Growth niches are emerging in the commodities market and problems are receding

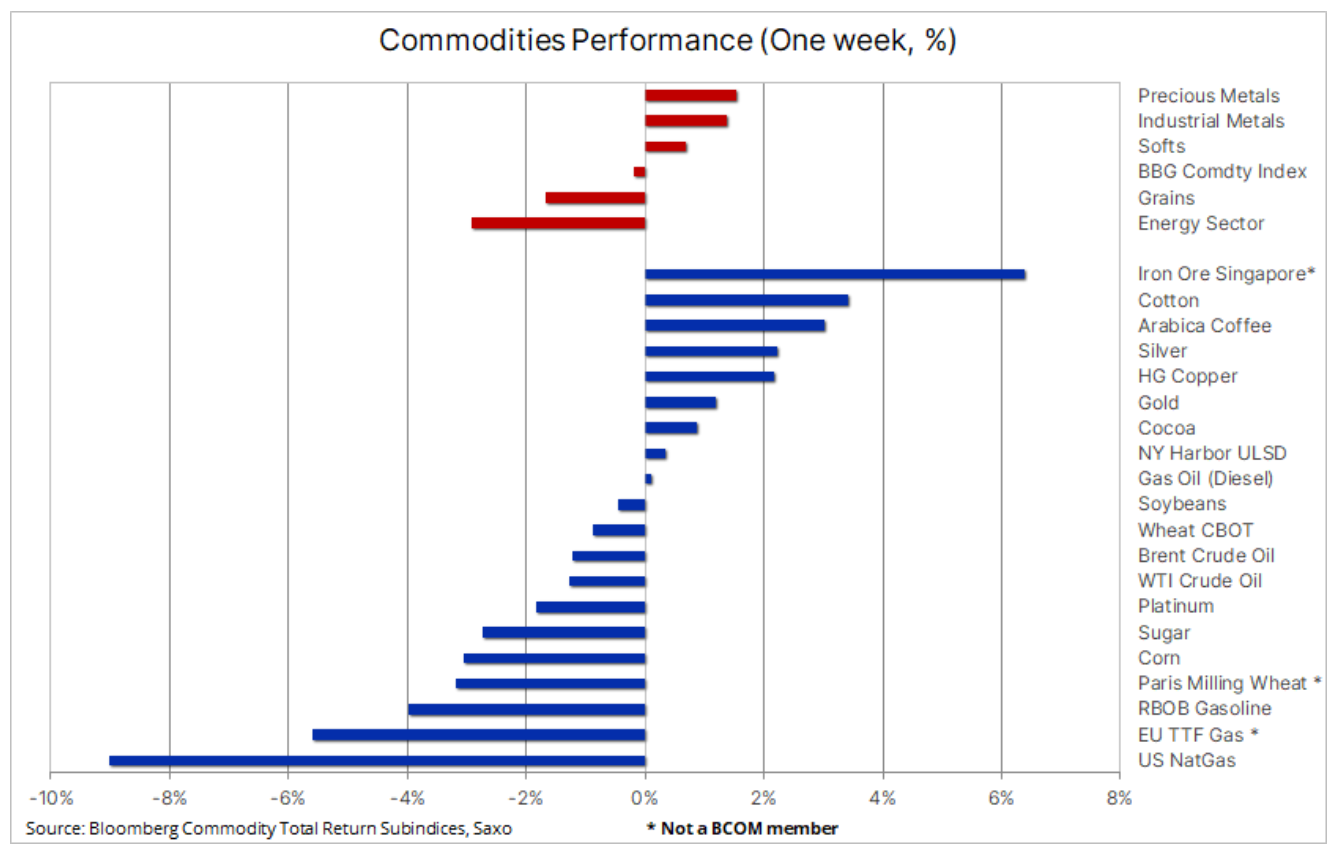

After a turbulent May, in which all sectors - most notably industrial metals and energy - took a hit amid recession fears, a stronger dollar, the US debt ceiling deadlock and doubts about the short-term direction of US interest rates, as well as mounting evidence of weakening China's economic recovery, growth niches began to emerge in the commodity sector in the first week of June.

Meanwhile, June began with an overall improvement in risk appetite after the US Senate finally passed the debt cap bill, leading to the dollar's first weakening in four weeks. The deal should mean that the debt ceiling issue should not be an issue until at least early 2025, but some observers suggest that the new fiscal constraints in the bill could lower projected US GDP growth by 0,2% over the coming year, potentially reducing risk of further aggressive interest rate hikes.

Bloomberg's Index of Overall Commodity Markets Returns was almost unchanged over the week after a 5,6% drop in May, with gains in precious and industrial metals offsetting losses in the energy sector, most notably a nearly 9% drop in natural gas prices. Metal prices surged after all metals - from gold to copper - managed to rebound from key support levels, and the aforementioned depreciation of the dollar contributed to the improvement of sentiment.

Copper headed for its first weekly gain in seven weeks, initially finding buyers despite the continued deterioration in China's economic data, and then with added impetus from reports that the Chinese government was developing new measures to support the real estate market. As a result, the renminbi hit a weekly high, and given its current strengthened correlation with copper, this contributed to a further improvement in sentiment. At the same time, gold attracted new buyers after finding support ahead of $1, with subsequent strengthening supported by lower US Treasury yields and a weaker dollar after the US debt ceiling was reached, and as market valuations once again included a higher the likelihood of interest rate cuts before the end of the year.

Diversified situation on the market of agricultural products

In the agricultural products sector, the situation was mixed: cereals managed to attract buyers after reaching new cycle lows due to the previous predictions of strong supply in the northern hemisphere in the upcoming production season. Those predictions could be called into question if the drought seen last month in parts of Europe and the US continues into June. All eyes are on Russia, which so far is forecasting another bountiful harvest of wheat this season. Reports of dry soil conditions and renewed concerns about exports from Ukraine as fighting escalated contributed to a rebound in wheat prices. Earlier in the week, the price of this grain hit its lowest level in more than two years and briefly fell below the price of corn for the first time in a decade.

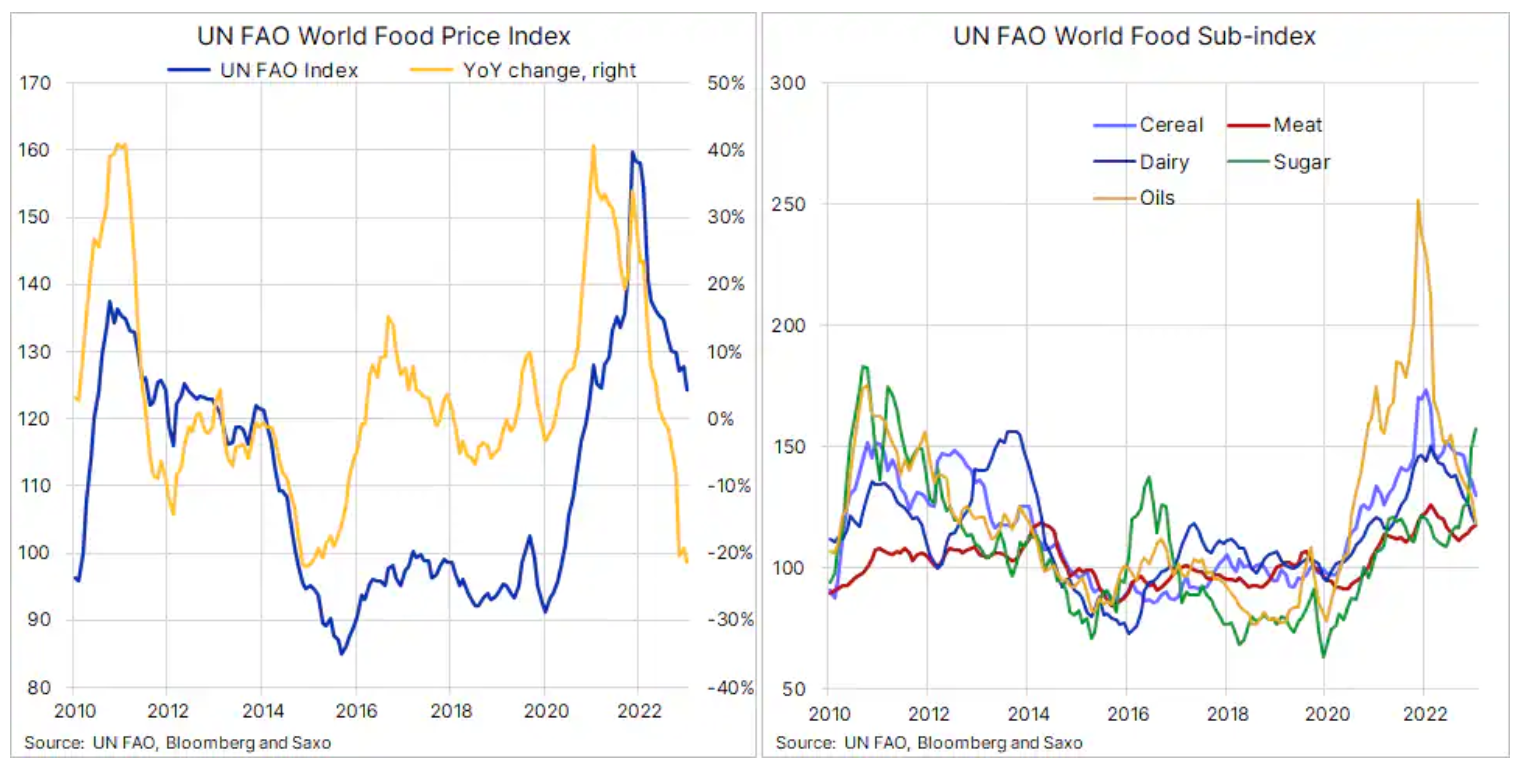

At the same time, the Food and Agriculture Organization of the United Nations (FAO) published its monthly food price index in May. The index, which monitors the prices of 95 foodstuffs across five major sectors, averaged 124,3 points, a two-year low and down 2,6% from April and 22,1% from its record high in April. March 2022. The decrease in May was caused by a significant decrease in the prices of vegetable oils (-8,7%), cereals (-4,8%) and dairy products (-3,2%), and was only partly offset by the increase in sugar prices (+5,5 .1%) and meat (XNUMX%).

Uranium producer stocks are moving up thanks to the US Nuclear Act

On Thursday, shares of uranium producers around the world surged after the U.S. Senate Committee on Environment and Public Works submitted a bill that would speed up the commissioning of a new fleet of advanced nuclear reactors. The act provides for a review of the procedures for granting licenses for nuclear power plants by the US Nuclear Regulatory Commission (NRC) and checking whether the guidelines could be modified in order to quickly approve the construction of advanced nuclear reactors.

In particular, the bill provides for an accelerated licensing of next-generation reactors at former industrial or commercial sites, and requires the NRC to coordinate efforts by the United States and other countries seeking to develop nuclear power, and to assist in training foreign nuclear safety regulators . The Global X Uranium ETF is up 10% since Tuesday, while Canada's Cameco Corp, one of the world's largest producers and processors of uranium, is up 12,4% to a XNUMX-year high. More inspiration about large companies operating in this area can be found in Saxo's Nuclear Thematic Basket.

OPEC+ is trying to regain control of prices

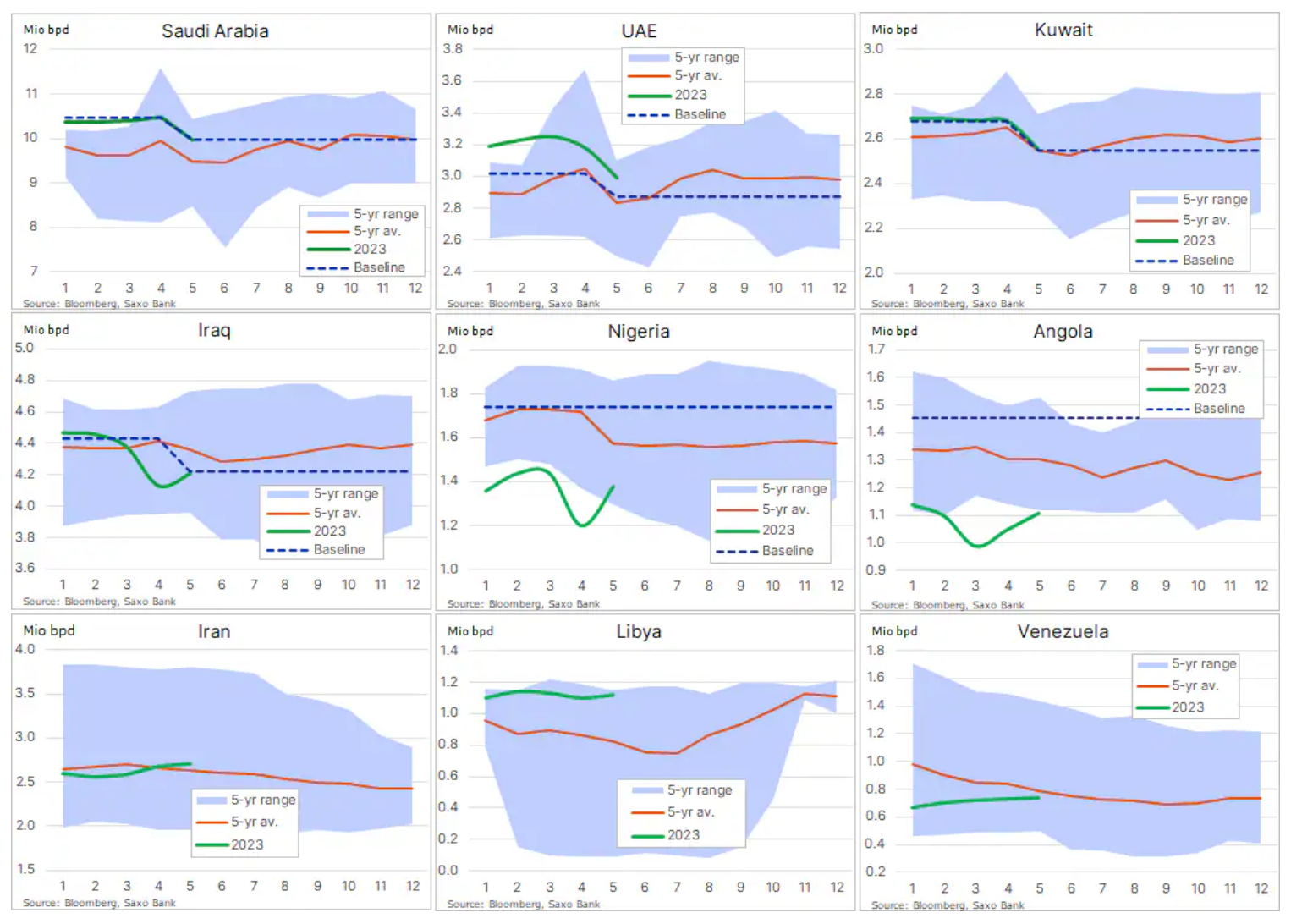

Oil prices they stay around the minimum of the cycle; Brent crude oil has been oscillating around USD 75 per barrel for a month. Concerns about global growth and demand forecasts continue to be a major factor, not only in China - the world's largest oil importer - but also in the US and other key oil consumption regions. These concerns sparked a wave of oil sales from macro-focused funds looking to hedge against such a slowdown.

The market unexpectedly found itself again on a collision course with some of the largest producers - led by Saudi Arabia - who have not yet seen any price-beneficial impact of the production cut on April 2. Ahead of the OPEC+ meeting scheduled for June 4, the temperature was steadily rising, and the Saudi energy minister was very negative about speculative investors.

In addition, as we highlighted in a recently published analysis, “buy side” exposures in the five major oil and fuel futures fell to their lowest level in more than a decade. And despite an increase of 12% to 384 thousand. contracts in the last reporting week ending May 23, as a result of the increase in the net long position in Brent crude oil and the overlapping of short positions in diesel oil, the total position remains 43% lower than in the same period last year. This situation can unexpectedly provide additional support by building long positions as soon as the technical and/or fundamental forecast becomes more price-friendly.

OPEC oil production fell by an average of 500 barrels a day last month, according to a Bloomberg study. As expected, all the largest producers in the Middle East who reached the agreed quotas reduced production, as announced in early April, but the effects of this decision offset the increases in production for producers who did not meet or were not covered by their quotas. Overall, total production was reduced to 000 million barrels per day, a 28,26-month low.

Brent crude oil is currently trading in a range above $70; for this situation to change, and at the same time there is a signal of establishing a minimum in the market, it is necessary to try to break out and break above the psychological level of USD 80.

Gold rises as May's troubles recede

Gold it re-attacked the resistance level above $1, and another solid US jobs report contributed to some profit-taking ahead of the weekend. Still, the yellow metal was on track to record its best week since April. The US Senate's adoption of the Debt Cap Act cleared the black cloud that hung over the market for much of May, given the impact of debt on the dollar and yields that surged in May, complicating the market and forcing speculative investors to cut back on their growth game prices in the futures market. The bill could result in a slight decline in economic growth in the United States, and coupled with economic data released on Thursday showing some progress in controlling inflation, it has revived expectations for an interest rate cut before the end of the year. Key support has been confirmed around $980 while resistance remains at $1, a 950-day moving average below $1.

A weaker dollar and a support package for the Chinese real estate sector push up copper prices

Copper prices in New York and London headed for the first weekly gain in seven weeks, with the rally being an extension of the previous week's technical developments pointing to a re-emergence of support. Despite another set of disappointing economic data from China, the market took comfort in the fact that prices managed to bounce back. This rebound accelerated later in the week after reaching an agreement on the US debt ceiling, as well as news that the Chinese government is developing a new package of measures to support the real estate market, a key source of demand for copper in the world's largest copper consumer metal. The yuan strengthened the most in two months, and given its current correlation with copper (see chart below), this provided additional support.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)