At the end of the year, the paths of energy and metals diverge

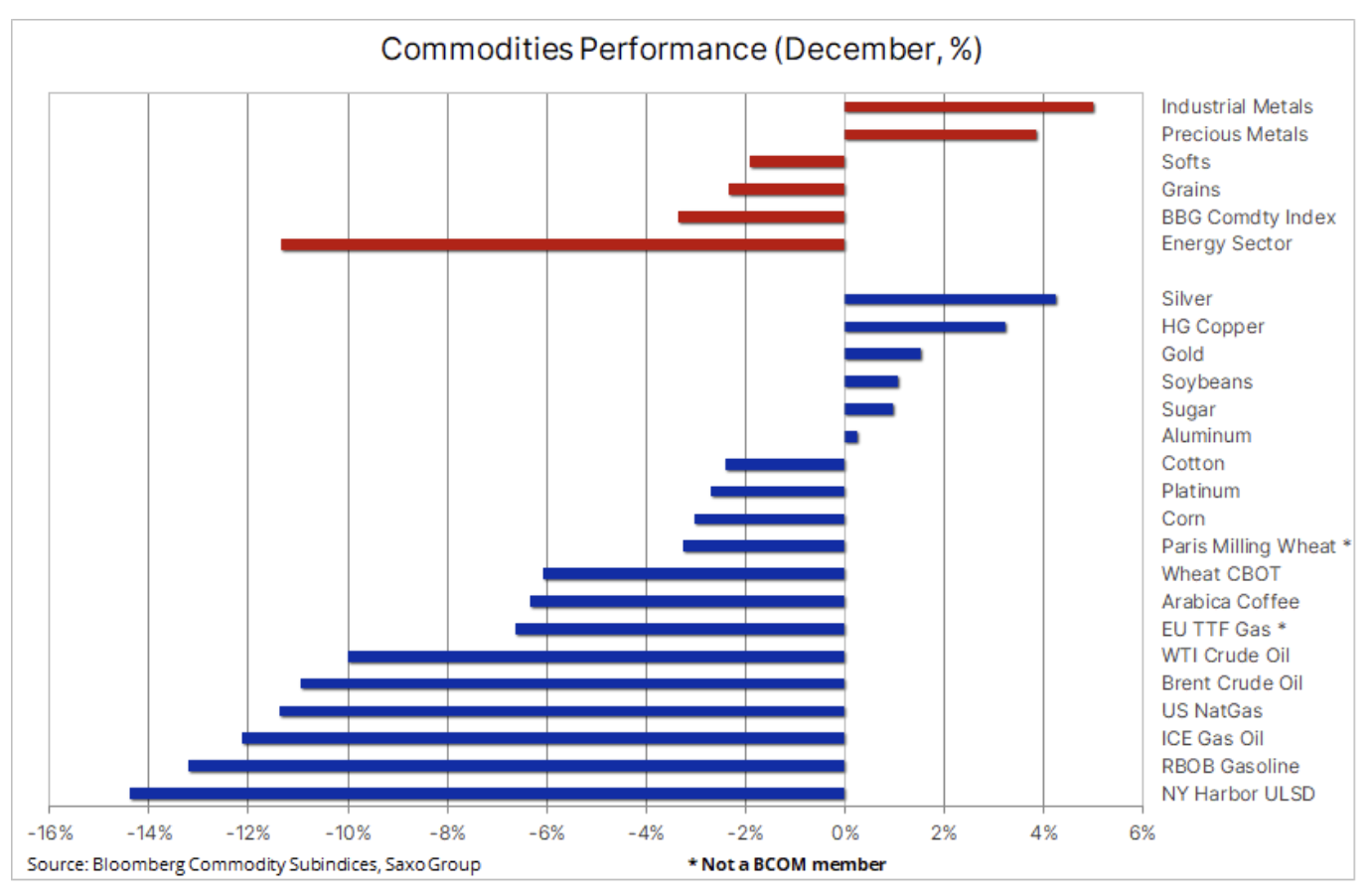

For the commodities sector, December started with two significant developments that saw energy and metals move in opposite directions. Crude oil lost more than 10%, while copper gained 3% – a difference due to diverging expectations for economic growth in China and the rest of the world. Growing concerns about the economic outlook for the United States, Europe and elsewhere have caused riots exodus from long-held positions benefiting from higher energy prices, while the easing of stringent Covid restrictions in China has allowed prices for China-dependent commodities, from copper and iron ore to soybeans, to rise.

Expected to be American Federal Reserve will raise interest rates by 0,5%, thus ending a series of four increases by 0,75%. The meeting will take place at a time when the market is becoming increasingly wary of the economic outlook for 2023. As a result, the gold and silver US 3,5-year bond yield fell to XNUMX%, and the yield curve inversion reached another XNUMX-year high. At the same time, the agricultural products sector has recorded a worse performance this month, with the increase in the prices of soybeans and sugar being outpaced by the decreases in the prices of wheat, coffee and livestock.

Hopes for reopening China

While the energy sector declined due to concerns about projected global economic growth, industrial metals took comfort in the possibility of a recovery in China - the world's largest metals consumer - after the decision to further relax the Covid-19 regime while implementing a number of measures to to support the struggling real estate sector.

The Bloomberg Industrial Metals Index is up 5% m/m so far, with zinc and copper achieving the biggest gains; Iron ore also rebounded strongly. Although in recent years "Doctor Copper" has reacted more often to the health of the Chinese economy than to the condition of the global economy, the strengthening observed last month remains impressive. One of the reasons is the expected oversupply next year - supply from mines is expected to increase and the global economy is facing a temporary downturn.

However, the market now behaves as if this increase in supply from the mines could be below expectations, in which case the market will rather focus on a price-friendly supply deficit in the coming years as demand for renewables around the world gathers momentum. Stock levels monitored by stock exchanges in New York, London and Shanghai are near multi-year lows and in the absence of the expected increase in supply from the mines, the shortage may occur earlier than currently reflected in market valuations.

For the second time in a month copper HG is hitting resistance near the 3,925-day moving average, currently at $4 per pound, with a break above that allowing the metal to return above $XNUMX - a level that provided support for more than a year until June, when the extension of China's lockdowns pushed the metal down below this level.

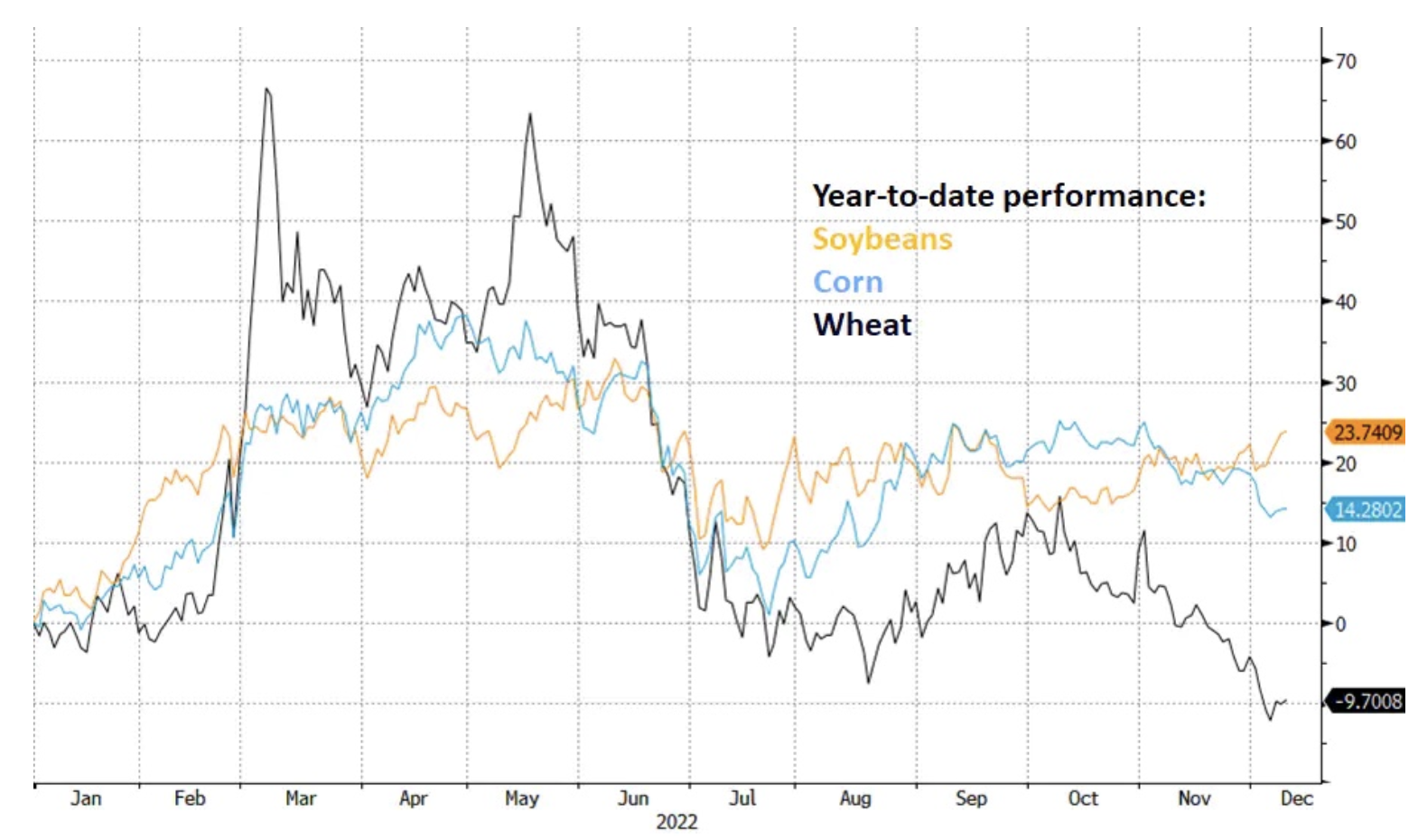

Wheat seeks bottom; soybeans supported by demand from China

The Chicago Wheat futures briefly hit its lowest level since October 2021 before finding support near $7,25 per bushel. The Bloomberg Wheat Index is now down almost 10% year-on-year after it jumped about 65% in March as Russia's invasion of Ukraine led to panic buying by consumers fearing supply disruptions.

The low prices observed since October were the result of a better than expected harvest in the northern hemisphere, in particular in Russia. In addition, the Ukrainian export corridor provided a major relief in terms of the availability of high-protein wheat for human consumption. Despite the flooding, this year's harvest in Australia is expected to be bountiful; in particular, wheat production is expected to be record-breaking. All these developments make it difficult for US exporters, who are already struggling with a loss of competitiveness due to the strong dollar. Despite a decline towards the end of the year, the price of wheat on the Chicago Stock Exchange remains about a third above its recent average. At the same time, soybeans were supported by strong demand, primarily from the largest importer China, and the prospect of reopening the market provided additional support last week.

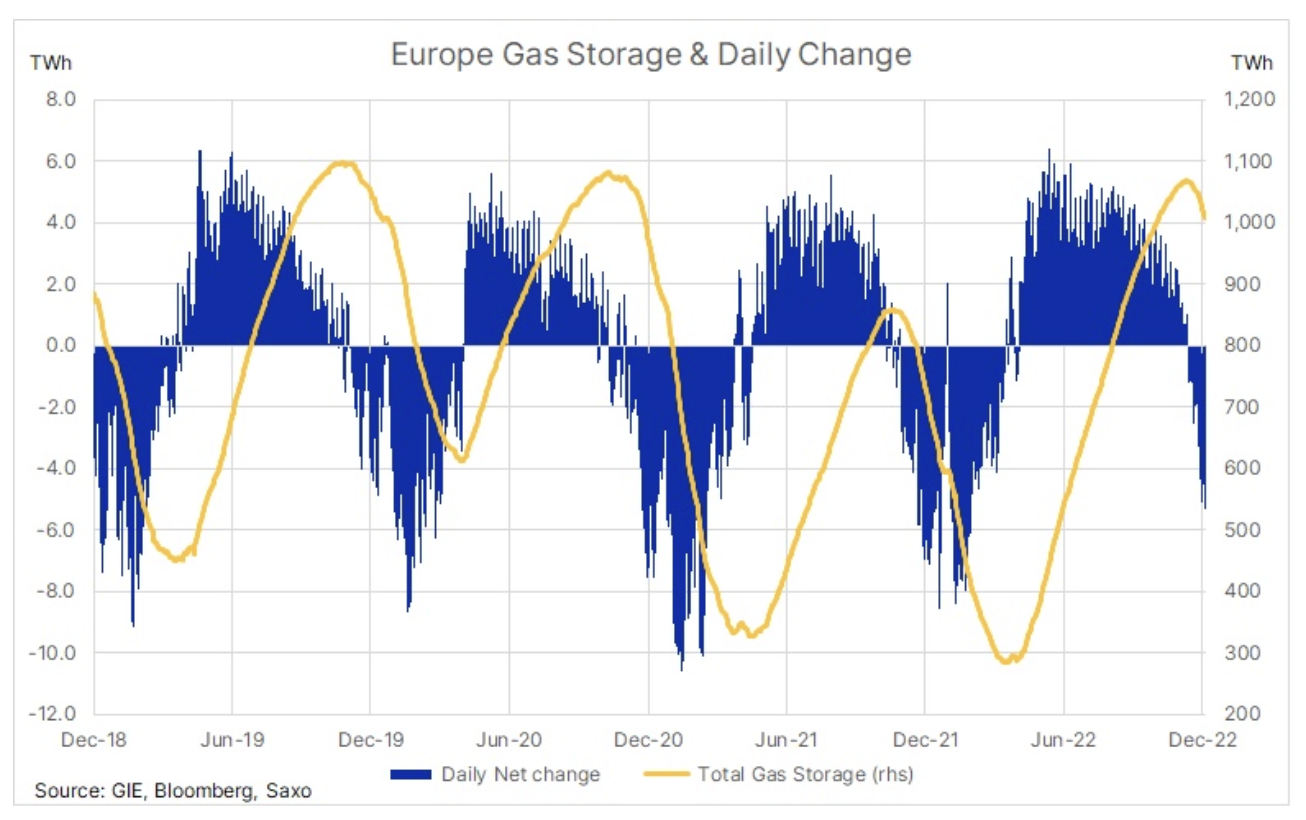

Gas prices in the EU remain capped

Demand for gas is picking up as unusual winter weather sets in for north-western Europe, which is likely to spread across mainland Europe next week. However, a very mild autumn and the beginning of winter not only helped to delay the start of the gas withdrawal season, but also ensured a quick stockpiling. As a result, European gas stocks of 1 TWh are now 000% higher than the level observed in the same period last year.

While increased stocks in warehouses will provide some buffer, it is not enough to ensure Europe survives the winter, which may turn out to be colder than usual. As a result, imports from Norway and via LNG must remain strong, and after months of weak demand from China, the easing of lockdowns could increase LNG competition from Asian buyers. Much therefore depends on the ability of consumers to keep demand in check, primarily by reducing heating to maintain stock levels.

After a period of stabilization around EUR 100/MWh, the price of the Dutch benchmark TTF gas contract has increased to EUR 140/MWh, but it is still well below the panic levels above EUR 300 reached in August, when Russia cut off supplies via of its largest gas pipelines supplying gas to Europe. Meanwhile, energy production with wind turbines generates considerable volatility due to its unpredictable nature. Increased demand for gas at times when wind speeds drop has caused electricity costs to skyrocket over the past few weeks. For example, the price of a German monthly electricity contract briefly exceeded EUR 400/MWh this week, meaning it has doubled in just two weeks.

Petroleum

Petroleum fell to an annual low with Brent crude briefly dipping below $76 and WTI below $72, down more than 10% so far this month. The deterioration of macroeconomic forecasts, which resulted in an inversion of the US yield curve to recession-indicating levels, overshadowed the EU embargo on Russian oil and the prospect of a recovery in demand in China due to further relaxation of lockdowns. Market conditions continue to be dictated by short-term technical traders looking to squeeze out existing long positions as overall participation levels continue to decline as we approach the end of the year. This week, Russia will announce how it intends to fight the price cap imposed, with the risk of a production cut potentially providing new support for the market as we face a challenging 2023 where we believe supply concerns will keep prices high despite risk of lower demand.

Precious metals

Primarily silver due to its link to rising industrial metals prices, they are on a monthly basis, supported by declining US Treasury yields and a weaker dollar amid fears of an upcoming economic slowdown. The market will focus on the meeting FOMC on Wednesday, and earlier - on Tuesday's publication of the November CPI reading. Investors' approach to both metals has changed over the last month, and the strengthening selling strategy, which has been implemented for many months, has been replaced by the strengthening buying strategy. In case of gold we will look for a challenge to the key resistance at USD 1, the break of which will create the potential for further increases in 808.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)