Side track China theme, time to focus on breakfast

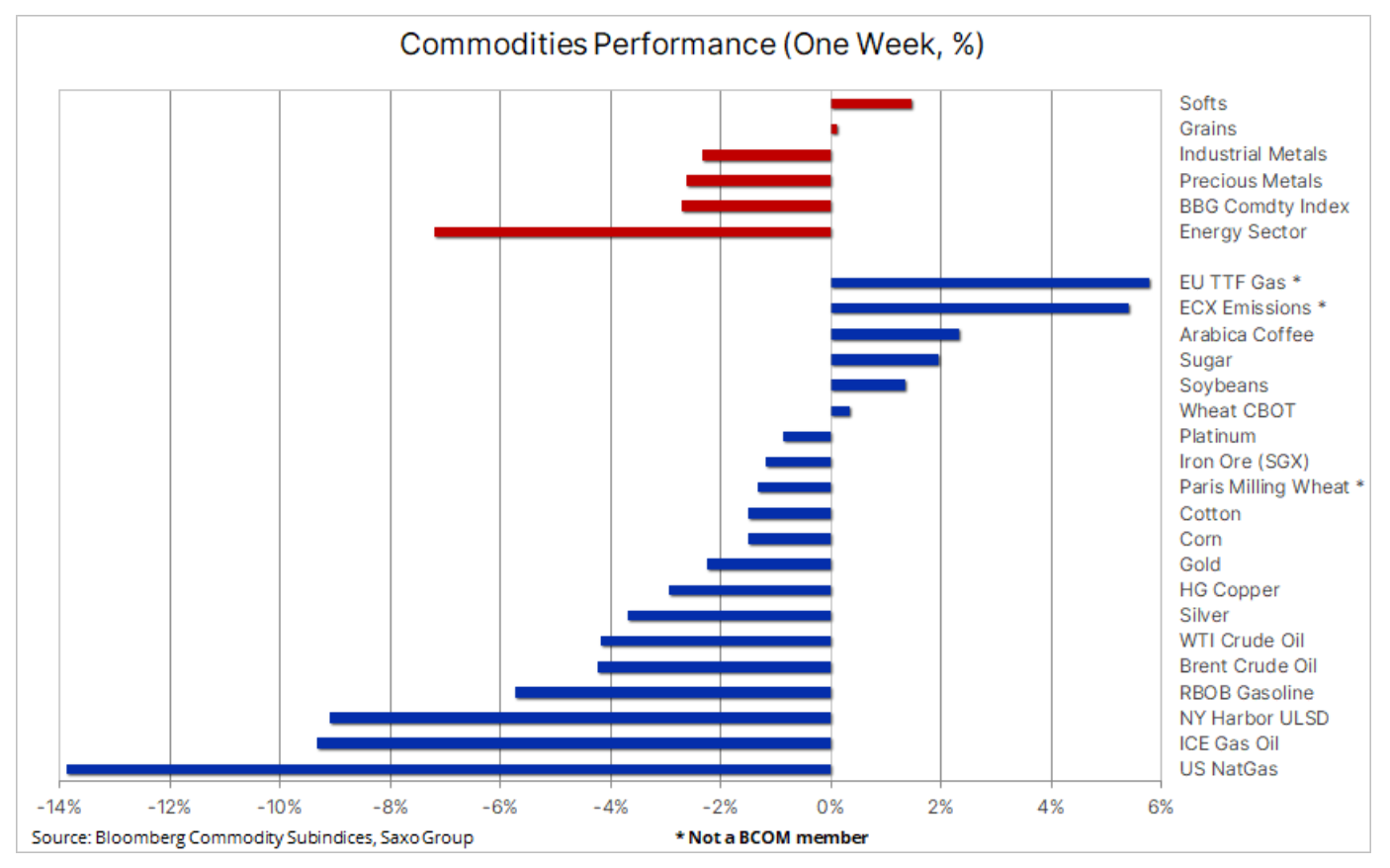

February got off to a poor start for the commodity sector as optimism about the pace of China's post-pandemic recovery began to wane and investors focused on gaining exposure to the stock market, which despite forecasts to the contrary, saw a strong rebound, in particular the tech index Nasdaq, which has gained more than 15% since the beginning of the year. Aside from US natural gas, which continued its month-long decline, oil and fuel products, as well as copper and iron ore, were the biggest losers, commodities that recently benefited from expectations that rising demand in China will more than offset any fears of a slowdown in other countries.

The Bloomberg Commodity Index (BCOM) traded lower for a second consecutive week to near its annual low, with losses in the energy, industrial metals and precious metals markets only partially offset by gains in grains, and most notably all the so-called "soft" foods.

Three major central banks, led by the US Federal Reserve, raised interest rates last week as expected, but the comments that followed led the market to believe that we were nearing the end of the current rate hike cycle. In particular, this concerned EBC – the most hawkish central bank in the G10 group – which has signaled that it will assess the future path of monetary policy at its March meeting. This remark dampened a key fundamental driver of EUR/USD's uptrend, causing the dollar to rebound sharply since it hit its latest post-meeting low FOMC. Gold hit a new cycle high on Wednesday after a dovish FOMC comment before breaking through support as the dollar gained value and the US monthly employment report shocked the market with 517 added in January. jobs, far exceeding estimates.

While economic data from China continues to support expectations for an economic recovery, the market is more skeptical about the pace and timing of demand growth. There is no doubt that the world's largest consumer of commodities will provide support for key commodities, from oil to copper, as the year progresses. However, in the short term, the market may be a bit too optimistic about the timing and strength of this rebound. Lower prices over the past week have forced hedge funds to reduce recently placed long positions - in particular in oil, fuel products and industrial metals - and may have contributed to overestimating the scale of the current correction.

Gold retraces sharply after reaching a new cycle high

Short-Term Technical Forecast for gold it worsened later in the week after the FOMC-driven rally to a new cycle high near the $1 resistance level was replaced by a sharp reversal as the dollar strengthened, particularly against the euro following a moderate ECB rate hike. The dollar reversal underscores that gold continues to follow the overall USD trend. Gold's sell-off extended after the release of an exceptionally positive US jobs report, further weakening the short-term technical outlook, with Thursday's bearish engulfing pattern on the daily candlestick chart pointing to a temporary high in the market.

Mining-based exchange-traded funds see increasing inflows, bullion-based ETFs lag behind

Following the surge in gold since the November low, there has been an interesting discrepancy between exchange-traded funds (ETFs) monitoring mining companies and funds based on the actual price of the bullion. Gold companies and ETFs monitoring major mining companies are gaining traction with investors as the price of gold is up 17% from its cycle low and the outlook could improve further if central banks eventually cut interest rates. Historically, gold has appreciated strongly as the US Federal Reserve halted its hike cycle and lowered interest rates, and coupled with strong demand from central banks, the market seems to pre-empt the Fed's expected shift towards easing. The largest publicly traded fund based on gold mining companies - VanEck Gold Miners (GLD) - saw a 400% increase in inflows, suggesting that retail investors are increasing their positions. Other popular now ETF on the gold market are iShares Gold Producer UCITS (IAUP) and iShares MSCI Global Metals and Mining Producers (PICK) – the inflow of funds to these funds has increased by over 100% this year.

At the same time, the total position for bullion ETFs has not increased and is still at a three-year low. This may confirm that the recent strength of gold was driven more by real physical demand than by the so-called paper demand. This observation also seems to be confirmed by the fact that the total number of open futures contracts on the COMEX exchange fell to the low of November 21 (468 contracts). In other words, despite the aforementioned strong rally, there was no significant increase in the number of open contracts.

From a technical point of view, last week's swing in the gold market suggests a long-awaited correction. Technical investors will be more negative after Thursday bear market engulfment formation, and a close below the 1-day moving average - currently at $914 - would signal an additional loss of momentum. A close below this level could see a short-term downward move towards $1 or even $872.

Oil under pressure from speculative liquidation of long positions

Petroleum fell more than 4% on a weekly basis as optimism about China wanes and US inventories continue to rise. Even before the Chinese New Year celebrations, the market had priced in the prospect of a strong recovery in China, but now there are doubts about the timing and extent to which this increase will be able to offset the weakness in other countries. We believe that Chinese demand and additional sanctions on Russian fuel exports that will come into effect on February 5, together with OPEC+ price support through actively managed production, have created a soft bottom in the market. In the short term, the market continues to struggle with long liquidation as hedge funds are forced to reduce recently created long positions.

In the six-week period ending Jan. 24, cash managers increased Brent longs by 163 million barrels, of which 95 million barrels were purchased in the last two weeks. This highlights the short-term challenge the market is currently facing and explains why the current correction could prove deeper than what might be warranted given the current fundamentals.

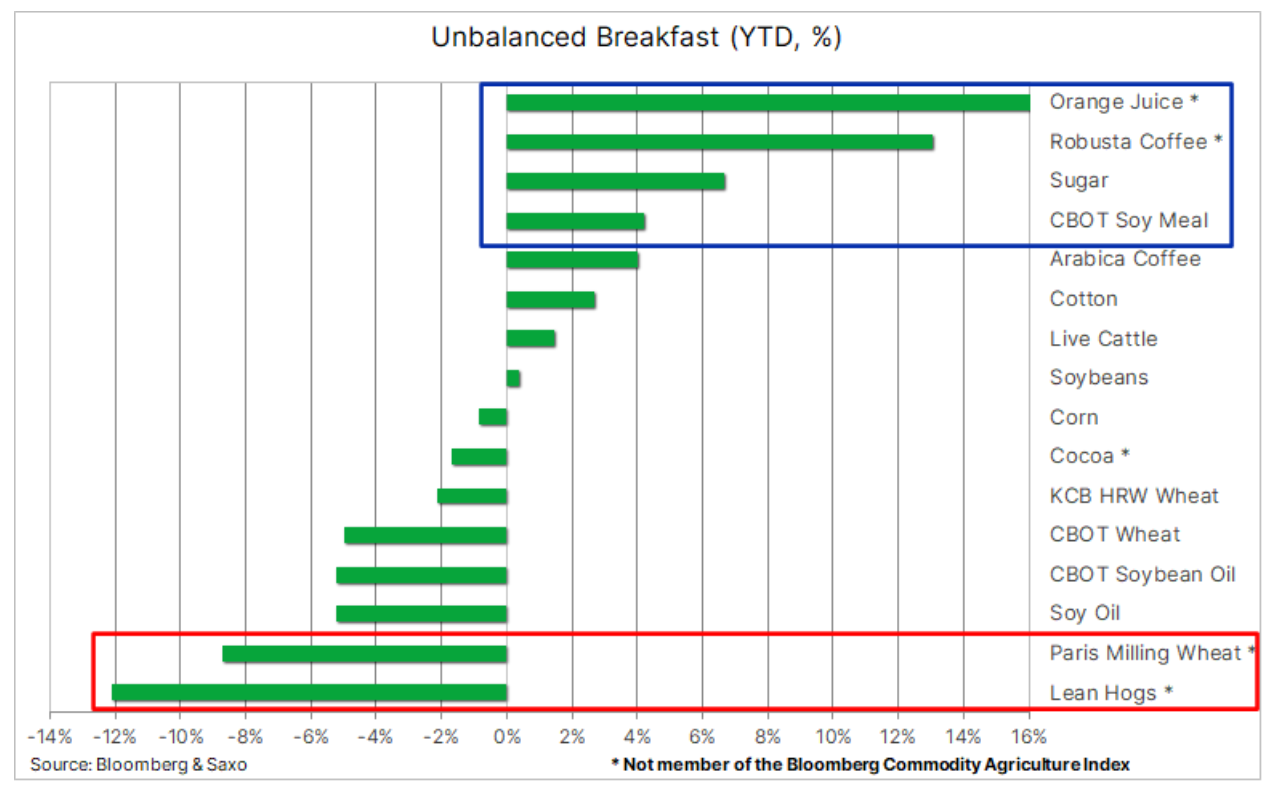

Your unbalanced breakfast

Although the attention of investors has been largely attracted to copper and gold this year, the sharp increase in the prices of the so-called of soft foods, in particular last week, has pushed the sector to the top of the scoreboard. The Bloomberg Softs Index, which includes arabica coffee, sugar and cotton but excludes robusta coffee and orange juice, which are gaining heavily in value, is up 7,3% this year. This was due to unfavorable weather conditions in key growing areas, short positions being covered by speculative investors and, in the case of sugar, rising gasoline prices increasing demand for biofuels.

Futures contracts for arabica and robusta coffee Stocks in New York and London hit three-month highs amid growing fears that the world could face a third consecutive deficit due to a shortage of robusta beans. Recent increases were initiated by robusta, which - after a decline in the second half of last year - rebounded strongly last month, mainly due to concerns about supply. Robusta stocks monitored by ICE fell to their lowest level since 2016, when contract rules were changed. In addition, exports from Vietnam, the world's second largest exporter of coffee - primarily robusta - fell 31% year-on-year in January.

At the same time, arabica coffee continues its recovery after a five-month correction that saw the price fall by 11% between August last year and January 40. Since then, the futures price has risen 29% to hit a three-month high of $1,82 a pound. The main reason for this is the deteriorating forecast for the upcoming season in Brazil, which for the third year in a row indicates a small harvest. Delayed harvests in Central America and concerns about the next harvest in Peru amid political protests added to the upward pressure on prices.

These developments have forced a major turnaround for hedge funds, which have accumulated their largest net short position in arabica coffee in more than three years in recent weeks. This highlights the importance of tracking weekly COT reportas a change in the technical and/or fundamental forecast can have a huge impact on the price when positions are significantly increased.

Global supply concerns also remain a key factor in the recent rapid rise in prices sugar, which culminated last week with the New York Stock Exchange's March futures trading at a November 2016 high of around 22 cents a pound. The latest increase in prices was affected by reports from India, the world's second largest sugar producer, after the Indian Sugar Mills Association lowered its estimate for domestic production this season by 6,8% to 34 million tonnes. As a result, exports will most likely fall from the previously forecast 9 million tons to 6,1 million tons. The main reasons for the reduction are unfavorable weather conditions and sugar refineries allocating more cane to ethanol. Thailand, the world's second-largest exporter after Brazil, could increase its exports as production is expected to increase by 14% to 11,6 million tonnes, which could prevent sugar prices from rising further at this stage.

At the same time, futures contracts for Orange juice they hit a record high of around $2,45 a pound and, based on the BCOM OJ index, are up more than 90% year-on-year. Prices were driven up by the citrus crisis in Florida, which saw the key state's lowest harvest since 1936. Adding to the problems of a series of hurricanes over the past few years can be added frost damage and citrus greening, an insect-borne disease. In addition, in both Brazil (humid weather) and Mexico (increasing demand for fresh fruit), juice production was significantly hampered during a period of strong demand.

All of the above factors contributed to the increase in the cost of an average breakfast, while a large supply wheat, in particular from the Black Sea region, has resulted in wheat prices being slightly lower this year so far. Attention, bacon lovers: its price has also fallen, and futures on lean pork in the United States reacted negatively to the increasing availability of inventories. The USDA's latest Cold Storage Inventory Report showed that total frozen poultry stocks as of December 21, 2022 were 7% higher than the previous month and 23% higher than a year earlier.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)