Commodity markets: Between recession and limited supply

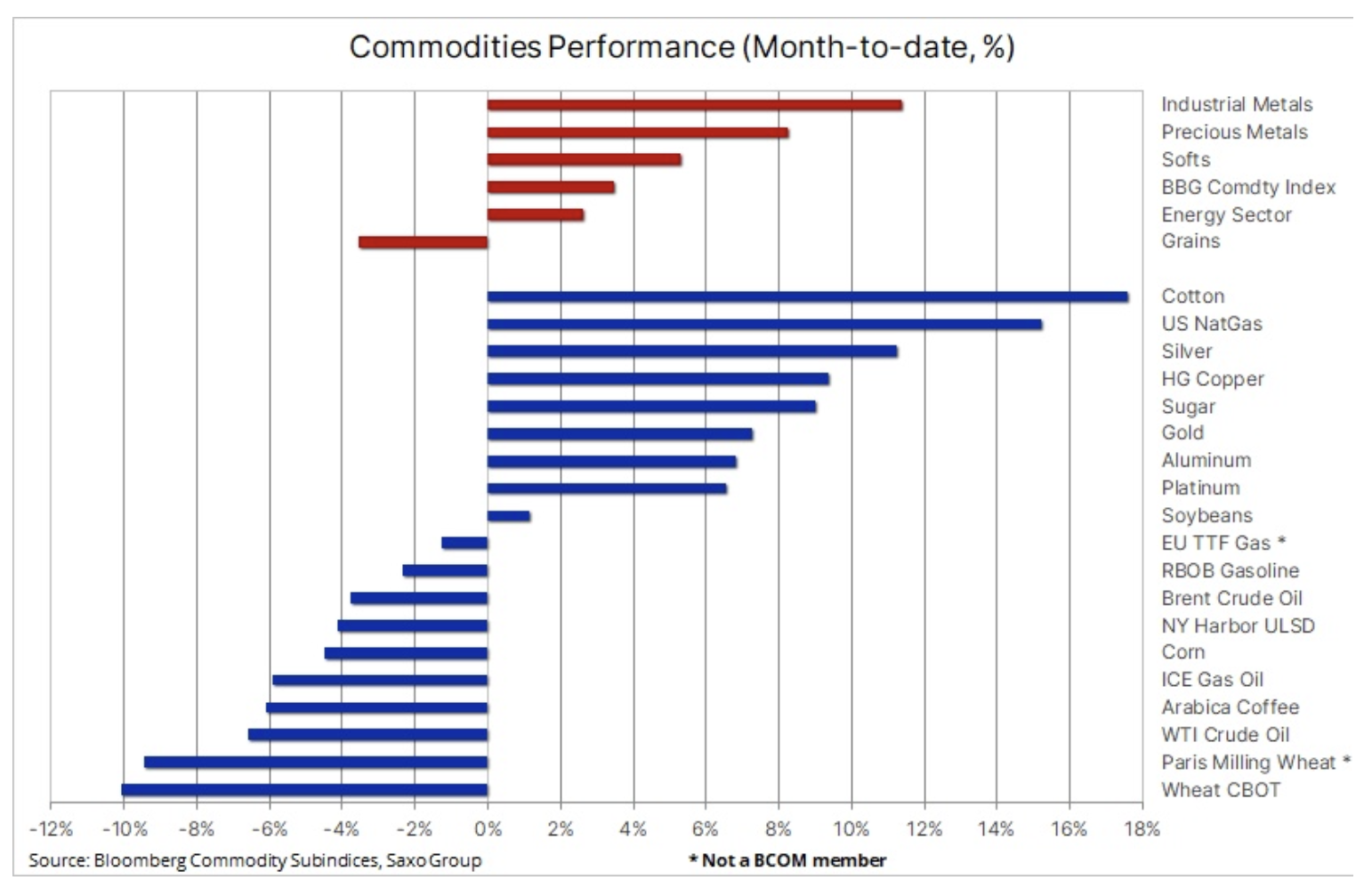

Commodity markets remain ahead of other asset classes such as bonds and equities as we approach the final weeks of trading in 2022. Crude oil and other Chinese-dependent commodities remain temporarily affected by lockdowns in China, while other commodities, such as copper, silver or gold, benefited from the weaker dollar and the FOMC's readiness to slow down the pace of rate hikes. We discuss some of the key aspects that could determine the direction commodity markets take in 2023.

After a strong end to 2021, driven by post-pandemic commodity surges and an extensive fiscal stimulus package and coordinated monetary support, the year has started off very well. With demand booming during a period of underinvestment, investors' attention quickly shifted to supply concerns following the Russian invasion of Ukraine.

The sanctions against Russia and the threat to supplies of key food products from Ukraine have led to a price jump in all commodity markets, e.g. in the energy, grain and metal markets. As a result, the Bloomberg Commodity Total Return index went up by more than 25% in the first quarter, and then gradually fell over the following months. However, despite numerous headwinds such as the strongest dollar in years, prolonged Covid lockdowns in China and central banks raising rates to suppress inflation at the expense of economic growth, the commodities sector performed very well, as evidenced by a return of almost 20% in terms of year to day.

In the perspective of 2023, the direction in this market will be determined by four main topics:

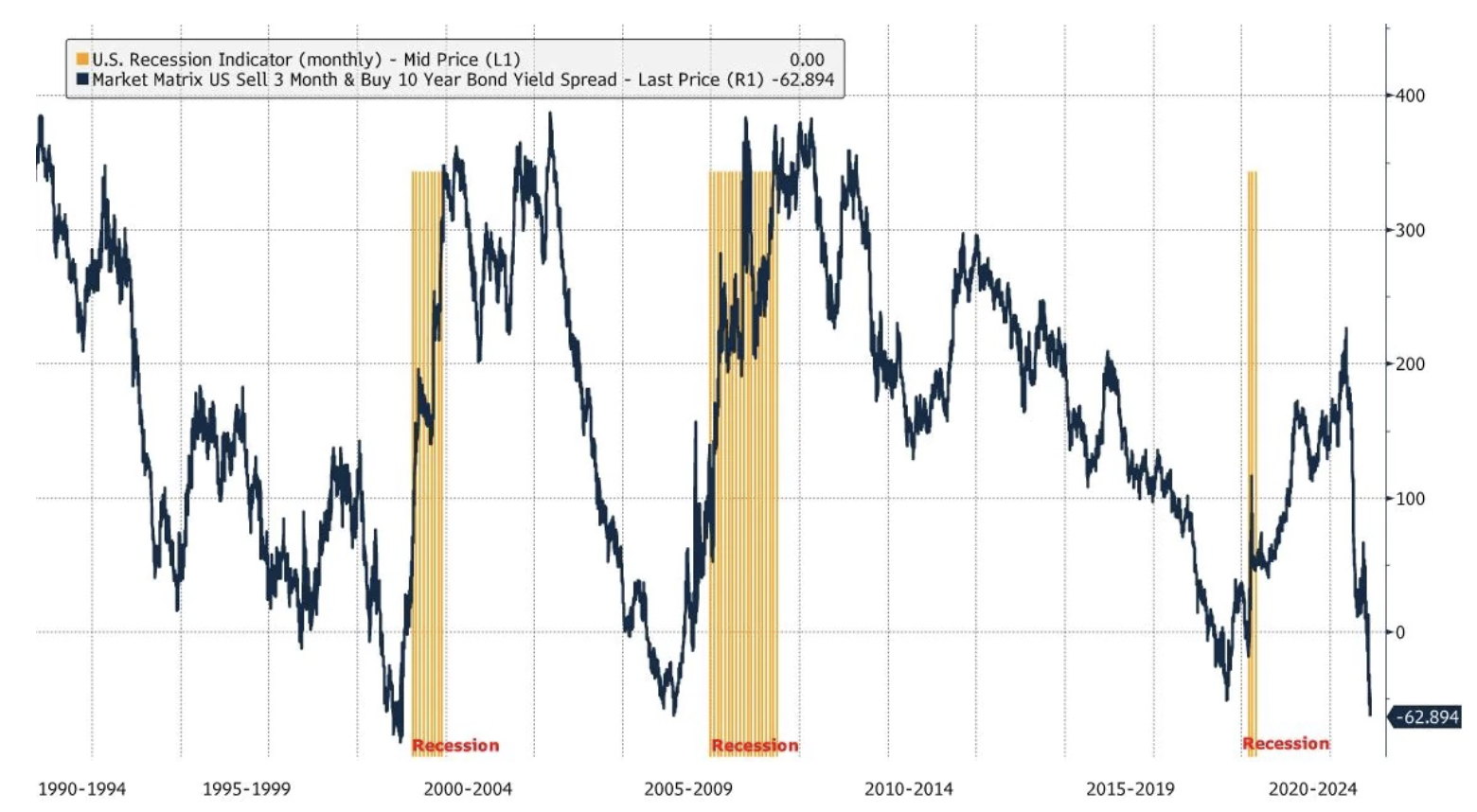

- The scale of the coming recession, currently priced in by the market via the most inverted US yield curve since the early 80s.

- A recession forcing the US Federal Reserve to shift its focus from rate hikes to economic support, potentially before inflation reaches satisfactorily low levels, thus contributing to a reversal of the dollar and US Treasury yields.

- The reopening of the Chinese economy leading to a stimulus-driven recovery in demand for industrial metals and energy.

- The duration of the war in Ukraine and its potential impact on the supply of key commodities, from oil and gas to wheat and major industrial metals.

Recession and limited supply

The risk of an economic slowdown during the period of limited supply of a number of important commodities will be one of the key aspects that, together with the strength of China's economic recovery after the pandemic, will help to set the direction for commodity markets in 2023. After many months of aggressive interest rate hikes, the US Federal Reserve is signaling currently, the pace of future increases will be slowed down - while their final maximum level will depend on the incoming data.

The US bond market is already hinting to the Fed that tightening may have gone too far - the yield spread between three-month Treasury bills and ten-year Treasury bonds has fallen to a twenty-year low of -64 basis points. A reversal of this magnitude has only been seen just before the three previous recessions. Short-term interest rates have gone up as a result of the Fed's move to raise rates overnight Fed funds, while longer-dated bond yields have fallen amid the prospect of slowing economic growth (or even recession) coupled with sustained long-term inflation.

November has been a good month for commodity markets so far, with the Bloomberg index up 3,4%, with industrial and precious metals recording the biggest gains. Even daily reports of a deteriorating situation in China, where local officials grappling with a record number of Covid cases, have once again come under pressure to implement President Xi's strict and increasingly unpopular "zero Covid" policy have not prevented this. In order to support the economy, the People's Bank of China intervened on Friday, lowering the reserve requirement rate for banks by 0,25%.

While the energy sector struggles with a seasonal slowdown in demand, exacerbated by events in China, other markets, particularly precious metals, have been supported by a fall in yields at the long end of the curve and the dollar, which has lost almost 5% this month. This was due to a lower than expected CPI reading in the US earlier this month, deterioration in US economic data and the publication of minutes from the last meeting of the Federal Reserve, where the possibility of slowing down the pace of future rate hikes was discussed.

Cycle minimum for gold, silver and copper?

After the events that supported the strong rebound in gold, silver and copper prices, as well as strengthening by $170 from what increasingly appears to be the low of the cycle around $1, gold spent the last week consolidating before finding support in region 615 $1. Overall, Saxo maintains its long-standing constructive opinion on gold, and even more so on silver. This is mainly due to the upcoming economic slowdown and a significant revaluation, when the market realizes that long-term inflation will remain at a higher level than currently valued values below 735%.

However, with continued lack of interest from investors to buy exchange-traded funds and increased competition from bonds as yields decline, prolonging gold's strength above the key $1 area will likely require further yield declines and the dollar or some other trigger for investors to flee to safe areas.

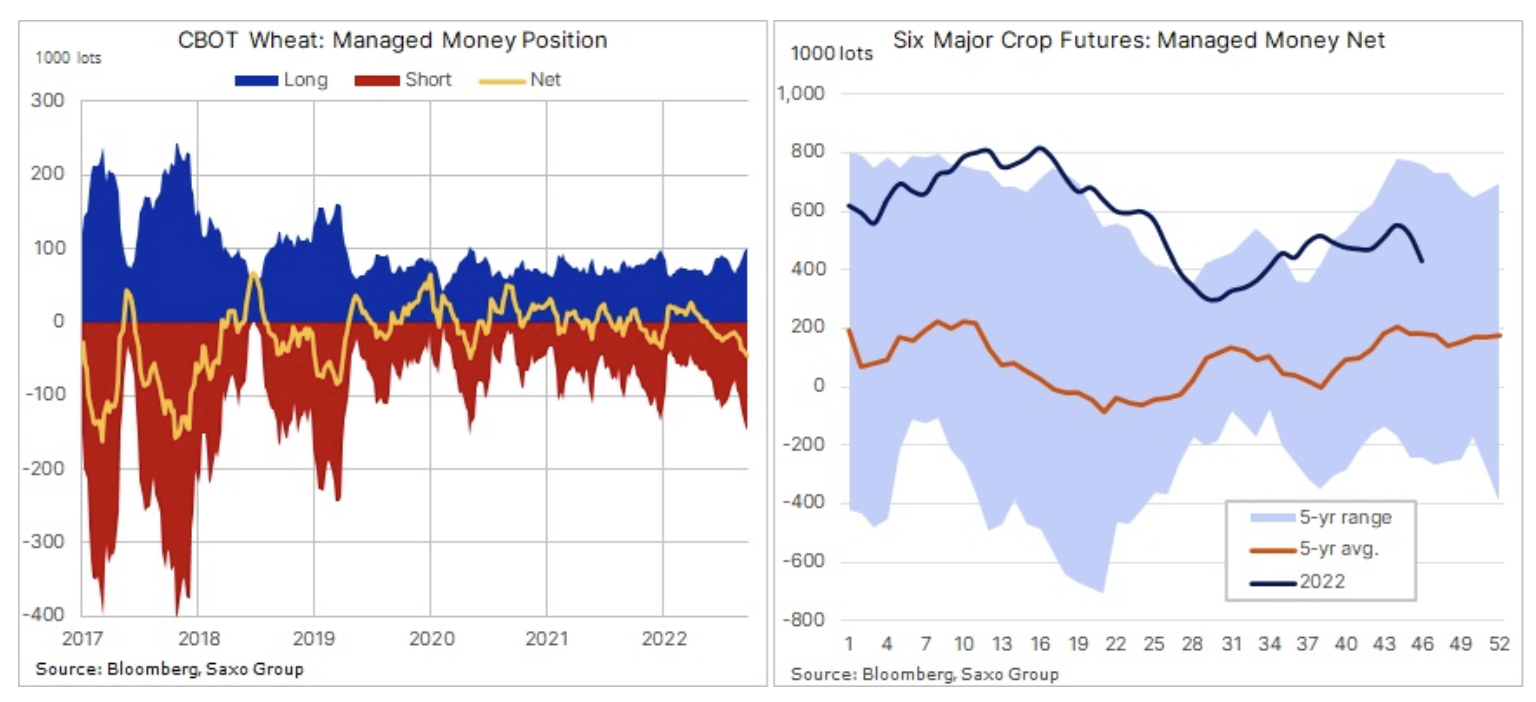

Weakness in the cereals sector - mainly wheat

At the very bottom of the table was the grain sector. Cereals record a loss on a monthly basis, mainly due to low prices wheat in the United States and Europe. This is the result of maintaining the Ukrainian grain corridor and a large harvest in Russia, which is looking for buyers around the world. Speculative traders responded to the general weakness by reducing the cumulative net long of the top six grain futures to a three-month low of $430. contracts. According to the latest Commitments of Traders report For the week ending November 15, speculative investors carried out the largest weekly purge of corn longs since August 2019. At the same time, wheat net short rose to a 27-month high of 47. contracts; contracts for soybeans and soybean meal also suffered.

Oil struggles with lockdowns in China and recession fears

Petroleum for the third consecutive week, as demand concerns, particularly from an increasingly confined China, weigh heavily on market sentiment. The G7-sponsored plan to cap Russian oil prices has apparently stalled as EU member states cannot agree on a specific level - the result will be either no cap at all or the level will be so high that it will have no significant impact on supply, not to mention Russia's reaction. The XNUMX-month spread on WTI and Brent crude oil futures has fallen to its lowest deportation level since December last year, reflecting a market concerned about the recession and the seasonal slowdown in demand, which is negatively affecting near-term contracts.

In addition, the fact that the market does not include the oil premium before the EU introduced the EU embargo on exports of Russian oil by sea underscores the impact of a strong economic slowdown in China, the world's largest oil importer. Middle Eastern producers have seen their spot premiums for key Gulf crude fall sharply after premiums have risen sharply since the invasion of Ukraine, when many buyers began to look for alternatives to Russian oil, thus boosting demand for Middle Eastern oil.

The slowdown in demand in China will be temporary, but after months of unsuccessfully fighting the Covid pandemic with lockdowns, the prospect of improvement seems to be many months away. This would only be accelerated if the Chinese authorities started to implement a 20-point plan to ease the "zero Covid" policy published earlier this month by health authorities. Brent crude oil is near the lower end of its established range, but given the considerable uncertainty around supply and demand, the prospect of an extended decline appears limited in our view.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)