Employment in the US: another test for US profitability and the dollar

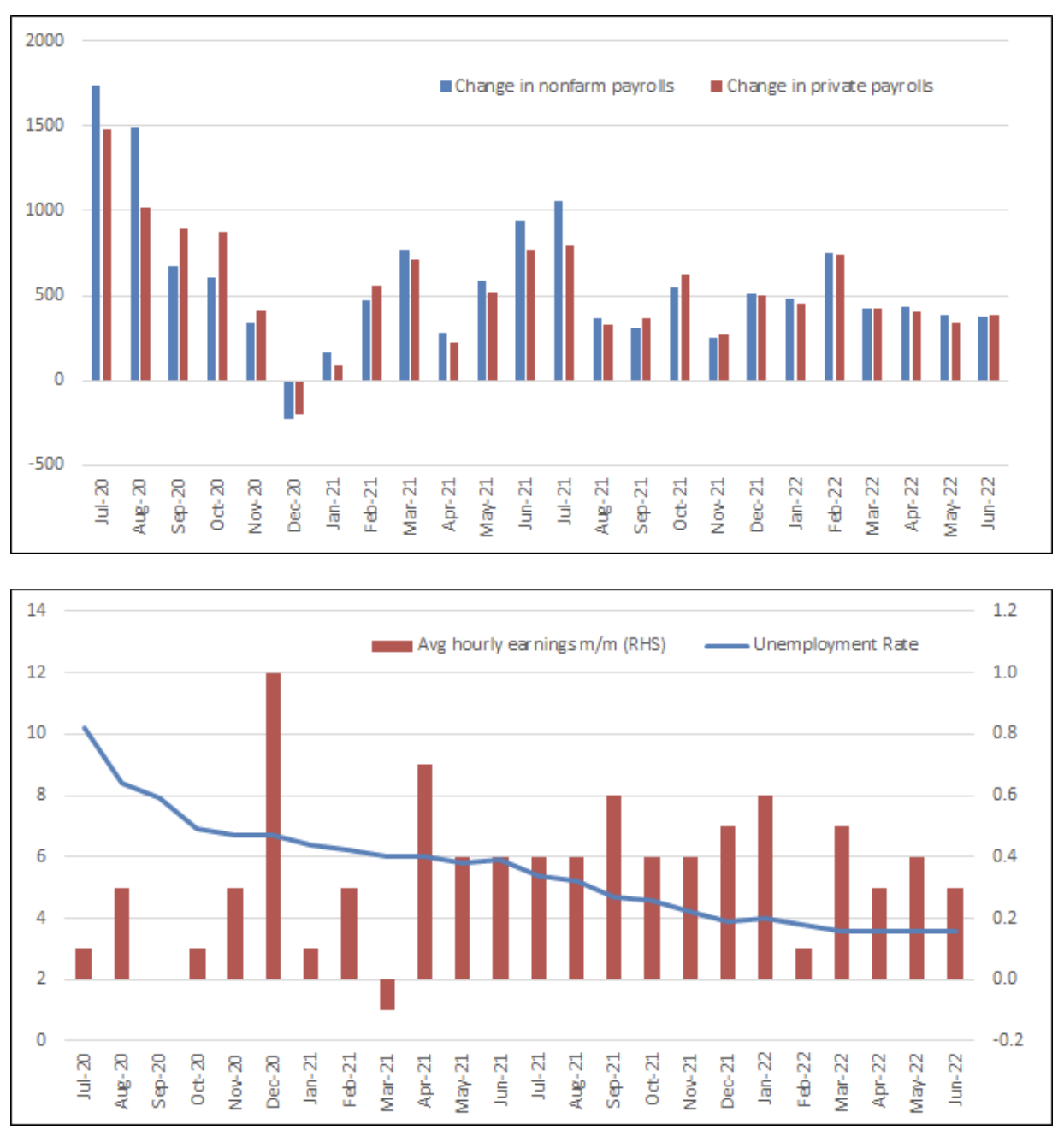

The US economy may be slowing down, but it is not. No guidance from the site Federal Reserve means that every data point and every Fed comment will be scrutinized to the limit for more information on the future path of interest rates. The US employment report this Friday is likely to be of crucial importance given that constrained labor supply remains one of the key pillars of the strength of the US economy. Wage increases are particularly closely watched as this indicator may reverse the weakening of the US dollar should US Treasury yields go up.

What is employment in the non-agricultural sector?

Non-farm payroll employment is one of the most closely watched monthly indicators published by the US Department of Labor, usually on the first Friday of the month. It presents the number of people currently employed as well as the unemployment rate and wage growth in the United States. While it is always worth following these figures to better understand the dynamics of the US labor market, they have gained increasing attention lately as they are a pillar of strength for the US economy in the face of rising pessimism about growth and no guidance from the Fed.

Expectations for the July NFP

It cannot be denied that the US labor market is slowing down, but it was to be expected from the popandemic growth. There are still two job vacancies for every unemployed American, and small businesses face severe staff shortages. This means that the problem is still more with labor supply than with demand, suggesting the economy is still able to absorb further Fed tightening.

The recent surge in unemployment benefit applications indicates that this situation in the labor market may soon change, but the four-week average of the number of applications, correcting for weekly volatility, was still below 23 in the week ending 300 July. Moreover, ISM reports suggest that even if the US economy is showing a slowdown, it is not a slump. The ISM index of employment in factories in July rose to 49,9 from the previous figure of 47,3, mainly due to a lack of available workers. This potentially increases the likelihood that Friday's reading of non-farm payrolls will turn out to be better than expected. The Bloomberg consensus suggests an increase employment in the non-agricultural sector by 250 thousand and an increase in employment in the private non-agricultural sector by 228 thousand, with the unemployment rate unchanged at 3,6% and an increase in the average hourly wage showing a slight decline to 4,9% y / y as compared to the previous result (5,1%).

At the same time, the argument in favor of a longer period of high inflation is also stable wage growth. Higher wages mean more money in the pockets of American consumers, and that in turn may mean a stable level of demand - again giving the Fed a pretext to uphold its aggressive policy.

Another key aspect to consider in the context of employment in the non-agricultural sector is the structure of the labor market, in particular as an indicator of the sustainability of wage growth. The tourism and hospitality industry is currently responsible for growth in the labor market, which remains exposed to the cyclical slowdown in discretionary spending. Construction employment growth is likely to be slower due to higher mortgage rates hampering housing sector growth.

Markets mispricing Fed expectations

The lack of Powell's guidance at the July meeting means that markets are currently pricing in extremely aggressive Fed policy. The end rate is currently trading at 3,25% and markets are expecting the Fed to cut rates next year. We believe that the path of Fed rate hikes from then on will most likely be more volatile and there is a potential for an upward correction. One of the factors behind such correction may be Friday's non-farm payrolls data.

Better than expected result for both the number of jobs and salaries, could increase expectations of another interest rate hike by 75 bp in September, although by the time of this meeting there are still many data releases and speeches of Fed representatives waiting for us. This should contribute to the increase in US bond yields and provide an impulse to the dollar strengthening. High wage growth, even with a modest number of jobs, may still indicate that The Federal Reserve will continue to focus on the problem of inflationgiven that fewer jobs only mean an improvement in labor supply. However, if wage growth is slower than expected, it may further lower expectations of rate hikes and accelerate the pace of dollar depreciation.

There is a certain possibility that the US dollar is able to strengthen even amid lower yields and weak US dataif the market forecast for a soft landing changes to that for a harder landing, which will attract investors looking for a safe harbor to the dollar. The dollar has recently shown a higher correlation with financial conditions and the trajectory of US yields, but if yields fall and the level of fear in the market rises, the US currency may prove to be strong against pro-cyclical currencies.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)