2023 earnings forecasts and Tesla risk developments

Consensus increasingly assumes Tesla's profits are unchanged next year, which would suggest, however, that the net profit margin will remain close to its all-time high and not subject to much pressure. This stands in stark contrast to the words of the CEOs, who in their third-quarter earnings reports considered wage and margin pressure to be the greatest threat to results. QXNUMX data suggest margin compression is increasing, with changes in operating margin directly related to year-on-year changes in earnings. Our baseline scenario assumes negative earnings growth next year and another difficult year for equity investors.

READ: How to buy Tesla shares? Everything about investing in Tesla [Guide]

Unchanged earnings growth in 2023 is unrealistic

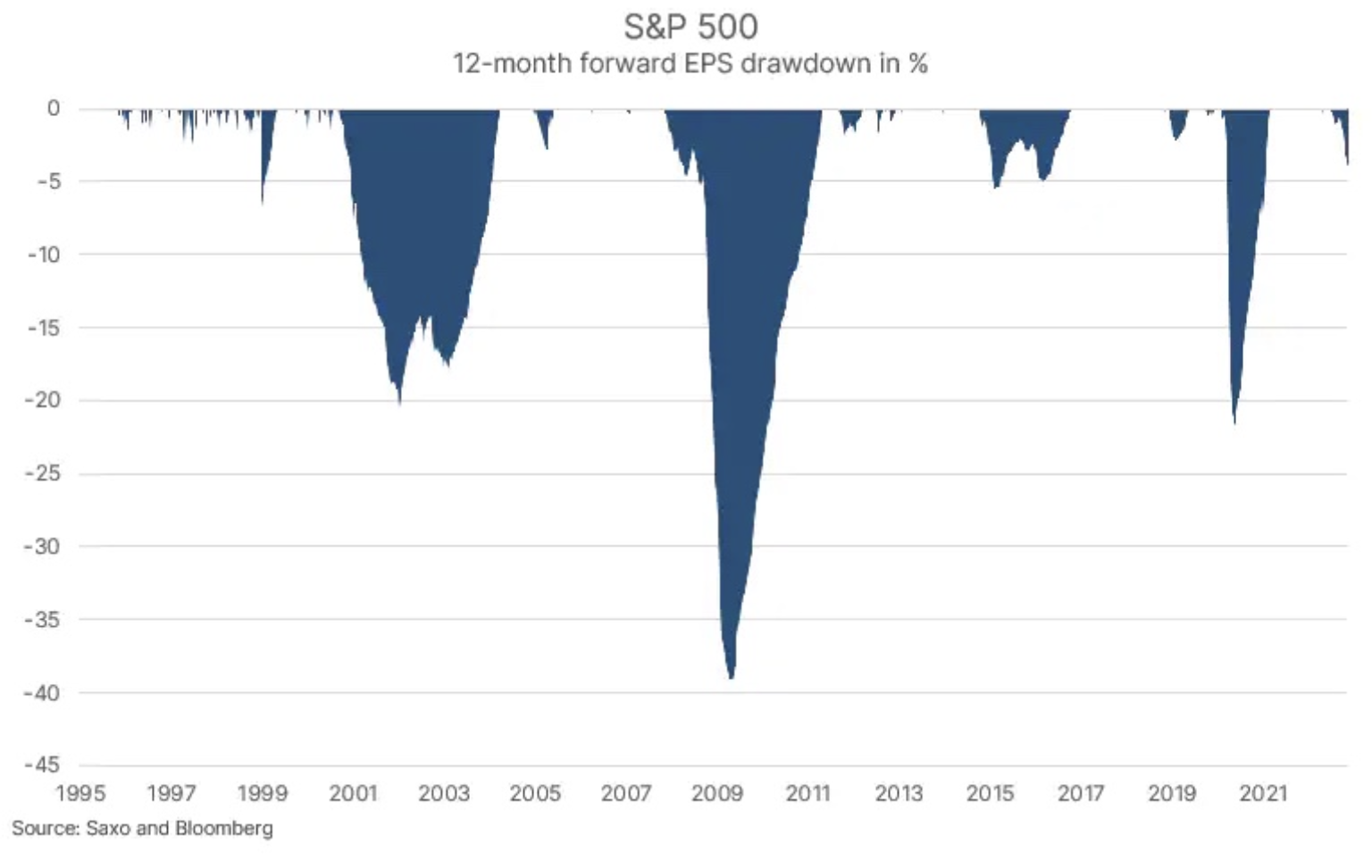

In a number of articles about shares, we emphasized that the estimated profit of companies with the S&P 500 index 235,34-Month is currently too high at $7, which is 2022% above the FY219,38 earnings per share forecast of $500. There is nothing unusual about this contradictory discrepancy, as analysts on the selling side naturally gravitate towards long positions, as detailed in relevant studies, and are therefore slow to react and take into account new information. The fact that the S&P 4's estimated 500-month earnings per share is just 2023% off its most recent peak despite ongoing margin compression speaks for itself. In any case, many banks on the sell side are now publishing their earnings per share targets for S&P XNUMX companies for XNUMX, and the consensus seems to be increasingly that we can expect earnings to remain unchanged. In our opinion, this is a very naive approach. We already explain why.

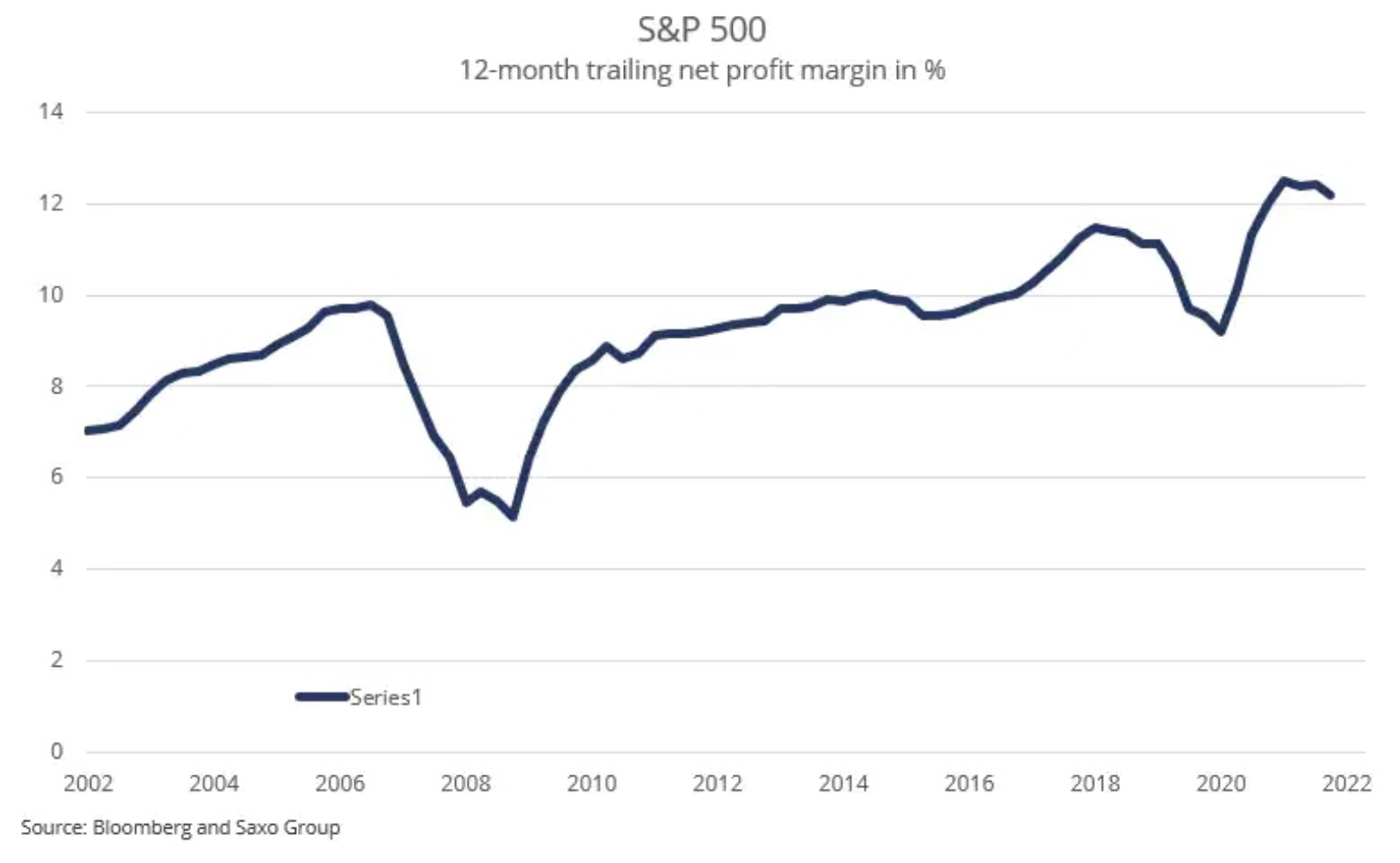

Assuming earnings per share next year to be $220 and dividing that by expected earnings per share of approximately $1, which pretty well reflects the one-year lag in US nominal GDP growth, we get a net profit margin of 800 %, which is exactly where the 12,2-month rolling net profit margin was in September (see chart). In other words, this approach suggests that S&P 500 companies are able to maintain their current net profit margin next year. Before we get into the arguments as to why this is a completely unrealistic assumption, it's important to understand why our obsession with operating margin and net profit margin is so important.

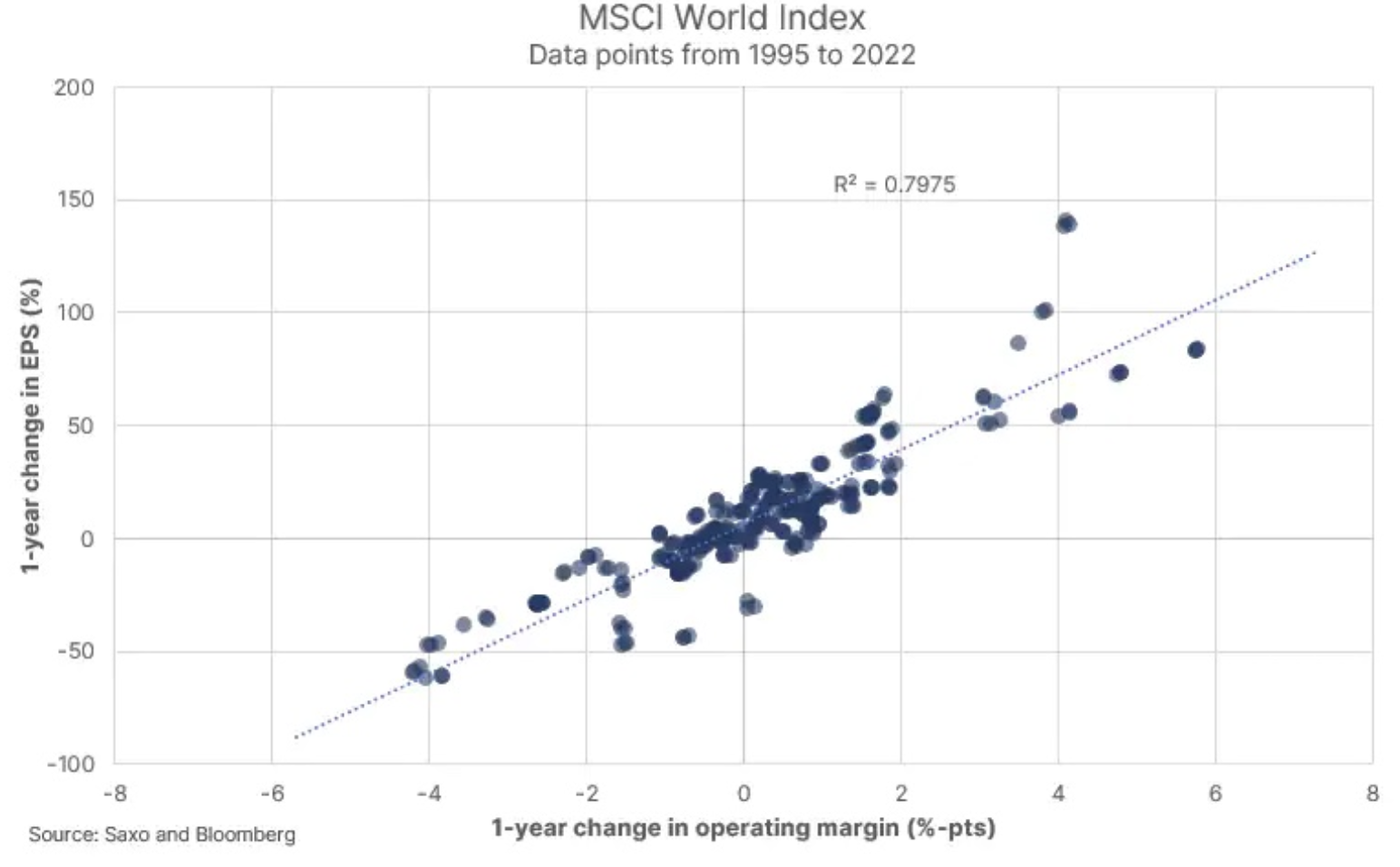

If we look at our scatterplot with the annual change in operating margin on the x-axis and the annual change in earnings per share on the y-axis for the MSCI World Index, we see a clear relationship between the two variables. In other words, over a short time horizon such as one year, changes in earnings are strongly related to changes in operating margin. The variance around the linear fit is a function of revenue growth, interest rates, and the effective tax rate. So any talk about earnings in 2023 is basically talk about whether operating margins can go up, hold steady or fall. In our opinion, the operating margin will decrease next year. Here's why:

- In their Q500 earnings reports, companies regularly highlight the issue of margin pressure, primarily due to wage pressures, and still to some extent to commodity prices and energy costs. The fact that the net profit margin of S&P 11,9 companies in the third quarter was XNUMX% (below the XNUMX-month rolling figure) and is on a downward trend suggests that margins are falling at a faster pace than predicted.

- Operating margin and net profit margin are currently at historically high levels, and as margins tend to return to the average, this fact alone indicates that they will be on a downward trend from current values.

- Wage growth in the United States and Europe is at its highest in decades and is a major concern for CEOs, as salaries are typically the largest cost item for many companies. The investor and analyst should exercise caution in any outlier observations, and high wage growth is difficult to offset in an inflationary environment where recent price increases in the enterprise sector have reached levels where they have become disruptive to volume growth (the most recent example of such approach is Home Depot).

- Another downside risk to earnings per share next year is that revenue growth may be lower than currently estimated as Q6,7 nominal GDP growth fell to 12,2% y/y from an average of 2021% y/y in XNUMX

In addition, higher interest rates will increase the cost of financing. Small as the refinancing will only cover 12% of the debt over the next 20 months, but it will still take a toll on operating profit before the earnings per share impacts the net profit margin. If we are right about the operating margin in 2023, the impact on S&P 500 companies will vary depending on the equity risk premium (C / Z ratio), revenue growth and actual net profit margin. In our recent article on the stock market titled "Investors should not dream of an average stock market" we discuss the sensitivity of the S&P 500 index to these variables.

Tesla's concentration could have a domino effect on the US stock market

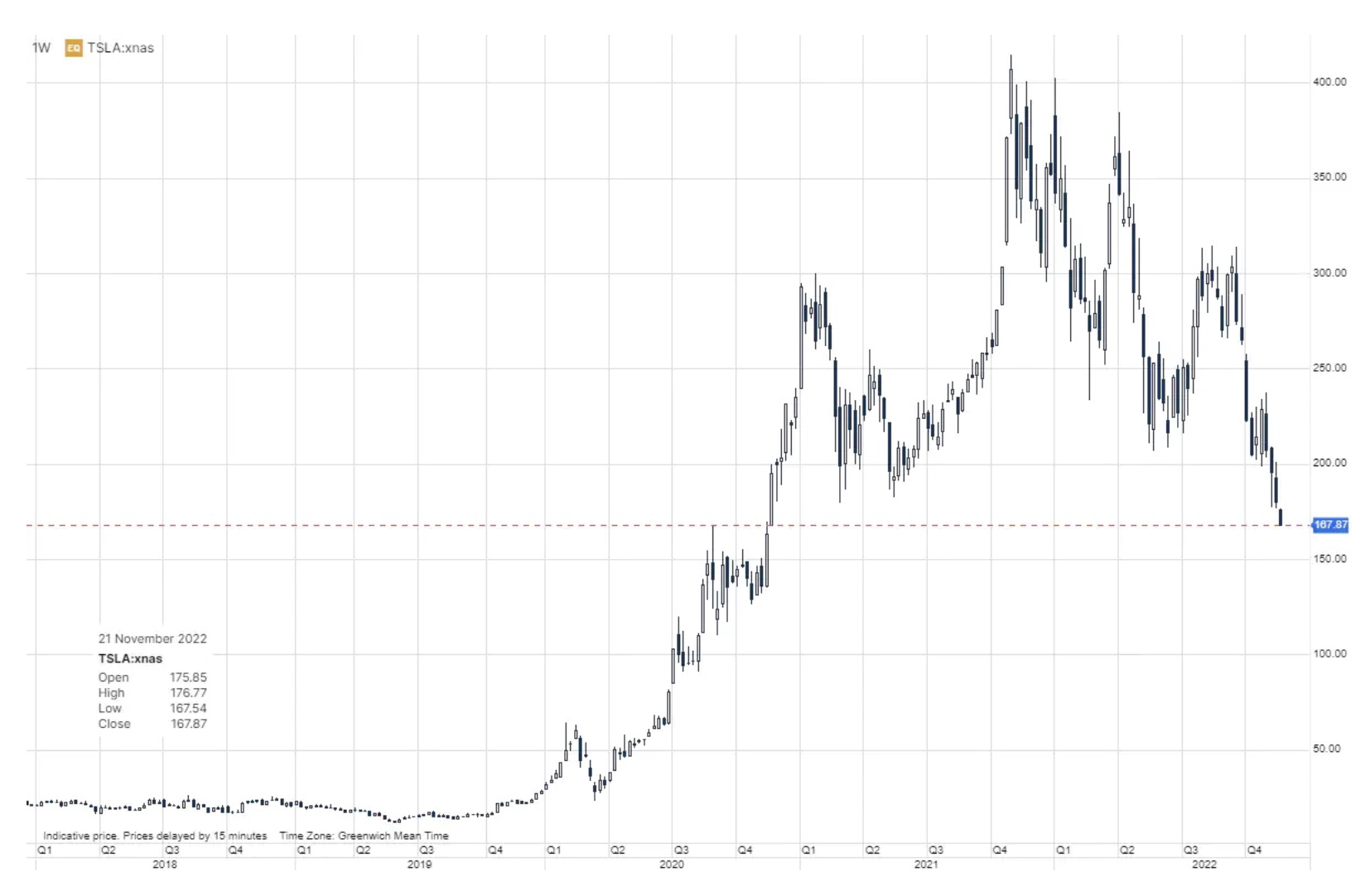

At the beginning of 2021, we published a number of articles on the stock market in which we indicated that the positions of investors holding Tesla shares, cryptocurrencies and participation units in the Ark Innovation exchange fund largely overlap. Another common feature of this "risk group" is that young men with an exceptionally high risk tolerance tend to invest in such instruments. From the beginning of 2021, the fund's units peaked first Ark Innovation, then cryptocurrencies and Tesla shares. This year saw the cryptocurrency market crash, coupled with the recent bankruptcy and scams FTX cryptocurrency exchange increased the risk and downward trends in this market. Tesla has stayed afloat because a social phenomenon by the name of Elon Musk has sustained the narrative of Tesla's rise.

However, the recent massive U.S. vehicle recalls and China's difficulties in restarting the economy have left investors wary of growth forecasts. Battery supply constraints and generally high commodity prices, soaring energy costs and chip shortages have negatively impacted Tesla's production. To make matters worse, Elon Musk's acquisition of Twitter plunged him into a rescue vortex as his decisions scare away advertisers, turning Twitter from a cash-flow positive company into an all-inclusive platform, which for the social media giant means growing existential risk. Investors are also beginning to fear that Musk's Twitter behavior and priorities are negatively impacting his decisions and possibly even his brand, which could eventually extend to the Tesla brand as well. Tesla shares fell 7% in Monday's session and thus is a clear source of risk in a market where Tesla shares are a significant item in the investment accounts of many retail investors.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)