Bumpy start to March in commodity markets

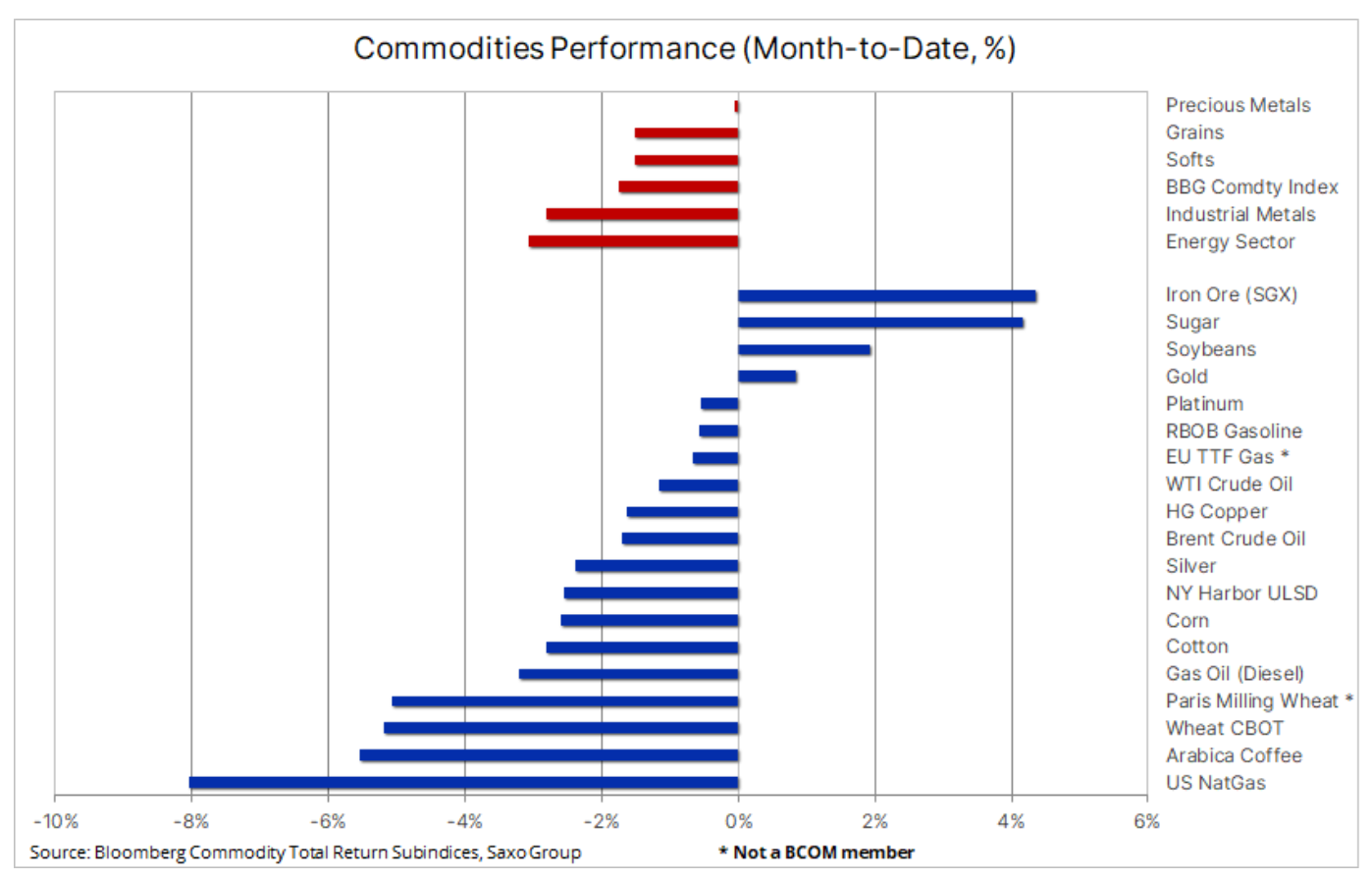

March began with further widespread weakness as news came from China and the US, the world's two largest consumers of commodities, pushing prices down. Sentiment deteriorated further after heavy losses from two small US creditors sent the S&P 500 index down to a two-month low. Bloomberg Commodity Index, which monitors a broad basket of commodity futures evenly spread across energy, metals and agricultural products, fell 1,7% m/m and 7% y/y, with the energy and industrial metals sectors suffering the biggest losses this month.

The strength of the expected demand recovery in China has been dampened after the country's leaders announced a conservative growth target of 2023% in 5, one of the lowest figures in decades. Combined with a slight increase in fiscal support, this lowered expectations for additional stimulus to accelerate economic recovery. In Saxo's view, this is partly due to the Chinese government's desire to avoid making the same mistakes as other governments and central banks, which resulted in inflation reaching its highest level in forty years. Growth consumers are now suffering the consequences as central banks increasingly use interest rate weapons to bring inflation under control.

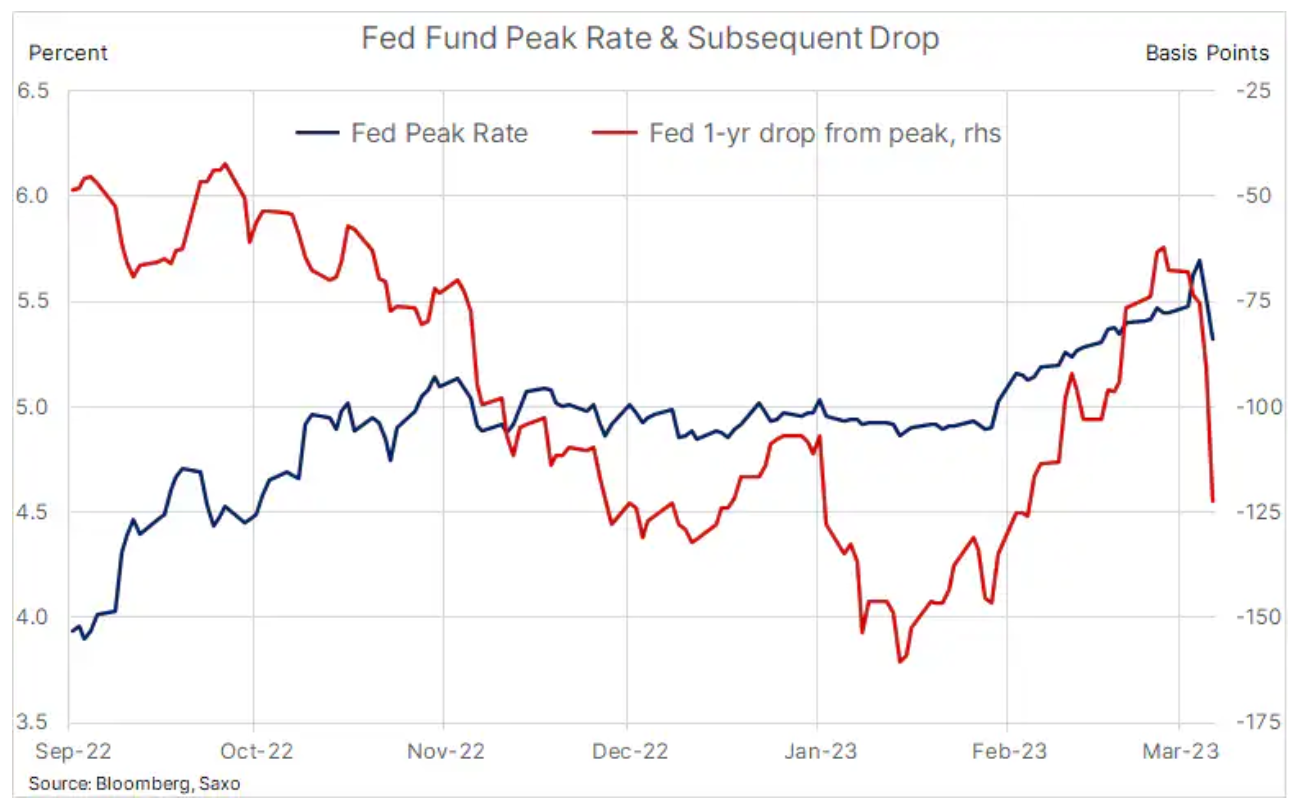

At the same time, Chairman Powell of the US Federal Reserve stepped up his attack on persistent inflation. During a semi-annual two-day visit to Capitol Hill, he told lawmakers he was ready to ramp up the pace of rate hikes to higher-than-expected levels if the incoming data continued to be strong. The swap market reacted by pushing the final rate expectations above 5,66% from 4,75% in early February, before Thursday's banking equity turmoil pushed the peak rate back below 5,5%.

During Tuesday's question-and-answer session after the Fed chairman's speech, a significant exchange took place between Powell and Senator Elizabeth Warren (D), highlighting the risks he is taking FOMC, continuing to raise rates until an event occurs to stop them. Warren asked Powell what he was going to say to the two million people who would lose their jobs as a result of further rate hikes. The answer was: "Will working people be better off if we just stop doing our jobs and inflation stays at 5-6%?"

His comments supported the view that the FOMC would continue to be data driven and, apart from a small risk of a systemic event taking over, would continue to raise rates despite the obvious risk to the economic outlook. Saxo will continue to watch the dollar closely given its inverse correlation with commodities (in particular gold) and, increasingly, the way the market is pricing in recession risk and with it the magnitude of the eventual fall in rates. Saxo monitors this through expectations for the final Fed Funds rate and the size and speed of further cuts after it peaks, now expected around September this year.

After much enthusiasm at the beginning of the year, the trade impulse from reopening the Chinese economy to the world continues to fade, in particular following the government's announcement of the moderate growth target mentioned above. However, it is premature to write off China as the main contributor to the increase in demand for commodities, as it will take several months for the real impact to be felt and for prices to benefit. It should be taken into account that producers tend to be quicker to increase supply before demand increases. This has recently been seen in China, where the increase in copper inventories monitored by the exchange in February has not yet seen a corresponding increase in demand.

Crude oil remains within the range despite numerous headwinds

Prices oil are in the range, with rising demand in Asia being able to offset the dark clouds gathering in other parts of the world, most notably in the US, where Fed Chairman Powell showed his willingness to risk a recession in Capitol Hill last week to control inflation. Although the data indicate a strong revival in demand in reopening China, the market was disappointed with Beijing's announcement of the lowest economic growth target in decades. In addition, concerns about a banking crisis, even if minor, kept risk appetite low.

Overall, these price-negative developments were not enough to drive prices down and out of the ranges they had been in since late November. In the short term, macroeconomic developments are likely to overshadow possible changes in the oil market, unless they have a significant impact on the supply-demand balance. After breaking the upward mini-trend within the dominant range, Brent crude oil could be at risk of further weakness in the short term, partly due to fund liquidation, which in recent weeks increased its net long position to a 286-month high of 286k. flights or 28 million barrels. At the same time, the gross short position continues to shrink - in the week ending February 22, it fell to just 12. flights, the lowest level in XNUMX years.

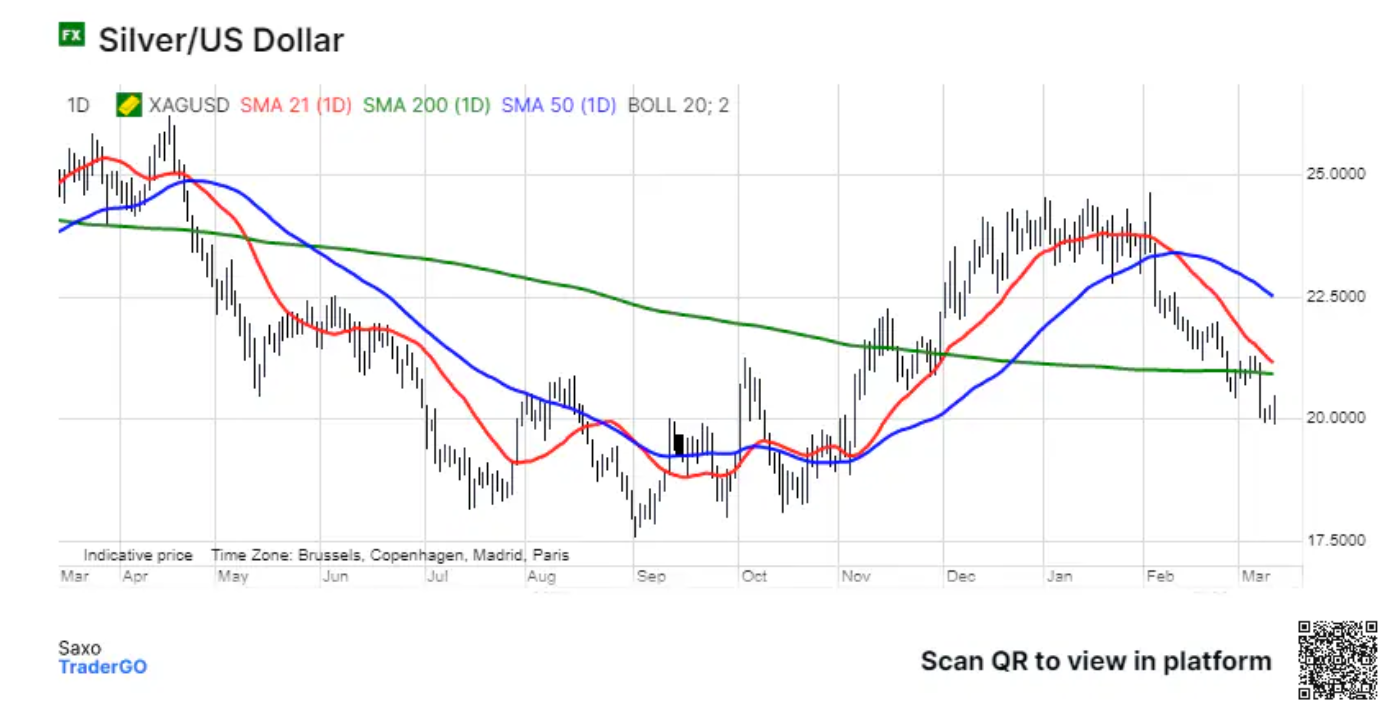

The figures support gold

Prices gold i silver mid-week they fell after President Powell said in his congressional address that the Federal Reserve was prepared to increase the pace of rate hikes, and to a higher-than-expected level, if the incoming data remained strong. Having failed to break through the $1 resistance level, gold declined before finding support again at $864. At the same time, silver resumed its weekly decline, reaching a four-month low before it managed to attract new buyers around the $1 level. The relative weakness since late December has seen the gold/silver ratio rise from 800 (ounces of silver to one ounce of gold) to a six-month high of 20, down 75% and underlines the short-term challenge silver will face to generate fresh demand .

In the short term, given that Powell has signaled an incredible reliance on data, the most important will be the latest US data, kicked off by Friday's employment report, which has essentially eased the pressure on the Fed to scale up its next rate hike on March 22 federal. Given that the market is pricing in heightened expectations for a rate hike, any weak data could now trigger a stronger positive reaction than would otherwise be warranted.

Saxo is keeping a close eye on when rates peak and how aggressively the market is pricing in the subsequent cut. As seen in the chart above, the interest rate peak is now expected to be around July and is priced at 5,34%, down from 5,70% earlier in the week. Moreover, the pace of subsequent rate cuts accelerated to 125 basis points over the next 12 months. This is worth noting because, historically, gold has tended to perform well in the months following the fund rate peak Fed, often accompanied by a weakening of the dollar and falling bond yields.

The WASDE report increases downward pressure

Futures contracts for corn i wheat Chicago-listed stocks continued their decline this week after the U.S. Department of Agriculture said in its monthly supply and demand report that domestic stocks rose more than expected due to lower exports. The ministry also raised its forecast for Ukrainian corn exports, while the price of wheat, already under pressure due to sales from Russia and the expected extension of the Ukrainian grain corridor agreement, fell to a 20-month low after the Department of Agriculture increased production estimates for Kazakhstan, Australia and India. Meanwhile, soybeans found support after the Department of Agriculture lowered its production forecast for drought-stricken Argentina much more than expected. The world's largest exporter of soybean meal and soybean oil will harvest 33 million tonnes of beans this year, the smallest harvest since 2011 and down 20% from the Department's February estimate.

All major Chicago and Paris wheat futures remain under pressure and all are oversold on relative strength indicators. This is a very different situation from last year, when Russia's invasion of Ukraine - a major supplier of high-protein wheat ideal for human consumption - sparked a wave of panic buying. On March 9, Chicago-listed wheat peaked at $12,85 per bushel before declining 50% to its current level of $6,66 per bushel.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)