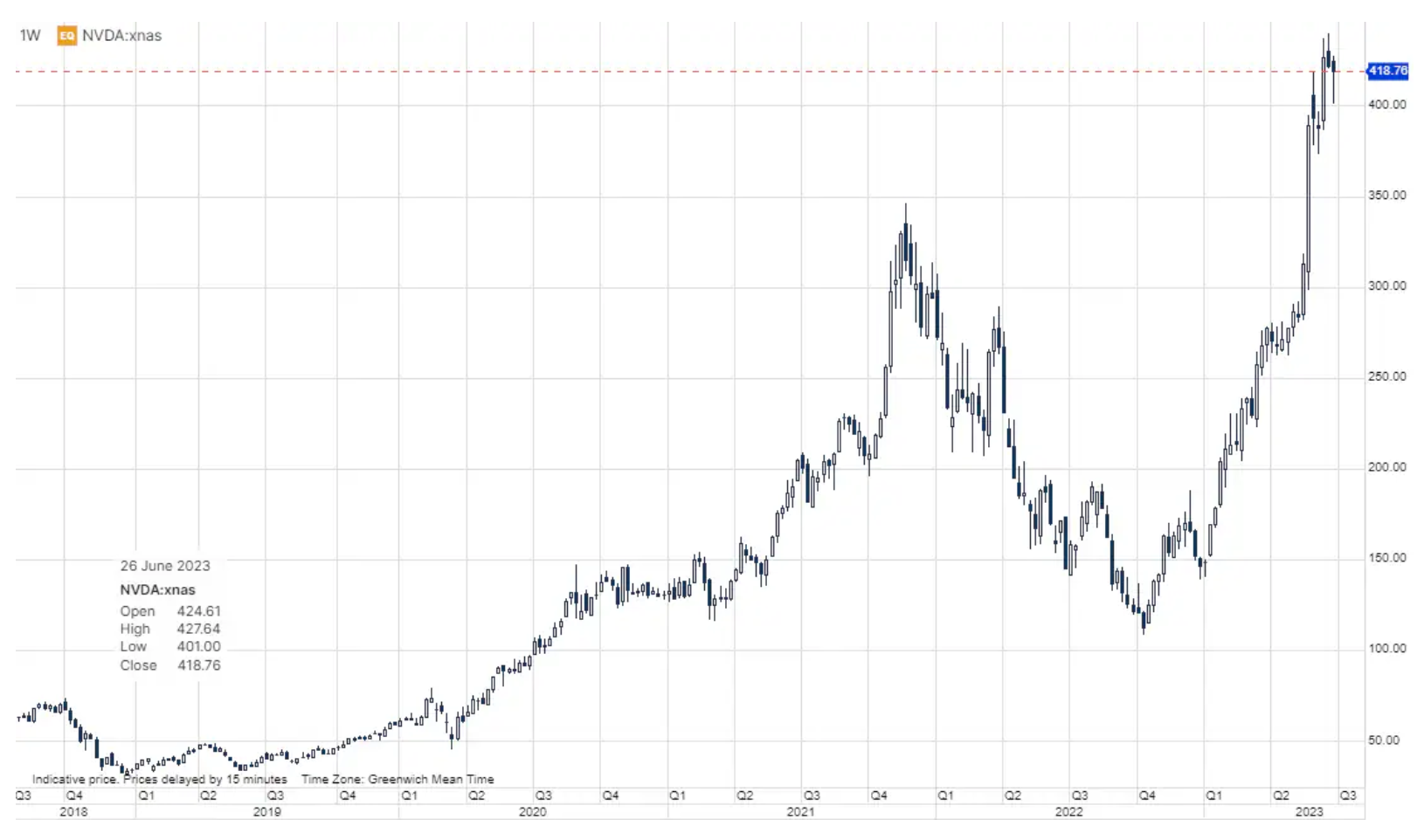

Two days ago, after the US stock markets closed, the Wall Street Journal announced in exclusive articleThe U.S. government is considering introducing new export restrictions on AI chips that would most likely require Nvidia to obtain licenses for specific customers in China. The deadline mentioned in the article for the US Department of Commerce to make a decision on this issue is the beginning of July. The rush suggests that the United States is concerned that China is doing everything in its power to catch up with the American leader in artificial intelligence technology. Nvidia shares fell 4,5% in pre-market trading with a potential key break of 400 in today's trading session if investors reduce their exposure to the company's shares. AMD shares fell 3.5% in pre-market trading.

China a key factor for Nvidia's prospects

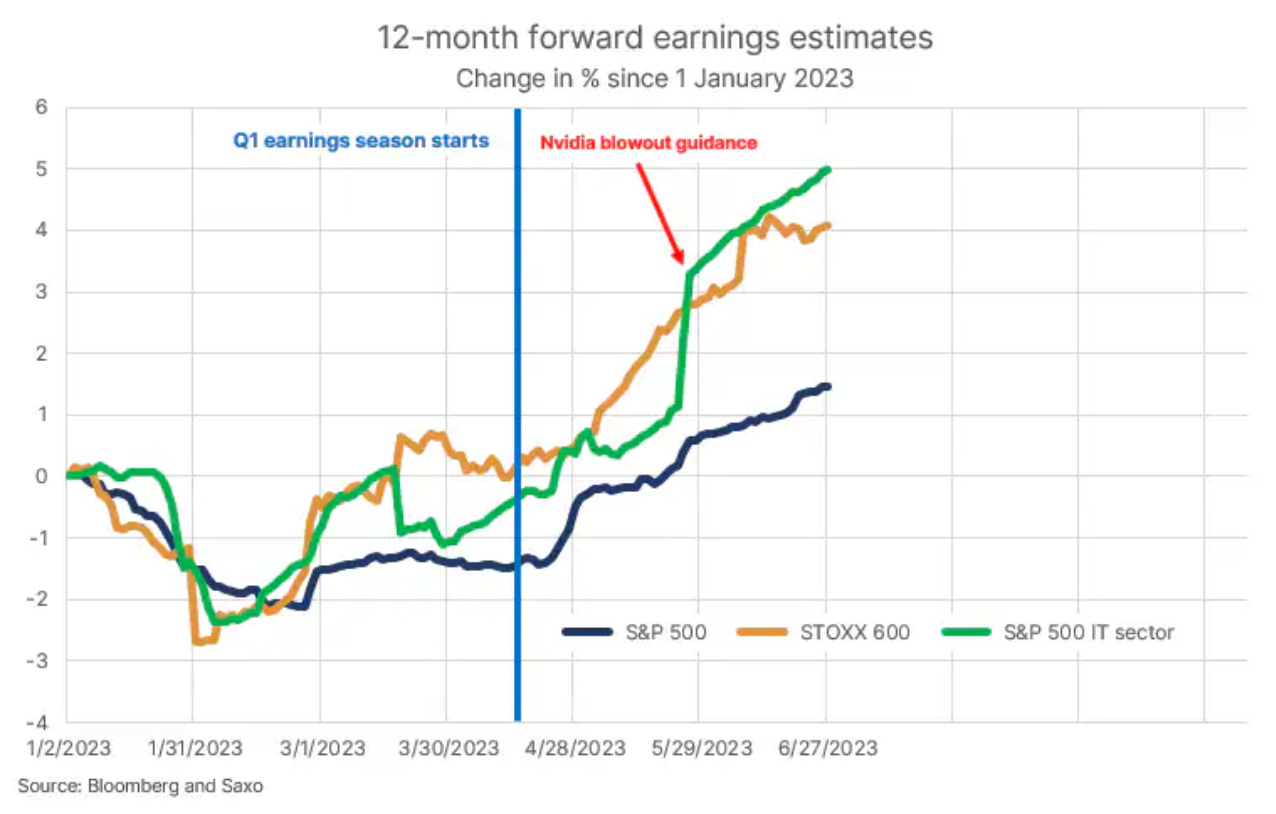

The contemplated new export restrictions would be crucial to market sentiment as the rise of US stocks fueled by the development of artificial intelligence was a key driver of this year's results. Nvidia's upbeat outlook for FY2024 Q30 (ending April 24) May 12 results boosted valuation of entire AI stock cluster as well as 500-month earnings guidance for S&P XNUMX tech ahead of big earnings announcement for the second quarter, which will start in mid-July.

To understand the significance of the new export restrictions that companies like Nvidia and AMD will potentially face, we need to go back to October 7, 2022, when the Biden administration introduced controls on the export of US artificial intelligence and semiconductor technologies to China. This policy was intended to prevent high-tech manufacturers such as Nvidia from exporting their A100 chips to China. Nvidia shares fell 12% in four trading sessions as investors realized that around 26% of the company's operations could be directly affected by the new regulations.

A month later, it was reported that Nvidia is working on a solution that would allow it to export AI chips to China without violating the new rules. In recent 10-K reports, the company mentioned A800 and H800 chips being prepared for the Chinese market as replacements for the popular A100 and H100 AI chips. The change that Nvidia made was to limit the fast NVLink connection bus to a maximum of 400 GB / s. This change allowed the company to reopen to the Chinese market without requiring a license for modified AI chips.

As emphasized in articleChinese demand for A800 and H800 products surged in April, fueled by purchases by Tencent and other Chinese tech giants. This confirms that China is well behind US companies when it comes to artificial intelligence, and the launch of ChatGPT and Bard has created a sense of urgency in China to catch up with the US in this area. Chinese media write about the plans of the Chinese government to significantly increase spending on research and development this year. According to a recent Bloomberg article, AI spending in China is expected to reach $15 billion this year alone.

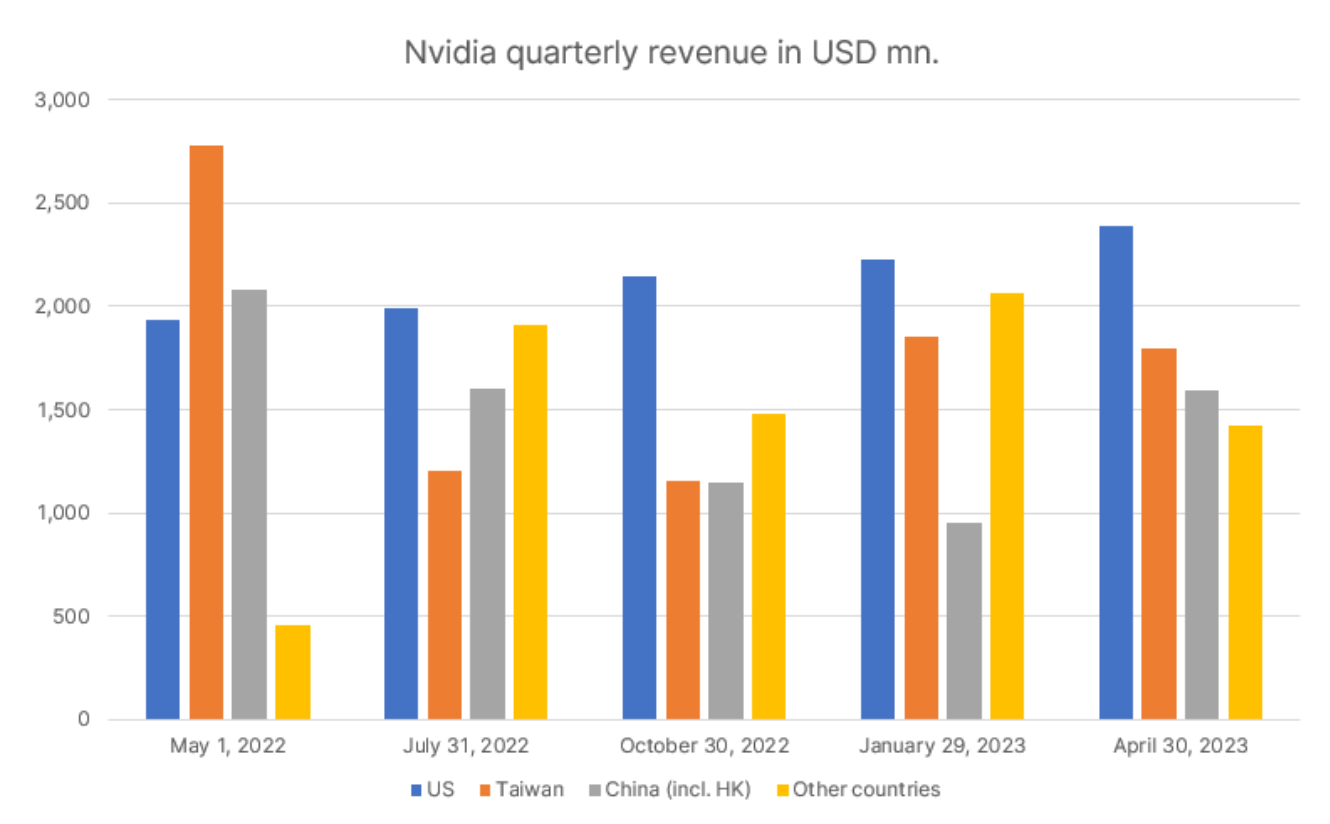

Analyzing the data on Nvidia's revenues broken down by geographical areas, we can see an explosion in demand from the Middle Kingdom. Nvidia never mentions either cryptocurrency mining or China in its press releases or investor presentations. This is a deliberate action. For revenue data broken down by geography, delve into 10-K reports. A clear trend emerges from these documents. In 2022, the company's revenues from China and Taiwan fell as cryptocurrency mining became much less profitable as a result of the collapse of, among others, Bitcoin. The market has been flooded with Nvidia GPUs as they have ceased to be used for cryptocurrency mining.

Another extremely interesting observation is the sharp decline in revenues from the Middle Kingdom in the quarter ended January 29, 2023, despite the stabilization of the cryptocurrency market. It can be assumed that this decrease was due to the new export restrictions introduced on October 7, 2022. In relation to the same quarter, there is also a sharp increase in revenues from other countries. From the recent 10-K report, it is known that Singapore, which is now treated separately, is the most important country in this segment, and therefore could be used as an intermediary for the sale of A100 and H100 chips.

In the first quarter of the 2024 fiscal year, which ended on April 30, 2023, Nvidia presented its optimistic forecasts. Revenues from China grew by 67% q/q, while revenues from the US market only increased by 7% q/q, despite the country being a powerhouse when it comes to the development of artificial intelligence. In the rest of the country segment, revenues fell by 31% q/q. It is striking that despite a significant increase in revenues from China, Nvidia mentions the country only once in its press release and investor presentation. In addition, it is an insignificant memo regarding the automotive segment saying that "some NEV customers in China are adjusting their production schedules to reflect slower than expected growth in demand".

If we put all the data together, we see that the new A800 and H800 chips are driving demand in China as Chinese tech companies, spurred by the Chinese government, try to catch up with US tech giants in artificial intelligence. The fact that the U.S. Department of Commerce is considering changing export rules suggests that the U.S. government has also noticed this trend and is beginning to fear what it might mean for the U.S. leader in AI technology.

The risk of being impacted by new export restrictions is by far the greatest risk for Nvidia shareholders, as having to meet licensing requirements to sell AI chips to China would have a significant negative impact on Nvidia's bottom line, as outlined in Nvidia's 10-K report. Should the U.S. government introduce new export controls for AI chips, it could slow down the AI race across the U.S. tech sector as funds would likely reduce exposure and take profits.

Nvidia won't run away from the fragmentation game

As described in our quarterly forecast for QXNUMX, the world has entered a an era of fragmentation which is an extension of the trade war started by the Trump administration in 2016. Fragmentation is a geopolitical game based on the idea of destabilizing global supply chains. At first, Europe tried to take a neutral position, but Russia's invasion of Ukraine pushed the continent into the game. This strategy has four main pillars: 1) defence, 2) energy, 3) goods and 4) technology.

If artificial intelligence technology is the main vector of the technology market in the next decade, Nvidia will not be able to adopt the classic neutral commercial strategy of maximizing shareholder profit. The company will be forced to strictly comply with US policy for the industrial sector and national security in relation to AI technology. Given that investor expectations are now being shaped by Nvidia's recent outlook, which has been driven mainly by demand from Chinese tech companies forced to catch up with the US giants, the company faces significant risks should the US government decide to introduction of new restrictions on the export of AI chips to China.

Investors hoping to make big gains from Nvidia stocks and US tech stocks in general should consider optimizing the risk of their portfolios by lowering their exposure. Great expectations can be shattered by fragmentation. The negative impact on Nvidia is likely to spread to the cluster of remaining AI companies, which consists of shares of companies such as AMD, ASML, Adobe, A, Meta, Advantest, Palantir, Marvell Technology, Microsoft and Applied Materials.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)