Concerns about the peak of the recession are bringing raw materials down to earth

The commodities sector remains under pressure from a range of negative developments, with a particular focus on heightened recession concerns. In addition, the general decline in risk appetite in difficult market conditions pushed the dollar to levels not recorded for several decades. At the same time, China, the world's largest consumer of commodities, continues to grapple with Covid-19 infections and problems in the real estate sector. In this article, we discuss what this means for oil, copper, precious metals, gas, and grains.

The commodity sector remains under pressure from a number of negative developments. In early June, weakness in the industrial metals sector, which had already suffered from a zero Covid policy and continued lockdowns in China, spread to all other sectors. The impulse was the higher-than-expected inflation reading that forced the FOMC to react with a 75bp rate hike - a move that fueled recession concerns (the word now appears regularly in most market news).

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In addition, the general decline in risk appetite in difficult market conditions pushed the dollar to levels not recorded for several decades - primarily against the euro and the Japanese yen. A stronger dollar pushes up the cost of dollar-denominated commodities, putting additional pressure on demand in regions like Europe, which is already struggling with inflated gas and energy prices.

China, the world's largest consumer of commodities, continues to grapple with increasing Covid-19 infections and problems in the real estate sector. As a result, this delays the recovery, in particular for industrial metals, whose prices have fallen by a third from their record high in early March. The challenge for the Chinese economy was highlighted by a 0,4% y / y decline in real GDP in QXNUMX. While lower growth slows persist in market supply constraints, an outflow of speculative investors from the sector and sales by macro-targeted funds may continue to exert downward pressure until the dollar stabilizes and inflation begins to decline, easing pressure on central banks to maintain their current aggressive stance on tightening monetary policy.

Inflation, which has hit its highest level in several decades, and the way central banks try to contain it remain in the spotlight in all markets. While production costs have started to decline thanks to lower commodity prices, there is still concern that central banks' actions to curb economic activity through monetary tightening could lead to an economic slowdown that could trigger a recession. Currently, the focus is on Europe, where exceptionally high gas prices negatively affect activity, and the United States, where another shockingly high reading of inflation (9,1% in June) is likely to trigger another 0,75% rate hike at the meeting FOMC July 27.

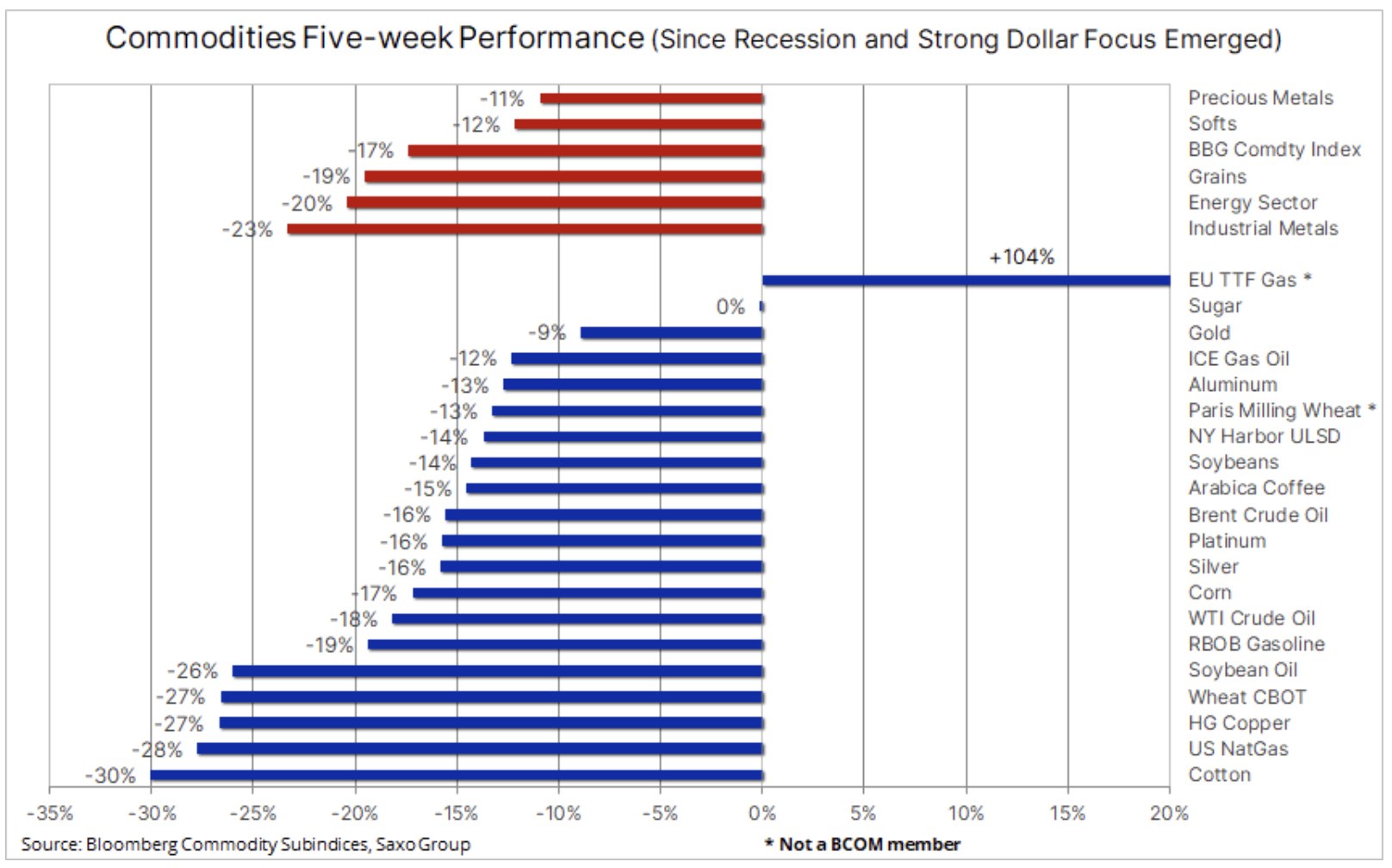

Since reaching a record high in early June, before a rate hike in the United States raised fears of a recession and a strengthening dollar, the Bloomberg spot commodity index suffered losses for five consecutive weeks. The overall decline was 17%, with all sectors deeply correcting. This mainly concerned industrial metals (-23%), energy (-20%) and cereals (-19%). Precious metals were also affected by declines: the price of silver in this period fell by 16%, and gold - by 9%.

Petroleum

Price oil (Brent) is still hovering around $ 100 a barrel after briefly dropping below the key support of $ 97,5 a barrel - for WTI that level is $ 93,50. Overall, the market has almost wiped out the gains seen in the aftermath of Russia's invasion of Ukraine, and the focus has shifted to the risk of an economic slowdown that could hurt demand. This would have a positive impact on the limited supply, which has been pushing up prices in recent months. President Biden's visit to Saudi Arabia it is unlikely to produce much of the extra barrel effect, especially given the recent fall in prices. In the short term, the market will continue to focus on the dollar and the Covid-19 outbreaks in China - the latter pushing Chinese economic growth to its lowest level since the outbreak of the Wuhan pandemic in early 2020.

Questions are now being raised about the ability of the energy sector to withstand the additional sales tide associated with the recession. We continue to believe - and fear - that anxiety about the destruction of demand will be more than offset by supply constraints. Russia's ability to maintain current production levels will be increasingly put to the test in the coming months. In addition, a number of members OPEC + near the end of their production capacity, and only a few oil suppliers are still able to increase production.

In the short term, there will be a further battle between macroeconomic traders selling "paper" oil through futures and other financial products as a hedge against recession, and the physical market, which still has limited supply supporting prices - particularly in the Brent crude oil market, which buyers of physical barrels pay a near-record premium for immediate delivery. In addition, the United States will eventually be forced to halt the marketing of nearly a million barrels a day from its strategic reserves. Based on this, we expect Brent crude oil to be around the support level. However, in response to the current fears of recession, we are lowering our Q95 target range to $ 115-XNUMX.

Industrial metals (copper)

Copper is heading for the largest weekly decline since early 2020, with the increasing difficulties of the Chinese real estate sector and the global economic slowdown necessitating a significant revision of the short- and medium-term price forecasts for this metal. The Rio Tinto capital group, the main supplier and the world's second largest mining company, in its quarterly report warned against the deterioration of the global economy, including due to the war, inflation and the tightening of monetary policy.

Technically speaking, the price of HG copper has been steadily falling over the past three weeks since the key support broke at around $ 3,95. After a sharp appreciation of $ 3 / lb from the 2020 pandemic low to a record high on March 11 this year, the price of copper has recovered by as much as 61,8%. Hedge funds now have a net short position of $ 26 in response to these developments. flights - still well above 68 flights after a price plunge as a result of a pandemic in early 2020

A break below $ 3,14 / lb could signal a complete reversal of the uptrend and a return to the pre-pandemic range of $ 2,5-3. Such a significant decline can only be prevented by the easing of the pressure related to the recession and the strengthening of the dollar.

Precious metals (gold and silver)

Like copper, gold it is heading for the fifth consecutive weekly loss; the series of relegations is the longest in almost four years. During this period, the price of gold fell by 9%. The main reasons for this are the much stronger dollar, the sharp decline in US inflation expectations over the ten-year horizon, causing real yields to rise, and the drastic handicap of silver, which is increasingly behaving like an industrial metal under pressure.

For gold to find new support, some of these factors - most notably the dollar - must be reversed. We believe that the recent weakness in gold is excessive as the threat of stagflation has not gone away. However, we also respect the market's ability to inflict pain, especially during the low-liquid holiday months, when it is often allowed to move in both directions with limited appetite to counter the prevailing trend. As a result, we observe a significant reduction in the overall exposure to exchange funds, and - in the case of speculative investors - in futures contracts. In this group, the long position fell to a three-year minimum.

After attempting to break the $ 1 level for the first time since your brief move last August, falling below that level will put $ 700 at your fingertips - a level that has repeatedly provided support in the past two years. At the same time, the price of silver dropped 1% to a $ 675 grip level from its 40 peak of around $ 18 after breaking through several layers of support. During this time, speculative investors changed their positions again, reaching the largest net short position in more than three years. A sentiment shift will be needed at this stage to prevent further losses and cause buyers to question the short position again.

European gas prices have more than doubled since the beginning of June

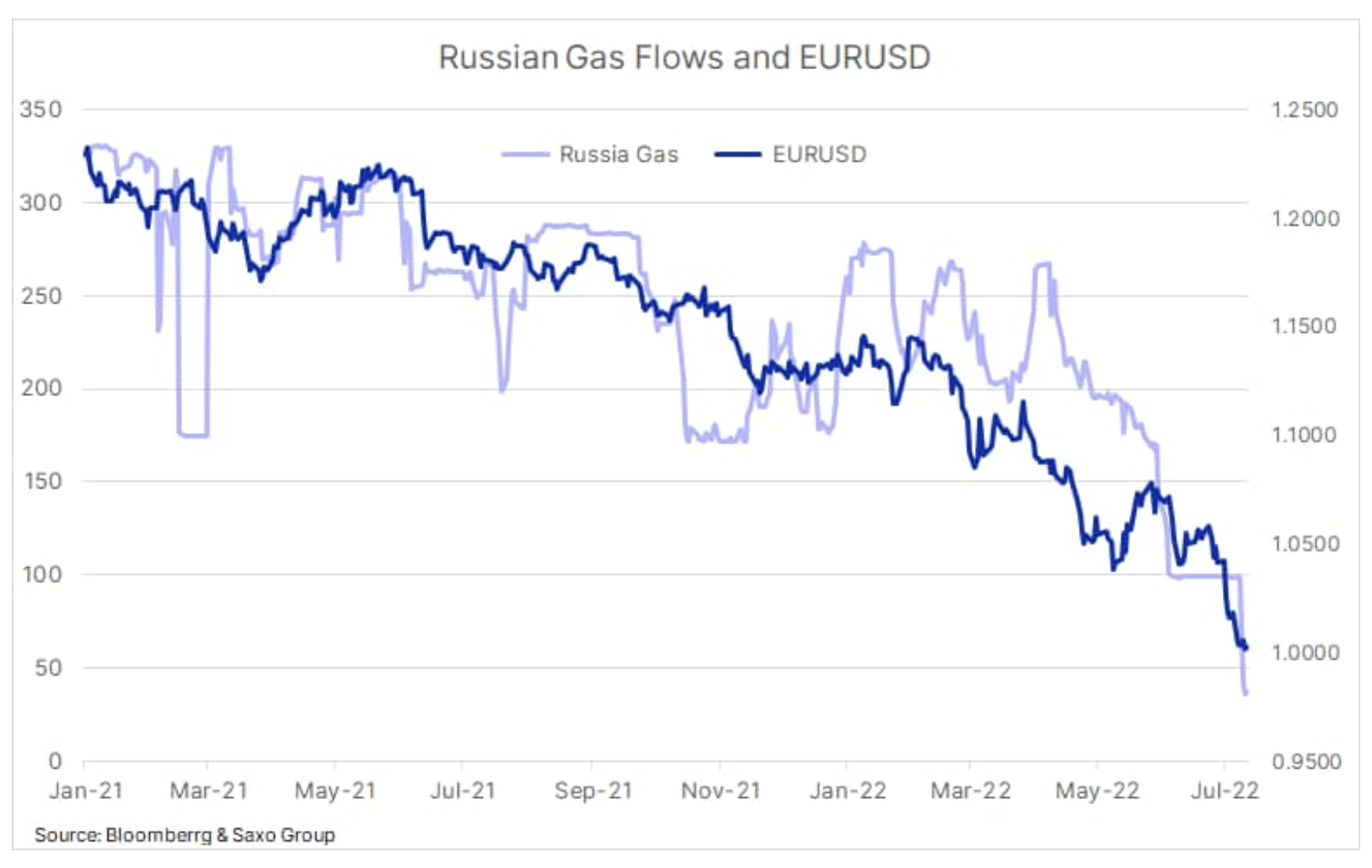

Dutch benchmark TTF gas futures contract (Title Transfer Facility) is trading around EUR 170 / MWh or USD 50 / MMBtu, with Russia increasingly appearing to be using its gas supplies to Europe as retaliation for sanctions and supporting the region for Ukraine through military aid. While a short-term supply disruption from Norway early last week pushed prices to EUR 187 / MWh, the focus is on the Nord Stream 1 pipeline - currently shut down for maintenance. The gas pipeline, which is the main gas supply channel to the European Union, in particular to Germany, was already operating with an efficiency of 40% before it was shut down. This has contributed to the aggravation of the energy crisis, which is hitting industry and at the same time raising concerns about winter supplies. The main problem is whether it will keep the gas pipeline closed after the completion of maintenance work at Gazprom. If it did, it would be a major challenge for Europe's efforts to rebuild stocks ahead of the peak of winter demand.

Record high gas prices driving heating and electricity costs are one of the reasons why EUR / USD pair it reached parity for the first time in 22 years. As a result, we are currently observing a high correlation between the flow of Russian gas to Europe and the euro exchange rate. In other words, the decision of Gazprom / Russia this week to launch Nord Stream 1 could cause additional weakening, or potentially, in combination with the expected interest rate hike by ECB (European Central Bank), make it possible to establish a lower limit for the Community currency.

Agricultural products (cereals)

As a result of the strengthening of the dollar, new supply in the form of recently harvested winter crops, the forecast of large wheat production in Russia and Australia, and a deterioration in investor sentiment regarding raw materials as such, the Bloomberg cereals index again remains unchanged on an annual basis, thus nullifying all gains achieved after the invasion. The biggest weakening occurred within five weeks from the emergence of fears of recession and strengthening of the dollar after the release of the CPI reading in the US in June and the related FOMC rate hike.

Speculative investors, sensing that the market was losing steam, began reducing their exposure to six major grain and soybean contracts in late April. This came after the total long position exceeded 800k. Lots - a level that has led to sharp price and position reversals three times over the past decade. As of July 5, the long position was reduced to 391k. flights. However, in view of the uncertainty about production in the United States, and in Europe in particular, due to the current heatwave, we doubt that prices will have further room to maneuver until there is more clarity on the level of production.

Talks last week in Turkey between Russia, Ukraine and the UN to unblock millions of tonnes of Ukrainian grain exports have been described as constructive and, if successful, will further reduce the risk of a food crisis in the coming months. Ukraine, a major exporter of high-quality wheat, corn and sunflower oil, has blocked its main export artery across the Black Sea since March. This resulted in a sharp increase in the prices of wheat and cooking oils until relative peace returned in the first weeks of the war.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)