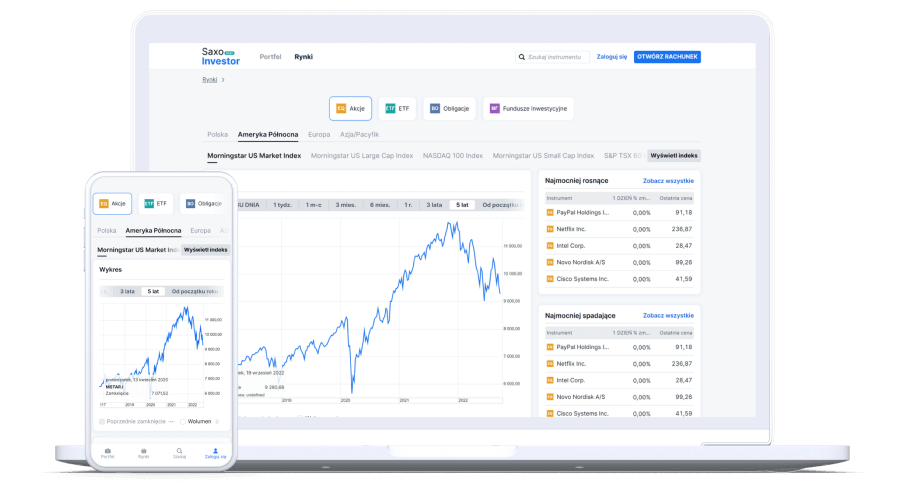

SaxoInvestor - a new intuitive and user-friendly platform

Saxo Bank made the platform available to its clients in Poland SaxoInvestor. It has been designed to make investing simpler, intuitive and personalized. With its rich content, it stands out as a platform for investors looking for guidance and inspiration to make more informed decisions. The premiere of SaxoInvestor is part of Saxo Bank's long-term strategy to expand the investment space in Poland, where more and more people are interested in multiplying and accumulating wealth by investing. It is also another of the announced novelties for Polish customers, after the introduction of lower prices at the beginning of September.

In a nutshell:

- The new trading platform has been designed to make investing simpler, intuitive and personalized.

- Available for mobile and desktop devices, offers curated investment themes, inspiring content and broad access to markets at low cost

- This is another novelty announced for investors in Poland, after the introduction of lower prices at the beginning of September.

- At the same time, Saxo Bank increases the interest rate for net free equity in various currencies that is yet to be invested.

- The premiere of SaxoInvestor is part of a long-term strategy of expanding the investor space in Poland, where more and more people are interested in multiplying and accumulating wealth.

SaxoInvestor - Multiple Markets in One Place

Built on the same technology as other Saxo Bank platforms, SaxoInvestor offers a simplified interface to meet the needs of retail investors and is available for mobile and desktop devices. Thanks to the transparency of prices, as well as one of the richest share offers, ETFs, bonds, and over 5 investment funds worldwide that can be invested in with no fees to buy, the platform is the solution for investors who want to take advantage of broad market access and professional analysis to make more informed investment decisions.

- SaxoInvestor was designed with a specific purpose: to provide much-needed convenience to retail investors in Poland. We want to offer support to everyone - from new market participants to experienced investors. SaxoInvestor is an attractive platform for anyone who wants to have access to high-quality investment education, analysis and access to global markets at a low cost, made possible by major reductions in our price list in September - says Marcin Ciechoński, Marketing Director of Saxo Bank in Central and Eastern Europe.

In addition to the low cost of accessing capital markets, the distinguishing feature of SaxoInvestor is the section personalized investment themes, offering high-quality inspiration for investors and the possibility of gaining exposure to a wide range of topics and trends. These include electric cars, semiconductors, defense, renewable energy and cybersecurity. The section on investment topics is dynamic, is constantly updated and offers investors inspiration and a list of properly selected stocks, mutual funds and ETFs, ensuring optimal exposure in each thematic category.

- We are aware that many investors want to invest in key trends, but have difficulties finding instruments that offer adequate exposure. This is why the investment topics section is such a vital component as it provides inspirational and educational content directly within the platform. An added benefit is that the platform helps investors diversify their portfolios which is essential given the current volatility in the markets - adds Marcin Ciechoński.

SaxoInvestor is now available to new and existing Saxo Bank clients at no extra cost. With its premiere, clients gain access to three trading platforms, which can be used on the level of one investment account, depending on their needs for access to instruments, mobility requirements, functionality advancement or interface configuration options. SaxoTraderGO is a fast-paced trading platform for mobile and desktop devices, with access to all asset classes and many features. On the other hand SaxoTraderPRO is a powerful platform for professional traders, running only on desktops and providing access to the latest risk management functions, advanced trading tools and a fully customizable interface, adapted to work with multiple screens.

Lower prices and better storage conditions for free funds

Saxo Bank clients from the beginning of September, they have access to new, lower prices, including the liquidation of fees for the storage of financial instruments, the so-called custody fee. The new price list puts a lot of emphasis on reducing the costs associated with trading shares and ETFs on the Warsaw Stock Exchange, as well as many other global exchanges, including in the USA. Depending on the size of the transaction, savings when investing in stocks can now range from several hundred to even several thousand zlotys.

On the occasion of the premiere of SaxoInvestor the attractiveness of the offer was also increased in the context of interest rates on net free capital in different currencies that is yet to be invested. For VIP and Platinum accounts, the minimum interest rate threshold is completely abolished, so now it earns free net capital regardless of the amount. In the case of the Basic Classic account, the minimum amount threshold that triggers the interest on the funds has been reduced five times - now this amount will be the equivalent of US $ 50 in a given currency.

Thanks to the attractive interest rates for funds held in different currencies, clients can further take advantage of the differences in the level of rates in individual markets. In the case of the Czech koruna it can be up to 6,01%, and for forints - up to 10,41% per annum (the rates depend on the type of account you have).

|

VIP |

Platinum |

Classic |

|

|

PLN |

4,98% |

3,98% |

2,98% |

|

USD |

1,76% |

0,76% |

- |

|

CZK |

6,01% |

5,01% |

4,01% |

|

HUF |

10,41% |

9,41% |

8,41% |

|

The minimum value of net free capital to activate the interest rate for a given currency |

- |

- |

50 000 USD |

Simulate new conditions based on the Saxo bid rate as of September 26, 2022.

The important point is geographic diversification of funds held at Saxo Bank. Denmark and the Scandinavian countries have long been famous for their stability, which is an important criterion when choosing a location for all or part of your capital. Opening an account in a foreign bank usually requires having a place of residence in a given country, while by opening an account with Saxo Bank online, you can easily get an investment account in Denmark. Our funds are automatically protected by a Danish guarantee fund up to an amount of EUR 100, just like customers of other Danish banks. If, at the same time, we have funds in a Polish bank, we have both Polish and Polish protection Bank Guarantee Fundand its Danish counterpart for funds held at Saxo Bank. So in total we get security in the amount of EUR 200.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)