Fed hawks and China's problems are reversing trends in commodity markets

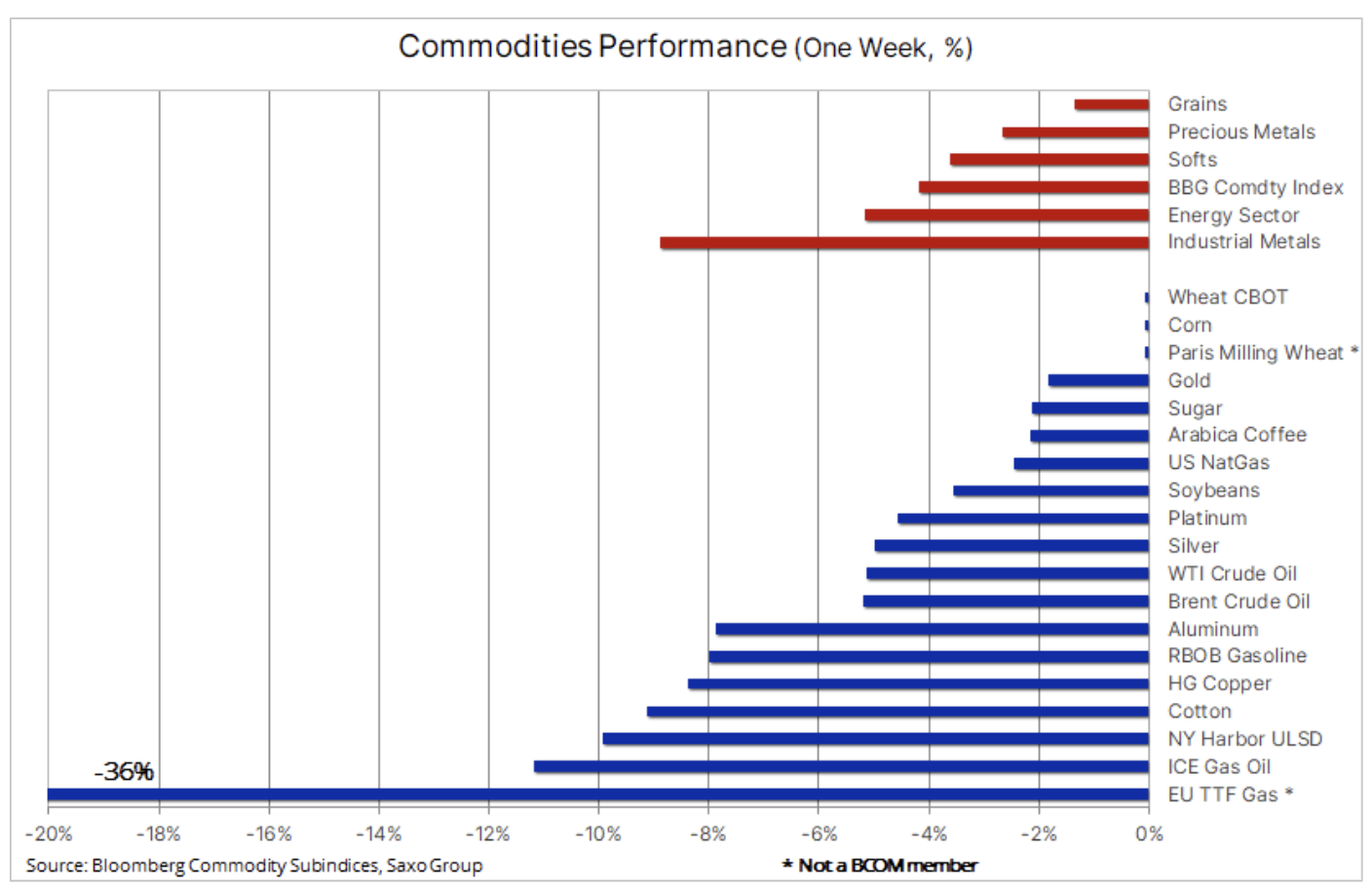

The commodities sector plunged sharply last week on the back of negative market reaction to further concerns about economic growth after US CEO Federal ReserveBy Jerome Powell, it was clear that the US intended to continue raising rates and keeping them high for an extended period of time as part of the fight against galloping inflation.

Concerns about economic growth have risen again over China's protracted fight against the Covid pandemic and President Xi's zero-Covid policy following the introduction of further lockdowns, primarily in Chengdu, a metropolis of 21 million. Industrial metals recorded the greatest losses, while cereals lost the least.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Both of these developments have caused investors in commodity markets to refocus on demand, which may suffer during the economic downturn, instead of the forecast constrained supply of a number of key commodities, from corn and coffee to diesel and gas, as well as many industrial metals due to mining and production challenges. Raw materials dependent on economic growth and on China, such as industrial metals and cotton, suffered heavy losses, while the prospect of Gazprom resuming gas supplies via the Nord Stream 1 pipeline from Saturday morning contributed to lower gas prices in Europe. The price of diesel oil has fallen along with it, given the assumption that the demand for switching from gas to fuels may slow down.

Gold, silver and copper

Goldand silver in particular, suffered heavy losses as hawkish announcements from several US Federal Reserve members and concerns about China further hampered investment metals due to their impact on the dollar - which has gained 11% this year against a basket of major currencies - while US ten-year bond yields in real terms recorded the biggest jump in several decades, so far in 2022 at 1,9%.

Demand for investment metals is likely to remain in question until the dollar and bond yields stabilize. This may only happen when the deteriorating economic forecasts force policy makers to reflect, or when inflation does not fall at the pace currently projected by the market. Inflation expectations have lowered further since Fed Chairman Powell's aggressive speech in Jackson Hole and five-year inflation swaps now point to inflation below 3%.

The biggest drop was recorded silverwhich is still looking for directional inspiration, not only from gold and the dollar but also more recently (more importantly) from industrial metals, particularly copper. Both metals are now down 24% year-on-day, with silver reverting back to the previous consolidation range of between $ 16,50 and $ 18,50. This resulted in a dynamic increase in the ratio of gold to silver to the highest level in two years, around 95 (ounces of silver per one ounce of gold). Currently, this indicator has recovered over 50% of the losses incurred in 2020-2021, when there was a decrease from 127 to 62 points; full recovery largely depends on developments in China and the copper market.

Regarding the supply of copper, it is worth mentioning that copper It fell 8% in the week in which production in Chile - the world's largest producer of this metal - fell for the second month as mines grapple with the problem of ever lower ore content. This means that obtaining the current amount of copper now requires more work. An additional obstacle for producers are restrictions in access to water. This could cause copper, and with it silver, to experience a strong recovery as soon as the situation in China improves.

The role of gold as a diversification factor has been increasingly questioned since the recent decline in the key support area ($ 1 / oz).

It is worth underlining once again, however, that gold - with the exception of the XAU / USD ratio, which has been hurt by the aforementioned 11% dollar appreciation - continues to perform much better than stocks and bonds under pressure. The yellow metal has so far once again managed to find support in the region of $ 1, an area that has repeatedly provided support in the past two years. A breakthrough downwards would worsen the market sentiment even more and could challenge investors with long-term positive stance on the metal. At this point, price must break above the trendline from the March peak, currently at $ 680, before this is considered a signal of recovery.

Oil prices within the range but volatile

Reflection oil from the six-month minimum was resumed after an aggressive announcement from Jerome Powell, chairman of the Federal Reserve. Coupled with renewed lockdowns in China, this has once again diverted the market from limited supply to concerns about demand. As a result, there was a correction of nearly $ 12 to around $ 90 for Brent crude and $ 85 for WTI, with some sales driven by speculative investors who bought crude oil at the break above $ 100 due to Saudi comments. , that OPEC + may consider cutting production.

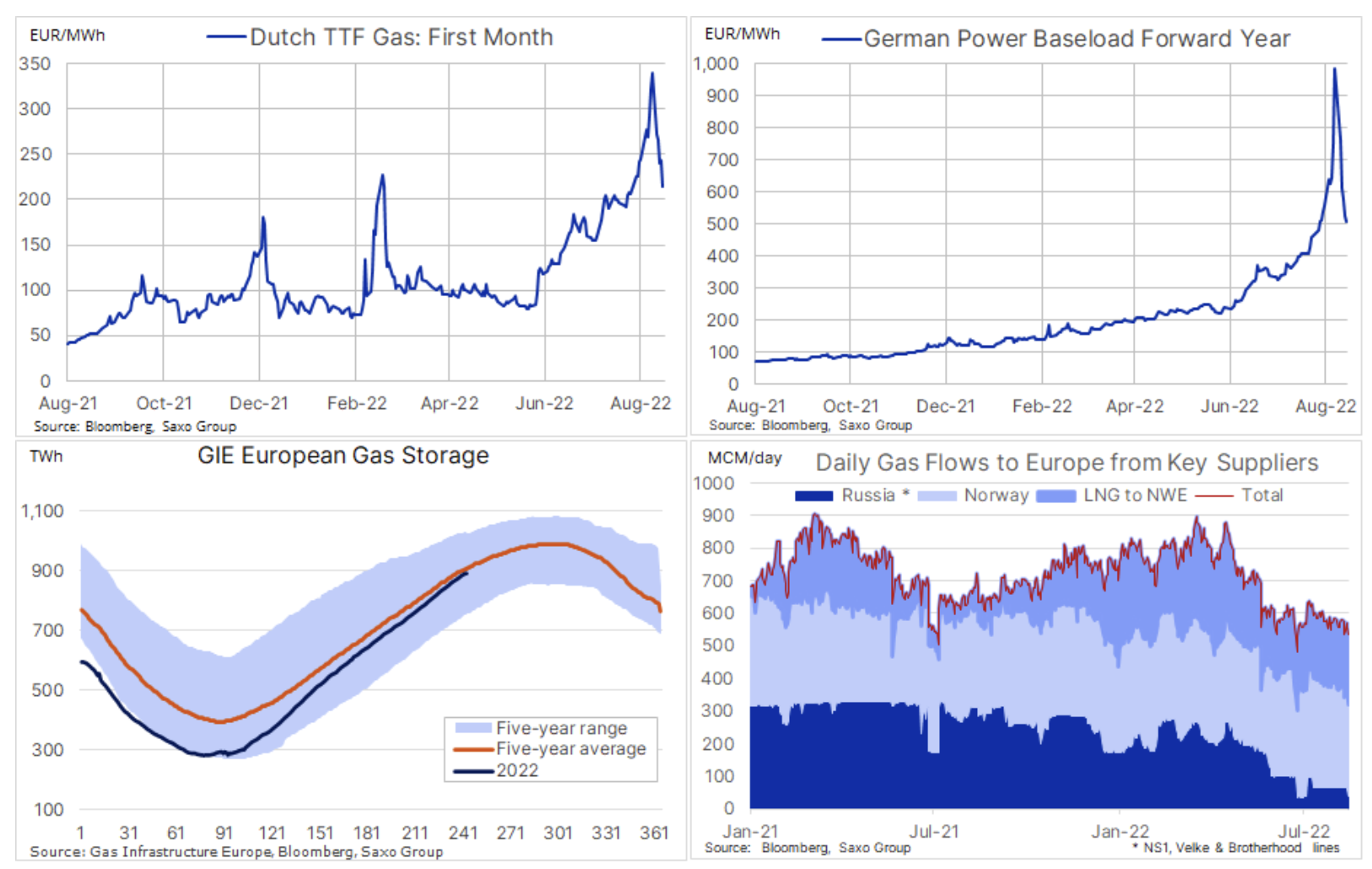

In Europe, and increasingly in Asia, high gas and electricity prices continue to drive substitute demand for fuel products such as diesel and heating oil. In the short term, the price of gas in the fall months will continue to be dictated by supplies from Russia, in particular whether or not Gazprom (and Putin), as announced, will resume operation of the Nord Stream 1 gas pipeline after a three-day maintenance shutdown.

On the supply side, the market will watch the impact of the EU embargo on Russian oil, which will start to affect supply from December, and the release of 180 million barrels from US strategic reserves at the rate of one million barrels a day, which is expected to end on October 21. In addition, a nuclear deal with Iran has yet to be reached, and after Washington described Tehran's response to recent efforts to restore the 2015 agreement as "unconstructive", the risk of failure remains to be expected. After retail gasoline prices in the US have fallen by 25% since June, and the Democrats do not want to be seen as being too submissive to Iran, this deal seems increasingly unlikely, at least in the short term.

Given that OPEC + will meet on September 12 to discuss production, a further decline in oil prices is unlikely, and support at $ 85,50 for WTI and $ 91,50 for Brent is unlikely to be affected in the near future. time.

EU gas and electricity prices are falling amid hopes for the resumption of supplies from Russia

The European energy market has managed to offset some of the recent strong gains gas prices and electricity after the recent jump caused by high demand for gas supplied via pipelines after low water levels on the Rhine prevented the normal supply of coal and diesel fuel to utilities and industrial plants located in central Germany. However, the three-day downtime for the maintenance of the key Nord Stream 1 pipeline has driven prices up sharply amid concerns that deliveries will not resume as announced by Gazprom.

Nevertheless, as the week progressed, the risk of not opening the gas pipeline decreased and Dutch TTF gas price dropped to a level close to EUR 200 / MWh, while the price of electricity in Germany fell by more than half in the coming year after a short jump on Monday above EUR 1 / MWh. In response to energy prices that are so high and damaging to economic growth, the EU is preparing to intervene and adjust energy prices throughout the region. The recent chaos has also fueled fears that the speculative investors with the most resources - the initial margin for one of the German futures contracts a year ahead - have been able to spontaneously push prices up to levels unjustified by the current fundamentals only to abandon items when the shopping panic has expired.

After filling the EU storage facilities and ensuring that NS1 restores gas supplies, gas prices could fall below EUR 200 / MWh - a level which is however still high enough to contribute to gas rationing and the destruction of demand.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)