A Painful Transitional Phase - A Step into the Darkness

A 2017 book by Andrew Lo "Adaptive Markets" ("Adaptive Markets") makes a compelling case against the dominant efficient-market hypothesis, as it borrows key concepts from biology to explain what we see in financial markets and, more generally, in our economic system. In nature, some species are more adaptable to their environment, so they have a higher survival rate, acquire more resources and, as a result, reproduce more successfully. These animals are better adapted to survive, but sometimes - due to random mutation or external changes in the environment - other species become more successful. Environmental transitions can be brutal and transcend cause and effect relationships commonly known in physics, such as when water turns to ice or steam and our chaotic human societies become extremely unpredictable.

In the era of globalization in the years 1980-2020, international companies seemed to be best adapted to the conditions. In the late phase of the information age, software companies were best suited because there were fewer constraints in the physical world. Globalization coupled with cheap gas from Russia has made them particularly well adapted to survive Germany. Due to low interest rates, companies of the type were very well suited to the conditions venture capital, private equity and entities from the real estate sector. In 2022, we witnessed a situation where the best-fit models and actors in our economy entered the dark as the world entered a transition phase. Globalization as we have known it since 1980 has come to an end. It is difficult to predict what we will find after the end of this transition, but our working concept is that what was well adapted during the period of globalization will be less adapted in a world shaped by geopolitics and the process of transition to a bipolar world based on two different value systems. In other words, all the models that have worked very well so far will fail in the future.

This stock market outlook is dedicated to these broken models and covers the top five implications:

- Higher structural inflation because the "geopolitical war" is inflationary

- Lower corporate margins as workers fight back and taxes rise due to the new dominance of fiscal over monetary policy

- Physical assets will outperform intangible and financial assets

- Self-sufficiency will help optimize supply chains, creating winners and losers in emerging markets

- Lower real growth rates and greater macroeconomic uncertainty

The physical world is back – and with a bang

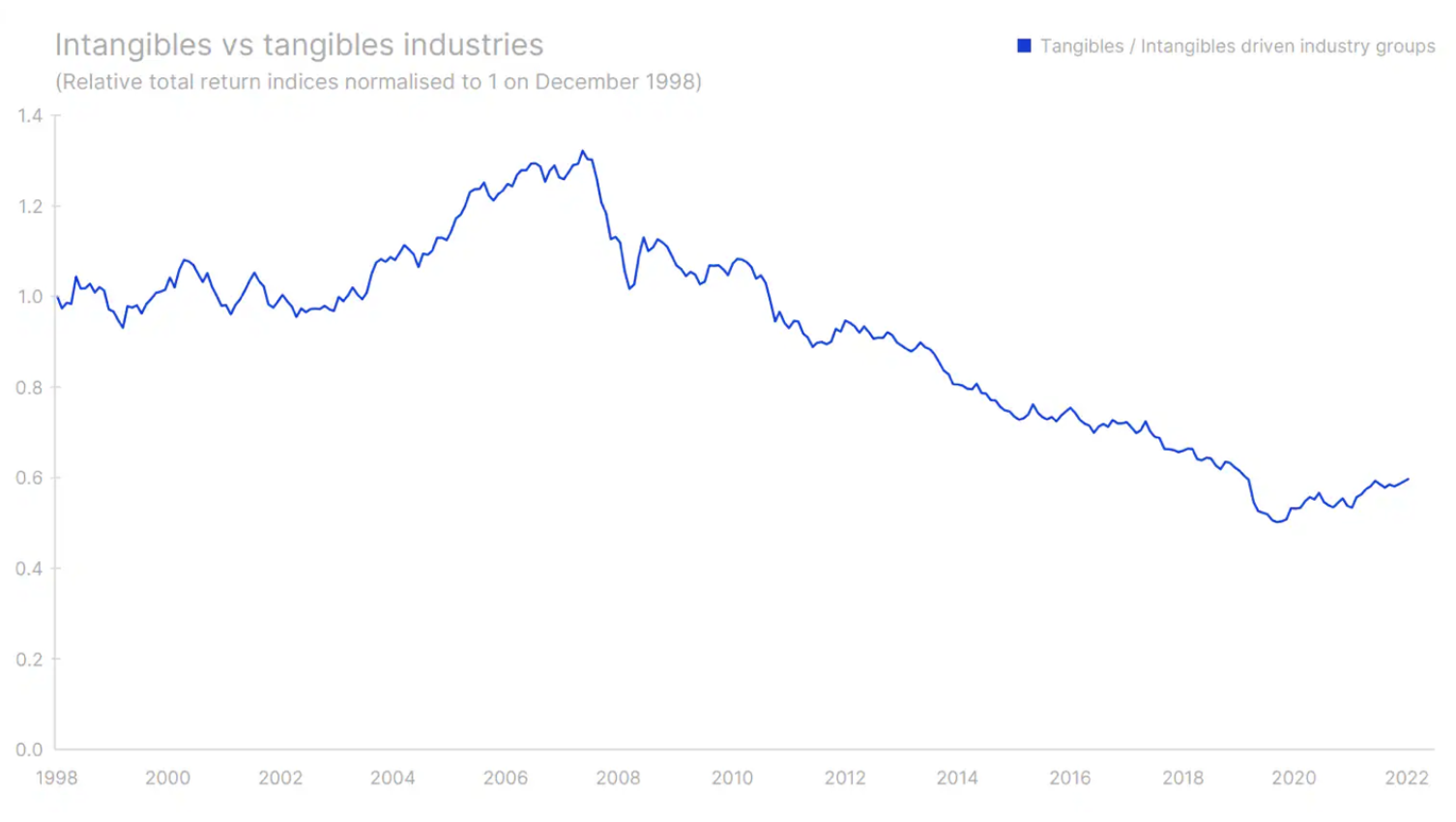

The digitization process began in the early 90s, and one of the first key events in this regard was the establishment of the company Amazon in 1994. However, digitization only began to dominate capital markets after the global financial crisis. Along with other companies where they were leaders intellectual property rights i intangible assetssuch as network effects, brands and patents, etc., companies based on them performed much better than companies based on fixed assets, such as machinery, collateral value or buildings. Period prosperity in the world of intangible assets started around April 2008 and lasted until October 2020, i.e. until the month before the news about the development of mRNA vaccines against Covid-19. Vaccines have changed everything.

They allowed the economy to restart faster than expected. As a result, the implementation period of fiscal and monetary stimulus, which was supposed to protect society from a baseline scenario in which vaccine development would take about four years, has been shortened. The faster-than-expected resumption of economic activity resonated widely in the global economy, causing bottlenecks in the physical world as people widely increased their wealth and income and were finally able to spend it outside the digital world. This kind of release of demand in the physical world was comparable to the stimulus implemented after World War II, when the reconstruction of Europe took place and inflation took off naturally. Commodity prices have skyrocketed, entering what could turn out to be by the end of this decade raw material supercycle. Fixed asset industries outperform the world of intangible assets for the third year in a row. In our opinion, this trend is just beginning.

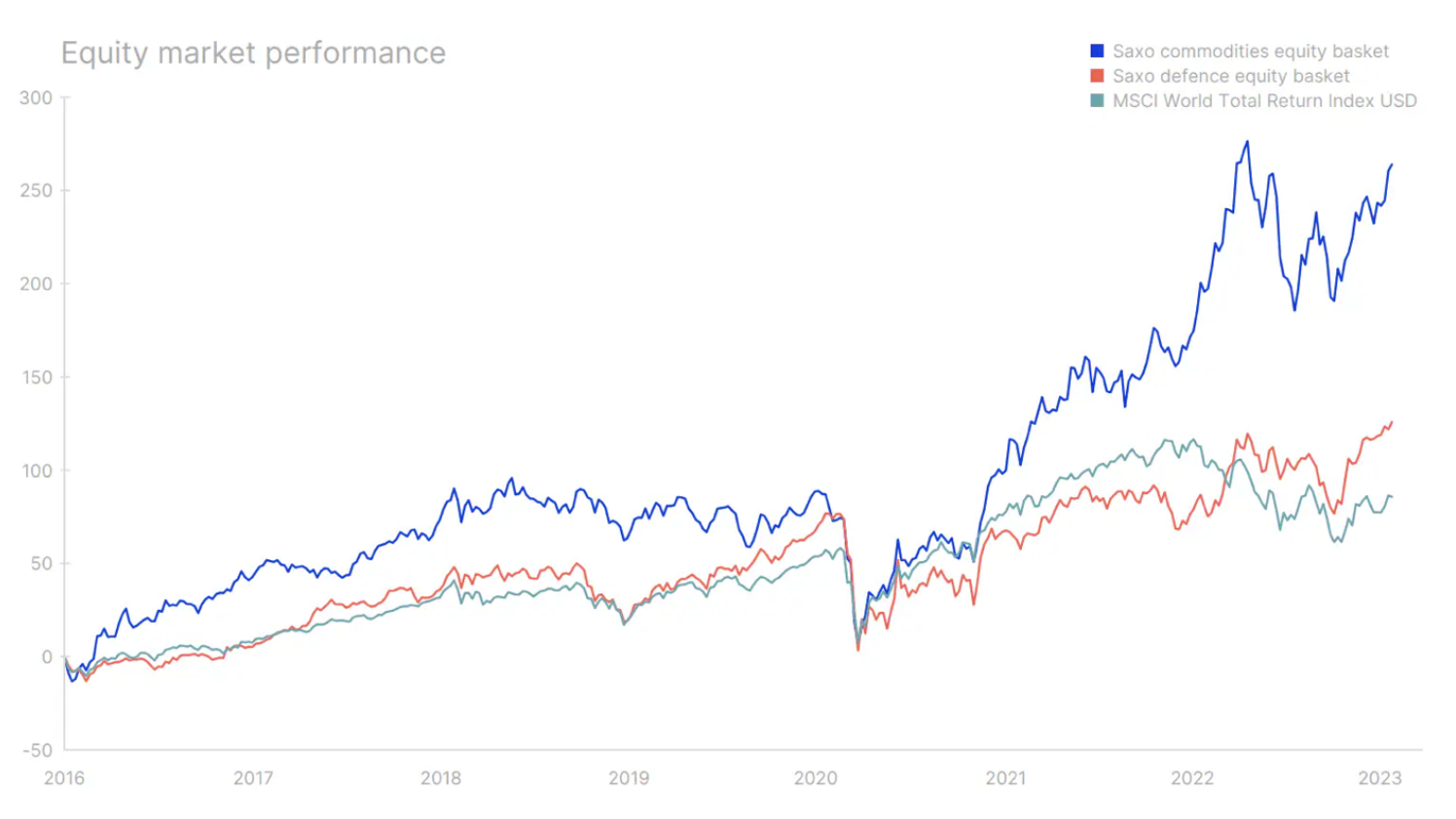

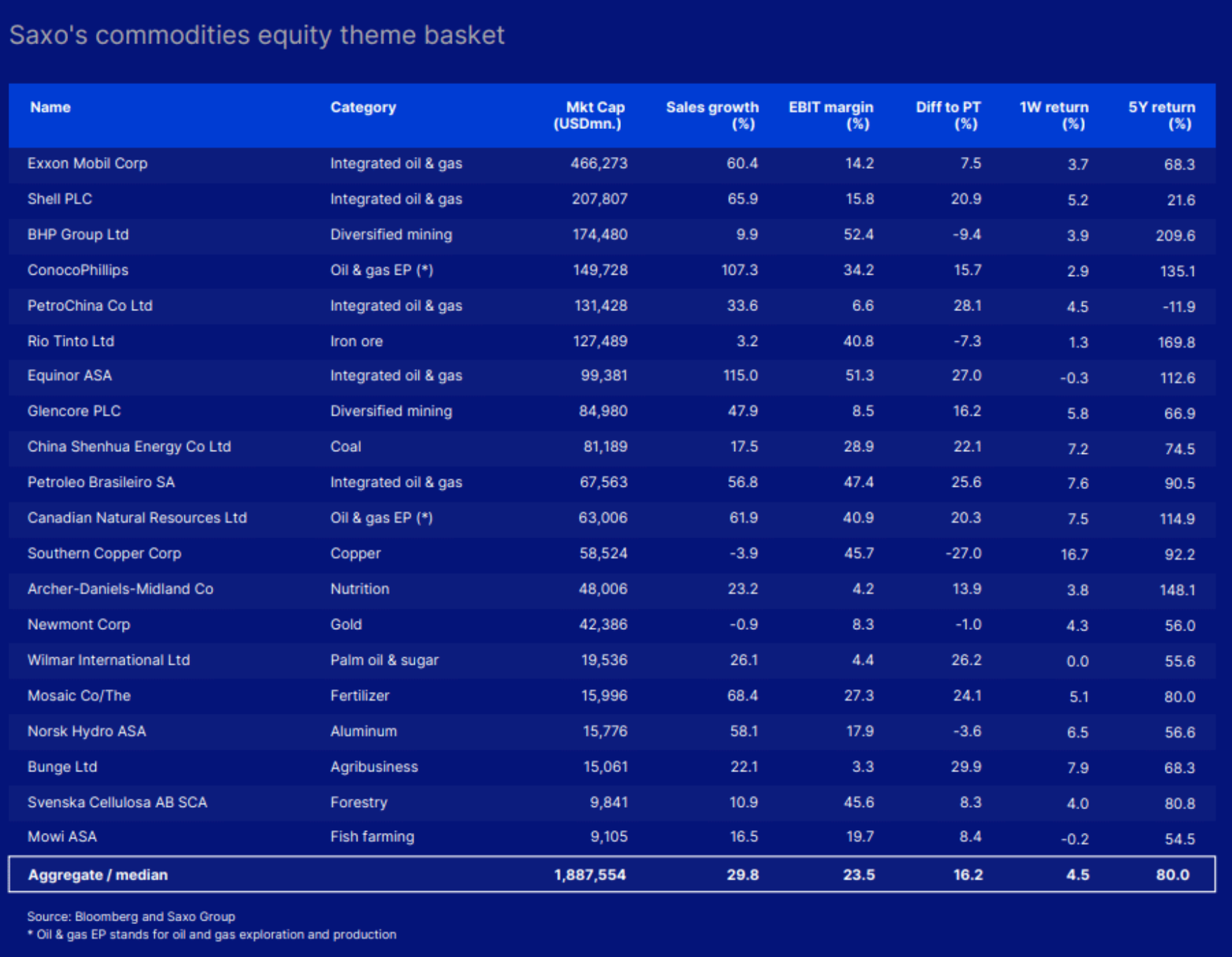

Two segments of the physical world did well last year. Commodity companies (agricultural, energy and mining) and defense industry were the only ones to show positive trends. Both of these segments seem better suited than digital companies for a world where there is a "war" on different value systems and where the US and Europe are racing against time to invest in security of supply, infrastructure and defense, modifying global supply chains , and, on top of that, shift their economies to non-fossil fuel sources of energy. The boom in intangible asset-based companies offering fantastic returns to investors has reduced the amount of capital available to the physical world, laying the groundwork for the current transformation. However, the real turbocharging was provided by the pandemic and the subsequent war in Ukraine.

Within our overall positive outlook for commodity markets, copper and lithium mining companies stand out particularly constructively due to the green transition and the huge political capital invested in its implementation. Many experts say that commodity prices have already increased significantly, making the risk-reward ratio unfavorable. If we have indeed entered a ten-year supercycle, commodity prices will remain high for eight more years, and in previous commodity supercycles, spot prices have increased by 20% per year. The new geopolitical environment will mean a huge boost for the European defense industry, which should record double-digit growth in the next business cycle, around 20% per year, as the Old Continent doubles its defense spending as a percentage of GDP.

However, there are always exceptions to the rule. Given the intense "war" of Fr computer microprocessors American as a result CHIPS Act From 2022, we expect a significant investment boom, growth and tax incentives that will help increase profits for US and European semiconductor manufacturers over the next decade. While semiconductors are very much tied to the physical world to some extent, semiconductor stock valuations suggest that the industry is driven by strong intangible assets such as patents.

In a world shaped by geopolitical upheaval, where "war" is fought in many other dimensions than old-fashioned kinetic warfare, digital systems are vulnerable. Therefore, companies and governments will devote significant resources to protecting digital assets, and this will create a long growth path for companies in the industry cybersecurity.

US vs. Europe, Emerging Markets and Top Caps?

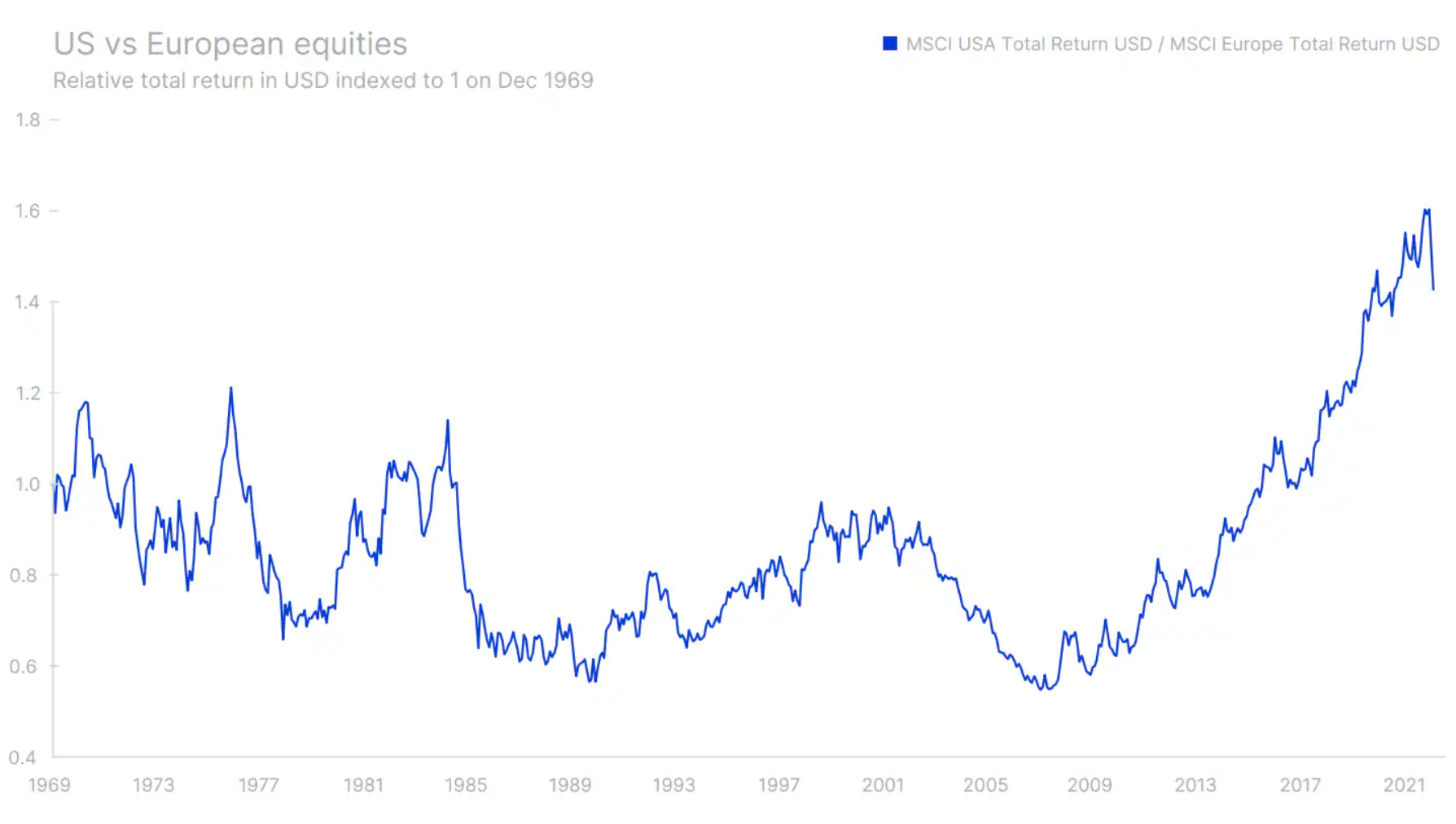

Well-adapted to surviving the tech sector in the late phase of globalization, coupled with low interest rates, the US tech sector as measured by the Nasdaq Composite easily outperformed everyone else. This led to an alpha rise in US stocks relative to European stocks, with the latter lagging behind since the Eurozone crisis. Europe has basically lost the fight for dominance in the digital world to the United States. With advancing deglobalization, war in Ukraine compounding the energy crisis, and global demand for physical assets, Europe will stand to gain from this shift. There are many more companies on European capital markets that will be able to thrive in this new environment. It's about e.g green energy technologies, mining industry, automation, robotics i advanced industrial components.

European countries – including fiscally conservative Germany – will also be forced to run up deficits due to rising infrastructure and defense spending, which could translate into significant growth this decade. In terms of equity performance in terms of total return denominated in USD, European equities actually outperformed US equities between 1969 and 2008, with several longer cycles occurring during this period. However, from mid-2008 to October 2022, US equities outperformed European equities. This was due to the progress of digitalization contributing to the development of sectors based on intangible assets - and this competition was won by the United States. While asset-based industries are beginning to outperform intangible industries, European stocks have lagged behind until recently. If the new geopolitical environment turns out to be in line with our expectations, European equities will come back into play. With the US dollar historically strong against the euro, the currency side could provide strong support if the US currency were to weaken due to structurally higher inflation compared to Europe. With regard to stock valuation, Europe shows an advantage as twelve months C / Z ratio is 11,9 compared to 17,7 for US stocks. Such a discount in the valuation will certainly not be ignored by investors, and after Europe secures its energy supplies and after the end of the war in Ukraine, the influx of investors will begin. Finally, as China reopens its economy to the world and embarks on a 2008-style fiscal expansion, Europe, China's largest trading partner, can only benefit. European equities can be seen as a good intermediate way to go long in the context of China and its fiscal expansion.

At the country level, typically exporting countries such as Germany, South Korea, Taiwan, and China in particular, were best adapted to the conditions. In the new geopolitical environment, this situation is likely to change. In Asia, the winners appear to be India, Vietnam and Indonesia. And closer to Central Europe - Eastern Europe and some North African countries can win by relocating production there, while Sub-Saharan Africa will experience an investment boom due to Europe's energy and material hunger once Russian supplies are excluded. Approaching the geographic vicinity of the United States, Mexico will benefit from production, and South American countries will benefit from the resource supercycle.

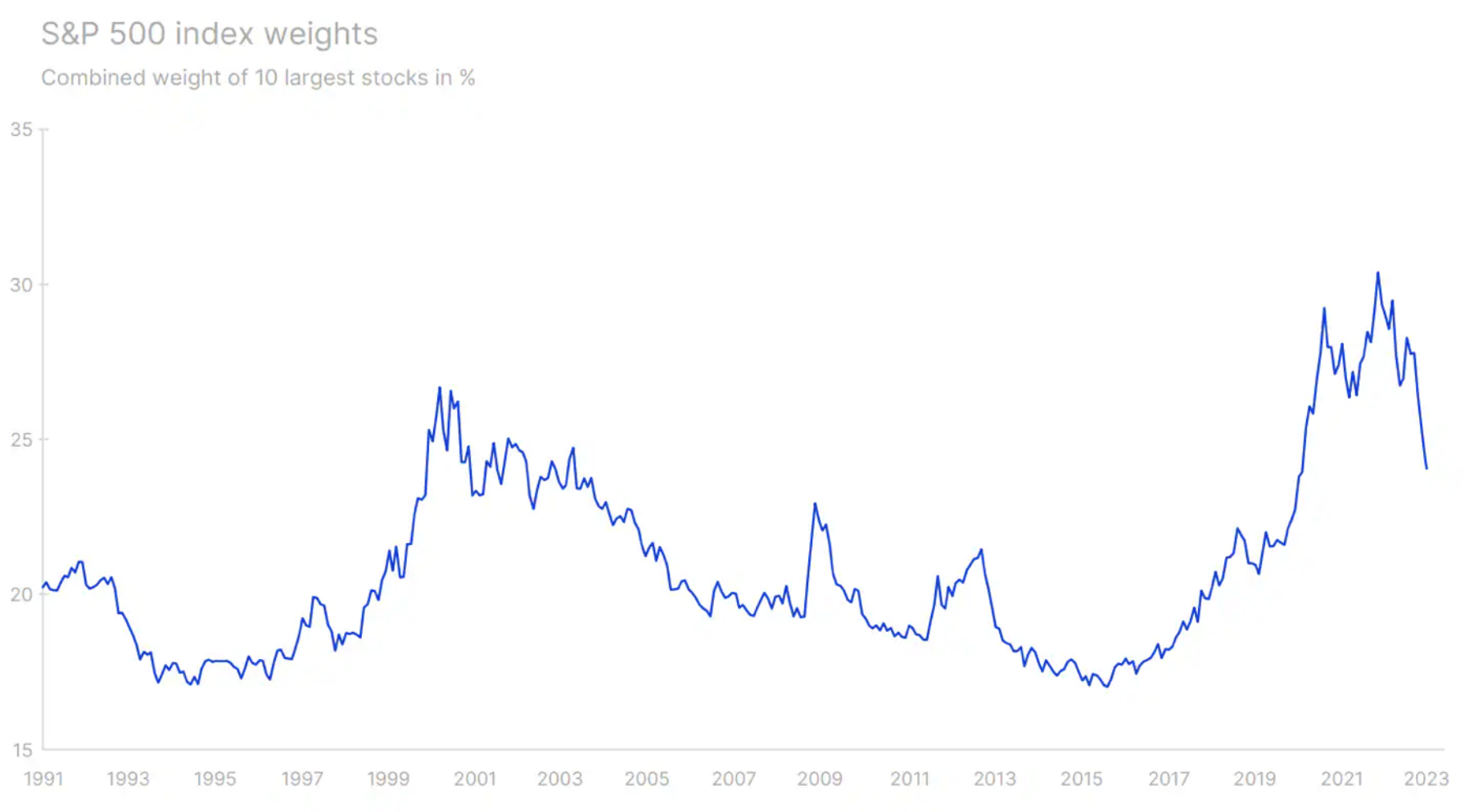

Deglobalization and self-preservation policies will also make life more difficult for companies with the largest capitalization. Their combined market value peaked at the height of the pandemic, setting a new market value concentration record, last recorded in the 70s. As this reverses, the new system will not favor such large-scale companies and entities, but rather smaller, companies operating in niche industries, supplying products for building the physical world, to the domestic market.

Quality and high margin are less sensitive to wage inflation

The last 10 years will go down in the annals of the extraordinary monetary policy in the aftermath of the Great Financial Crisis and the Eurozone crisis two years later. Lowering the cost of capital probably lowered the threshold for return on invested capital (return on invested capital, ROICs), and the low interest rate environment reduced costs for the most heavily indebted enterprises. Low interest rates have also contributed to significant risk-taking and value distortion over time, most notably in the industry venture capital, in which the new model blended beautifully with digitization and network effects. Financing loss-making companies to ensure market leadership was no longer a problem as low interest rates allowed capital to flow into projects venture of extremely high risk.

Such dynamics created a veritable forest of tech startups and turbocharged a biotech industry that had been dormant since the dot-com bubble. One of the most iconic examples of this phenomenon is Uber – according to TechCrunch, with 32 rounds of funding worth around $25 billion in the 13 years since the company was founded. Uber still has a negative ROIC despite revenue of $29 billion. WeWork and the entire portfolio of SoftBank-funded tech startups was another role model in this era. In the current set of inflation and interest rates, this model is broken. The companies that are best suited to higher interest rates, wage resets, and high inflation are those with high ROIC or high operating margins combined with less overpriced stock valuations. Companies with low margins, high financial leverage and low profitability are the least adapted to the new conditions.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

![A Painful Transitional Phase - A Step into the Darkness Skip to Main ContentSkip to Toolbar About WordPress Forex Club 81 WordPress Update, 5 Plugin Updates, 2 Theme Updates Create View SEO PostGood SEO Rating Contact Form 7 Style Disqus Insights Forms Delete Cache UpdraftPlus Hello Paweł Mosionek Sign Out Screen OptionsHelpWordPress 6.1.1 is now available! Update now. Edit Post Add New Please Setup Website Analytics to See Audience Insights MonsterInsights, WordPress analytics plugin, helps you connect your website with Google Analytics, so you can see how people find and use your website. Over 3 million website owners use MonsterInsights to see the stats that matter and grow their business. Connect MonsterInsights and Setup Website Analytics Learn More Draft post updated. View entry Hide message. Add title MOVE Index - An index of fear for the bond market words: 12 The author of the last edit is Paweł Mosionek, it was made on 1207-2023-02 at 13:09 Move up Move down Toggle panel: MonsterInsights Move up Move down Toggle panel: Publish Preview(opens in a new tab) Status: Sketch EditEdit status Visibility : Public EditEdit Visibility Version: 51 BrowseBrowse Versions Schedule for: Feb 3, 15 at 2023:08 AM EditEdit Date & Time Readability: Good SEO: Good Move to Trash Move UpMove DownToggle Panel: Featured Image Set Featured Image Move UpMove DownToggle Panel: Categories All Categories Most Used Beginners Indices Commodities AxiTrader Crypto K Charts cryptocurrencies Cryptoretirement News Exchanges Education Tokens Invest Cuffs Investments Investment systems Guides Indices Shares Commodities Other Social Trading PAMM accounts I Can't Trade Alfa Forex Uncategorized FXopen Forex for Business Tools News Transaction platforms Slot machines Add-ons Widgets Programming News News Events Contests and promotions List of warnings Education Advanced Trading Psychology Regulations Training Literature AT Encyclopedia Taxes Dictionary Video Analytics Education Platforms Tools STO Brokers XTB IC Markets Vantage Markets Tickmill eToro Dukascopy FxPro TMS Brokers Saxo Bank List of Forex Brokers About the Market Broker Models ECN Model STP Model MTF Model MM Model CFDs Binary Options Bitcoin Intertrader + Create category Move upMove downToggle panel: Tags Create tag Separate tags with commas Delete term: interest rates interest ratesDelete term: risk riskDelete term: bonds bondsDelete term: vix index vix indexRemove term: move index move indexDelete term: bond prices bond prices Select from the most used tags Move upMove downToggle panel: Attributes Highlighted ("Read:" post) Move upMove downToggle panel: Auto Cache Settings Move upMove downToggle panel: Bonuses free book bundle up to 30% Commission discount up to -15% commission refund 26% Commission discount 11% Commission discount 20% Commission discount Negotiable discount Free support Forex Club Free tax Forex Club Tools FREE SPONSORED MATERIAL Discount up to $50 / lot Move upMove to downToggle panel: Parameters MT5 MT4 JFOREX CTRADER DISCOUNT WITH FOREXCLUB Move upMove downToggle panel: Excluded Reactions Like Interesting Heh... Shock! I don't like Too bad Move upMove downToggle panel: Yoast internal linking This is a list of related content you can link to in your post. {}Check out our article on site structure(Opens in a new tab) to learn more about how internal linking can help improve your SEO. Consider linking to these articles: Copy linkFirst signs of an end to interest rate hikes around the world?(Opens in a new tab) Copy linkIt's Central Bank Week, EUR/USD returns above 1.09(Opens in a new tab) Copy linkNext week's top economic events (January 30 - February 3)(Opens in a new tab) Copy linkHow will Jerome Powell comment on Friday's Non Farm Payrolls?(Opens in a new tab) Copy linkCentral banks in the game. What will the future hold?(Opens in a new tab) Copy linkAUD/USD rises in reaction to hawkish signals from the RBA(Opens in a new tab) Copy linkBurn Economic Models - Saxo Bank QXNUMX Forecast(Opens in a new tab) ) Copy linkFOMO drives stock market growth(Opens in a new tab) Copy linkEUR and JPY, currencies of countries that may prove to be the safest(Opens in a new tab) Copy linkArtificial intelligence warms up investors. Worse performance of US companies(Opens in a new tab) Move upMove downSwitch panel: Author Author Forex Club Move upMove downSwitch panel: Teaser Teaser For many people, it may come as a shock to learn that the bond market is bigger than the stock market. According to data collected by SIFMA (Securities Industry and Financial Markets Association), in 2021 the US bond market was estimated at $47 billion. For comparison, the capitalization of American companies is about 40 billion dollars. Therefore, it is worth paying attention to what is happening in the bond market. There is an index that is a bond "VIX". We are talking about the MOVE Index, which will be the main topic of today's article. Teasers are optional, handcrafted summaries of your posts that you can use in your theme. Learn more about creating teasers manually. Move upMove downToggle panel: Yoast SEO Premium SEO Community Readability Google News KeyphraseHelp in choosing the best keywordphrase(Opens in a new tab) move index Google preview Preview as: Mobile resultDesktop result URL preview:https://forexclub.pl › move-index-fear-index-for-the-bond-marketSeo title preview: MOVE Index - Fear index for the bond market. Why is it worth following? Meta Description Preview: The MOVE Index is basically the "bond" counterpart to the much more familiar VIX volatility index. What exactly does it tell us? Well... Edit page appearance in search results SEO analysisGood move index Add a similar keyword Key content Insights Advanced Move upMove downToggle panel: Additional post options Move upMove downToggle panel: Additional fields Menu info Exclude from menu? Exclude from comparison? Move upMove downSwitch panel: Shortcode Generator Shortcode Choose one... Move Up Move Down Toggle Panel: Layout Options Post Layout Sidebar Layout Disable Heat IndexDo not display the heat index at the top of this post. Disable View CountDo not display the view count at the top of this post. Disable Like CountDo not display the like button/count at the top of this post. Disable SharingDisable the +AddThis social sharing buttons Disable ComparisonDo not allow this post to be compared. Disable Featured ImageDo not display the featured image for this post. Display Featured ImageForce display featured image even if it is disabled site-wide. Custom Sidebar Choose one... Featured Video Background Color Select a color Override Site BackgroundDisplay this color instead of your main site background image Background Image Background PositionNot Set (use value from theme options) Left Center Right Background RepeatNot Set (use value from theme options) No Repeat Tile Tile Horizontally Tile Vertically Background AttachmentNot Set (use value from theme options) Scroll Fixed Subtitle Disable Contents MenuDo not display the contents menu for this post Disable Post NavigationDo not display post navigation for this post Disable Pop-out NavigationDo not display pop-out navigation at the bottom of the post Content Title Affiliate Code Primary Category Choose one... Unwrap PageDo not contain the page within a content panel "wrapper" Move UpMove DownToggle Panel: Review Options Post TypeArticle Review Positives Negatives Bottom Line Rating MetricStars Numbers Percentages Letter Grades Schema TypeEditor Rating (single) User Ratings (aggregate) Offer Size Choose one. .. Choose one platform reliability Choose one service quality... Number of Choose one promotions... Speed Choose one... Transparency Choose one... Number of possibilities Choose one... Choose one... Total Score Override Choose one... Move upMove downToggle panel: Send trackbacks Send trackbacks to: Separate consecutive URLs with spaces Trackbacks are a way to let older sites know that you're linking to them. Added links to WordPress-based sites will automatically notify those sites with pingbacks without the need to take any additional action. Move upMove downSwitch panel: Details Account types Min. deposit Regulations Instruments Leverage Type of spread Spread EUR/USD Min. volume Commission Polish bank account Deposit guarantee Platform WEB platform Mobile platform Additional services DEMO ACCOUNT REAL ACCOUNT Move upMove downSwitch panel: Discussion Allow comments Allow trackbacks and pingbacks on this page. Move Up Move Down Toggle Panel: Simplified Name Simplified Name Move Up Move Down Toggle Panel: Reset Values WARNING: PERMANENT DELETION These settings will cause permanent deletion and you will not be able to recover IP Addresses or total counts. For advanced use only. Delete LikesDelete all IP Addresses and reset like count to 0 Delete ViewsDelete all IP Addresses and reset view count to 0 Delete User RatingsDelete all user ratings for each criteria and total rating Delete User ReactionsDelete all user reactions for this post Move UpMove DownToggle panel: Google Remarketing Remarketing Code or Image URL Move UpMove DownToggle panel: Versions Paweł Mosionek, 4 seconds ago (Feb 13, 2023 at 09:51:09) Paweł Mosionek, 37 seconds ago (February 13, 2023 at 09:50:36) [saved automatically ] Paweł Mosionek, 56 minutes ago (February 13, 2023 at 08:55:18) Thank you for creating with WordPress.Update to 6.1.1 Close Featured Image Dialog Upload FilesMedia LibraryExpand Details Filter MediaFilter by Image Type Filter by Date All Dates Smush: All Images Search Media List ATTACHED FILE DETAILS move-index.jpg 2023-02-13 59 KB 700 to 450 pixels Edit image Delete to za all Alt text Please describe the purpose of the image(will open in a new tab). Please leave blank if it is purely decorative. Title move index Caption Description File URL: https://forexclub.pl/wp-content/uploads/2023/02/move-index.jpg Copy URL Smush File processing is in progress.](https://forexclub.pl/wp-content/uploads/2023/02/move-index-102x65.jpg?v=1676279100)