Commodities Weekly Review: A bumpy start to 2024

The first weeks of a new financial year are a period that should always be treated with some caution in terms of watching for trade signals, stock direction and investment topics. Last week was no exception in this respect, especially in global stock markets, which started 2024 on the defensive, primarily due to the fact that traders patiently waited for confirmation of the sustainability of the significant gains achieved at the end of last year. A shift in focus in early November from additional interest rate increases to the prospect of lower rates in 2024 signaled by a number of central banks, led by the U.S. Federal Reserve, contributed to a significant increase in share prices at the end of the year, and the MSCI global index increased by 14,5% over the last two months.

The U.S. jobs report released on Friday, combined with generally strong data on the U.S. economy, has lowered expectations, raising doubts about the timing and depth of subsequent cuts to U.S. interest rates. Swap traders, who were previously almost certain of a March rate cut, have now lowered those expectations by about 50%, while this year's expected number of 25 basis point cuts has fallen from more than six to just under five.

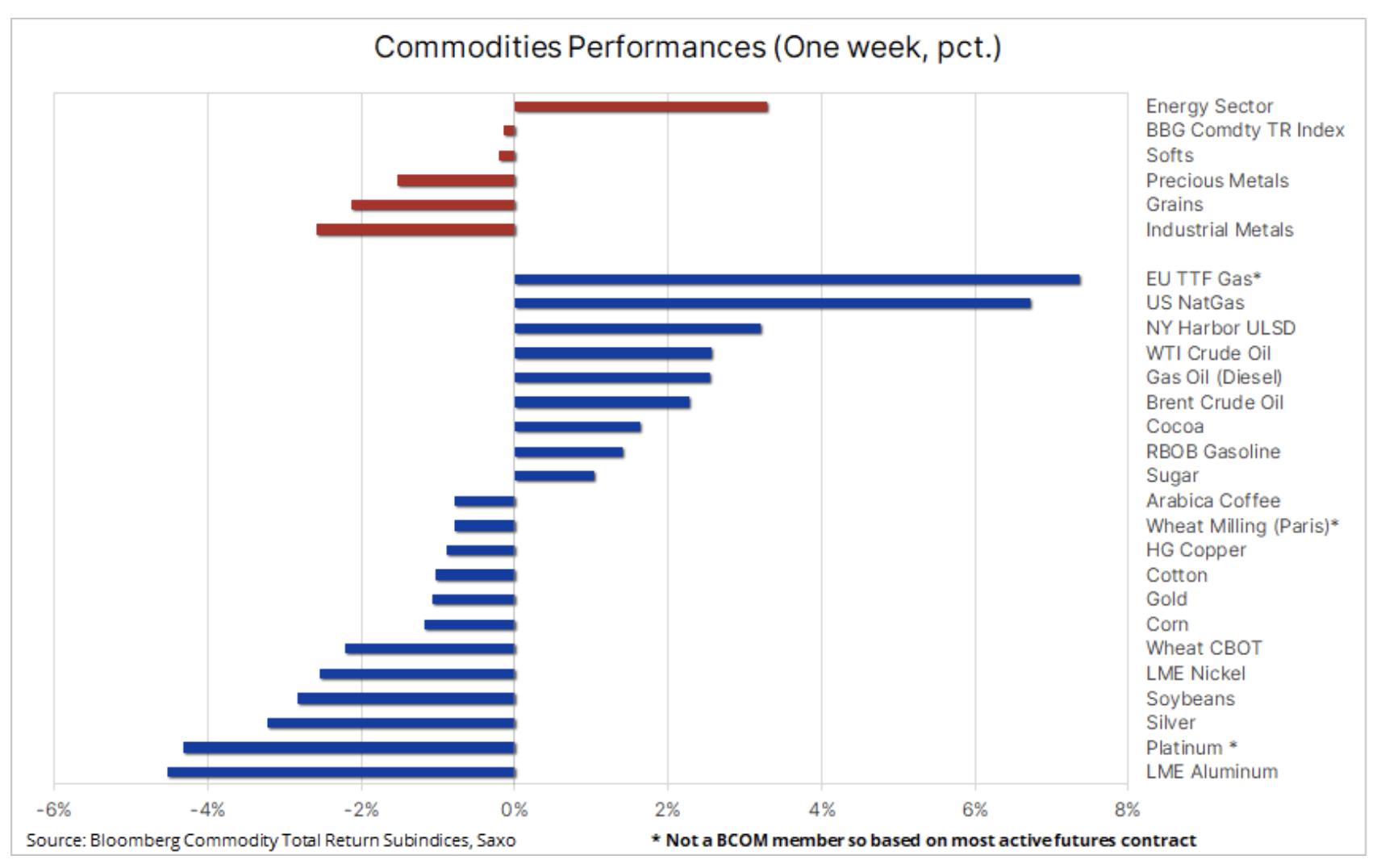

On the commodity side, the Bloomberg Commodity Total Return was almost unchanged on a weekly basis, with losses in the metals and agriculture sectors offset by gains in the energy sector. The main factor behind these changes was the above-mentioned negative impact of lower expectations regarding interest rate cuts in the United States, weak economic data from China, geopolitical risks related to the Red Sea region, as well as areas of significant cooling in the Northern Hemisphere increasing demand for gas and electricity.

High inventory levels prevent natural gas prices from rising due to the cold weather

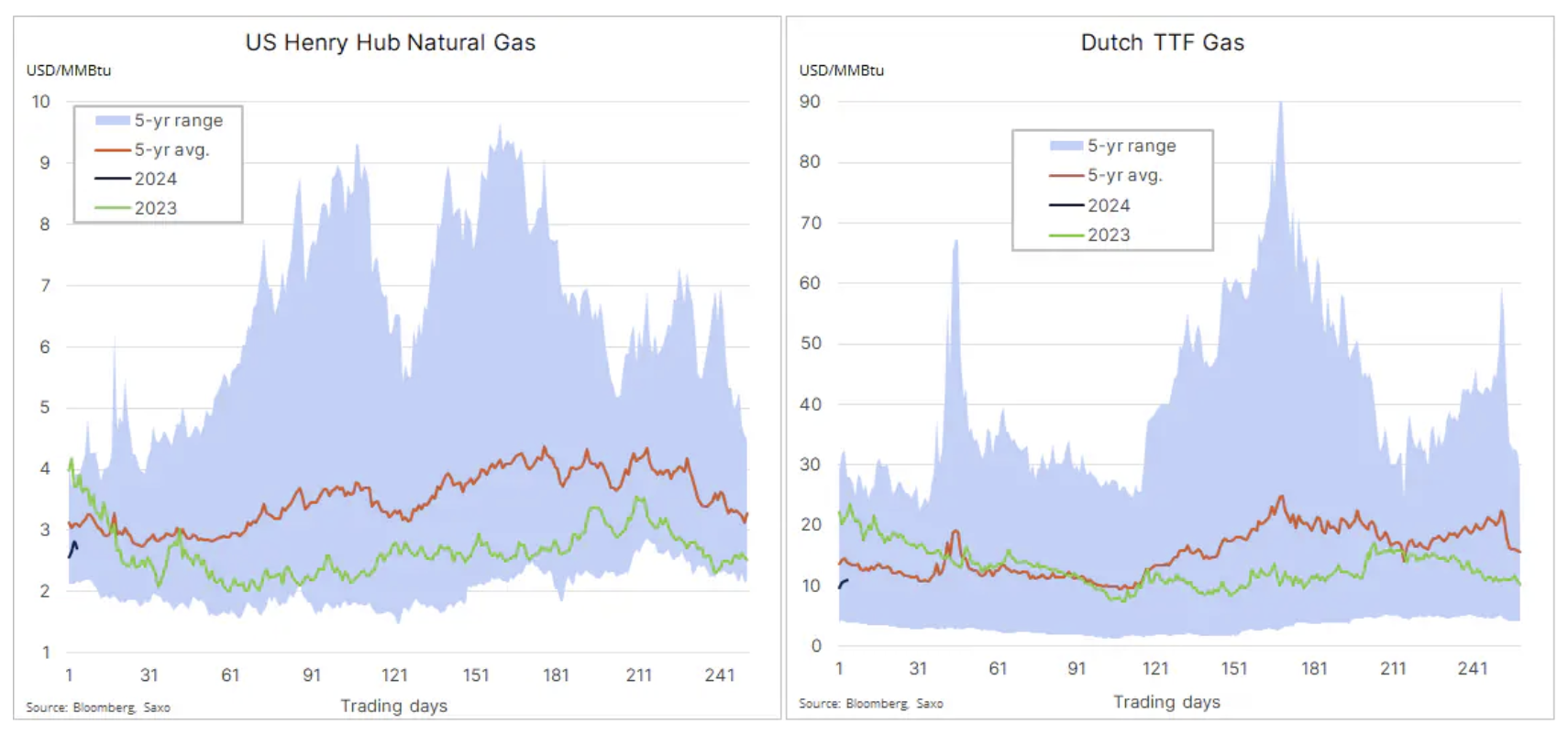

Last year's biggest losers started gaining strongly last week, and a natural gas prices worldwide have risen as strong winter demand helps offset rising inventory levels in the United States and Europe. Gas prices in the United States are up around 7% on the week, but are still more than a third down compared to the same period last year, while in Europe, futures prices for the Dutch benchmark TTF gas are down around 55% on the year to year. This follows a year in which inventories increased as a result of slowing demand, a warm autumn and the reconfiguration of supply chains in favor of LNG instead of Russian gas. EU warehouses are currently 86,5% full compared to a five-year seasonal average of around 70%. At the same time, in the United States, gas prices fell below $3 and end-2023 inventories reached their highest seasonally level since 2015, following a year of record production and lower weather-related demand, and despite rising exports.

Gold sees weekly loss

For gold 2024 started relatively calmly, with a decline of around 1,5% in the week of the release of Friday's report containing solid data on the US economy, causing bond yields to rise and lower expectations for cuts in US interest rates. In addition, fluctuations in geopolitical risk related to tensions in the Red Sea region have contributed to increased interest in gold; silver has lagged due to the decline in industrial metal prices due to the situation in China. At one point last week, the gold/silver ratio reached its March high of above 89 (ounces of silver to one ounce of gold). Generally, silver is trading around the middle of the four-dollar range between $21,4 and $25,4.

After surprisingly good results in 2023, when gold rose in price by 13%, in 2024 we predict further strengthening of the yellow metal, and with it silver, as a result of the impact of three factors: following the momentum by hedge funds, further purchases of the precious metal at a record pace by central banks, as well as fresh demand from investors ETF, such as asset managers who have been absent from the market for almost two years due to rising real yields and asset holding costs. With the US Federal Reserve leaning towards rate cuts, we anticipate that trying to guess the number of these cuts will be a major factor in the volatility in the coming months, with the current level of expected cuts warranting a soft landing, while a hard landing or recession would mean an even greater need for cuts Stop.

We see the possibility of gold reaching a new all-time high of $2, while silver, finding additional support from the expected increase in the copper price, could move towards the 300 high of $2021, signaling a decline in the gold/silver ratio back to ten-year average below 30.

Crude oil: a quarter within range ahead

In the last analysis market situation oil We found that Brent is likely to remain range-bound around $80 in the coming quarter as concerns over non-OPEC+ supply and global economic growth offset production cuts, tensions in the Middle East and another increase in global demand, albeit at a slower pace than last year. The OPEC+ group of producers will continue to support prices by extending and potentially deepening existing production cuts. They are thus giving up market share while increasing the level of available production reserves. The timing of the first and subsequent interest rate cuts in the United States will increase market volatility due to speculative investors focused on macroeconomic conditions.

Hedge funds started 2024 cautiously.

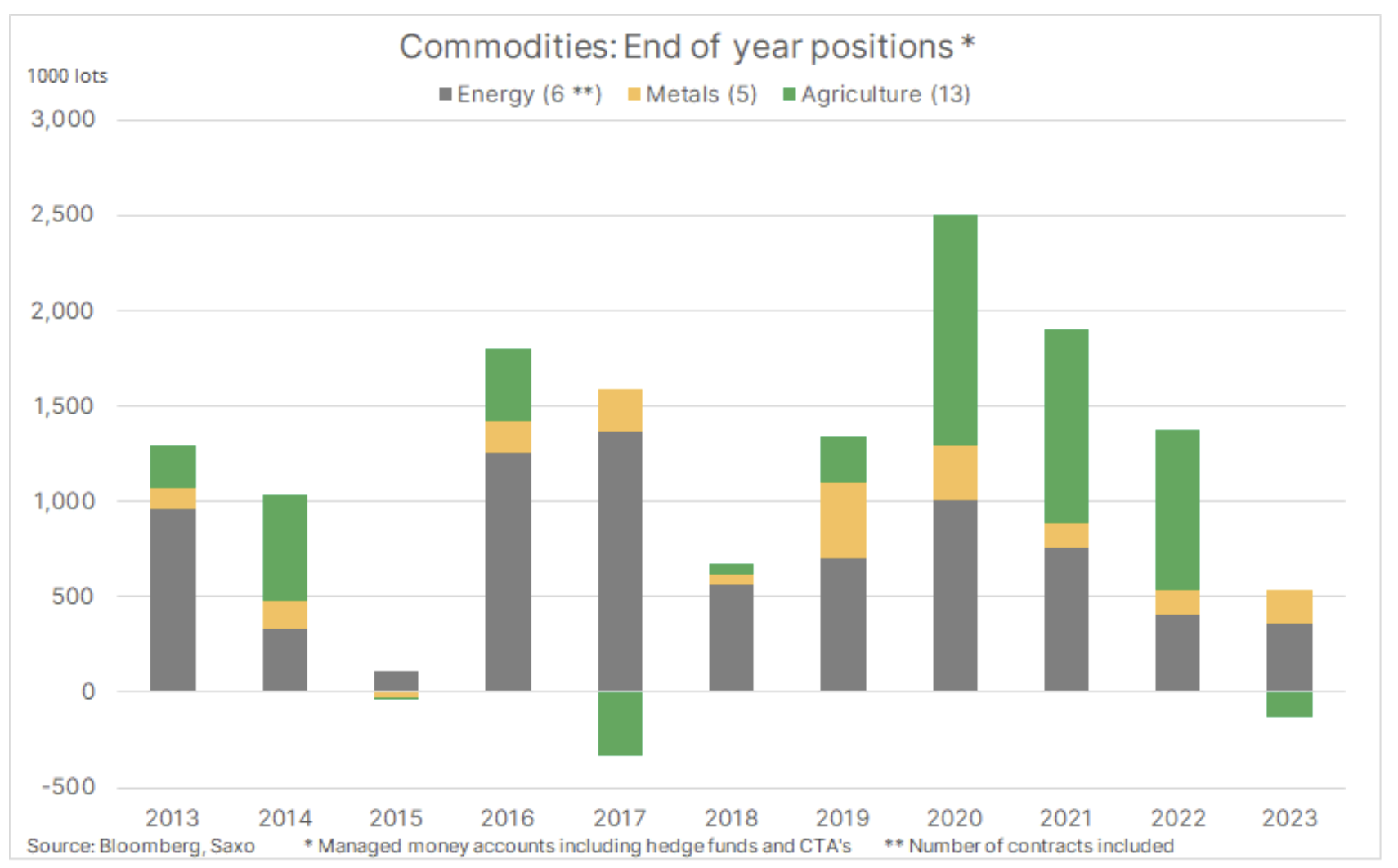

Over the past two years, the Bloomberg Commodity Total Return Index, which tracks the performance of 24 major commodity futures contracts, spread almost evenly between energy, metals and agricultural products, generated a return of 2021% in 27. and in 2022, 16%. Therefore, the assumption that the index return would be around 8% was quite reasonable given the past year's challenges. It should be noted that if American natural gas were excluded from this index, the price of which dropped by as much as 67%, its annual result would remain almost unchanged.

As a result of this decline, there was a wave of selling by hedge funds and trend-following funds (CTAs) in the period from October to early December. As a result, the net long position in 24 of the most important commodity futures contracts fell to levels last seen during the most turbulent period of the pandemic in the beginning of 2020, when there was a decline in global demand for raw materials, primarily fuels. Although the Red Sea crisis in early December boosted oil demand, the total net long position ended the year at its lowest level since 2015.

In the context of these developments, we see an asset class that has been declining in popularity, having struggled over the past year as concerns about economic growth in China and around the world and a sharp increase in financing costs prompted the industrial sector to reduce excess inventories. We also see a sector that, under favorable circumstances, could see a strong recovery in 2024 when technical and/or fundamental outlooks become more favorable, leading to a new wave of short buying and covering. Factors that could trigger such a change could include cuts in interest rates that lower financing costs and therefore contagion, which will result in replenishment of inventories in the industrial sector, tight control of oil supply by OPEC, as well as signs of reduction in the supply of key raw materials, offsetting the risk of economic slowdown in the world's largest economies.

As of December 26, money managers had a net long position of 409 contracts covering 000 major commodity futures contracts, divided into energy (24), metals (356) and agricultural products (-179). In the case of 126 contracts, positions were long, while the remaining 15 net short positions concerned mainly contracts for agricultural products, primarily grain. The largest long positions based on dollar notional value included gold ($9 billion), crude oil ($28 billion), RBOB gasoline ($25,6 billion) and arabica coffee ($2,9 billion), while the largest short positions concerned corn (-4,3 billion USD), wheat (-$1,9 billion) and natural gas (-$1,7 billion).

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response