Problems with the weather and the energy crisis are pushing up the prices of raw materials

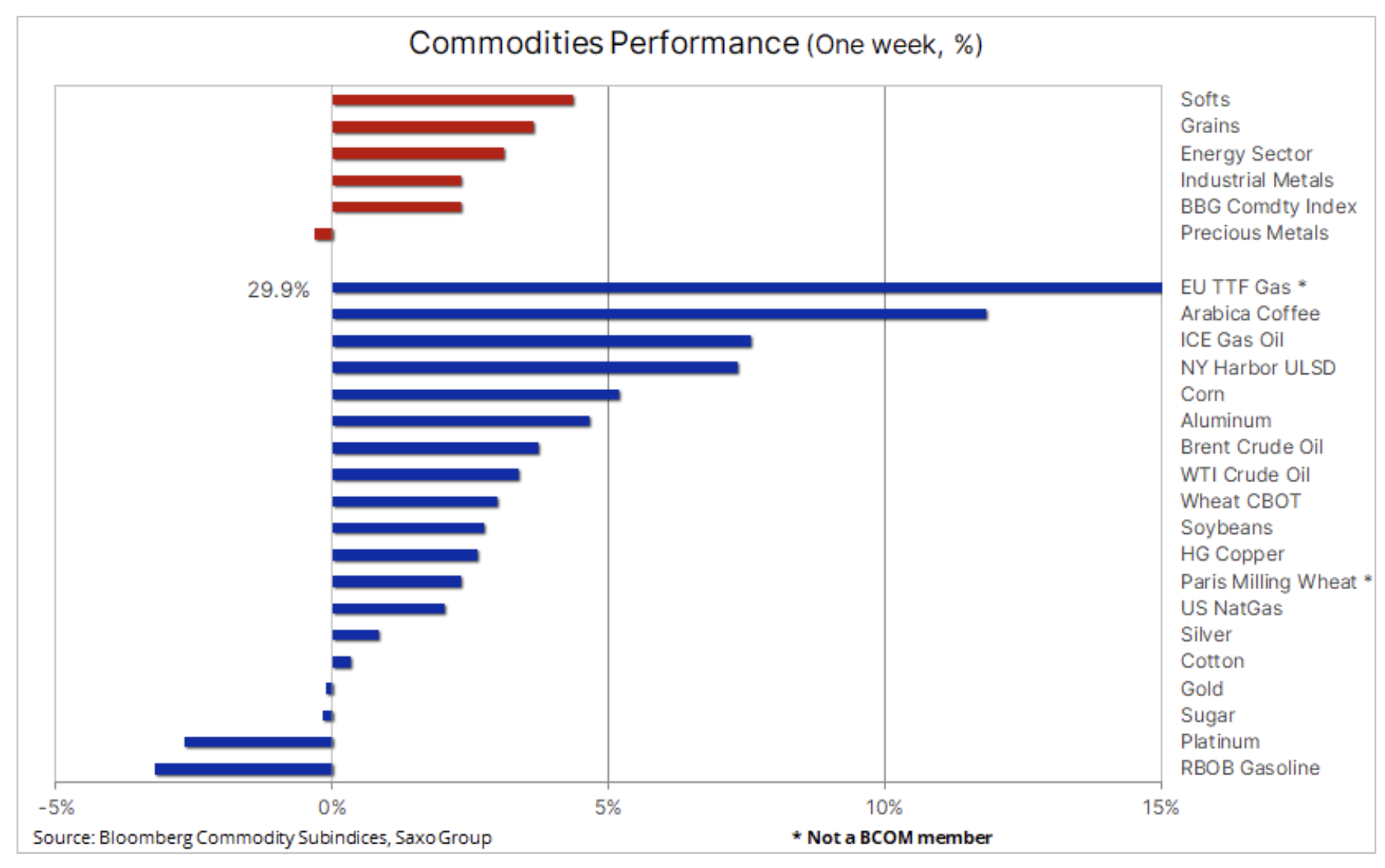

The commodities sector continues to gain, and the Bloomberg commodity index recovered more than half of its losses from the June / July correction by 20%. This confirms our long-held view that commodity markets are able to cope with the economic downturn, which also negatively affects the supply of key raw materials. Most sectors reported profits last week - most notably the agricultural and energy sectors, with the latter having an increase in diesel demand as gas prices continued to rise almost vertically.

Article prepared prior to Friday's speech by Federal Reserve Chairman Jerome Powell in Jackson Hole

Most sectors reported profits - most notably the agricultural sector, as weather problems pushed up the cost of coffee and the three main crops, maize in particular. Industrial metals gained an impetus in the form of China's continued efforts to support the weakening economy, including announcements of further broadly understood economic stimulation policy, as a result of which billions will be allocated to infrastructure projects. The energy sector has been backed by rising gas prices that boosted demand for diesel, and Saudi Arabia has signaled the risk that OPEC + it may reduce production to stabilize markets with high volatility.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In financial markets, the dollar hit a new twenty-year high against the euro as the energy crisis in Europe continues to put pressure on the economic outlook for the region. US stocks slumped sharply and bond yields climbed ahead of Friday's eagerly awaited CEO speech Federal Reserve Jerome Powell. It was expected that the president would emphasize once again efforts to lower inflation through further interest rate hikes. Actions to fight inflation, such as raising interest rates and removing incentives in a post-pandemic downturn, have been the main driver of the recent commodity price correction.

Overall, however, this confirms our long-held view that commodity markets are able to cope with the economic downturn, which also negatively affects the supply of key raw materials. In the longer term, raw materials will be supported by underinvestment, urbanization, green transformation and deglobalization. In the short term, prices will most likely be supported by the unfolding energy crisis in Europe, supply disruptions in the wake of sanctions on Russia, unfavorable weather conditions triggering new concerns for food supplies, and China's actions to support the economy.

Sellers in the oil market are starting to have doubts

While the macroeconomic outlook remains a challenge due to lower forecast economic growth and the recent dollar appreciation, the markets oil and its products, however, managed to rebound sharply last week. The energy crisis in Europe has continued to worsen and gas and electricity prices have jumped to levels of $ 530 per barrel oil equivalent of $ 1 and $ 400 per barrel respectively. This latest increase was due to the recent low-water disruptions in the Rhine and the announcement of Gazprom's three-day shutdown for Nord Stream 1 for maintenance, which will begin on August 31.

If Gazprom (President Putin) decides to continue to use supplies as a weapon of war and the pipeline will remain closed after the completion of maintenance, there is a risk of further price spikes and thus widening the already large difference between gas and oil prices. Such a development of the situation will additionally support the already visible increase in demand for fuel products, in particular diesel oil, and later this autumn - also for heating oil, at the expense of gas demand. The switch from gas to fuel contributed to the recent recovery - last week the US shipped a record volume of diesel to energy-hungry customers looking for alternatives to supplies from Russia.

However, the factor that ultimately pushed oil prices up last week was comments from the Saudi Energy Minister and other OPEC members. These comments pointed to possible output cuts in the wake of the recent growing mismatch between the downward bound futures markets and the physical market, which has shown no signs of weakening so far. We have also noticed this discrepancy in recent weeks, when crude oil futures were traded as a hedge against the economic downturn, while little attention was paid to the physical market and its current price-beneficial foundations for supply and demand.

After finding support after a 61,8% retracement from the 111% rise line from December to March, the Brent crude oil futures contract has returned to $ 100 per barrel and trendline resistance - currently at $ 102,25 - prevents further strengthening. A further recovery at this point could force cash managers to re-evaluate their exposure to Brent and WTI crude oil, with a potential for a so-called 'backlog'. squeezing short positions (short squeeze). In the three weeks to August 16, speculative investors reduced their net long position to 278. flights, which is the lowest result since April 2020.

Rising grain prices and a strong dollar are once again sparking up food supply concerns

American maize hit its two-month high, which, combined with more moderate gains from the remaining major grain futures quoted on the U.S. exchanges food. However, with unfavorable weather conditions that continue to negatively affect production and the fact that Ukrainian exports are still significantly lower than in previous years, these fears have started to resurface - particularly considering the recent dollar appreciation which has only worsened the situation of buyers of cereals paying with local currency.

The recent rise in the price of US maize has been fueled by concerns that the hot and dry weather conditions in the Midwest during the end of the growing season could reduce production. The United States is the largest producer and exporter of maize, which is used in everything from animal feed to biofuels and sweeteners, and the poor harvest in the United States is likely to fuel recent concerns about food security caused by war, drought and the overall impact of climate change.

Apart from the above-mentioned aspects and the aforementioned slow pace of supplies from Ukraine, there is currently a drought in China that threatens the local harvest, which may lead to an increase in imports. Droughts in the European Union this summer continue to negatively affect production forecasts.

Coffee prices are rising due to supply concerns in Brazil and Vietnam

Both the futures contract on arabica coffeeas well as for robusta coffee, increased significantly due to signals of a worsening supply forecast. Stocks in Vietnam, the world's largest supplier of Robusta, are projected to halve by the end of September compared to last year, while Arabica stocks monitored by ICE fell to their lowest level in 23 years. Abnormal weather conditions in South America over the past year have worsened production forecasts in Brazil, Colombia and Central America sharply, and the recent drought and steady rise in fertilizer costs are already raising concerns about next year's harvest. The Arabica futures contract came to a halt after a June high of $ 2,42 a pound, but the risk remains that it may be pushing for its eleven-year high of $ 2,605 in February.

Industrial metals find support in China

Industrial metals, most notably steel, aluminum and zinc, have responded positively to news that the Chinese government is stepping up efforts to support an economy devastated by the successive Covid lockdowns and the real estate crash. China's Council of State announced an incentive package worth 1 trillion yuan ($ 146 billion), of which 300 billion has been allocated to infrastructure projects, doubling the amount the government has allocated to a project that will increase demand for industrial metals.

After remaining in the range of $ 3,55-3,73, on Friday copper HG has risen and may now target $ 3,85 / lb, however this will most likely require a rally above $ 4 / lb before speculative traders, who are dominant in short positions in this metal since April, begin to return to net long positions . China remains the focus of attention and whether these stimuli prove to be strong enough to provide sufficient support for the continuation of the upward move.

The price of gold remains stable despite the recent rise in the dollar and yields

Gold managed to rebound slightly, but broadly continued its recent struggle of strengthening the dollar and rising bond yields. In particular ahead of Friday's Fed chairman Powell's speech in Jackson Hole, gold traders fear that the aggressive stance will provide additional support to both the dollar and yields and thus further delay the recovery of gold, potentially sending it below 1 support. USD.

In a year of spike in inflation, some investors may feel hurt by gold's negative year-over-day performance in dollar terms, but given that the metal had to deal with the biggest jump in real yields in more than 25 years and a dollar strengthening by 10% against a broad basket of major currencies, the performance is acceptable, particularly for non-dollar traders.

We maintain the view that the market is overly optimistic, assuming that central banks can effectively bring inflation down to currently projected levels. Such a scenario would create a problematic outlook for interest rate- and growth-sensitive equities, thereby increasing the need for tangible assets such as gold and broadly understood commodities to survive a period of low growth and high inflation.

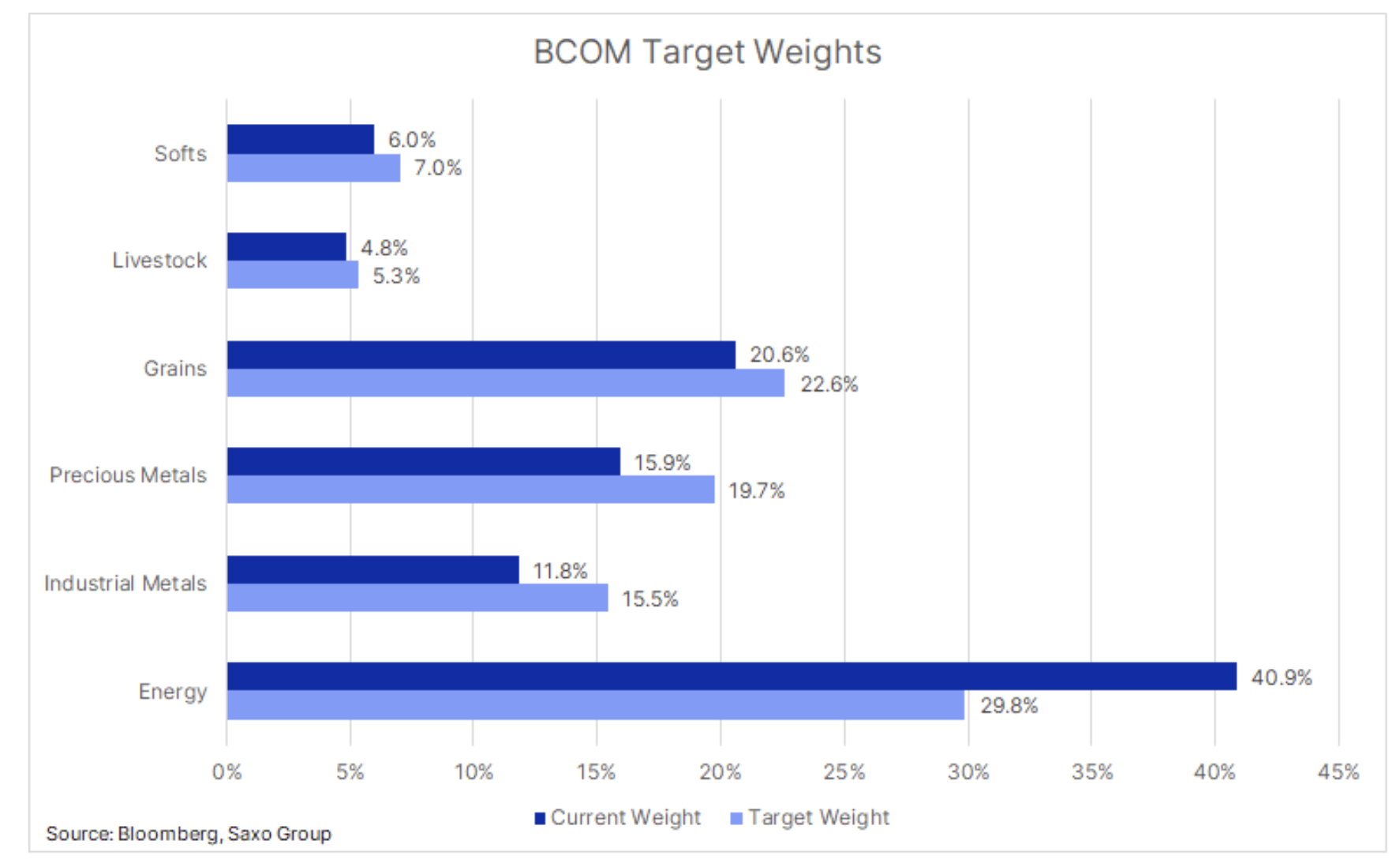

Natural gas - currently the main component of the Bloomberg Commodity Index

BCOM index, along with the S&P GSCI and DBIQ Optimum Yield Diversified Commodity indices, is a heavyweight indicator in the global investment industry in relation to commodities. It monitors the performance of 23 major commodity futures, seeking to gain one-third of exposure to each of the major sectors: energy, metals and agricultural products. Target weights are set once a year in January, and should prices change significantly throughout the year, the weighting will not change until January of the following year.

However, the surprising increase in the price of natural gas futures in the United States by 160% year-on-day more than doubled the weight of natural gas - from 8% to 17,2% - and made it a major component for the first time in history. BCOM index, more than double the combined share of WTI and Brent oil contracts. From a sector perspective, this increased overall energy exposure by 9,2% to 40,9%. All other sectors and sub-sectors saw reductions, with industrial and precious metals being the largest - by 7,5% in total. The deviation from the target weights will not be corrected until January next year. At this point, we can see more activity as the balancing process will sell gaining raw materials, especially natural gas, while the biggest losers will be bought.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)