The boom in the grain market increases fears of inflation

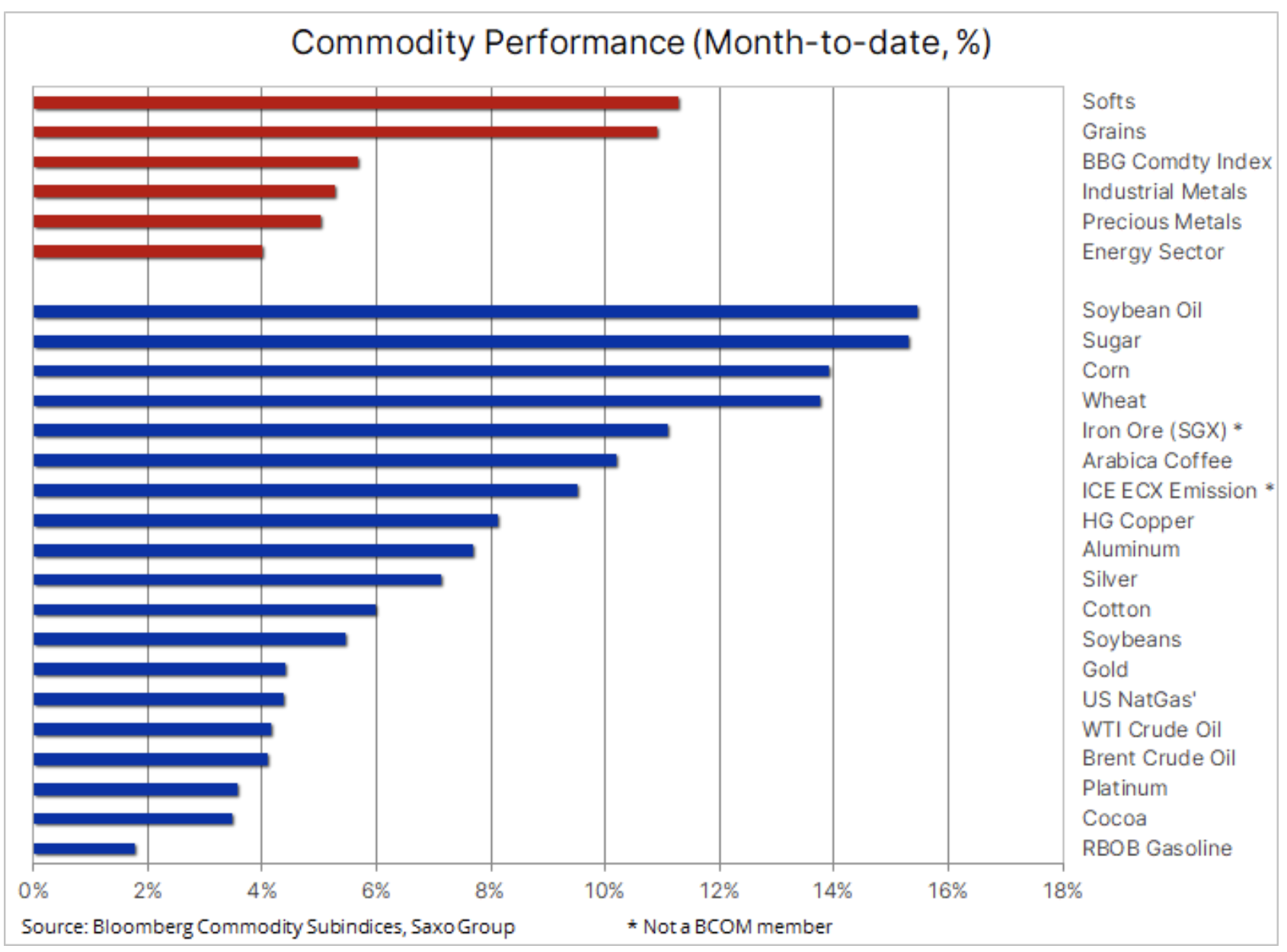

The commodities sector has been recording better and better results for the second week in a row; During this period, the Bloomberg commodity index recovered all losses from the March correction to a new nine-year high. The general recovery was driven by the weakening of the dollar and the decline in bond yields, with the continued rise in the prices of key agricultural products, from soybean oil and wheat po sugar and corn.

This resulted in a further strengthening in the commodity markets due to the improvement in the outlook for central banks, which underestimated the short and medium-term trajectory and the level of inflation. Investors responded with increased demand for financial instruments providing exposure to commodities. Leaving aside the extremely volatile agricultural sector, examples include copper and gold, which have managed to capitalize on recent technical breakdowns.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

At the same time, the energy sector has lagged behind, as the dramatic second wave of Covid-19 infections in India means potential difficulties on the way to a global recovery in energy demand. While some countries are now recovering from the pandemic, the situation in Asia is worrying, especially given the possibility of OPEC + increasing supply in May. An OPEC + meeting at ministerial level is scheduled for April 28; deterioration of conditions by then would increase speculation that the group may again be forced to extend the restrictions.

CO2 contracts

Contract for European CO emission allowances2 recently he made new records every day; it peaked on Thursday when it reached EUR 47,36 / t, an increase of 60% this year. The further increase was related to the agreement of European legislators to raise the targets for environmental pollution ahead of the virtual climate summit organized by the United States. The fact that this contract pre-empted the real implementation of the new anti-emissions policies by utility providers and industrial plants underscores the increased appetite of investors / speculators for a market showing strong momentum since November, when Joe Biden won the US presidential election, signaling a policy shift Of the United States on combating climate change.

Agricultural commodities

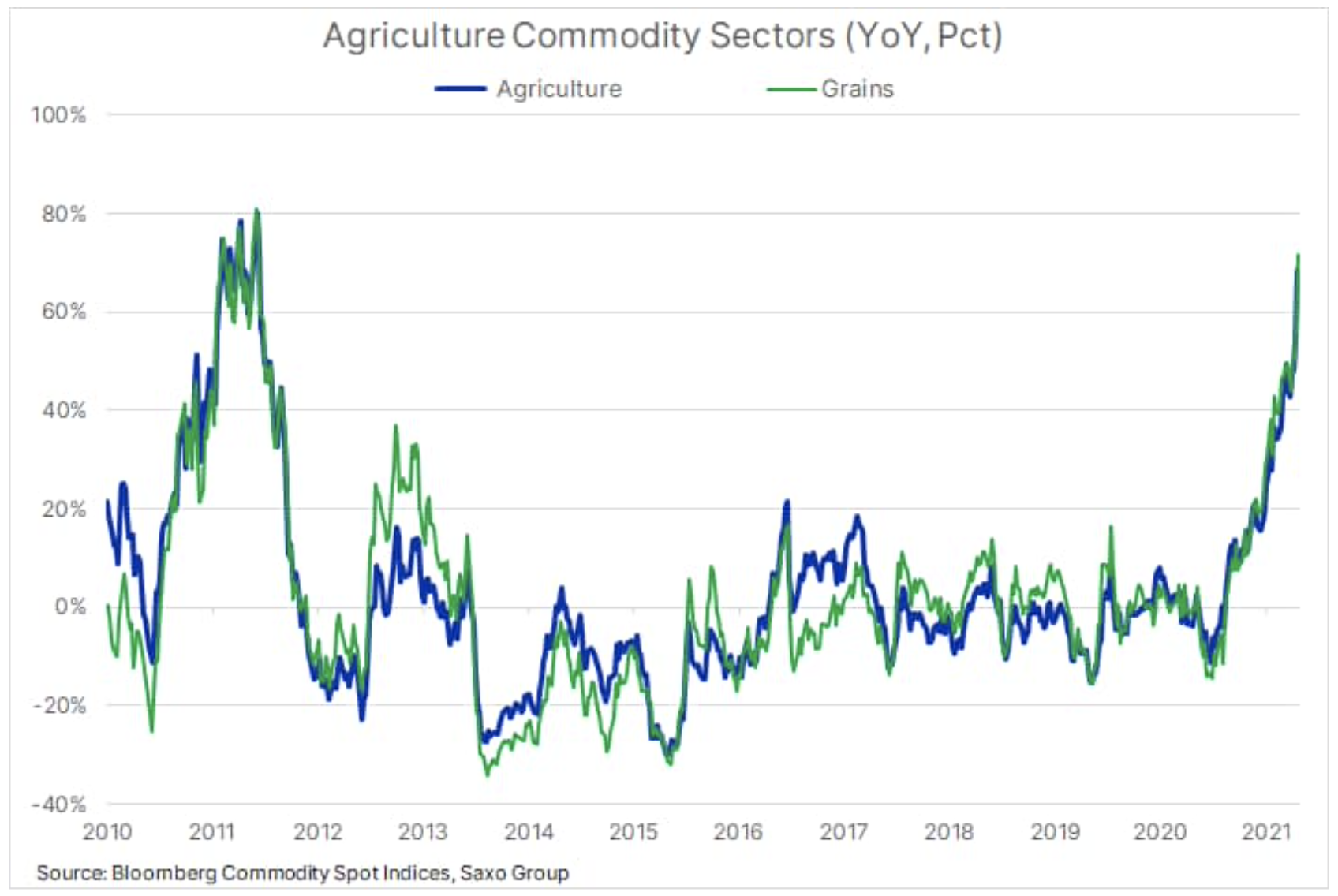

Prices cereals Not only do they remain high, but their growth is actually accelerating: the Bloomberg crop index hit a new eight-year high after rising 8% last week. All key crop contracts listed on the Chicago Stock Exchange have achieved their highest prices in many years. The price of corn exceeded $ 6 per bushel, soybeans were over $ 15, and wheat was over $ 7. The latest highs were the result of an already low inventory level due to strong Chinese demand and a record cooling that delayed planting in the United States and hurt some areas of winter wheat cultivation. In addition, Brazil is experiencing deterioration in growing conditions due to the drought.

On Wednesday, the U.S. Department of Agriculture's Beijing branch said China intends to import a record 28 million tonnes of maize this season to make up for shortages after the Middle Kingdom restored a cattle population decimated by African swine fever. The U.S. Department of Agriculture predicts that demand will fall to 2021 million tonnes in the 2022-15 season as China strives to become independent from foreign grain supplies and recommends reducing the amount of corn and soybeans in its feed.

In this context, and in the perspective of record crops in the Northern Hemisphere, if the weather permits, the prices of new agricultural crops experience an increasing discount compared to previous crops. For example, contracts for both cornand on soybeans with a deadline for completion later this year, they hover around 12% below the prices currently on the market for products available now.

The y / y change is now almost 70%, according to the Bloomberg instant agricultural price index, which monitors futures for a range of major agricultural commodities, from cereals to soft commodities and livestock. These (wholesale) increases, which affect the cost to global (retail) consumers, can be seen in monthly data published by the Food and Agriculture Organization of the United Nations (FAO). According to the FAO global food price index, covering over 90 price quotations, the annual increase in food prices in March was 24,6%.

Following the recent spike in agricultural prices, this key index appears to go up even further in the coming months, adding to inflation concerns, particularly in countries that cannot afford it.

Precious metals

As we mentioned, both goldAnd copper managed to take advantage of the recent breaks. After shifting out of the current consolidation range of $ 4 to $ 4,2 a pound, copper continued to rise to $ 4,32 a pound, with less than 1,5% from its ten-year highest price. Copper belongs to the group of so-called green metals that are predicted to see a sharp increase in demand as the pace of the green transition accelerates or the carbon economy shifts away from the global economy in the coming years. In a recent study, Goldman Sachs predicts that the price of copper may rise by more than 2025% by 60, as the market may experience a "drastic" shortage of this metal in the next few years, unless there is a sharp rise in prices translating into an increase supply.

Gold

The commodity most sensitive to changes in interest rates and the dollar, prolonged its strengthening after the recent break above the key technical level of USD 1 / oz, which, combined with a double bottom below USD 765 / oz, made further growth prospects more plausible. The breakout was driven by rising inflation expectations, stable bond yields and the weakening of the dollar.

In addition, the market was supported by data showing a recovery in physical demand from China and India, the main global consumers of the metal, while publicly traded funds remained unchanged after months of redemptions. However, given that gold has been on a downward trend since August, the extensive coverage of short positions by long-term funds has yet to take place. For this to happen, gold should probably break at least above $ 1.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)