Metals benefit from speculation that China will ease covid restrictions

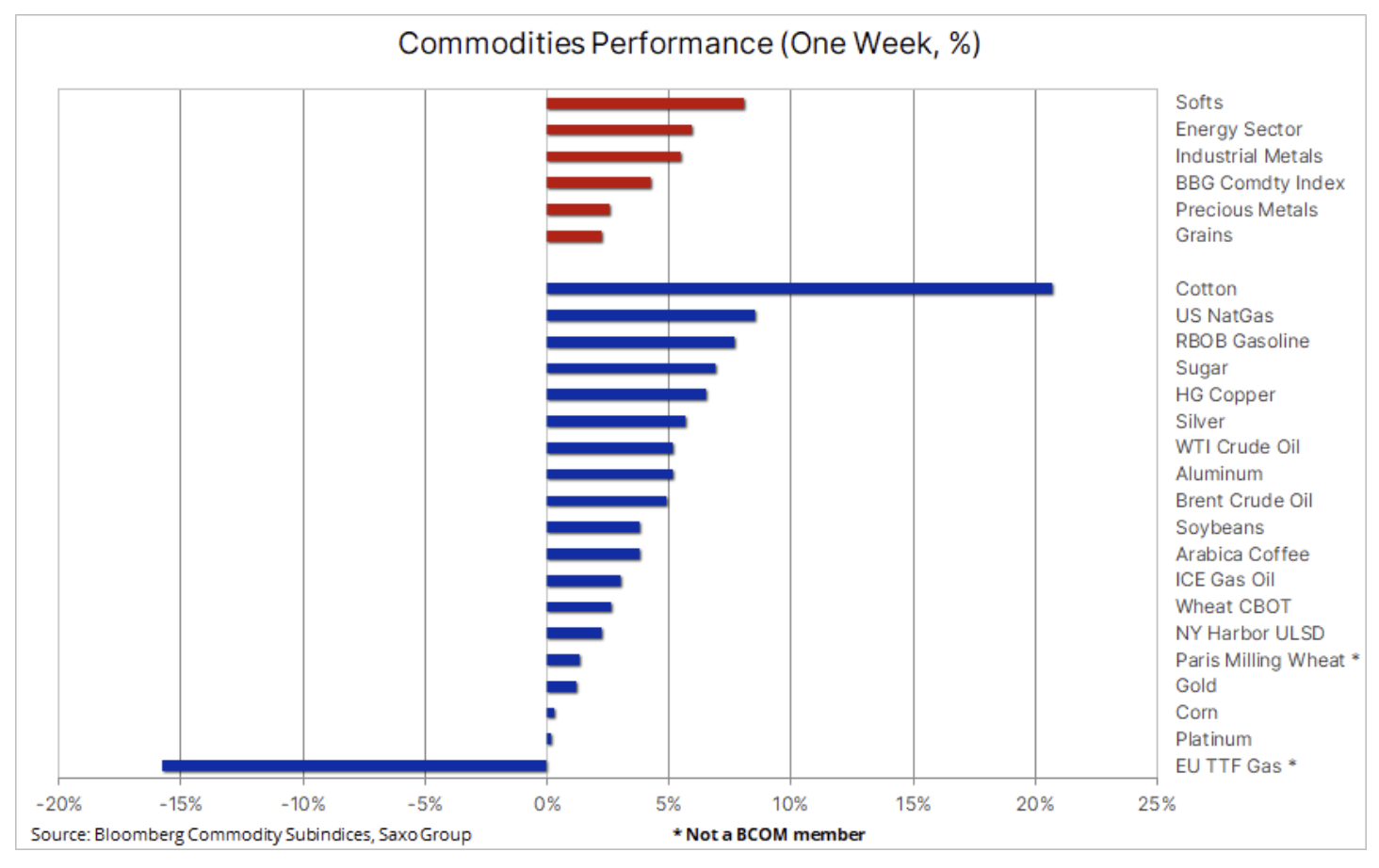

Commodity prices rose in a week when optimism about the re-opening of the Chinese economy took center stage, and at the same time the protracted cycle of rate hikes in the US, negatively affecting global growth and demand. Overall, optimism about China prevailed, with strong growth mainly from industrial metals, energy and cotton.

Commodity prices rose broadly in a week that brought optimism about the reopening of the Chinese economy to the fore, coupled with a protracted cycle of rate hikes in the US, negatively affecting global growth and demand. In addition, the energy market continues to focus on the price-supporting impact of output cuts OPEC + and the upcoming EU sanctions on the sale of Russian oil. The Bloomberg Commodity Index, which monitors a basket of major commodity futures evenly distributed across energy, metals and agriculture, posted an increase of more than 4%, approaching its three-week high.

After Wednesday, the fourth in the current cycle, the expected rate hike by 75 bps, the president of Powell from the Fed de facto temporarily suppressed the moods in the markets, noting that possible talks about the suspension of rate hikes are "definitely premature". However, it is also clear that FOMC will be guided by economic data, and any signs of weakness could change this approach after the Federal Reserve mentioned the possibility of holding back on rate hikes to assess the impact of "cumulative tightening".

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The delayed impact of rate hikes on the economy continues to give rise to concerns that the bond market is trying to price in via an increasingly inverted US yield curve. Last week, the spread in bond yields - from two to ten years - reached as much as -61 basis points, representing the biggest curve reversal since the 80s, and underlines the risk that a central bank policy error will weaken economic growth without effective containment of inflation. This contributed to the support of gold and silver, which rebounded heavily as a result of short positions being covered after an initial unsuccessful attempt to bring them down by a key support.

Gold recovers from another FOMC sell-off

Gold recorded a weekly increase after it managed to recoup its losses from the weakening of the dollar and the rise in profitability following the Fed President Powell's press conference. The initial weakness pushed gold close to key support in the $ 1 region for the third time, with the subsequent rebound supported by short coverage and a weaker dollar. The price was also supported by the aforementioned further inversion of the US yield curve, signaling an increased risk of an economic slowdown. After returning to safer regions, the market will watch incoming economic data, starting with Friday's US employment report, which, despite a relatively solid reading, did not stop gold strengthening at the end of the week.

At Saxo, we have long held the view that the medium-term inflation forecast is likely to surprise to the upside, and that the 4-5% range over the next decade is not that alarming. This will be the result of a new geopolitical situation in which the world will split into two parts, and any changes will be related to deglobalization resulting from the need to become independent from other economies. Combined with the energy transition, this means that we will use raw materials and capital intensively in the next decade, and the shortage of raw materials and labor will keep inflation at an elevated level for an extended period of time, exceeding the 3% currently priced in the swap market.

Such a scenario, combined with the risk of an economic slowdown, which would force central banks to reverse expectations of interest rate hikes, which would cause a decline in yields and the dollar's exchange rate, may in our opinion provide significant support for gold and silver in 2023. Moreover, support has already been provided by central banks , which in the third quarter acquired a record amount of gold of 400 tons, which more than compensated for the 227 tons decrease in total shares in gold-based exchange funds. After support is established at $ 1, the first key growth tier is in the region of $ 615-1, which is around the recent high, 675-day moving average and trendline that started with the March high.

The bulls in the oil market are gaining ground

Petroleum apparently it will see an increase for the third consecutive week with both Brent and WTI crude oil nearing the upper end of their agreed ranges. The market focuses on the impact on the supply of production cuts by OPEC + and the upcoming EU sanctions on Russian oil, as well as on the limited supply in the market of fuel products, while the demand side is torn between the prospect of increasing Chinese demand after the lifting of covid restrictions and fears that global economic activity will continue to weaken in the coming months.

While crude oil has remained broadly within the range since July, the market for fuel products continues to tighten as supplies in Europe and the US are increasingly scarce, increasing refining margins on gasoline and distilled products such as diesel, heating oil and aviation fuel. The main factor in this regard remains the product market in the Northern Hemisphere, where the scarcity of diesel and heating oil stocks is still a matter of concern. The chaos in this market was caused by the war in Ukraine and sanctions against Russia, the main supplier of refined products to Europe. In addition, the high cost of gas has accelerated the shift from gas to other fuels, particularly diesel and heating oil.

This situation has now worsened as a result of the extremely unfavorable decision of OPEC + to cut production from this month. While the continued release of US (light sweet) oil from strategic reserves will support gasoline production, OPEC + production cuts will primarily affect Saudi Arabia, Kuwait and the United Arab Emirates - producers of medium / heavy oil, which produces the most distillates.

As long as the product market remains constrained, the downside risk for crude oil - despite the current fears of recession - appears low, so we reiterate our forecast for this quarter's Brent price range between $ 85 and $ 100, with a tightening product market increasingly degree tilts the scales in favor of growth.

Good week for industrial metals with hope to reopen

The Bloomberg Industrial Metals Index was able to record its best week since July; The three main metals - nickel, aluminum and copper - achieved the largest increases due to unverified information that China may come closer to ending its strict zero Covid policy, and also due to concerns about a decline in supply as a result of increased activity of Chinese buyers. Additionally, copper was boosted by the suspension of mining in one of the largest mines in the world - the giant Las Bambas mine in Peru, owned by MMG. From October 31, work in this plant is blocked by local residents.

As you can see in the chart below, copper HG, which has been within the range since July, broke through several resistance levels, but to confirm a real recovery it would have to break above the August high of USD 3,78 per pound. Only then could new buy transactions appear from speculative investors who have been preferring to sell this metal for months.

Cotton is going up thanks to the coverage of short positions and signs of recovery in demand

The price of cotton, which has fallen by more than 50% since May due to concerns about the health of the global economy and hence consumer demand for clothing, has risen by 20% since last Friday. Despite the dollar rebounding negatively affecting other agricultural products, cotton has managed to rebound amid signs that China's yarn production appears to be on the rise. The US weekly data on export sales to China also provided support, which showed an increase of 98% compared to last year.

An eventful week for wheat

Wheat The quotes in Chicago and Paris rose sharply earlier last week after Russia announced a suspension of its grain export deal to Ukraine, and then fell after Russia allowed its continued supply. Even so, wheat eventually showed an increase due to increasing drought concerns in Argentina and the American Great Plains.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)