Oil is gaining, silver is losing due to the euphoric growth forecast

Another dramatic week in the financial markets is behind us: global stocks hit near record highs amid the resurgence of corporate earnings and central bankers' favor in the wake of the pandemic, and in the United States, pressure from President Biden to accelerate the adoption of the fiscal stimulus package. All of this came just one week after a short-lived, strong correction in response to concerns that a Reddit-inspired attack on short-selling stocks and silver could destabilize the markets and initiate a cash rush similar to what we saw in the early stages of the 2020 pandemic r.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

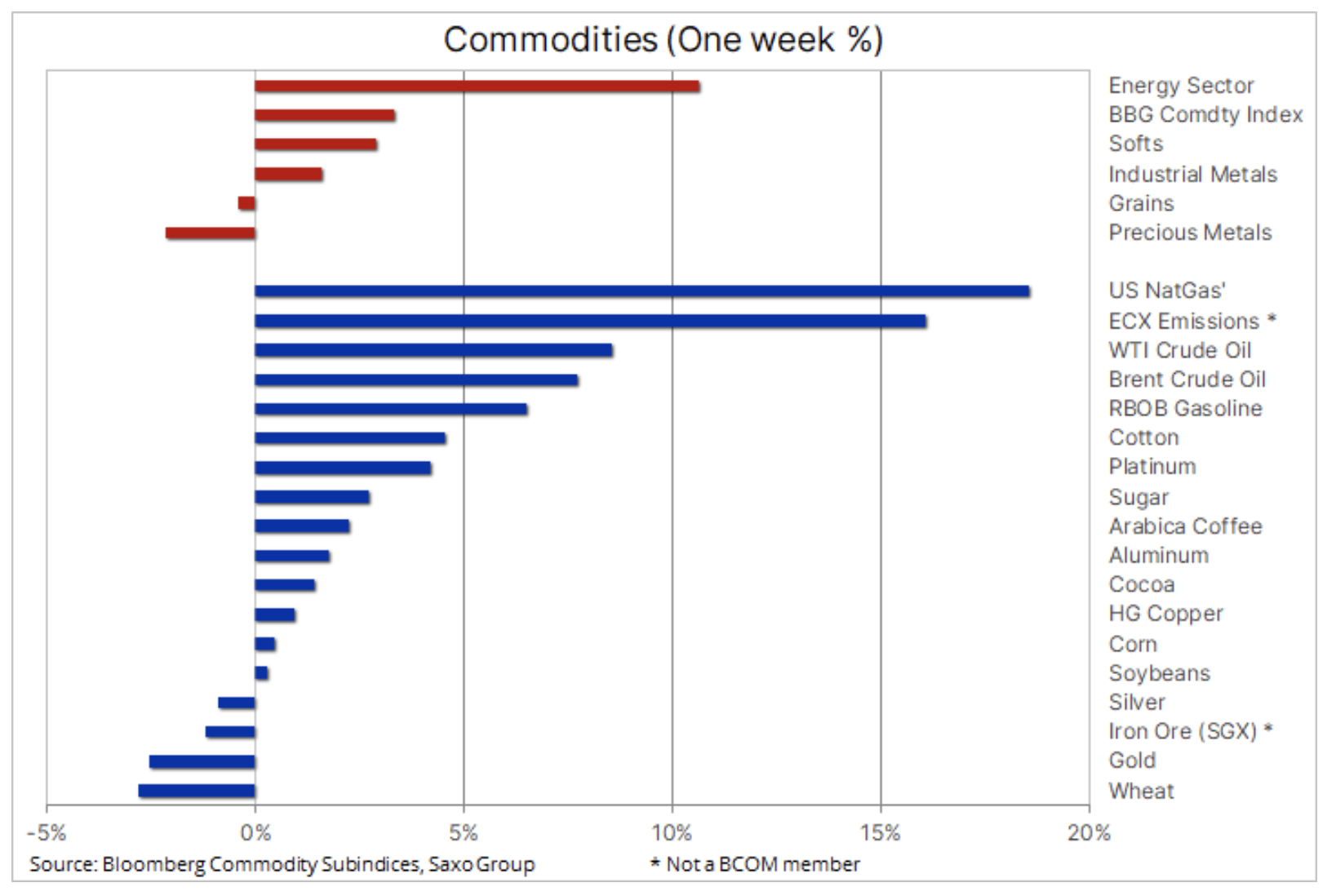

Commodity prices surged and the few falls were mostly in precious metals as silver saw a brutal correction following a failed and false a squeeze of a fictional short sale. The silver correction weakened gold as the metal struggled to defend itself against the dollar, which recorded its highest price since October, as well as another spike in bond yields, at this stage primarily as a result of an increasingly pronounced recovery in the US and the replacement of inflation concerns with projections on economic growth.

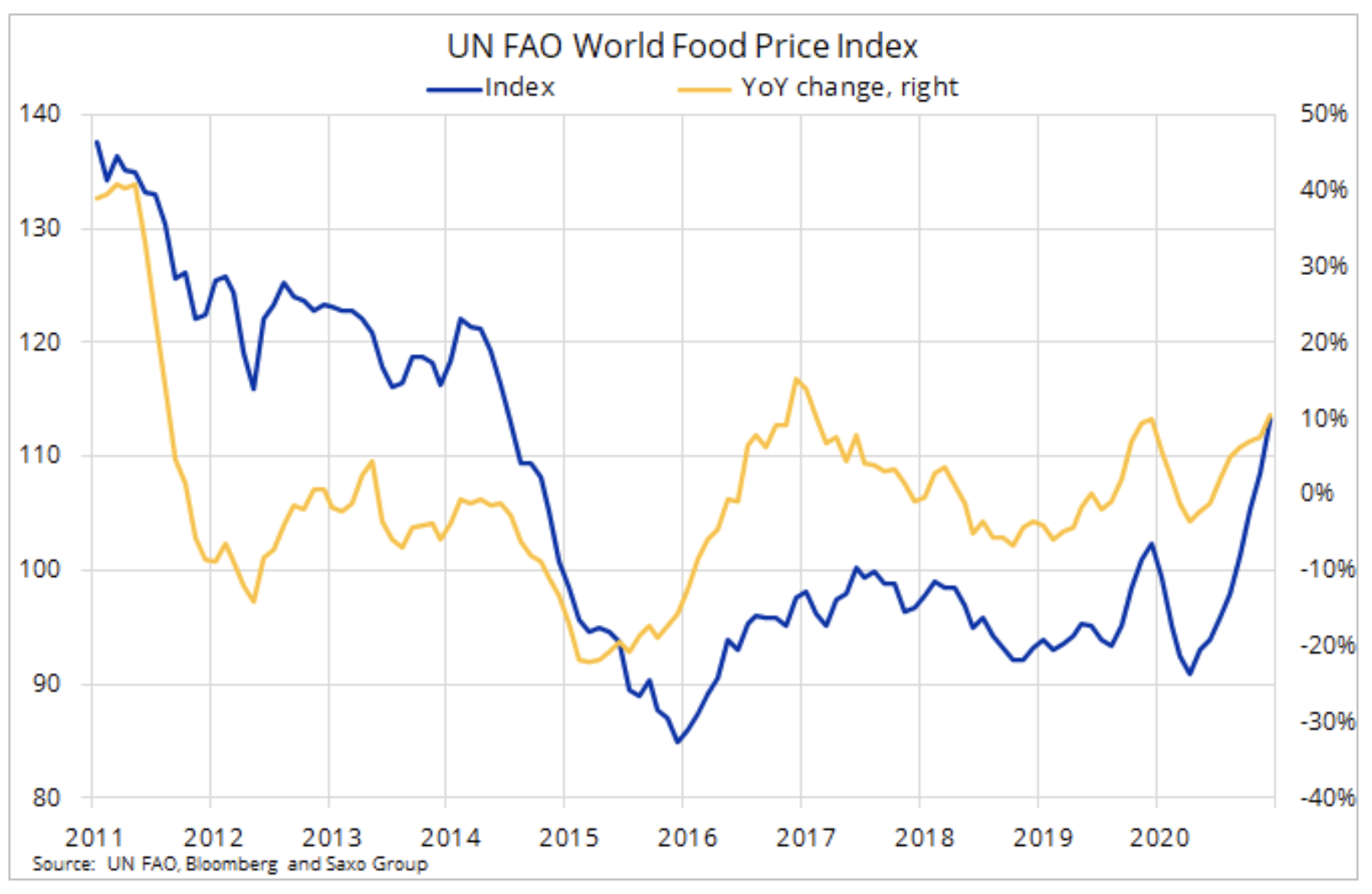

Inflation is already rising, however, as evidenced by higher food and fuel prices, as well as difficulties in global transportation and supply lines, resulting in higher costs. The latter factor caused the costs of containerized freight from China to the rest of the world to triple or even quadruple, imposing an additional cost on increasingly expensive foodstuffs such as soybeans and maize. We are confident that inflation will continue to rise in the coming months, especially when CPI inflation will begin to reflect the y / y increase in fuel costs initiated in April.

Crude oil and natural gas

It has been a solid week for the energy sector: Petroleum gained 8%, while natural gas - as much as 17% due to the forecast cooling and an unusually large reduction in inventories. At the same time, Brent crude oil is heading towards the resistance at USD 60 / b, i.e. a 61,8% retracement from the 2018 peak to the 2020 minimum, as a result of a reduction in supply on the market as OPEC + is expected to seek to support further price rises by restricting world supply even after the forecast for demand improves as global mobility is restored as a result of vaccination. Speculative demand remains strong, supported by continued risk appetite as evidenced by gains in the equity markets.

In addition, the market is increasingly recognizing in its valuations the belief that last year's price slump, along with increased investor interest in environmental, social and governance issues (ESG) could lead to a future scarcity due to a lack of investment in exploration. Before we get to this stage, however, global demand must recover from the current level of 94 million barrels / day to the 100 million recorded a year ago, while OPEC + is slowly returning to 7 million barrels / day despite limited production.

Agricultural commodities

The Bloomberg Agricultural Product Index, which monitors the performance of nine commodities including soybeans, cereals and the so-called "Soft" food products, in the last six months it has risen by 41% to the highest level in almost four years. The main drivers of growth were the Chicago-listed maize (+ 66%) and soybeans (+ 56%), both of which reached their highest level in seven years. The strong growth was driven by significant purchases of soybeans, including maize recently, by China seeking to replenish its reserves, as well as fears of drought in South America, the imposition of an export tax by Russia on wheat, and lower-than-expected production of key crops in the United States .

Be sure to read: Food market - how to invest in food? [Guide]

In addition, the combination of strong momentum and foundations contributes to record speculation on key crops, while further disruptions in the transport industry pushed grain and oilseed freight prices to their highest levels since October 2019.

As a result, the FAO issued a warning that the current price trajectory could create a "significant problem" for poorer, import-dependent countries. The warning came after the global food price index showed its longest monthly increase in ten years - in January the index rose by 4,3%, which on a year-on-year basis is above 10%. This index, which lists 95 different food products broken down into five categories, recorded the highest average value on a monthly basis since July 2014.

Precious metals

Independent rally silver, inspired by conspiracy theories and uninformed investors from the r / WallStreetBets (WSB) group on the Reddit platform, it ended almost before it actually started. After failing to break above $ 30 / oz, which is now double the peak, the idea of this investment fell very quickly. Previously, however, unfortunately, it managed to acquire 3 tons of new investments in stock exchange funds, most of which are currently in trouble. Accumulation of positions in ETF in just three days, it exceeded the value of buy transactions of the last seven months.

Without solid support from the site gold, which drifted lower in reaction to the appreciation of the dollar and the rise in bond yields, the rally was doomed to failure. First of all, this was due to the lack of fundamental reasons for the decline in the gold / silver ratio (ticker: XAUXAG) to the lowest level in seven years at this stage of the cycle. This ratio dropped to 62,35 (ounces of silver to one ounce of gold) on Monday before returning to the ten-year average of 70.

While bonuses on silver coins and small bars are rising due to strong demand from retail investors, forcing hapless buyers to pay a huge and potentially loss-making premium above the spot price, according to reports by the London LBMA last Monday in a London spot market the volume of transactions related to silver amounted to one billion ounces, ie 28 tons. While this was three times the level seen in recent months, the LBMA stated that "the market continued to be liquid and stable during this period, and there were no problems affecting trading, settlement or the effectiveness of the daily auctions."

Despite recent complications, we maintain an upward outlook for precious metals, but due to the current pressure for rapid post-pandemic growth, demand for safe investments is falling. We predict that inflation and the potential reversal of the recent dollar appreciation will be key factors that will eventually attract new buyers to the gold market, and silver in particular, given its industrial applications. This applies to solar panels, for which demand is likely to increase as more and more governments actively support the green transition.

After dropping 14% from Monday's peak, silver managed to find support around $ 26 / oz, with further weakening contingent on the level of weak long positions requiring another cut. Meanwhile gold maintains its downward trend from its August high; resistance is now at $ 1, followed by $ 830. The support is still the minimum at the beginning of December of $ 1, also corresponding to a 875% retracement of the March-August 1 bull market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)