Commodities: Weakness in Developed Markets vs. Strength in Emerging Markets

For key commodities, ranging from crude oil to copper and iron ore, 2023 started with a strong strengthening as the post-pandemic recovery in China, the world's largest commodity consumer, will more than offset the dark clouds on the economic horizon in other regions, in particular in Europe, which is still dealing with the effects of last year's energy crisis, and in the United States, where Federal Reserve, trying to fight inflation, continues to raise rates at the fastest rate in decades.

However, as the quarter progressed, it became increasingly clear that the upward momentum from China's reopening of the economy to the world was not developing strong enough to offset the negative impact of rising rates, especially after Fed Chairman Powell's announcement to the market that he would take "any possible measures. The market could see this as a planned recession drive where the Fed is ready to take aggressive action to cool inflation regardless of its impact on the economy, meaning higher rates and for a much longer period of time than previously assumed.

Despite promising signs of recovery in China, growth-dependent commodities were cheaper for the rest of the quarter and then fell further in value as a result of the banking crisis. However, while oil prices have fallen sharply after months of trading in the range, the damage to China and industrial metals from the green transition has been limited, with precious metals rising as bond yields fall and the Fed softens the deadline for reaching the peak interest rates unexpectedly came closer.

Just before the start of Q25, most of the commodities sectors show year-on-year declines, driven by concerns about economic growth and in part by the strong bull market in the same period last year after Russia's invasion of Ukraine. Sectors that are dependent on growth and demand, such as energy and industrial metals, have been hit the hardest, with annual declines of around 6%; In XNUMX, the agricultural products sector fell by XNUMX%, mainly due to strong price drops wheat and cotton, while precious metals, after the March turmoil, found support and their prices did not change over the year.

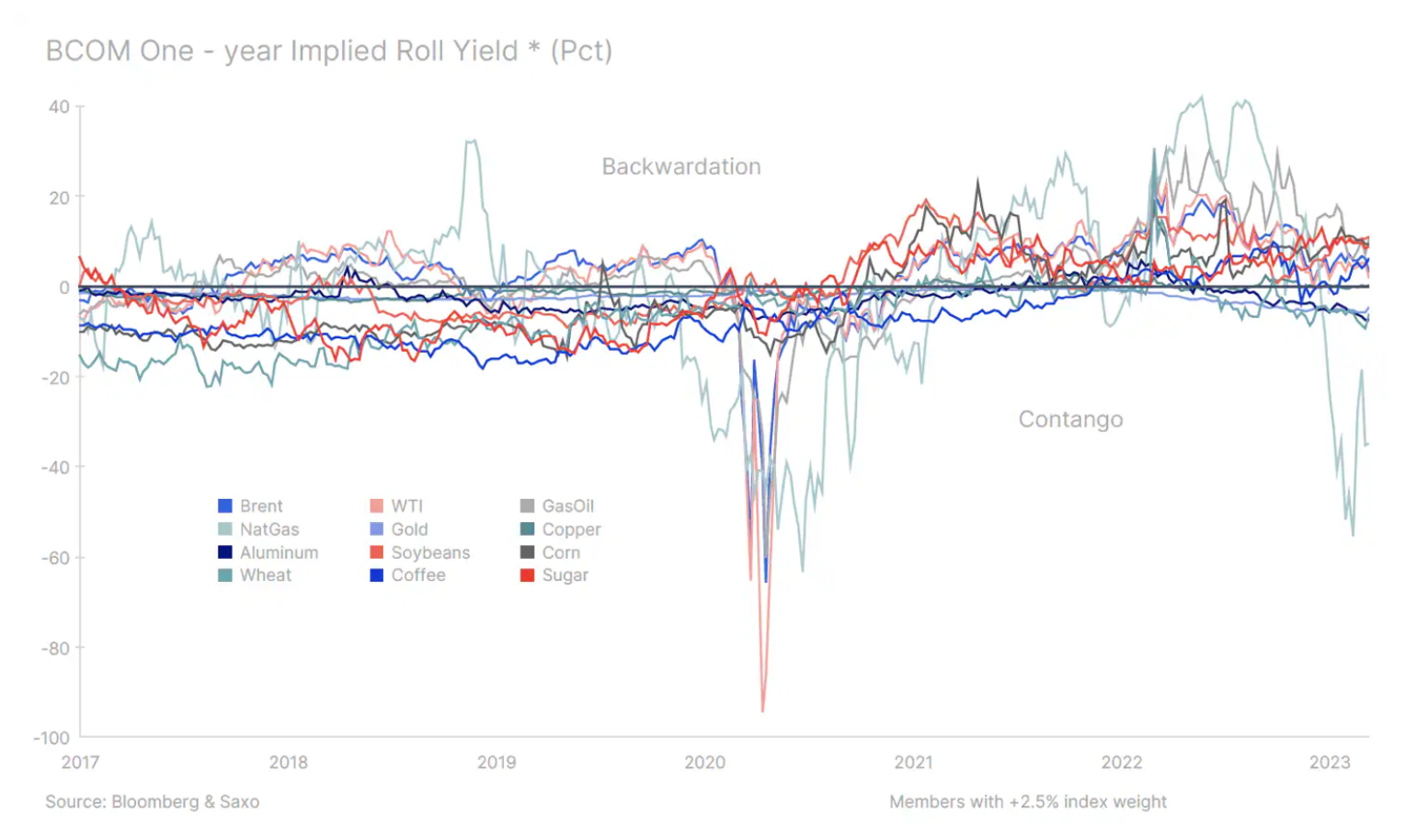

As a result, the previously limited supply in the overall market, which was very evident last year, has increased and contributed to significant gains for investors, although not as much as might be expected given the current growth concerns. Of the top 12 commodity futures listed on the Bloomberg Commodity Index and weighing more than 2,5%, only four show one-year gains contagion, which is usually characteristic of an oversupplied market where the spot price (spot) is lower than the one-year price.

The conclusion is that the long-term upside potential for commodities has not yet disappeared and will continue to rest on solid foundations in the increasingly scarce supply of a number of key commodities due to lack of investment (and the current banking crisis has by no means improved this situation), the recovery in China, global political support for the energy transition, redevelopment of infrastructure as well as increasingly volatile weather-related risks.

In the absence of a clear solution to the war in Ukraine, the game of fragmentation - the title of this quarterly report - is also strongly felt in the commodity market. The most severe effects can be seen in the energy sector, where the imposition of sanctions on Russia has created a two- or even three-tier energy market, leading to major changes in global trade routes. The consequence of this situation is the extension of trade routes and time spent at sea, which increases the pressure on logistical capacity and costs. For example, Russian oil and fuel exports from the Baltic states, most of which went to Rotterdam, must now find buyers much further afield – in the Middle East, India, China and even South America.

Precious metals are waiting for peak interest rates to provide support

Price increase potential gold i silver has not changed and after trading in the $1-800 range in Q1, in line with our previous forecast, we see increasing signs that the yellow metal may make another attempt at a new high above $950 in the coming months. If that happens, silver - a semi-industrial metal - could return to $2 an ounce, which is lower than our previous forecast ($100) given current growth concerns.

Having strengthened by more than $340 since its November low ($1), gold has corrected around $615 after Fed Chairman Powell warned of taking "all possible measures" and then rallyed sharply as yields and rate hike expectations subsided sharp reduction in response to the banking crisis. Gold briefly traded above $150, hitting a new high against the Australian dollar and a near-record high against the euro. Whether gold also hits a record high against the US dollar in the coming quarter will depend, in addition to changes in yields and the US dollar, on reaching the end of the Fed funds rate, an event that has already contributed to strong bull markets three times since 2 in the following months and quarters.

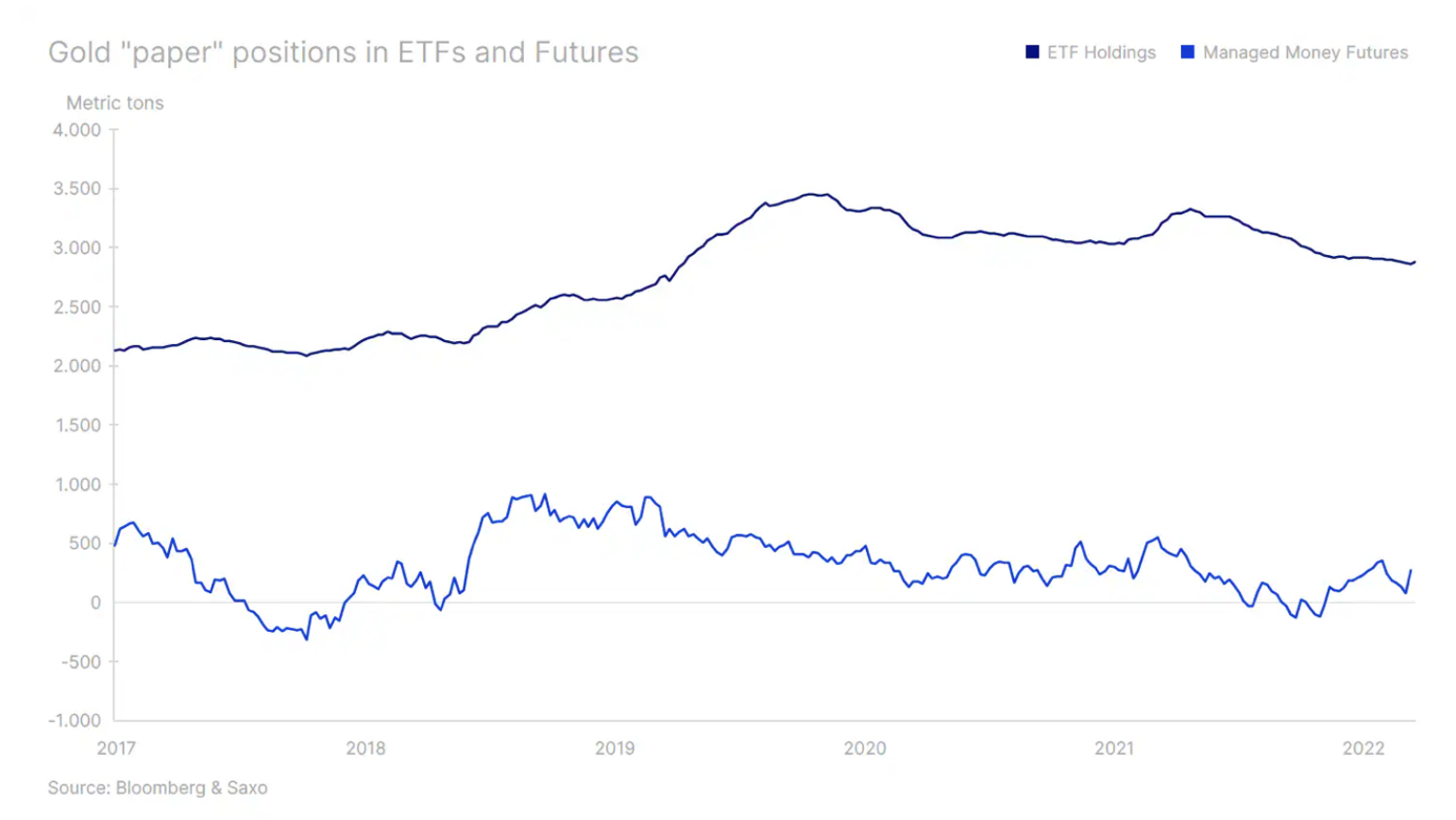

The combination of continued and strong demand from the central bank, which provided support to prices in 2022, when yields and the dollar surged, and new investment demand via exchange-traded funds after months of net sales, is likely to be the main driver supporting a sustained increase in prices . Due to their volatile and directional positioning, hedge funds will continue to provide an extra layer of strength during rally but also weakness during periods of correction.

Copper remains supported by the green transition

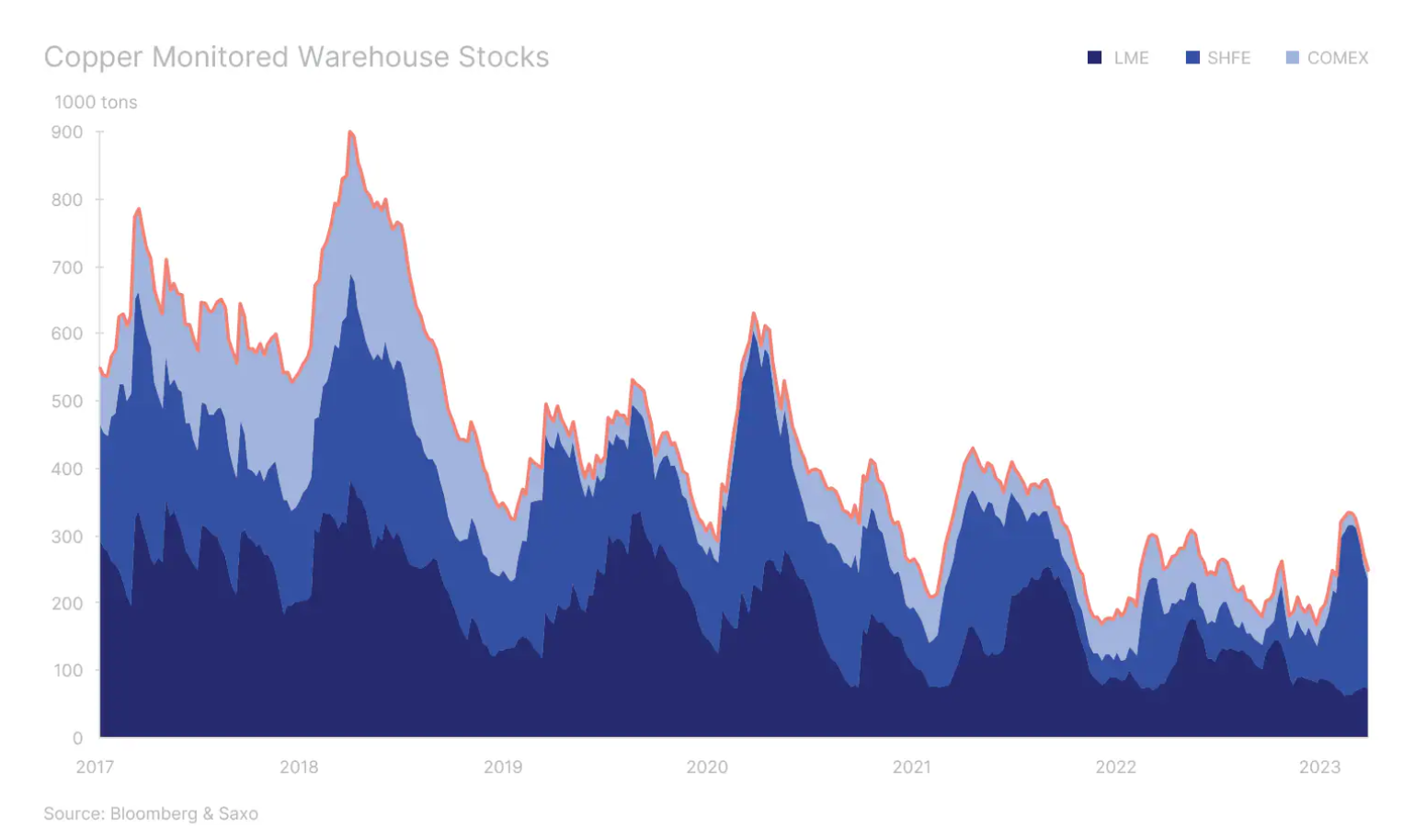

In our forecast for the first quarter, we predicted higher prices copper in 2023, however, we also wrote that after the initial rally, driven by traders and speculators anticipating the increase in demand from the recovering Chinese economy, hard work will begin to maintain these gains, with an increase in physical demand necessary to sustain the rally, in particular, taking into account the prospect of increased supply in 2023 after the implementation of a number of investment projects. Overall, we expect copper to trade mostly in the $3,75 to $4,75 range in the coming months before eventually breaking higher to a new high in the second half of the year.

This view is shared by some of the largest mining companies and physical traders, given the limited supply and the projected increase in demand for electrification as part of the green energy transition. In March, when crude oil fell more than 12% at one point, the copper market fell just under 4%, which we believe underscores that the growing demand for electric vehicle manufacturing, renewable energy generation and energy storage and transmission it is already offsetting the slowdown in the Chinese real estate market – which has been a significant source of demand in recent years – and the economic slowdown in the West.

If our opinion that the increase in demand for environmental reasons is only just beginning is confirmed, the prospect of increasingly limited supply in the copper market in the coming years will be a factor that will eventually lead to new record highs. China, already a major driver of green demand, will face increased competition from the United States, where the Inflation Reducing Act (Inflation Reduction Act, IRA), the most important climate law in the country's history, prompted European policymakers to develop a regulation on zero-emission industry (Net Zero Industry Act, NZIA); all this encourages further funding and support for the green transition, and with it the demand for so-called green metals, which include, among others, aluminum, lithium, cobalt and nickel.

Oil between the weakness of developed markets and the strength of emerging markets

In line with our forecast, Brent crude traded above $80 for most of Q70 until the banking crisis and recession fears drove it down to $90 as investors rushed to cut back. With oil entering Q18 from a lower-than-expected level, we see limited opportunities to return above $XNUMX in the coming quarter as fears of an economic slowdown in the US and Europe offset the effects of the current strong demand recovery in China. Opposing factors are currently affecting the oil market, with supply outpacing still weak demand, pushing inventories to an XNUMX-month high, the IEA writes in its latest oil market report.

Apart from the current heightened fears that the recession will negatively affect demand, the supply forecast turned out to be higher than expected, with Russia maintaining production levels close to pre-war levels despite numerous sanctions imposed by Western governments. Because Russia is redirecting its oil and fuel products away from Europe and its G7 allies towards Asian buyers, in particular India and China, but also Turkey, Africa and Middle East, the overall favorable price impact on global trade balances is yet unknown.

We note that the price-favorable backlash in the Brent crude market continued during the March sell-off, while refining margins increased, underlining that if current market conditions continue, they will continue to provide essential support. Overall, however, there is little doubt that the coming months are likely to be difficult, with the pressure on financial market stability offsetting the strength of demand from China and potentially also a weaker dollar supporting growth forecasts in emerging economies.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)