Statistical investor - what is he like? National Investor Survey 2020 [Results]

As every year, the Association of Individual Investors (SII) conducted the National Investor Survey (OBI), in which it checks the preferences and profile of Polish individual investors. More than 3000 people replied to the survey questions. How statistically do we present ourselves as investors? The most interesting parts of the survey results are published below.

What is the Polish investor like?

92% of the total are men, more than half of the respondents have higher education, and the average age is 42 years. Most of us invest overtime and work full-time. Only 20,2% of the respondents are owners of their own businesses. Investors with less than 5 years of experience dominate, but there are also "old-timers" who have been "in business" for over 15 years (18,9% of respondents).

How and in what we invest

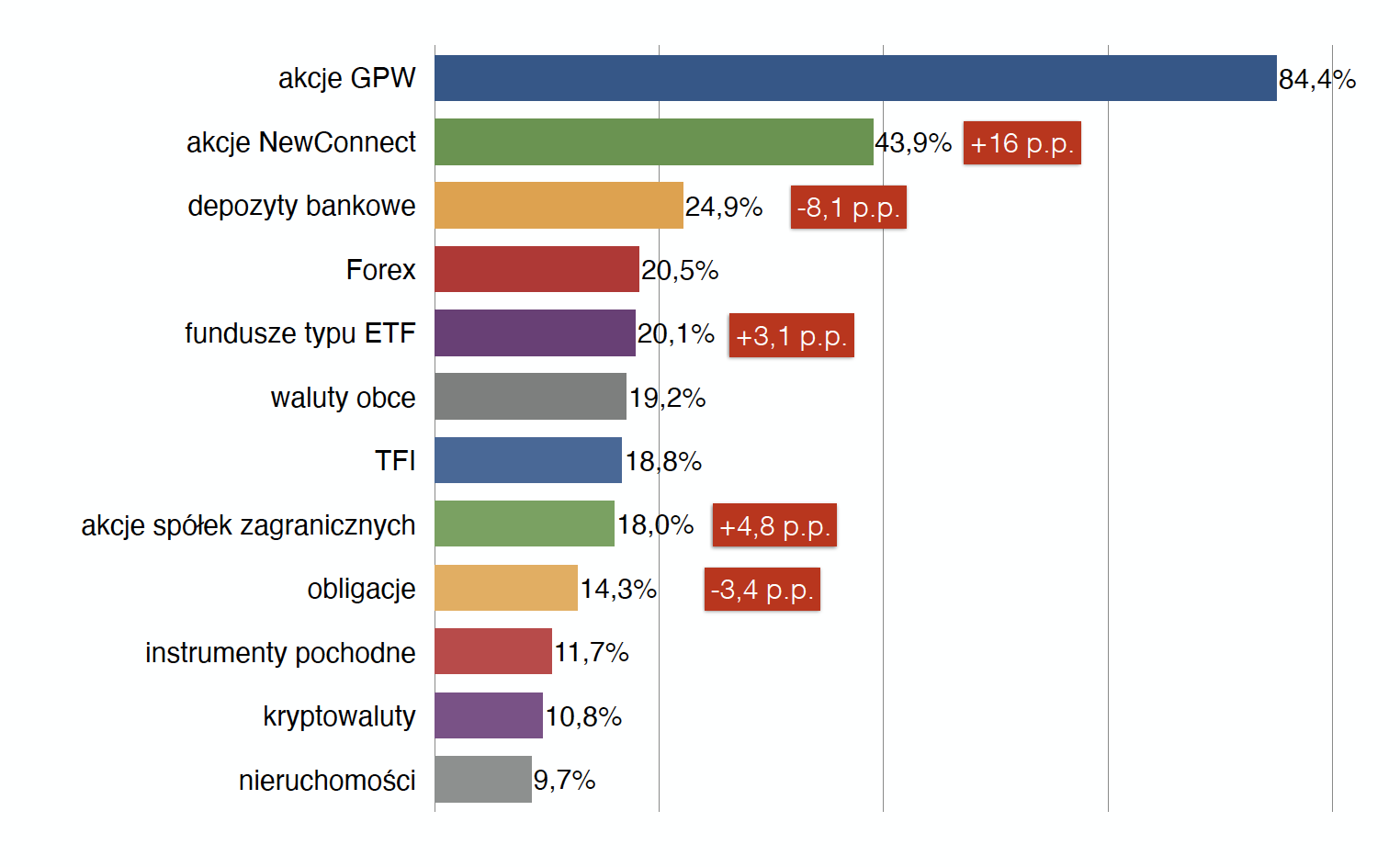

Equally, the most popular are shares on the WSE. Due to the record low interest rates, compared to the 2019 survey, there is a decline in interest in bank deposits and bonds. Interestingly, the attention has shifted to stocks from the NewConnect market while the interest Forex market remained at the same level.

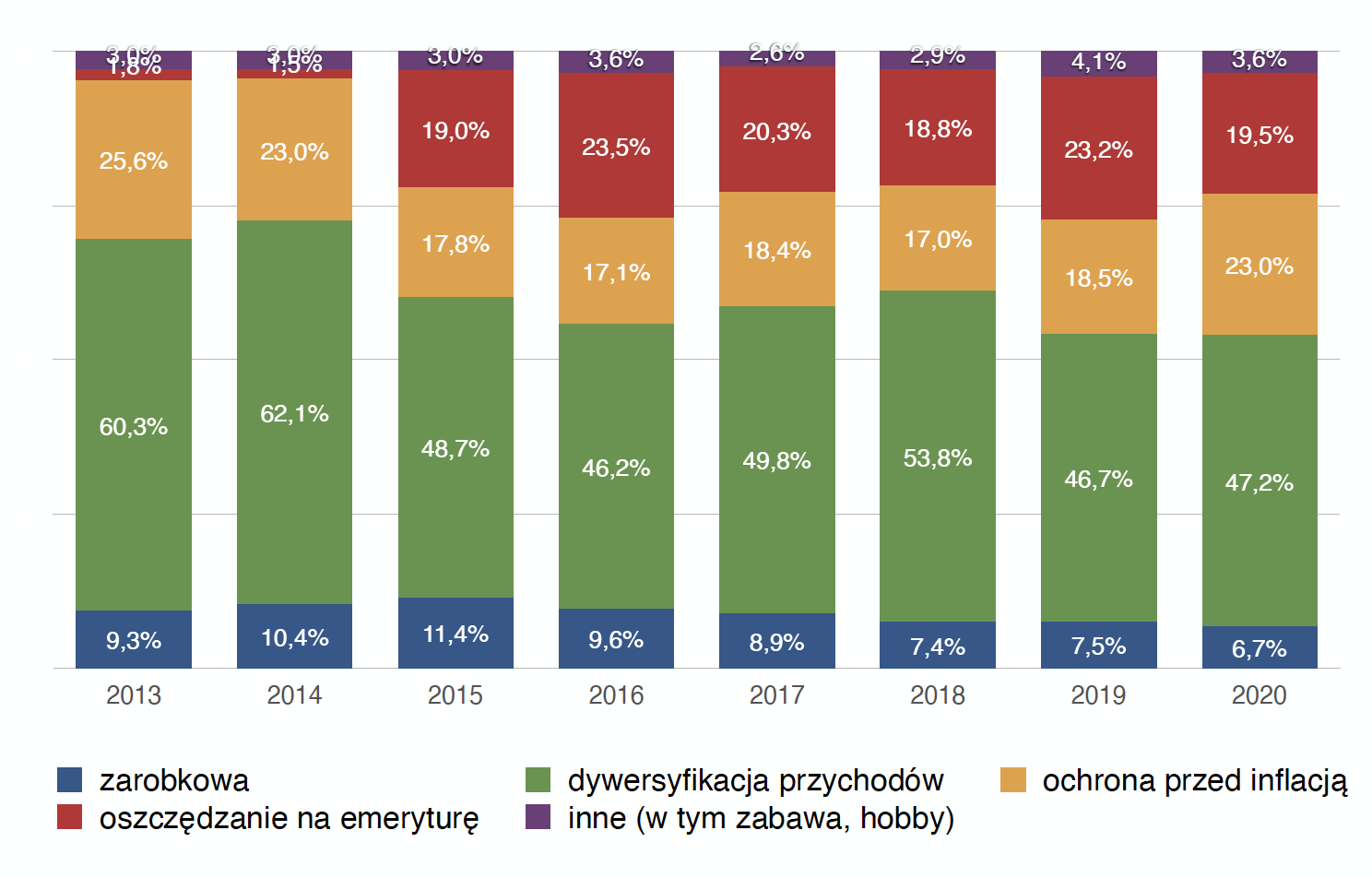

Most often (nearly 50%) our investment goal is to diversify revenues. Only 6,7% of the respondents invest "professionally" for profit, and over 23% want to defend themselves against galloping inflation - and this is the only clear change compared to previous years.

More than 40% use a combination of technical and fundamental analysis to make decisions to buy or sell assets. About 10% admit that they cannot analyze the markets at all.

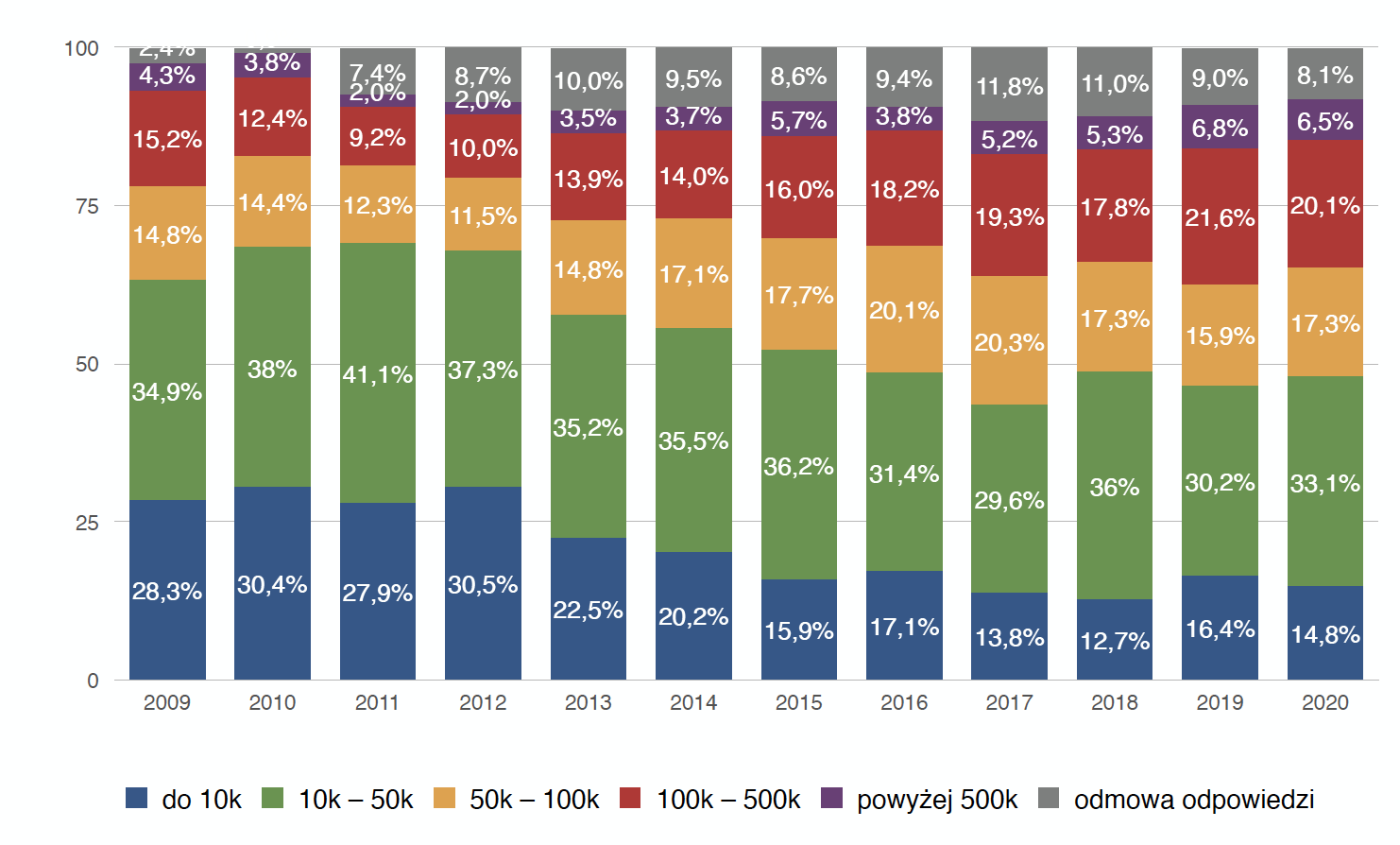

The most numerous group are people with an investment portfolio worth 10 thousand. - 30 thousand PLN (20,2%) and 100 thousand. - 500 thousand PLN (20,1%). The average value of the portfolio is approx. PLN 50 thousand. PLN. When analyzing the data over the years, it is difficult to outline any specific trend in this category.

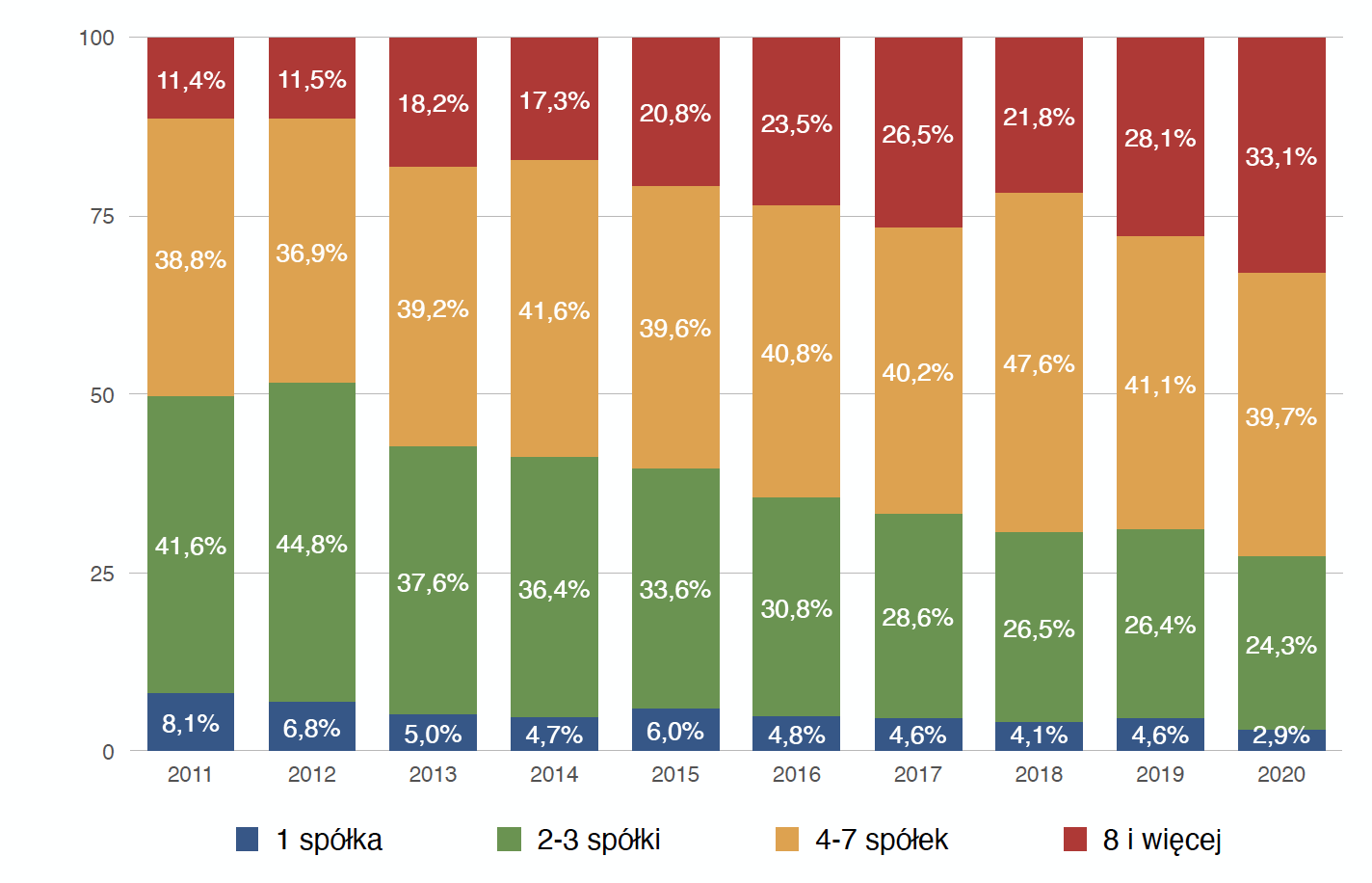

People investing in stocks usually have 4 to 7 companies in their portfolio (nearly 40%). The second largest group has over 8 of them (33,1%). This shows that the majority of Poles have learned their lesson from diversification and, looking at the previous years, you can see that this trend is deepening.

Coronavirus and investors' hope

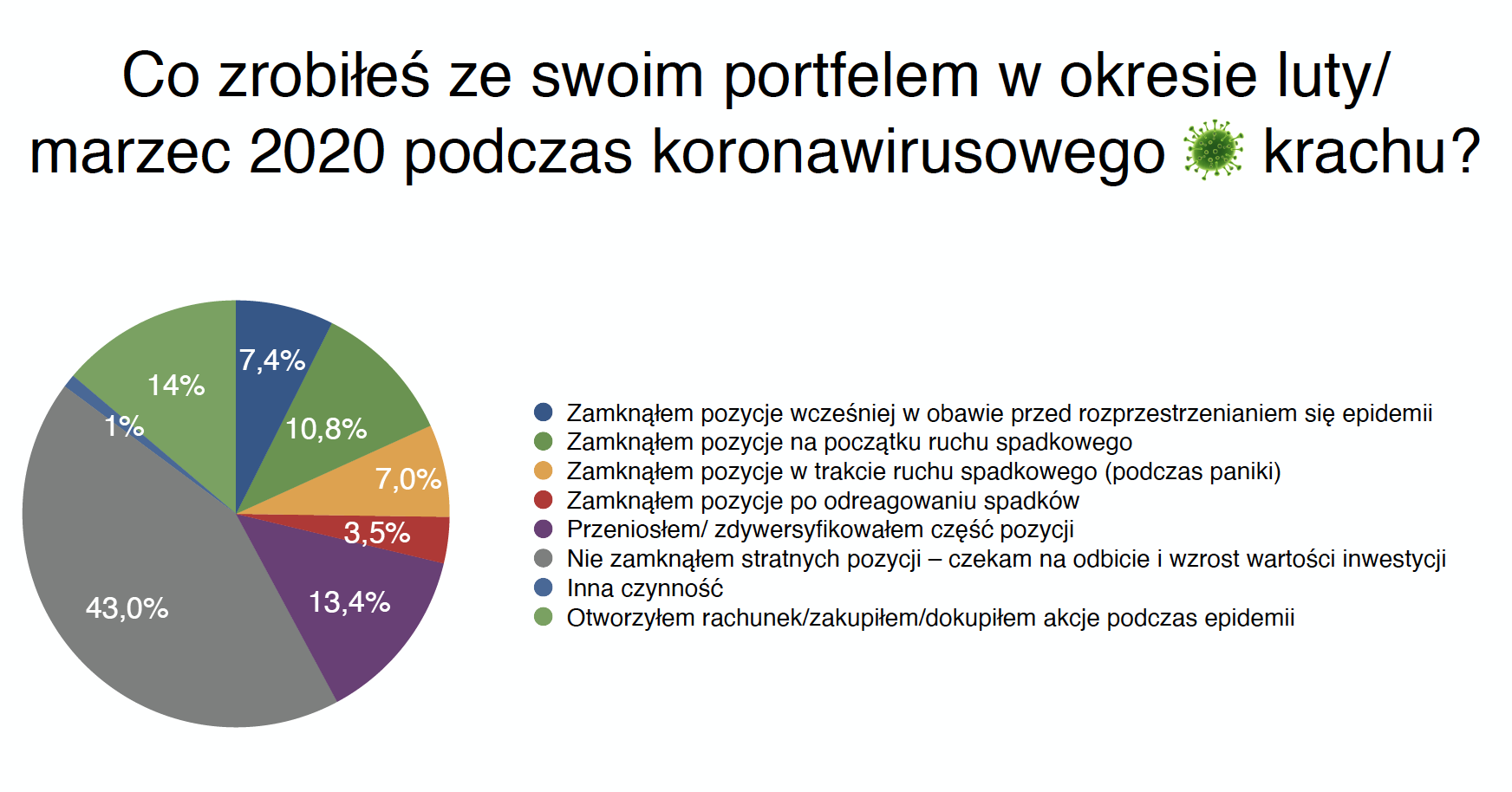

"Cut losses and let profits grow" - the survey shows that the majority, as much as 43%, do not follow this rule. After the Covid-19 pandemic and the crash in the capital markets, most investors decided to withstand losses in the hope of a quick rebound. While it was difficult to predict what would happen, the WIG8 index actually managed to return to the March levels within 20 months. The situation looks even better on the US indices, but these assets are chosen by less than 20% of respondents.

The full results of the OBI 2020 study can be found here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Statistical investor - what is he like? National Investor Survey 2020 [Results] nationwide survey of obi investors 2020](https://forexclub.pl/wp-content/uploads/2020/12/ogolnopolskie-badanie-inwestorow-obi-2020.jpg?v=1608633923)

![Statistical investor - what is he like? National Investor Survey 2020 [Results] KNF, Polish Financial Supervision Authority](https://forexclub.pl/wp-content/uploads/2017/05/knf-102x65.jpg?v=1598173284)

![Statistical investor - what is he like? National Investor Survey 2020 [Results] australia forex leverage 1-500](https://forexclub.pl/wp-content/uploads/2019/12/australia-forex-dz%CC%81wignia-1-500-102x65.jpg?v=1575373922)