Inflation and the risk of US intervention in the oil market

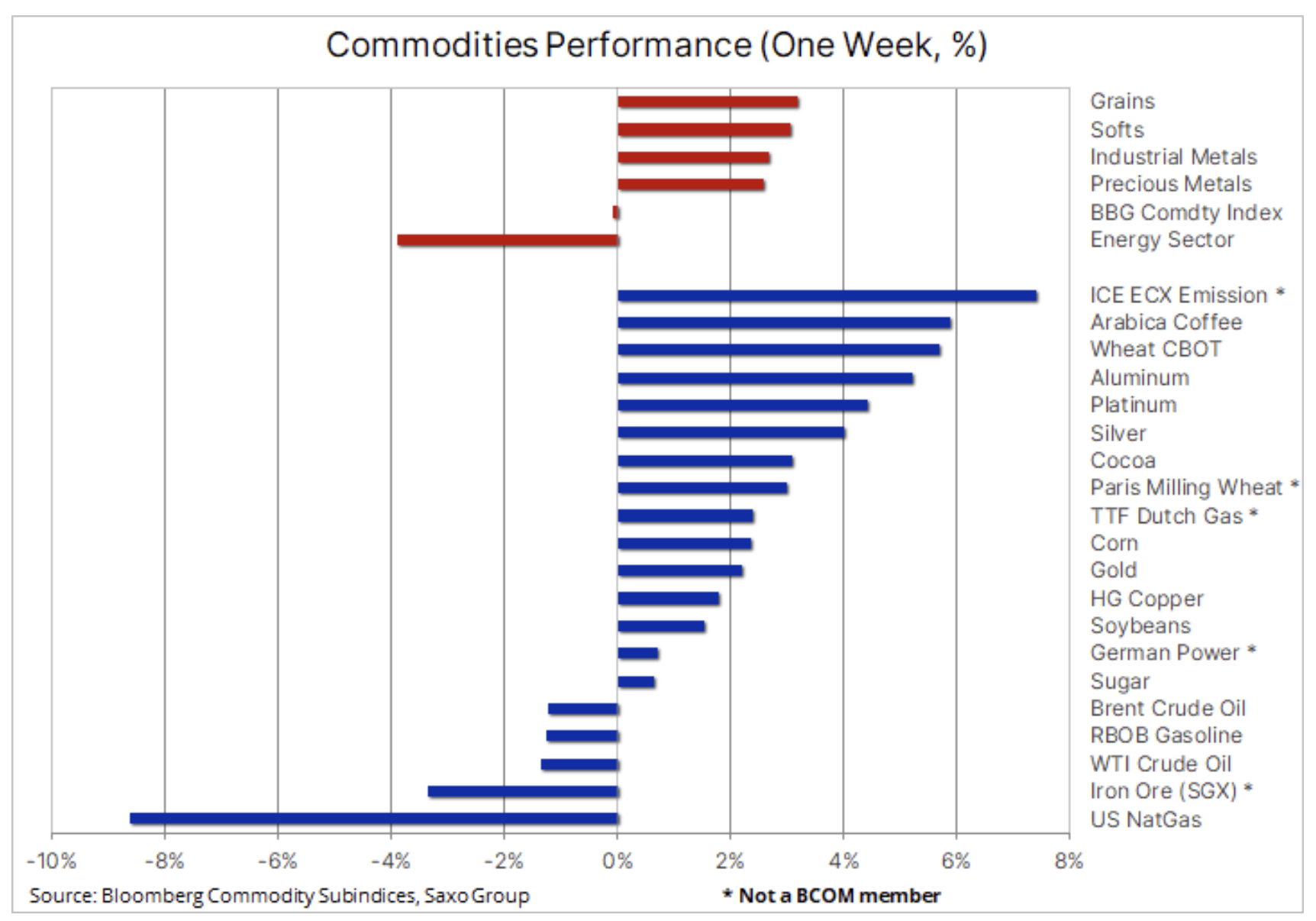

The Bloomberg Commodity Index fell for the fourth consecutive week; losses in the energy sector outweighed gains in metals and agricultural products. The performance of this index, which monitors 24 major futures contracts, reflects the events that the sector has faced - the highest inflation reading in the United States in thirty years, the US government's consideration of ways to lower oil prices, a deterioration in the outlook for key crop supply, and geopolitical uncertainty in the in relation to the eastern borders of Europe, and above all - with the strongest appreciation of the dollar in over a year.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The energy sector fell for the third consecutive week, mainly due to the fall in oil prices and the slump in US gas prices, with the simultaneous rise in industrial and precious metals prices. In contrast, the agricultural products sector has seen a significant increase in wheat prices as world supply has decreased; other key products such as kawa or maize.

Precious metals

After staying within the range for five months, gold has finally caught the attention of investors. breaking through by an area of resistance that has already been rejected many times since July. The market revived in reaction to the highest inflation reading in the United States in over 30 years, as a result of which the real yields of 1,25-year US bonds fell to a record level of -XNUMX%. Although the prevailing narrative after the last FOMC meeting was that the Fed would ignore high inflation, with the main emphasis on the labor market, this reading turned out to be sufficient to trigger a reaction in the market, which increased expectations of Fed's rate hikes next year.

The prospect of an acceleration in the pace of US interest rate increases in 2022, combined with an increase in bond yields at the long end of the yield curve, pushed the dollar to its highest level in more than a year. The recent appreciation of gold and the ability to deal with the strong dollar has brought the euro gold price to an annual high above EUR 1 / oz. All of this could signal a shift in market perception of the metal as these may be the first signs of gold's appeal as a hedge against rising price pressures.

Before speculating on further growth, gold needs to get confirmation that the last area of resistance between $ 1 and $ 830 is now support. If gold does not hold well in these regions, the liquidation of newly-opened longs may occur. Moreover, the reaction of investors through the market of exchange-traded funds will be of crucial importance. Over the past year, fund managers have gradually reduced their exposure to gold as declining equity volatility and rising equity prices reduce the need for diversification. It remains to be seen in the coming weeks whether the red-hot US CPI inflation reading will change this bias.

Petroleum

Clothing it fell for the third consecutive week after failing to pull in enough buyers once again to bring Brent crude oil prices above a double high of $ 86,70. While the global short-term forecast continues to show a price reduction in supply, the market is losing momentum due to the risk of US intervention to curb prices, another wave of Covid-19 in Europe and Asia, lower gas and coal prices, reducing the need for other sources as well as OPEC's monthly oil report, suggesting that current price levels are starting to negatively affect demand, particularly in countries such as India and China.

Following the recent OPEC + decision to maintain the current pace of monthly production increases, the US administration began increasingly blaming the organization for influencing the rise in oil prices. Very high, and in some states near record high, gasoline prices in the United States increase the likelihood of intervention to contain prices by releasing strategic reserves once, or - in a more controversial way - by temporarily banning US oil exports.

In his monthly short-term forecast for the energy market (Short-term Energy Outlook, STEO), the US Energy Information Administration (EIA) reiterated its opinion that there will be an oversupply in the market early next year - a view not shared by Russell Hardy, president of Vitol, the world's largest independent oil trader. In a virtual instance At the Reuters commodity markets conference last Tuesday, he said that global oil demand had returned to 2019 levels and would pick up even more in the first quarter of 2022. Not excluding the price of USD 100 per barrel of Brent crude oil in 2022, he stressed that the limited supply in the crude oil market would continue for another 12 months due to the decline in OPEC production reserves to the level of 2-3 million barrels per day.

In addition to the above short-term developments, the oil market faces long years of potential underinvestment - major players are losing their appetite for large-scale ventures, in part due to uncertain long-term outlook for demand, but also, increasingly, due to credit constraints on banks and investors on ESG (environmental, social and corporate governance) issues and the emphasis on green transition.

Whether the short-term range for Brent crude oil is USD 80-85, or there is a potentially deeper correction towards USD 75,50, will largely depend on the Brent administration taking action to curb prices. The release of strategic reserves of 50 million barrels could cause a temporary drop in prices, perhaps even by five dollars, but overall we do not expect such a decision to have a significant long-term negative impact on prices.

Agricultural commodities

Worldwide prices wheat continues to rise: the price of the wheat futures on the Paris exchange hit another record just below EUR 300 per tonne, while Chicago prices are near their highest level since 2012. The low harvest in North America, coupled with declining exports from Russia, the world's largest exporter, contributed to an increase in demand for European wheat, and with the prospect of another potentially difficult year for agriculture in 2022 due to the return of the La Ninã phenomenon and higher fertilizer costs, some of the largest importers have already started to increase the rate of purchase.

The recent increase was driven by the above-mentioned inflation reading, a further downward revision of global inventories by the US Department of Agriculture and, above all, concerns about a possible further slowdown in exports from Russia. Strong harvest forecasts for Australia and Argentina would have offered little relief if Russia, due to persistently high prices, decided to hold back most of the harvest to contain domestic price increases.

Coffee is another key product whose price has recently reached new highs for many years. Due to supply concerns in Brazil and Colombia, the Arabica coffee futures on the New York Stock Exchange hit a seven-year high at $ 2,16 per pound. After this price hovered in the $ 2015 / pound range between 2020 and 1,2 due to oversupply, there has been a strong increase this year. While congestion and delays in the global container shipping market in recent months have challenged shippers, the main reason for the continued growth is the decline in supply as a result of the collapse in production in Brazil. Drought and frost losses early in the year not only translated into lower harvests, but also raised concerns about yields in the coming season. In Colombia, heavy rains negatively affected crops and increased the risk of plant diseases.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)