Virus and profitability threaten short-term commodity forecasts

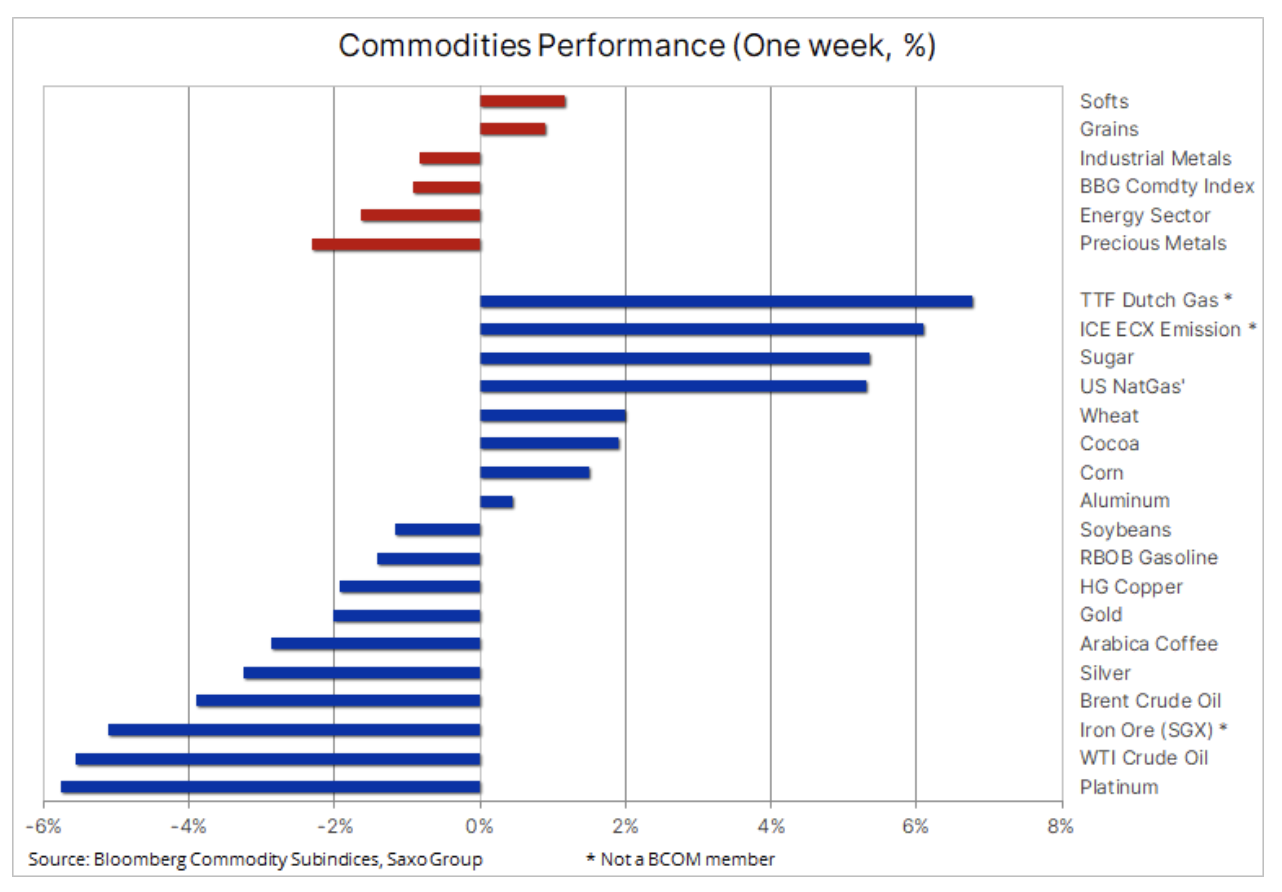

In commodities markets, August started off on the defensive as a result of weaker economic data from China and the rapidly spreading Delta Coronavirus variant, raising further concerns about the short-term outlook for demand. Prices for commodities dependent on economic growth, such as oil and industrial metals, plunged, and precious metals, which struggled to strengthen in response to the July decline in US Treasury bond yields, depreciated as yields rose and the dollar appreciated after aggressive comments Fed and a very solid US employment report.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Certain raw materials have increased: agricultural products such as sugar and wheat benefited from the hitherto extremely volatile weather conditions in selected key global growing regions. US gas prices peaked in 2½ years and record highs in Europe against a backdrop of tight supply amid high demand, triggering concerns about insufficient inventory levels ahead of winter, the peak demand period.

Despite the successive problems with Covid-19, the macroeconomic outlook remains favorable and predicts strong growth in Europe and the United States, which somewhat counterbalances concerns about the situation in Asia, where the virus has even penetrated into a fortress-like China, resulting in new lockdowns and forecast corrections. downward growth.

Copper market

Despite the sideways rate, he has become more cautious from exceptionally bullish in the last few months. In recent weeks, the price of this commodity has been influenced by a number of opposing forces, which has raised some concerns about the direction in the short term. Overall, however, we see further growth potential, and HG copper price it may eventually reach $ 5 / lb, but perhaps this will not happen until 2022, when the supply on the market may turn out to be insufficient due to the increasing demand for this metal in the context of green transformation and infrastructure projects. Despite the risk of a slowdown in China, growth in demand in the rest of the world has highlighted the threat of unmet demand - at least in the medium term - by increasing supply, which appears relatively inflexible.

The risk of simultaneous strikes in Chile's three main mines, including Escondida, the largest of them, is currently favoring the price of copper. On the other hand, there is also uncertainty about the signs of a slowdown in China and the overall impact of the now spreading Delta Coronavirus variant on economic growth. Demand for refined copper also fell slightly after China deviated from its planned scrap ban, and aggressive comments from Fed Vice President Clarida on normalization may further undermine investors' appetite for metals as a diversification and hedge against inflation.

Wheat

Futures contracts for CBOT wheat they approached their May high and then went down slightly on profit-taking. Adverse weather conditions increasingly indicate the possibility of limiting world supplies due to the projected reduction in production by key exporters - Russia and the United States. Rains negatively affected grain quality in parts of Europe and China, and heat and droughts translated into poorer forecasts for production in Russia and North America. Speculative investors have just turned their wheat positions back to net long position, and continued positive price momentum supported by favorable fundamentals could force them to chase market growth, according to the latest COT report.

In the short term, however, the increasing number of infections with the Delta variant may raise concerns about demand, and some of the world's largest consumers of wheat, incl. Egypt, Pakistan and Turkey have resigned from purchasing this raw material in recent weeks. The Egyptian president, under pressure from rising prices, is even considering raising the price of state-subsidized bread. The last such attempt was made in 1977, when President Anwar al-Sadat had to withdraw from a price increase as a result of riots.

Natural gas (Natgas)

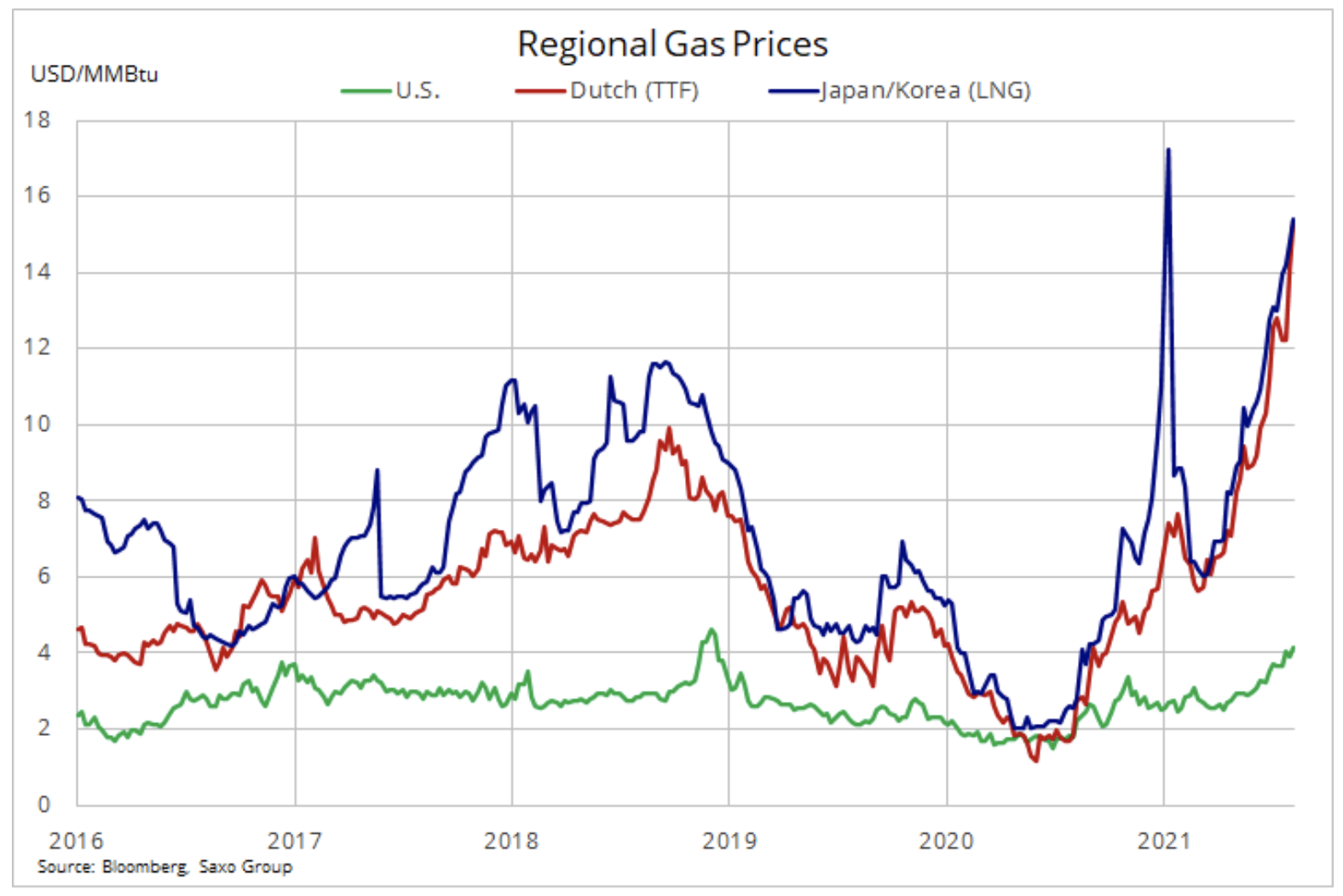

Prices natural gas globally continue to grow as a result of the heatwave driving increased demand for air conditioning and rising industrial demand as the global economy recovers from the pandemic. In the United States, the price of gas from Henry Hub exceeded $ 4 / MMBtu, the highest level recorded for this period of the year in at least ten years, due to increasing household demand and increasing LNG exports. This happened at a time when it became difficult to increase production, in particular due to the slow recovery in the production of shale oil, a by-product of which is natural gas.

The situation is much worse in Europe, where prices have hit record levels. The unexplained restriction of supplies from Russia, coupled with increasing competition from Asia for LNG supplies, has made it difficult to replenish the heavily damaged reserves ahead of the coming winter. This has led to an increase in demand for coal, forcing industrial users and utility suppliers to purchase more pollution permits, the price of which has already reached record levels. This has resulted in a sharp rise in electricity prices, which will ultimately be paid by consumers across Europe, which will represent a significant problem for governments and potentially undermine political efforts to decarbonise the economy at the agreed rapid pace.

Petroleum

Prices oil have gone down, and after months of focusing on OPEC + and the organisation's ability to support prices by maintaining a relatively tight supply, the market has refocused on the uncertain outlook for demand as a result of the rapid spread of the Delta variant, particularly in China, a key importer this raw material. This downgraded the outlook for economic growth and called into question the short-term outlook for oil and fuel product demand from the world's largest buyer.

Recent events warrant a cautious approach OPEC + to increase production too quickly and too early. They also highlighted why Saudi Arabia and the rest of the group were willing to extend the current quota system beyond next April.

The flexibility of OPEC + last year is likely to prevent a deeper correction should the increase in demand suffer more than predicted from the current increase in infections. Taking this into account, and taking into account the lack of reaction from US producers despite high prices, we maintain a constructive outlook for oil prices.

Precious metals

As soon as I got back from vacation, the first question I had to ask myself was: why isn't the price of gold much higher? US Treasury yields fell sharply last month, and due to broadly unchanged levels of inflation expectations, inflation-adjusted yields, or real yields, have fallen to a record -1,22%. Given the historic strong inverse correlation between real yields and gold, last month's unsuccessful attempt to strengthen last month baffled market participants, potentially resulting in the liquidation of long positions for fear that the rise in yields might not be offset by the same level of inactivity.

This concern was confirmed on Wednesday when the first signs of a rise in yields appeared in response to aggressive comments from Fed vice president Clarida discussing the path of interest rate tightening. These comments, which contributed to the strengthening of the dollar and yields, were further supported by a very solid US employment report for July.

At the same time, silver recorded even greater exodus: The metal's value against gold fell to its lowest level in six months after the gold-to-silver ratio returned above 72 ounces of silver to one ounce of gold. Hedge funds have recently reduced their net long position to just 21k in response to this disappointing performance. flights, which is the lowest level in 14 months. The ratio of gold to silver will have to return below 70 for silver to strengthen again, but to do so, gold must first meet the potential short-term challenge of rising yields.

In the context of the decline of both gold pricesAnd silverplatinum saw the greatest losses of all semi-industrial metals, its discount against gold rose to $ 800 from its April low of 300. This was the result of the current semiconductor shortage that negatively affected car production, as well as the increase in electric vehicle sales and the current spread the Delta variant.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)