Weekly Cryptocurrency Market Review: 50% Dominance, 10% Sales

For the first time in over 3 years bitcoin domination in the cryptocurrency market fell below 50%. In its quarterly earnings report, Tesla announced that it had sold 10% of the originally purchased bitcoins to prove there was liquidity in the market. After backing this month's software developer targeting the Ethereum network, JPMorgan is reportedly working on an actively managed bitcoin fund offering.

Bitcoin domination below 50%

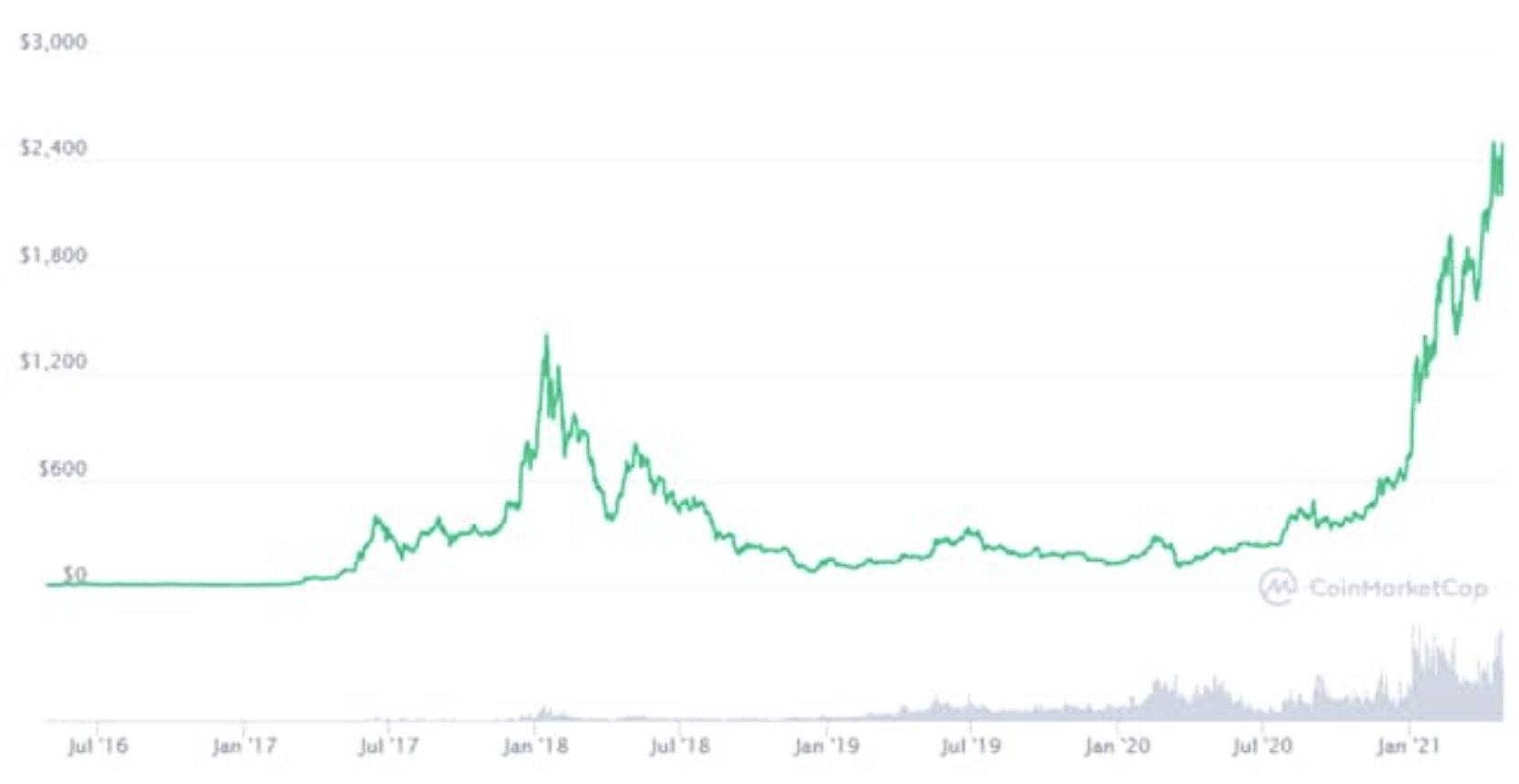

Domination for the first time in over 3 years Bitcoin compared to the entire cryptocurrency market fell below 50% last week. Before we experience this again, we need to go back to January 2018, which was also the month when ethereum hit its record high. Bitcoin started the year with a dominance of 70,7% and dropped to a low of 49,4% last Thursday. Although bitcoin has appreciated significantly this year so far, it has been surpassed by alternative cryptocurrencies (the so-called altcoiny), primarily Ethereum, corner coin, XRP i cardano. For example, ethereum started this year with a dominance of just over 11%, reaching the current dominance of 14,3%. As with other booms, altcoins tend to rise sharply in positive sentiment markets.

Tesla sells 10% of the originally purchased bitcoins

Tesla published her results for the first quarter. A profit report revealed that Tesla sold last month bitcoins worth $ 272 million. According to the records, Tesla made about $ 101 million from sales, with sales accounting for about 10% of the original bitcoin purchase made in early February. Following the publication of the profit report, Dave Portnoy commented on Twitterthat Tesla basically just rocked bitcoin up and then walked away from it. Elon Musk replied that Tesla essentially made the sale to prove bitcoin's liquidity as an inspiration to other companies. In our opinion, this argument sounds quite enigmatic, as it is no surprise that you can sell $ 272 million worth of bitcoins without any problems. The question to be asked is whether the sale was made to exceed Wall Street's estimate of profits. Surprisingly, the cryptocurrency community was rather positive about this transaction as it was apparently convinced by the argument that the aim was to illustrate sufficient liquidity in the market. Elon Musk confirmed in his tweet that he himself is a bitcoin owner and that he has not sold any of them.

JPMorgan enters the cryptocurrency market

Over the past few months, we have reported that a number of leading banks and financial institutions are developing their own cryptocurrency offers, incl. Goldman Sachs, BNY Mellon, Deutsche Bank and Citi. Goldman Sachs has launched its cryptocurrency trading department a month ago, and was recently joined by Morgan Stanley who started offering at the end of March access wealthy customers to bitcoin funds.

JPMorgan is also reportedly working on a cryptocurrency custody solution. Recently, rumors have surfaced that the bank is preparing to launch an actively managed bitcoin fund, and according to CoinDesk this fund may be launched this summer. The fund is to be targeted at clients from the segment private wealth . If the rumor is confirmed, JPMorgan will double its activity in the cryptocurrency market. The news of an actively managed Bitcoin fund comes just two weeks after the bank supported a software producer focused on the Ethereum network - ConsenSys - together with companies such as MasterCard or UBS, acquiring a total of USD 65 million. We briefly discussed JPMorgan and its 6 stages of cryptocurrency acceptance in today's podcast Saxo Market Call.

About the Author

Mads Eberhardt, Cryptocurrency Market Analyst, Sax Banks. Cryptocurrency Market Analyst at Saxo Bank. He gained experience as a trader at Bitcoin Suisse AG and founder http://BetterCoins.dk (website taken over by Coinify).

Mads Eberhardt, Cryptocurrency Market Analyst, Sax Banks. Cryptocurrency Market Analyst at Saxo Bank. He gained experience as a trader at Bitcoin Suisse AG and founder http://BetterCoins.dk (website taken over by Coinify).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)