US Elections, Covid and Commodity Markets

In the final quarter of the year, which many would prefer it not to occur, the global pandemic will continue to weigh heavily on the performance of sectors ranging from energy and metals to agricultural products. Given that the development of the pandemic is still dynamic, and that we are probably months away from the vaccine, the only thing that is certain is uncertainty. It will continue to contribute to the creation of variable and unpredictable market conditions, with geopolitical risk adding an additional dimension - including due to what awaits us, e.g. the fact that the presidential election in the United States on November 3 will most likely be much more even than the polls predict.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Never before have interest rates been brought so close to zero in so many countries, while fiscal deficits have spiked enormously and levels of debt historically high in the global economy. To this should be added government attempts to support economic growth by spending money that needs to be reprinted first, and the forecast for QXNUMX and beyond for precious metals and some industrial metals will remain favorable.

To maintain our positive outlook for commodities - especially those that have historically been able to hedge assets in times of greater uncertainty and higher inflation, it is crucial that central banks actively support the recovery of inflation and the potential for a further depreciation of the dollar.

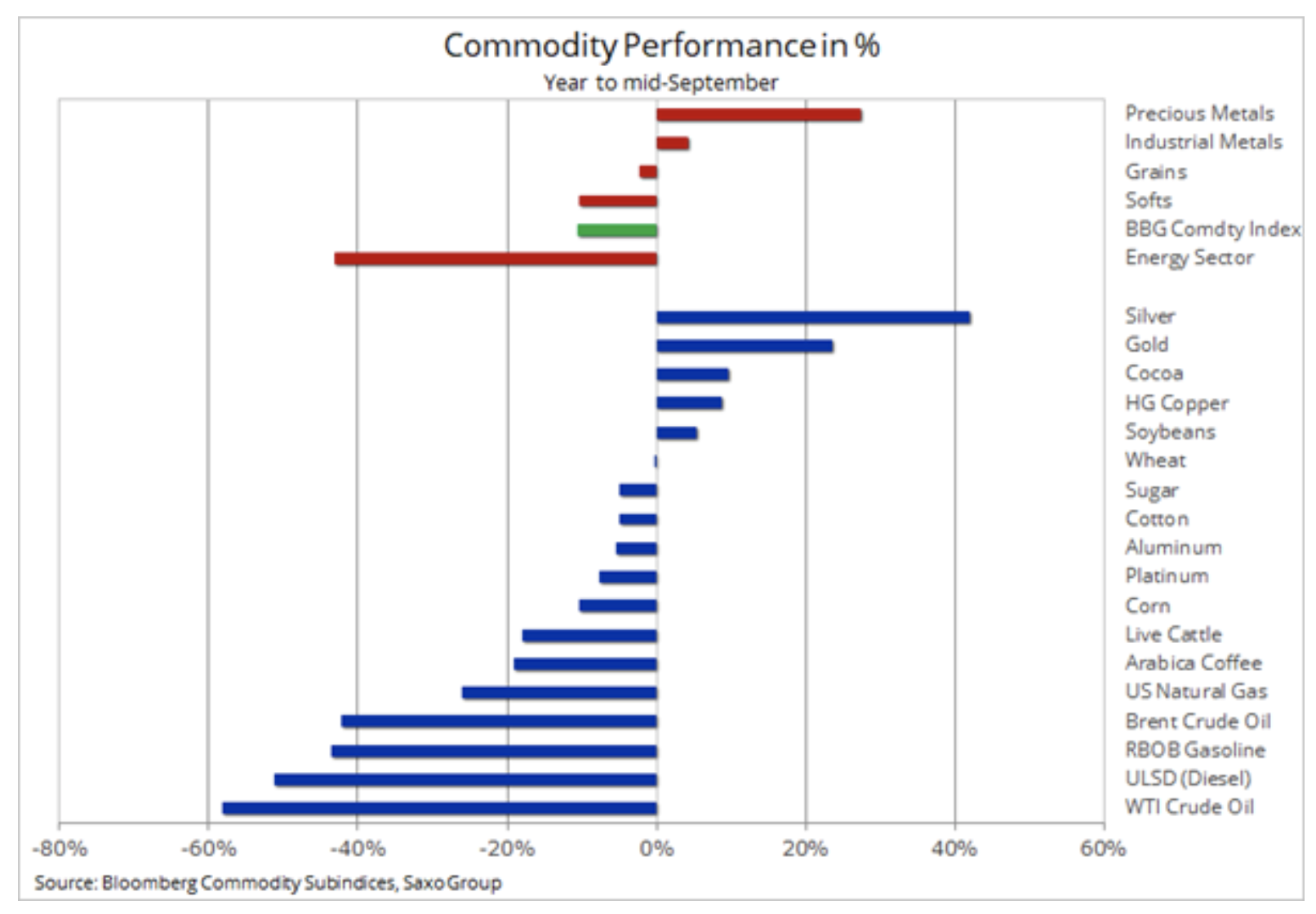

This year's performance of some key commodities until mid-September shows strong demand for precious metals in the context of a global decline in interest rates and a rising risk of inflation, as a result of which government bonds with yields close to zero or below will become useless as a form of safe investment.

Precious metals

China was the first to hit the virus and since then managed to achieve a strong debt-based recovery, as it did after the 2008 global financial crisis. Covid-related supply disruptions, financial speculators sought protection against inflation, and very strong demand from China leading to a decline in world inventories, it was a favorable year for industrial metals, primarily copper.

Finally, we see a break in the strong upward trend that has been maintained since the April minimum copper market HG, leading to a consolidation period that we believe will take place in QXNUMX. On this basis, we predict that the short-term growth potential of copper prices will be limited, and a possible factor for extending this period may be another announcement by the new US president regarding infrastructure spending - similar to the promise made by Trump four years ago, which, however, has not been delivered.

After the year that gold has gained more than 20%, and silver - twice as much, few people expect further increases, at least in the short term. However, these gains are indicated by exceptionally low interest rates, growing demand for hedging against inflation and the possibility of a depreciation of the dollar. After a long period of consolidation around, especially above, $ 1 / oz, gold will eventually move up, ending the year at or near $ 920 / oz.

Given that the current situation is unprecedented, it is difficult to reliably estimate the price of gold in 2021. After applying a decade-long price channel, in 2021 the target value may however be between USD 2 and 400 / oz, roughly 2% above the mid-September area.

Silver struggled to surpass gold after the ratio of the two metals recovered to the ten-year average of around 70 ounces of silver for one ounce of gold. Given our positive outlook for gold, silver may continue to grow, although its performance may slightly worsen given our neutral view on industrial metals. Record discount platinum in relation to gold could eventually attract investors' interest again, including due to the forecast this year's deficit on the market. A platinum to gold drop below 2 could potentially signal a move toward 1,8, which would be a 10% advantage.

Petroleum

Oil market It is unlikely to change: Brent crude oil will remain slightly above $ 40 for most of the last quarter before eventually rising above $ 50 in the first half of 2021. Based on this, we are increasing our Q38 range by $ 48 to the $ XNUMX-XNUMX corridor.

In September, the conflict between the OPEC + production cuts and the uncertain outlook for demand escalated, with Saudi Arabia expressing growing frustration about oil's inability to strengthen further. As a result, there was an oral intervention by the Saudi Minister of Energy, blaming countries that avoid cuts and short sellers for not making progress in their strategy. While failure to comply with the common agreements is a clear problem that needs to be resolved and short sellers can animate the market for a very short period, the fundamentals remain a key factor, currently weak due to significant fuel volumes and low demand.

We remain cautious about crude oil's short-term ability to gain strength, unless OPEC + surprises the market, abandoning its January 2mb / d increase in production. While the United Arab Emirates, which have recently lagged behind, are again restricting production, some doubts are raised by Iraq, which is famous for ignoring the agreements, and Libya, which will seek to increase production after the ceasefire is announced.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)