Will we see negative gas prices in the EU this fall?

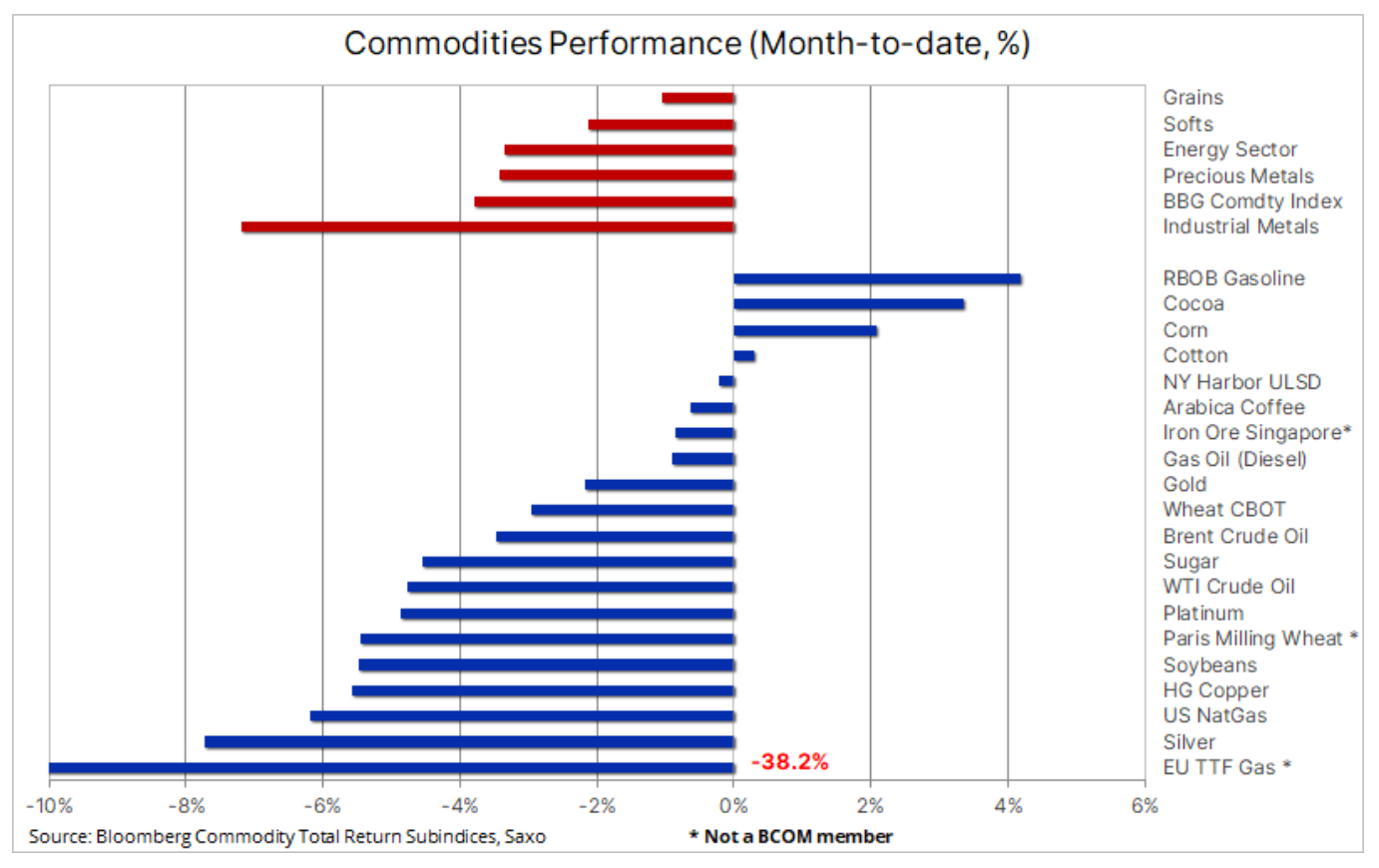

The commodity sector remains under pressure from rising recessionary risks, a stronger dollar, the deadlock over the US debt ceiling and doubts about the short-term direction of US interest rates, and mounting evidence that China's economic recovery is waning. In fact, the increasingly pessimistic outlook for China has seen industrial metals suffer the biggest losses this month - currently down around 7% - while the energy sector shows signs of stabilizing and refining margins have started to rise. Precious metals, most notably weakening silver, could see their first month-on-month decline in three months as the dollar and yields rise and the priced-in date for future US interest rate cuts has moved further into the future.

As a result of recent events, traders and investors have begun to ask themselves an important question: Is the commodity supercycle ending before it has even begun? As part of our weekly "Listeners' podcast", the Saxo Market Call team asked our listeners what price levels they expected for key commodities - such as gold, copper, oil and wheat – by the end of the year, and while 40% of respondents expect gold to reach a new all-time high, the second most cited answer (31%) was "None of the above: commodity prices are going down".

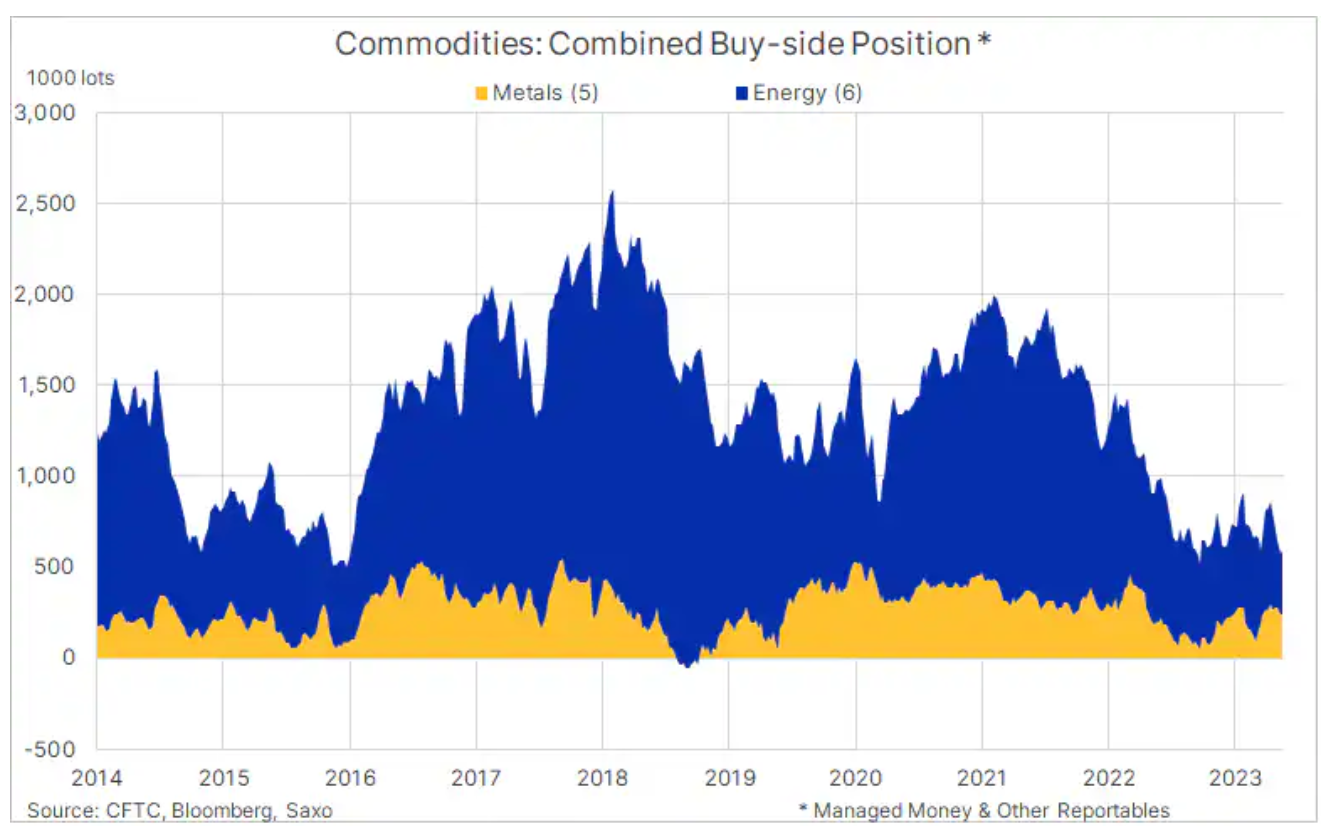

While we stand by our positive long-term outlook for commodities, it has become clear that we need answers to a number of key questions before a new upward momentum takes hold. According to a recent analysis by Goldman Sachs, the reason for the current weakness is the largest shedding of physical stocks and financial positions in many years as fears of a recession and higher interest rates make financing and holding both physical and financial positions a more expensive. However, if a recession does not ensue, the commodity market could see a strong rebound as commodity speculative investors will be forced back into long positions after a period of heavy net selling.

According to the weekly reports of the CFTC (US Commodity Futures Trading Commission) and ICE Exchange Europe (European Futures Exchange), the net long position held by hedge funds and other reportable entities in major metals and energy futures fell to more than a seven-year low, mainly due to the recent strong sell-off in crude oil, diesel and copper.

The reasons for our positive long-term outlook for commodities are as much related to limited supply as to strong demand. The main factors we focus on are as follows:

- Green transformation supporting the demand for industrial metals as part of the pursuit of "new" energy.

- Limited supply of key raw materials caused by rising prices of production factors, poorer grades of ore (mining), increasing regulatory costs and government interventions, climate change and lower investment appetite due to restrictions on ESG, investing and lending.

- Structural inflation of 3-4% driving demand for fixed assets.

- Dollar weakness

Overall, Bloomberg's Bloomberg Commodity Total Return index, which tracks the performance of the 24 most important commodity futures evenly spread across energy, metals and agricultural commodities, fell by around 4% m/m and 10% year-over-year. with silver, copper and crude oil suffering the biggest losses, while cocoa, gasoline, corn and cotton are the only contracts showing a positive return. At the same time, the price of natural gas in the EU has fallen by more than 36% this month and is now around €24/MWh ($7,6/MMBtu), which is very far from the level of almost €90/MWh ($28/MMBtu) seen in the same period last year, when the gas crisis escalated as a result of reducing supplies by Russia.

Negative EU gas prices this fall?

After an extreme price above €350/MWh ($110/MMBtu) in August last year, the European market is focusing on the risk of short periods of overnight negative gas prices this fall if too slow demand growth continues to push prices down sharply while quickly filling warehouses. For countries with limited storage capacity, such as the UK, the possibility of a short-term drop in natural gas prices below zero is greater. Overall stock levels in Europe are now close to 67% and if the current slow growth in demand and the fast pace of gas transport via pipelines and LNG deliveries continue, storage facilities could be full as early as September or October. Depending on how quickly winter demand picks up, in certain extreme circumstances, prices may even drop below EUR 10/MWh.

Copper prices fell sharply

The price of copper the LME dropped below $8 a tonne for the first time since November before rebounding after finding support above $000. New York HG Copper futures traded to support at $7 a pound before attracting new buyers in response to better-than-expected data from the US. The price was down about 800% from its mid-January high of $3,54 as investors were busy positioning themselves for the expected strong demand from China as the economy reopens there.

Industrial metals, including iron ore, remain under pressure after a series of disappointing economic data from China, the world's largest consumer of these metals. In addition, the US debt ceiling impasse, fears of a recession and the recent strengthening of the dollar have been the main factors driving prices down in a month when demand for industrial metals is usually weaker.

All of these developments have distracted from the overall structural long-term support history, which is the result of the growing demand for metals essential to the green transition and the increasing costs faced by mining companies due to rising input prices due to higher diesel and labor costs, inferior grades of ore, rising regulatory costs and government intervention, and climate change disrupting production from floods to droughts.

High Grade Copper (HG) has returned to its November low, but so far support remains at $3,54 above $3,50, the 50% retracement from the 2020-2022 rally line. Hedge funds have continued to sell for the past five weeks; during this time, the net position changed from a long of 20 to lots, into potentially the largest net short position since the pandemic crisis in March 2020. At this point, a breakout back above the $3,80-$3,82 resistance area is the minimum requirement to sustain the recent swing in sentiment.

These concerns were discussed at Melbourne's 121 Mining Investment Forum as fears grow that the world will not be able to produce enough copper, lithium, aluminum and other metals for global electrification. Reporting on the event, Reuters reported that most of the speakers highlighted the same problem: we do not have enough production to meet the expected demand, we do not develop enough projects, and in the case of discovering new mineral deposits, overcoming regulatory and financial barriers to their exploitation is a long-term process .

Overall, given the many uncertainties surrounding recession risk, the direction of US short-term interest rates, the strength of the dollar, and developments in China, our expectations of higher industrial metals prices are unlikely to materialize until we have an answer to the some of the above questions, which may not be until late this year or early next year.

Gold in trouble in the short term

Gold headed for its biggest weekly decline in nearly four months after recently weakening below $1 amid reports that the US economy remains resilient, while inflation shows signs of remaining too high for the FOMC to ignore - thus increasing the risk of further rate hikes and thus delaying the timing of the peak in rates that would be favorable for gold. An upward revision of US GDP in the first quarter, lower than expected unemployment figures along with rising inflation and consumer spending have led investors to increasingly bet on a rate hike in July, while the odds of rate cuts this year continue to fade. Support is currently at $950; a break above $1 will be needed to improve sentiment.

Oil prices within the range ahead of the June OPEC+ meeting

Oil prices they do not break out of the range, and given the latest broadly negative price news, this may indicate that the sell-off that has been going on for a month is over and the focus is on consolidation and subsequent rebound.

The negative news mentioned above was mainly related to the recent strengthening of the dollar, as the debate on possible further interest rate hikes attracts more and more investors' attention. The problem with the US debt, the risk of recession and a weaker-than-expected recovery in China were also of some importance. However, given that traders have already achieved their lowest exposure to the top five oil and oil futures contracts in more than a decade, it could be argued that these potential headwinds are now almost fully factored into valuations. In addition, refining margins, led by gasoline, are starting to recover after April's decline, which bodes well for oil demand in the future.

In the week ending May 16, the combined gross short position in WTI and Brent crude held by cash managers and other reportable entities hit a nearly two-year high of 233 million barrels - an increase of 111 million barrels over the last five weeks and 40 million barrels more than the gross short position before the April 2 production cut. The return of short selling has once again made the market vulnerable to upside movements in the event of unexpected developments in incoming news - such as the response of Saudi Energy Minister Prince Abdulaziz bin Salman, who, when asked about the involvement of traders trading commodity-based financial instruments, once again stressed that they should "be careful".

These comments underscore the growing concern over the weakness seen over the past month, which was in part due to the aforementioned return to short selling. The Saudi minister's comments propelled prices up, followed by an abrupt turnaround when Russian Deputy Prime Minister Nowak said at the June OPEC+ meeting he was likely to maintain current production targets. Essentially, crude oil prices are likely to stay within the range, and possible sharp declines are unlikely to go unnoticed by OPEC; in turn, growth potential can only be achieved when the economic outlook becomes clearer. In the case of Brent crude oil, the important level to break before we can speak of a change in direction is $80.

Corn futures rallied amid drought in the US

Chicago-listed corn futures are on track for their biggest weekly gain in nearly a year as a drought threatens new crops in the US, the world's largest corn producer. Cool and dry weather conditions favor corn and soybean planting on the remaining acreage, but the lack of moisture in the topsoil is becoming more and more evident. The price of the July closest-to-date contract surged 7,3% to $5,95/bushel last week as hedge funds, which often focus on the front and most liquid part of the futures curve, provided additional momentum by covering short positions . As a result, the December contract for spring crops harvested in autumn went up "only" 5% last week.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)