Actions into the world of unknowns - animal instincts, weather and crisis

This year has been a real rollercoaster for investors. Equities took off like a rocket, gaining nearly 7% in January as investors bought into a "no landing" scenario that sees the world economy see accelerated growth instead of a soft landing due to the impetus of China reopening to the world.

animal instincts took off and were clearly visible in relation to Tesla shares, bitcoin and our high beta-growth themed baskets such as "bubble" stocks. Our newly created luxury goods basket also generated a solid return as investors bet that China's reopening would boost luxury goods sales significantly.

Financial conditions - still not tight enough to contain inflation - and mild weather in Europe to avoid the energy crisis were also two important factors influencing animal instincts and allowing stock prices to rise. However, in February, after an initial recovery in stock markets, Fed Chairman Powell gave the market a strong message that can be briefly described as a "deliberate recession." That means the Federal Reserve is going to do everything possible to cool down inflation, which in turn means higher interest rates, and for a much longer period of time than previously assumed. This signal sent US bond yields skyrocketing until something snapped; turned out to be something bankruptcy of Silicon Valley Bank, the second largest in the modern history of the United States, which was a retreat from the idea of raising reference rates at all costs in order to cool down inflation.

Strong stock market performance in the first two months of this year - despite mixed QXNUMX results and unclear forecasts due to cost pressure - boosted our MSCI World index valuation model well above the historical average, lowering the future expected real rate of return. At the current valuation, the probability of the stock's return not exceeding the inflation rate is 30%, which is an unfavorable starting point in the historical context. However, most investors only need to glance at bond yields to see that the returns do not look any better, especially in the context of persistent inflation. We live in a world of lower expected returns until asset classes adjust to lower valuations due to the acceptance of structurally higher inflation.

Fragmentation means pain, but also opportunities

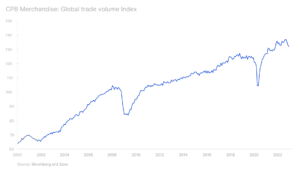

Globalization, as measured by the volume of world trade, was particularly intense between 2001 and 2008, when China's entry into the World Trade Organization changed the rules of the game, starting a race between companies to move production abroad as quickly as possible in order to unlock higher operating margins and returns for shareholders. During this period, the volume of world trade increased by 7,8% on an annual basis.

The financial crisis stifled the credit boom; the Chinese economy was no longer the same either, and over time it lost momentum due to increasing regulation, centralization of the state, debt, and most recently the housing crisis. The situation was by no means improved by Trump's trade war and in 2019 the volume of trade was low as a result of the slowdown in the global economy. In 2011-2022, the volume of global trade slowed down to an increase of only 2,2% on an annual basis, underlining the fact that the readily available gains from globalization have already been exhausted.

The game of fragmentation is essentially a strategic geopolitical dynamic of providing wider access to energy, technology and defense by large competing nation states. Electrification and green transformation is direct independence strategy in terms of energy supply which, apart from the war in Ukraine, is clearly a key strategic variable for any nation-state.

The green transition will positively affect the prices of metals such as lithium or copper, as well as growth in the sector of electricity suppliers, everything related to solar energy and energy storage systems. Equity investors will find numerous opportunities in these areas; and everyone else is waiting for the EU to introduce its own version of the US Inflation Law.

Semiconductors play a key role in the modern economy, a without a stable semiconductor supply chain, the production of military equipment is not possible, cars, advanced machinery, computers and data centers. The US CHIPS Act has transformed the semiconductor industry, and a significant amount of investment is currently underway in both the US and Europe.

Our Semiconductor Basket is the best performer this year, reflecting the strong growth outlook supported by this major new shift in US industrial policy. Our defense basket is another strong performer this year, given that the war in Ukraine could take years to resolve and Europe will have to do more on defense itself. We maintain our positive outlook for both of these topics.

The fragmentation game will also mean reshoring, i.e. moving production back home, with countries like India, Vietnam and Indonesia winning over other emerging markets. Logistics businesses will continue to thrive, and perhaps even more so in the game of fragmentation, as logistics become more complex, resulting in higher margins. It will also mean a stronger fiscal policy to guide the transition, which is likely to translate into higher costs for businesses and therefore lower margins. The fragmentation of the global economy is likely to push inflation to a higher level in structural terms, a the cost of capital will increase, which will cause problems for low-quality, high-indebted companies.

The fight against inflation puts pressure on banks

Would the Federal Reserve be able to raise the reference rate by 450 basis points without causing any problems? This was the question everyone was asking themselves, and the financial conditions suggested that it was possible. Then, however, SVB Financial ran into trouble, losing deposits on such a scale that it was forced to get rid of $21 billion worth of bonds available for sale, which resulted in a loss of USD 1,8 billion. The subsequent stock offering, designed to plug the hole and avoid a sell-off of a portfolio of nearly $100 billion worth of held-to-maturity bonds with heavy losses, deterred investors. The last of the withdrawing depositors may have lost a significant part of their uninsured deposits. The US government stepped in, providing a full guarantee on all uninsured assets.

However, the damage has already been done. As a result of the massive desire to convert deposits into short-term ones debentures, in just three days of trading, the yield on two-year US bonds fell by as much as 109 basis points. The move reverberated across markets, shaking up trend-following hedge funds and causing two consecutive sessions to result in a tail risk loss of 0,1% for funds with Commodity Trading Advisor status. CTA), including the largest one-day loss for this type of hedge fund.

The banking system came under pressure, with a number of smaller US banks scrambling for new deposits, pushing the Fed's discount window balance to $156 billion in just one week, reaching highest level since the global financial crisis. Due to the large unrealized losses on held-to-maturity bonds, these types of entities unexpectedly began to appear fragile and dangerous in a situation where the bank's deposits were not sustainable. The great battle for deposits has begun. The strong decline in confidence in banks culminated in the forced merger of UBS and struggling Credit Suisse, orchestrated by the Swiss government. To make matters worse, Credit Suisse's Swiss bailout included insufficient return to shareholders and the complete elimination of additional tier 1 (AT1) capital holders, who are above shareholders in the capital structure.

The long-term consequences of the US government's full guarantee of uninsured deposits and Switzerland's decision to eliminate AT1 capital are a great unknown and will remain unknown for many years to come. can negatively affect the economy and markets. One potential impact is that weaker banks lose access to deposits, which are their main source of funding, which may lead to a reduction in the number of banks and greater concentration in the banking sector. The AT1 bond market may never be the same again, and these assets may be trading at such a premium that banks will rush to redeem them as current yields will destroy any shareholder value.

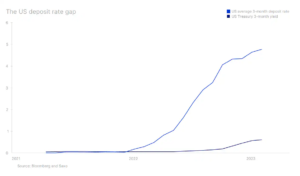

Bank stocks, particularly European stocks, have been a primary investment among macro investors as the net interest margin in 2022 has grown rapidly due to the lack of pressure on banks to pass higher rates on to depositors. The U.S. three-month bond yield is approximately 4,51% (as of March 20) compared to the average U.S. three-month term deposit rate of 0,61% in February according to the Federal Deposit Insurance Corporation (FDIC). Closing this profitability gap will mean the end of macro investment in banks.

The failure of SVB could lead to depositors questioning the interest rate on deposits compared to the yield on short-term bonds, which would result in a significant increase in the short-term funding rate of banks and thus reduce their profitability. Worse still, if aggregate deposits continue to decline, which is now happening on a scale not seen since 1948, another risk to markets could be forced asset sales, with many investors suffering unrealized losses due to higher interest rates.

All Saxo Bank forecasts available here.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)