The gaming industry is a long-term win [Market report]

This year, we have introduced five new action baskets and more are in the pipeline. This is a good way to identify long-term trends in the economy, but also an exciting way to analyze the stock market under different volatility regimes. We are currently launching Action Theme 30 with a Saxo Gaming basket of shares of XNUMX game developers.

Be sure to read: How to invest in gaming companies [Guide]

Revenue increase by 37% in 2020

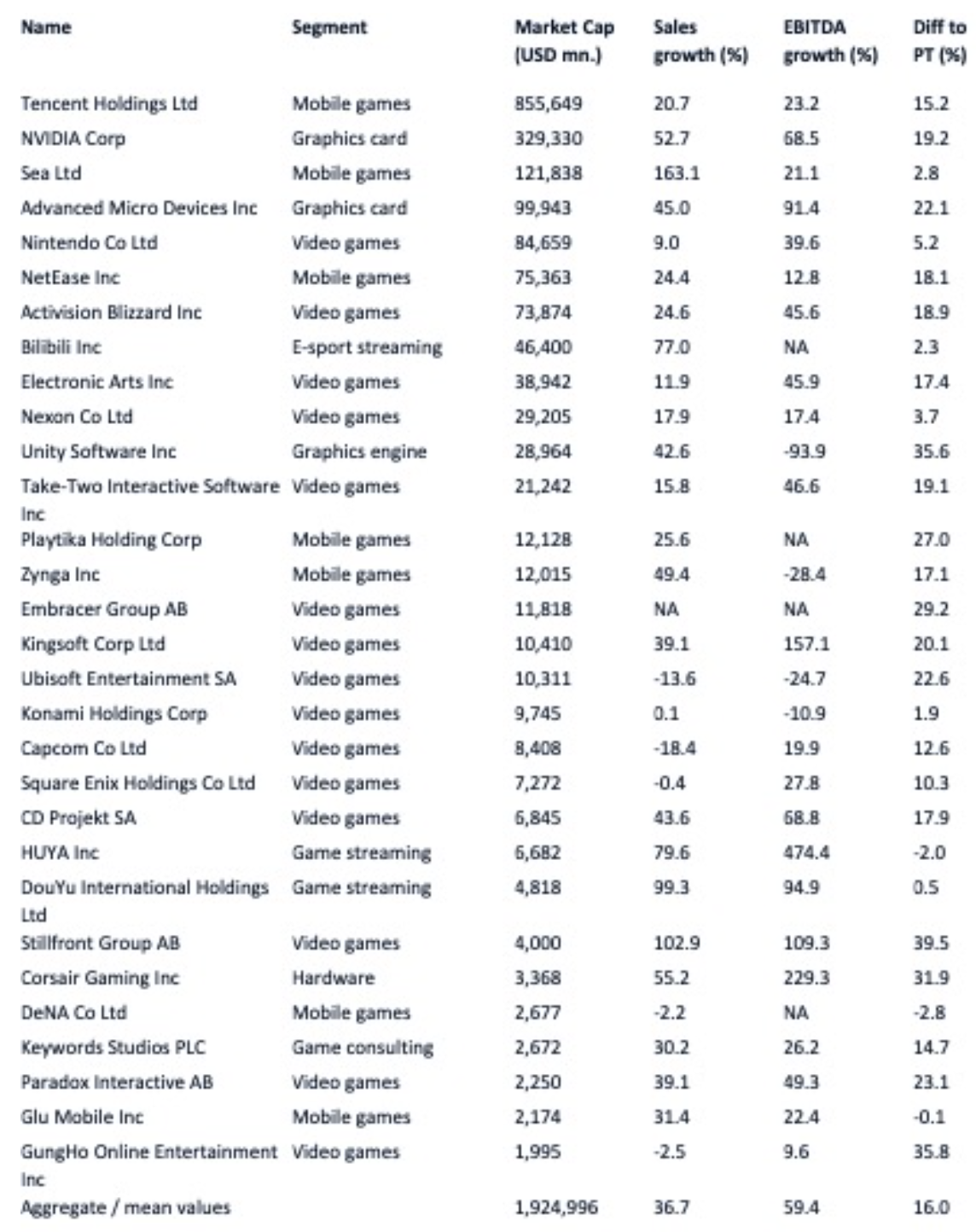

The gaming industry is vast and fragmented, with many companies reaping revenues and profits from other areas of the business as well. However, we identified 30 entities that we believe offer favorable exposure to the overall gaming trend. The geographic distribution is appropriate and, as the segment column indicates, engagement can be obtained through both graphics card manufacturers, streaming companies or game developers. We have selected the 30 largest companies in the gaming industry by market value, so this list should not be viewed as investment recommendations. We generally view this sector positively, but investors should exercise due diligence in the context of their own analysis of individual companies.

As shown in the table above, the rate of revenue growth is very high and averaged 2020% in 37 after the pandemic positively impacted demand. Other high-growth industries, such as low-margin e-commerce, struggle to generate large free cash flows, while the gaming industry is very profitable. The required capital expenditure is small and the revenues are easily scalable due to the digital nature of the business in this area. In 2020, EBITDA grew by 59% and analysts remain very positive about the industry, assuming the average target price is 16% above the current price.

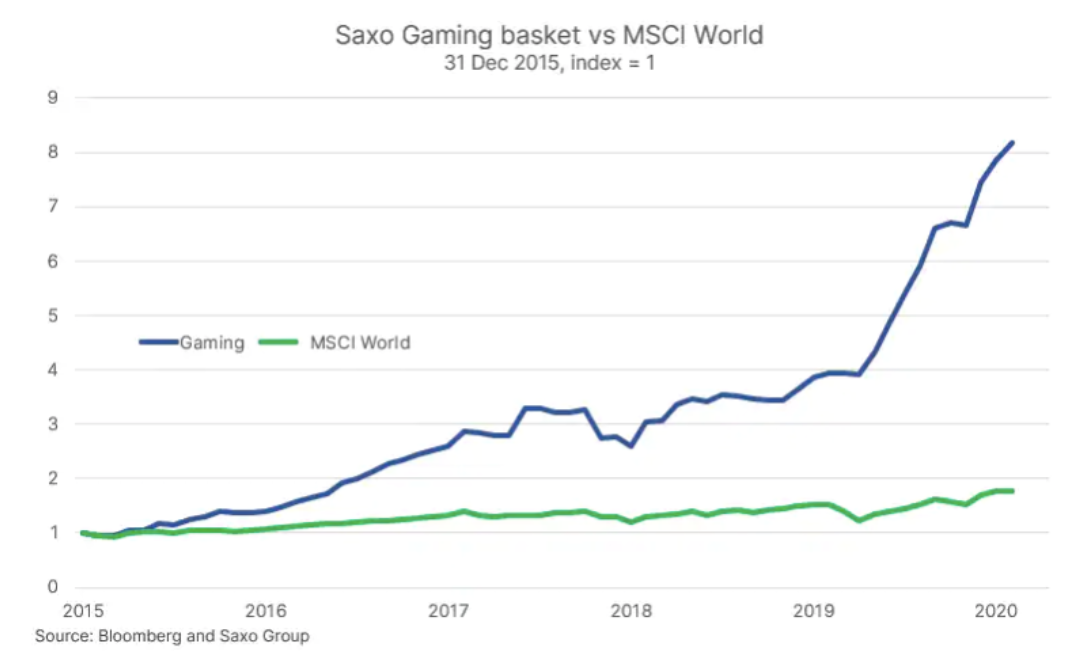

Our basket of companies in this industry year-on-day increased by 5,8%, in the last year it gained 101%, and in the last five years its value increased by 772%. However, since historical performance does not determine future performance, investors should not attach too much importance to the above data. They reflect high growth in the gaming industry, but an important aspect here is the potential for continued growth in the next decade.

The gaming industry will continue to increase its share of the recreational market

The pandemic diametrically affected the gaming industry, as many more users became interested in this entertainment after the cancellation of sports events and the closure of generally understood recreational activities. According to data on the gaming industry, the average American adult socializes online for one hour a day, and esports streaming is growing in popularity. This became apparent in 2019, when the CEO Netflix stated that the biggest threat to the company was not Disney or HBOand Fortnite, one of the most popular games in the world.

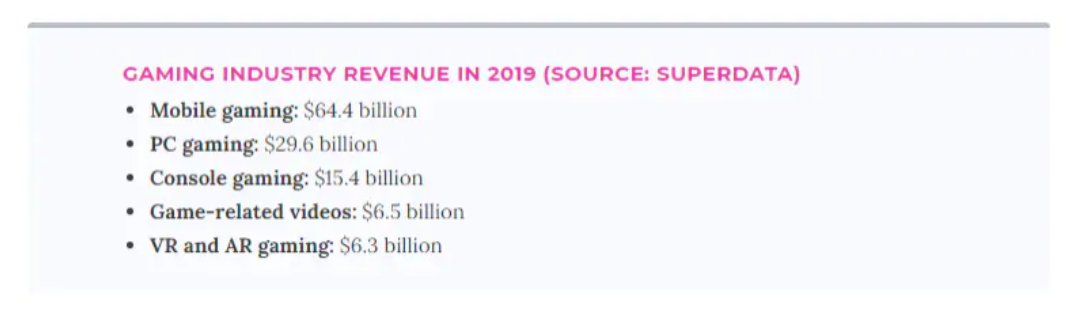

In 2019, prior to the pandemic, the gaming industry generated $ 120 billion in revenue (see breakdown below), and by 2021, 2,7 billion people are expected to play games on any platform. The development of this sector was positively influenced by smartphones, which attract users who commute to work or have free time. In addition, many games are based on feedback loops developed by social media platforms for engaging (often a euphemistic term for addiction). In the future, competition in the gaming industry will increase significantly as high growth and profitability already attract such technology giants as Apple Lossless Audio CODEC (ALAC),, Google, Amazon or Microsoft. Virtual reality / AI is expected to dominate gaming in the future, but the project Facebook - Oculus - contrary to forecasts, it was not successful.

Main areas of risk

The pandemic increased the pace of revenue growth and raised share prices and valuations for all companies. As the vaccine economy opens up, people will likely for a while to prioritize physical recreation, restaurants and coffee shops over computer games. This may hinder revenue growth in 2021. China has introduced new regulations limiting the playing time for minorsas the entertainment can be addictive, particularly considering that game developers are designing better and better reward feedback loops based on their experiences in the social media industry. The regulation hit Tencent hard at first, but the Chinese company quickly regained ground as the Covid-19 pandemic caused an increase in the number of elderly users. Similar regulations may appear in developed countries over time, which will reduce the time spent on gaming.

Other key areas of risk are the difficulties faced by game developers in the context of constantly developing new products that would attract users and maintain high growth. There are many examples of game developers who were once successful but have lost their ability to innovate over time. Large companies such as Apple, Google and Amazon, following Microsoft's example, are also looking for opportunities to develop in this industry. Technological giants, due to the huge scale of their distribution, may become a serious threat to current game producers and their platforms.

Many gaming stocks carry high valuations, which means the implied risk premium is low. Thus, an increase in interest rates will have a stronger impact on the valuation of shares, so the risk of an increase in interest rates in the United States should always be taken into account by investors planning to engage in the gaming industry.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![The gaming industry is a long-term win [Market report] gaming industry](https://forexclub.pl/wp-content/uploads/2021/03/branza-gier-gaming.jpg?v=1614772221)

![The gaming industry is a long-term win [Market report] financial spokesman webinar](https://forexclub.pl/wp-content/uploads/2021/03/rzecznik-finansowy-webinar-102x65.jpg?v=1614769800)

![The gaming industry is a long-term win [Market report] stock market, stocks, bonds](https://forexclub.pl/wp-content/uploads/2019/10/gie%C5%82da-analiza-102x65.jpg)