India and Southeast Asia offer calm in the midst of the storm

The economic, political and financial restructuring of the world is likely to bring many shocks to vulnerable emerging and developing economies. However, the ultimate goal - self-sufficiency - underlying the theme of our projections, "the game of fragmentation", is a stretched concept, and as the world's largest economies disconnect from each other, there will also be a need to find reconnections and new friends. India remains a key partner for many world economies, not only in terms of trade but also security and technology, offering long-term investment opportunities in a deglobalizing world. Many Southeast Asian economies also stand to gain from the fragmentation of the global economy.

India's ambitions as a reliable trading partner

The rivalry between the US and China has brought the first clear signs of changes in the supply chains in the manufacturing industry, and the Covid-19 pandemic and Russia's invasion of Ukraine have further increased the demand for shockproof supplies. Global economies have clearly focused on moving away from over-reliance on China - the world's factory - but are struggling to find a reliable trading partner that can provide the scale and skills of Chinese workers. India, Vietnam and Mexico have become the main beneficiaries of changes in the supply chain. Factors supporting India include a solid economic foundation, an effective digital infrastructure and a favorable demographic situation. However, India's increase in production was constrained by protectionist policies and an unfavorable business environment.

Today, this dynamic is changing rapidly and India is making every effort to become an attractive manufacturing and export hub for multinationals. The Modi administration offers financial incentives to companies that want to set up manufacturing centers in India. Coupled Incentive Scheme (Production Linked Incentive, PLI) has been a key driver of investment in some priority sectors such as vehicles and automotive components, specialty steel, advanced batteries, solar panels, mobile phones, electronic components, pharmaceuticals and food processing.

In addition, India has clearly changed its approach to FTAs, focusing on reducing trade barriers, eliminating tariffs and seeking preferential access to global markets. India's main interest seems to be bilateral agreements; pacts with Australia and the United Arab Emirates were concluded in 2022, negotiations are also underway with partners such as the EU, the Gulf Cooperation Council, Israel and the United Kingdom, with whom agreements are to be concluded by 2025. These initiatives are driving a positive image change India as a global trading partner. The culmination of this strategy was Apple's announcement that the latest model of the company's phones - the iPhone 14 - will be produced in India.

India is making progress, but existing problems remain unresolved

While the push to attract manufacturing has allowed Indian exports to skyrocket to record highs in fiscal year 2022 (ending March 2022), Indie they are also making progress towards significantly transforming the structure of the trade product basket through greater integration with global value chains, as well as the geographic structure of foreign trade to reduce dependence on imports from China, while extending market access to Australia, Japan and the United States.

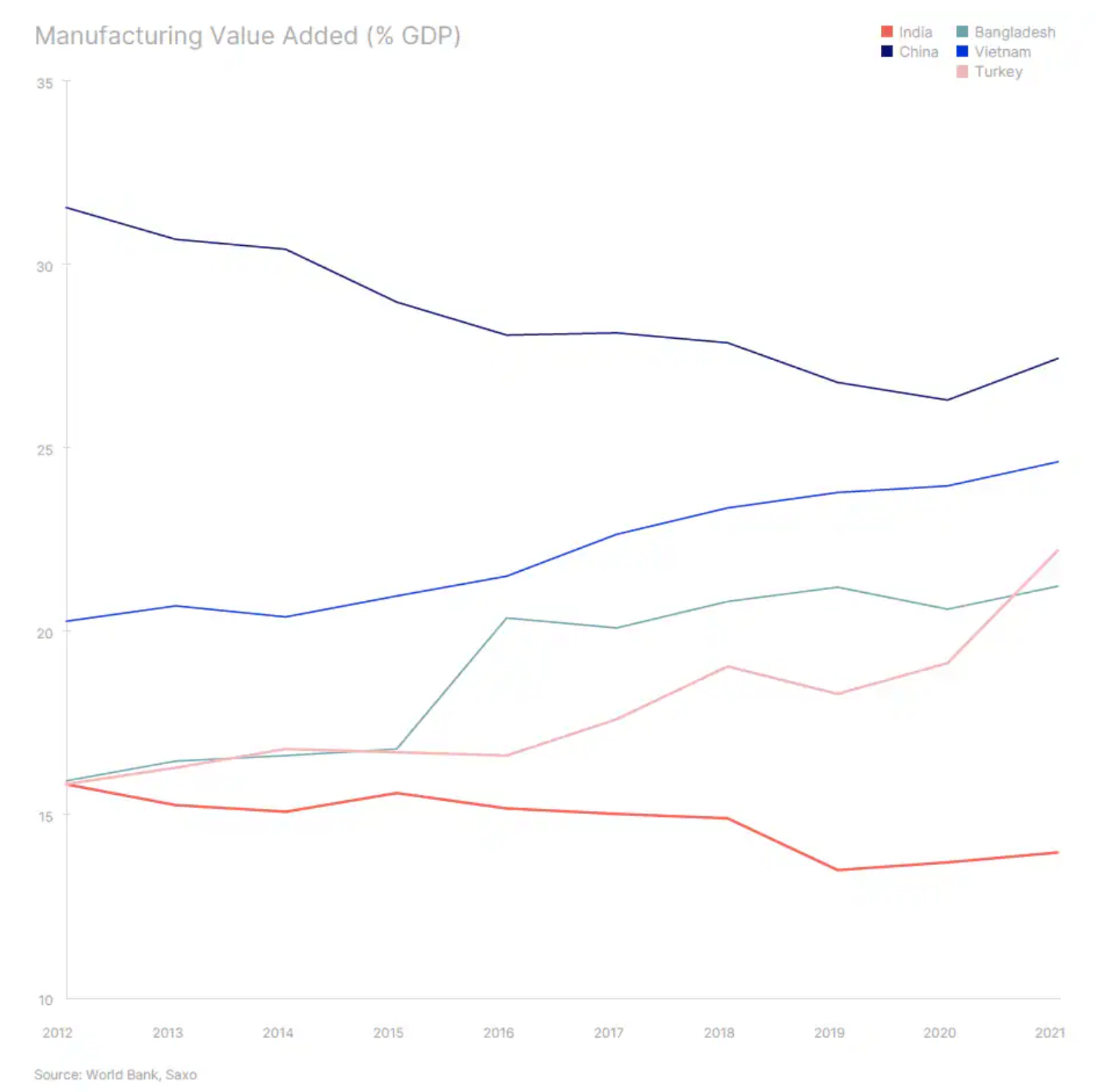

While all major economies want India on their side in the new world order, corporate governance issues, highlighted recently by the Adani group crisis, could still weigh on potential initiatives. The key risk factors are bureaucracy and infrastructure that do not meet modern standards, as well as the lack of qualified workforce and low quality of production. Indian companies also continue to be less competitive due to the protected domestic market, which is a key reason why India lags behind other economies such as Vietnam, Bangladesh or Turkeywhen it comes to increasing participation in global supply chains in the manufacturing sector. While a large domestic market means that India has more potential to grab a significant share of the manufacturing market, it still has a long way to go. It should be noted that the sharp increase in production in Turkey as a percentage of GDP is due to the increasing export value of production in GDP in local currency due to the significant devaluation of the Turkish lira.

The chaos in the banking sector is affecting Indian IT startups

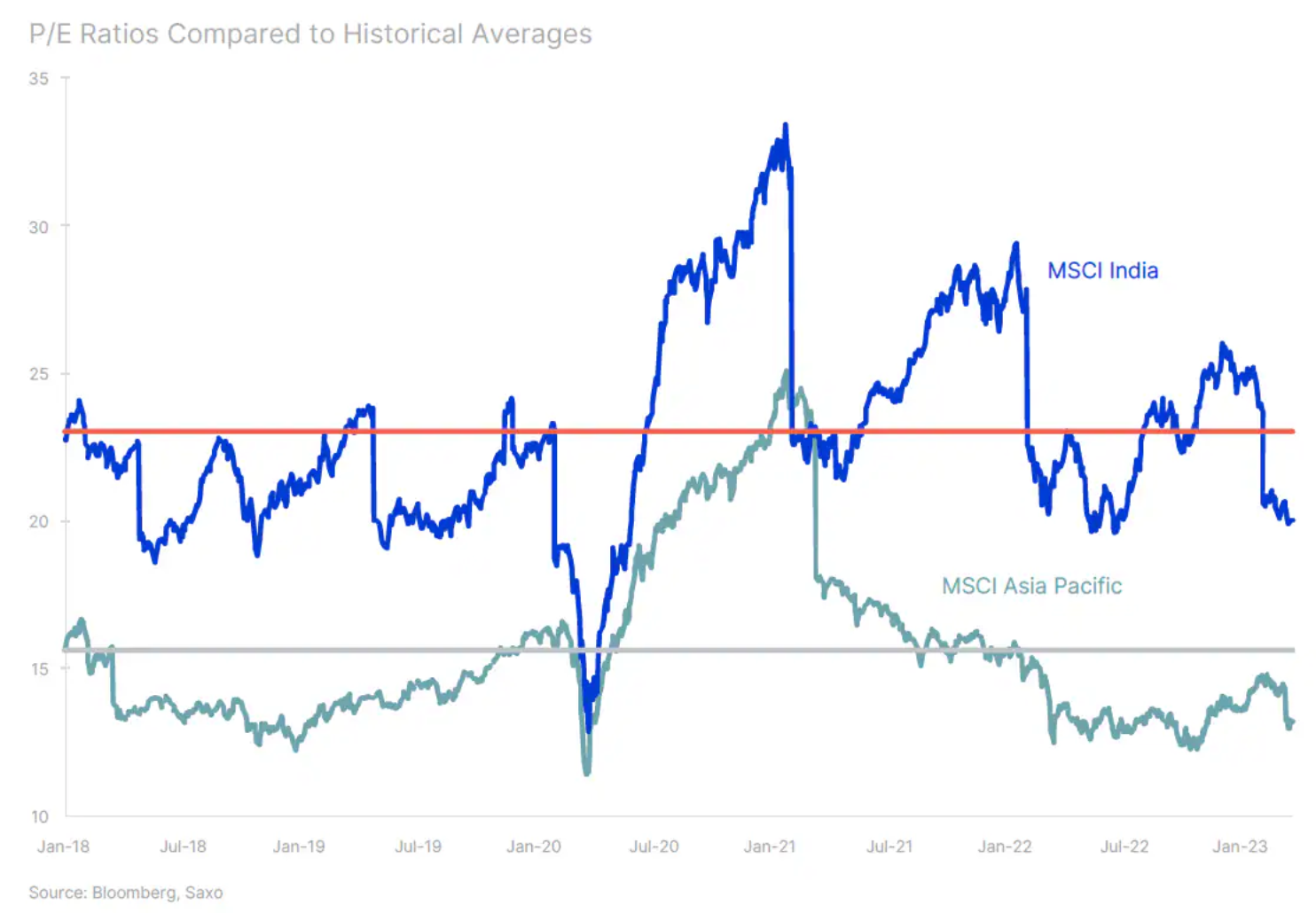

Amid global fears of contagion in the banking sector, India remains a safe haven due to its domestic deposit base and investment in bonds denominated in INR. Despite our earlier warnings that India's valuations seemed overstated at the start of the year, the significant correction in the Indian equity market in QXNUMX has made the risk/return ratio more favorable. Sectors focused on the domestic market, as well as high-quality companies with stable cash flows and strong growth in industries such as banks, pharmaceuticals and utilities remain interesting from an investment perspective.

The Indian tech sector also continues to be a profitable investment in the context of global digitization requirements. Increasing fragmentation may also mean further reliance on Indian IT offerings. A shift in Fed policy, if it comes due to financial risk, also bodes well for Indian tech stocks. The failure of Silicon Valley Bank, however, could have lasting negative consequences for Indian tech startups with deposits in the United States. New funding flows from venture capitalists may remain limited, holding back innovation until funding lines are reconfirmed.

Minimal contagion risk for the Asian financial sector

At the time of writing, the main topic is the problems in the banking sector after the failure of some regional US banks and after the takeover Credit Suisse by UBS at a significant discount and the elimination of additional Tier 1 capital holders. Despite the intervention of the competent authorities, markets remain concerned about the outlook for the banking sector due to the risk of financing costs of US, European and other developed countries banks, which could eventually lead to a credit crunch .

While the key theme in this scenario is minimizing portfolio risk, it is also worth re-emphasizing the benefits of diversification. Asian loans, particularly at the front end of the curve, remain much less exposed to the risk of somewhat less policy tightening in the region in the current cycle. At the same time, Asia's largest financial companies are mostly state-owned, primarily in India and China, and have limited exposure to foreign inflows, which reduces the risk of contagion. In addition, Asian credit continues to be supported by improved economic growth prospects in China, in contrast to the intensifying recession and financial risks in the United States.

The reopening of Asian economies to the world has great potential

Recent concerns about the banking sector have somewhat obscured the topic of reopening the Chinese economy to the world. It is worth emphasizing, however, that consumption in China continues to record a solid recovery, which is generally favorable for Asian markets. China's policy also remains growth-oriented, with the latest proof of this being the lowering of the reserve requirement ratio in March. Moreover, a faster turnaround in monetary policy is likely Fed in the light of financial risk, as well as lower oil prices, mean that favorable conditions for Asian equities are maintained.

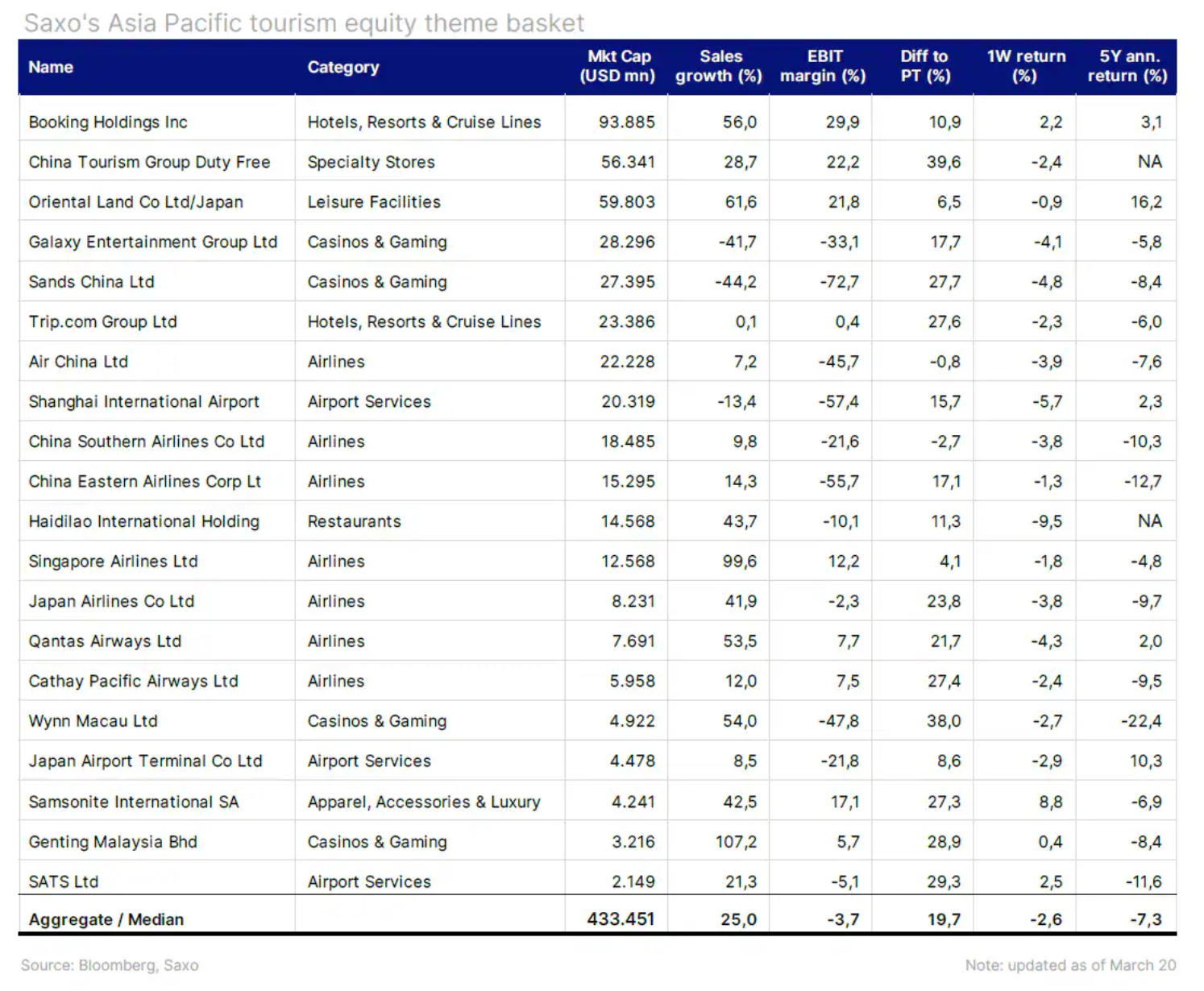

One of the key beneficiaries of China's reopening is likely to be Asia's travel and tourism campaigns. We have created a thematic basket of travel companies from the Asia-Pacific region (Asia Pacific Tourism), reflecting expectations of an increase in the number of Chinese tourists abroad. The list mainly includes Asian stocks of booking platforms, airlines, airport services, hotels, casinos and restaurants in countries that are likely to see the largest influx of tourists from China over the course of the year. In the context of Southeast Asia, shares of Thai and Indonesian companies also look promising.

North Asian stocks in Korea and Taiwan, as well as Japanese banks, may be at greater risk of being infected by tensions in the US banking sector. As Korean and Taiwanese stocks rely more heavily on exports, they may also face more problems as global demand slows down. At the same time, the strengthening of the safe Japanese yen, combined with a slowdown in global growth, may negatively affect the outlook for Japanese stocks. However, expectations regarding policy change will be crucial Bank of Japan by new president Ueda.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)