Putin's threats were more than neutralized by Powell's anti-inflation efforts

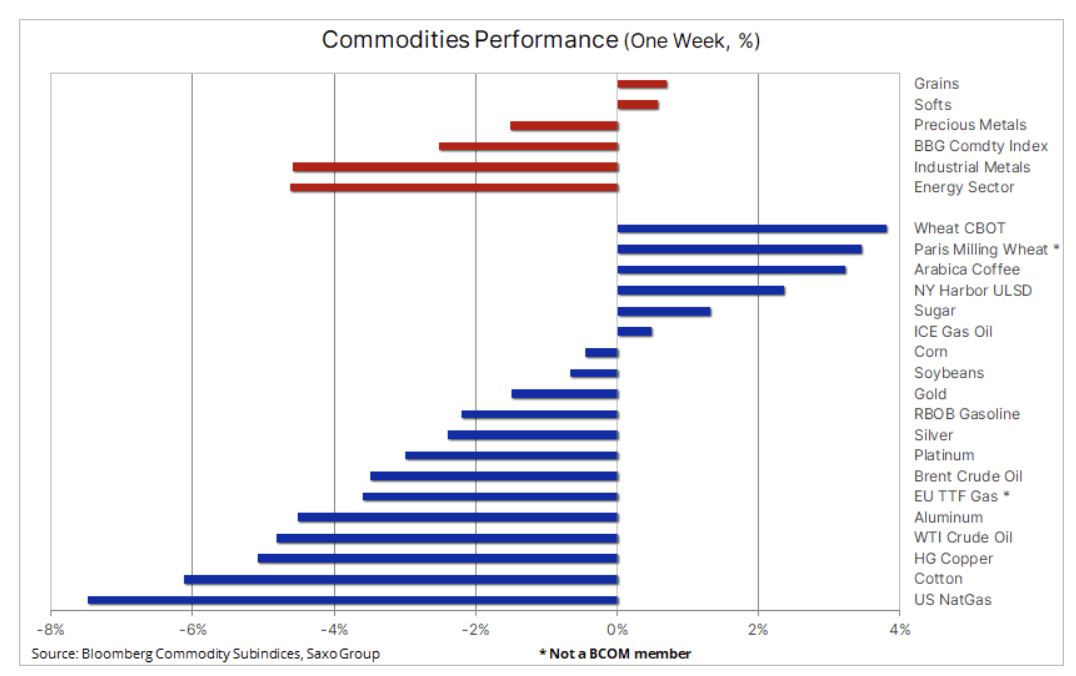

In the week with major decisions in Washington and Moscow, commodities underperformed overall. Powell's announcement that he was going to fight galloping inflation at the expense of economic growth and jobs triggered a market turmoil, followed by an increase in bond yields and a strengthening of the dollar, which led to declines in most asset classes. Putin's increasingly desperate efforts to make up for losses in Ukraine helped support a number of raw materials, including wheat, diesel and, initially, gold.

At the last meeting FOMC the US Federal Reserve managed to surprise the market with an aggressive approach after the expected 75bp rate hike was supplemented by the removal of expectations of a rate cut in 2023. These changes occurred despite a significant reduction in the GDP forecast for this and next year as well as a sharp increase in the forecast unemployment rate, which is a signal that Fed is willing to continue rate hikes even in the event of a downturn in the economy, in order to contain inflation.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

These developments contributed to a sharp rise in the dollar and US government bond yields, and as other major central banks also raised interest rates, fears of a recession prevailed and led to a sharp decline in the prices of commodities dependent on economic growth, such as cotton or copper. However, at the same time, other commodities, such as gold, wheat, and diesel, managed to find some support after Putin escalated his weakening invasion of Ukraine, thereby ensuring gold status of a safe haven while increasing the risk of supplying critical assets. raw materials such as wheat, crude oil and fuel products.

The Bloomberg commodity index declined by 2,5% on a weekly basis, which was driven by the tightening of monetary policy, which had a negative impact on economic growth forecasts, the weakening of the Chinese economy and the energy crisis in Europe, which resulted in the purchasing managers index (PMI) including region dropped to the lowest level since 2013. The biggest losses were recorded natural gas, Cotton, crude oil and industrial metals.

Due to numerous uncertainties, the environment for most commodities will remain highly volatile until the end of this year. While the signs of an impending recession are becoming more and more evident, the sector is unlikely to suffer serious damage before accelerating again in 2023. Recent FOMC actions have brought the market a step closer to the hawkish peak that could be reached in the last quarter of 2022. and when it does, the associated pounding of the dollar and government bond yields could alleviate some of the current difficulties.

Our forecast of stable and even potentially higher commodity prices, primarily with respect to the current high price niches in all three sectors: energy, metals and agricultural products, is based on sanctions, production cost inflation, unfavorable weather conditions and low investment appetite; with this in mind, we expect the Bloomberg commodity index, which monitors a basket of 24 key commodities, to keep most of its year-on-day gains at around 15% for the remainder of the year.

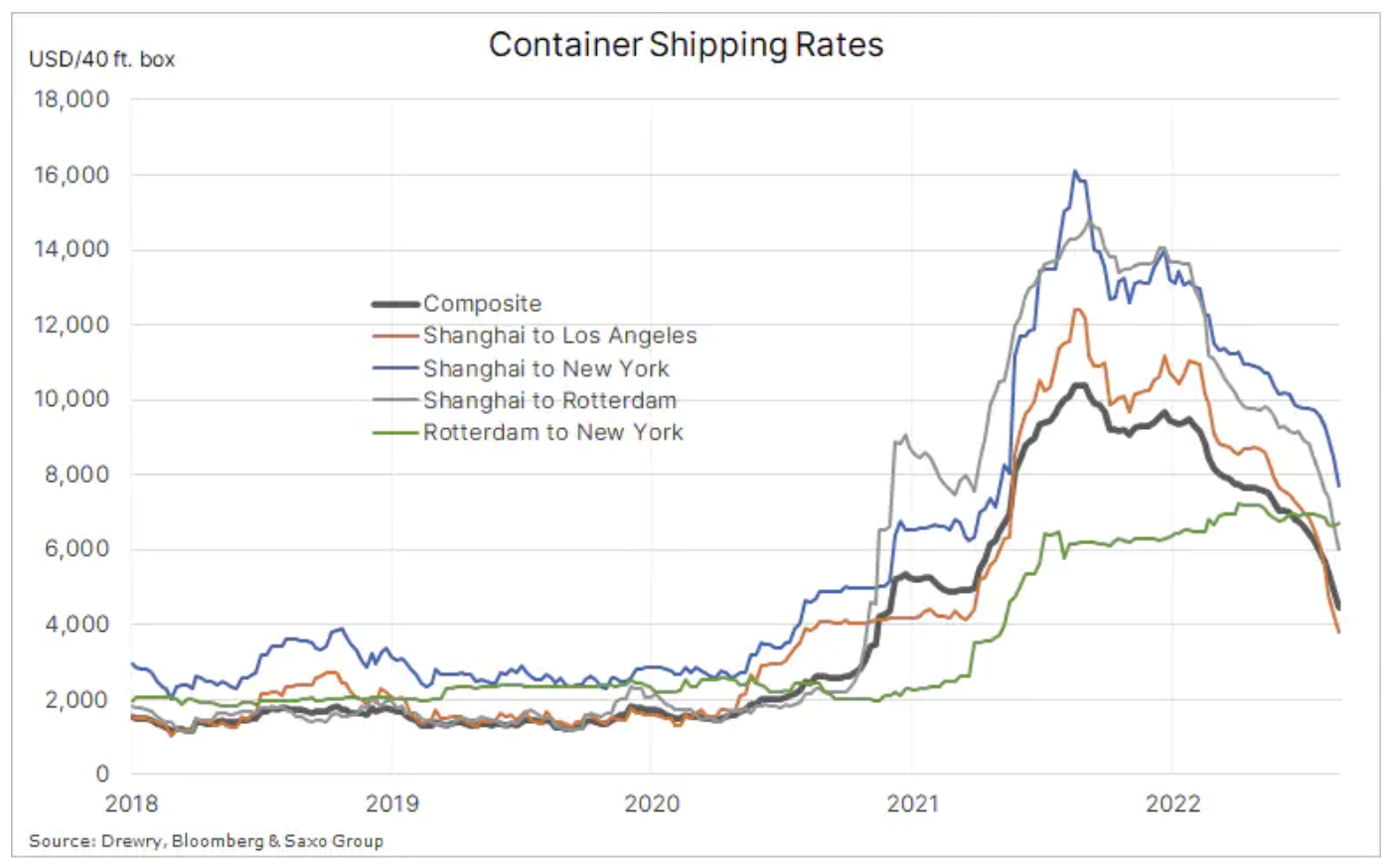

Global rates for container shipping are falling

The deterioration of the global economic outlook is reflected in the steady decline in the cost of transporting 10-foot containers worldwide, in particular on major trade routes from China to Europe, as well as to the east and west coasts of the United States. Drewry's global benchmark composite container freight rate fell 4% last week to $ 472 for a 2020-foot container, the lowest since December 57. It is also a 21% decline from the September XNUMX peak, but still price is three times the pre-pandemic average, suggesting a further decline as the world economy continues to slow down. As we mentioned, traffic on all major trade routes from China to the United States and the European Union has declined, while the transatlantic route to New York remains the same, potentially due to a depreciation of the euro supporting overseas exports.

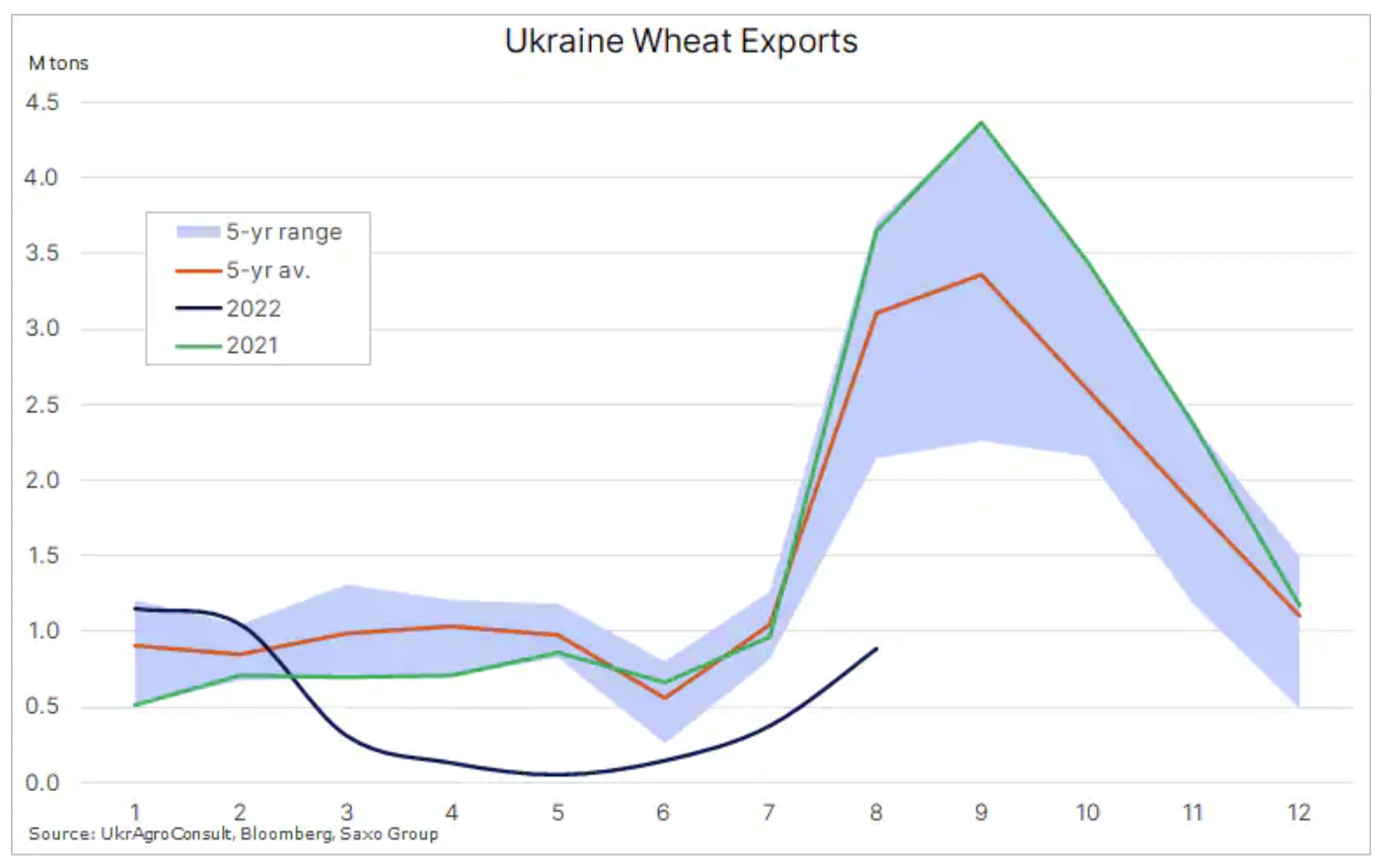

Wheat with the highest growth since March amid concerns over Ukraine and weather

Wheat futures traded on the Chicago and Paris exchanges - the two best performing commodity markets last week - peaked at a two-month high due to the risk of an escalation of the conflict in Ukraine threatening the UN-backed export corridor and due to drought in the regions crops in Argentina and the American Great Plains. This was despite the optimistic update of production data by the International Grains Council, which revised its forecast for world production for the 2022/2023 season by 8 million tonnes, mainly thanks to an increase in production in Russia, Canada and Australia, which means an increase in inventories at the end of the period by 10 million tons.

However, reducing Ukraine's already weak exports of high-quality wheat could bolster prices in the winter months, especially given the risk of a triple La Ninã phenomenon causing concerns over production in the upcoming southern hemisphere's growing season. In August, exports from Ukraine totaled 883 tonnes, approximately 000 million tonnes below last year's level. This deficit may increase in September - usually the busiest month for Ukrainian exports (2,7 million tonnes last year). However, keeping the route open would cause exports to gain support in the period that usually follows the peak season of activity.

Gold is succumbing to dollar strength and profitability

For most of the week, gold struggled to find a geopolitical deal that would protect it from the negative effects of the surge in US Treasury yields and the dollar. Eventually, however, the market sagged under the weight of worsening market sentiment, driven by the rise in US 32-year government bond yields by 3,75 basis points to a 2-year high of 1997% and a rise in the Bloomberg dollar index by XNUMX% to a record high (the highest since XNUMX). .).

Gold and other metals virtually-investment, such as silver or platinum, will likely continue to be under pressure until the market reaches its hawkish peak, perhaps no sooner than after ten-year yields hit 4% and the dollar clears all remaining shorts. Whether the turning point will be reached by the end of the year remains to be seen. Continuing the increases interest rates while raising expectations of slower economic growth and rising unemployment, the FOMC signals that the recession is a price worth paying to contain inflation. We have long held the view that the market, like the FOMC, may be overly optimistic to believe that inflation will return to below 3%, which is now priced in in the swap market.

Resistance has moved to $ 1, while a fall below $ 690 on Friday could see the market targeting a 1% retraction from the 654-50 rally line at $ 2018.

Copper and crude oil decline in response to concerns about economic growth

Raw materials dependent on growth and demand - from copper i aluminum material po oil - have gone down following the macroeconomic developments mentioned above, with supply support issues, in particular for oil, being sidelined for the time being. Some signs of weakness, however, were seen in the case of copper, the stocks of which monitored by the London Metal Exchange rose sharply for five consecutive days, while the spot market showed signs of a slight slack in supply. HG copper futures traded on the New York Stock Exchange fell 4% on Friday to $ 3,33 a pound, potentially meaning the metal will make another attempt to break key support around $ 3,14 a pound, the July low and 61,8% retracements from the 2020-2022 rally line.

Crude oil dropped after spending most of the week in a relatively narrow range; Powell versus Putin (demand versus supply) did not emerge as a clear winner until Friday, when both Brent and WTI oil fell as the FOMC reduced risk appetite and fears over economic growth while the dollar and yields continued to rise. We are facing a difficult and potentially volatile quarter with many conflicting uncertainties affecting the direction of prices. While the risks to growth are priced in, the market has left for another day concerns about the supply-reducing impact of the EU's oil and fuel embargo, as well as a partial reversal of the US selling 180 million barrels from its strategic reserves.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)