Energy and metals prices fall after rising in early April

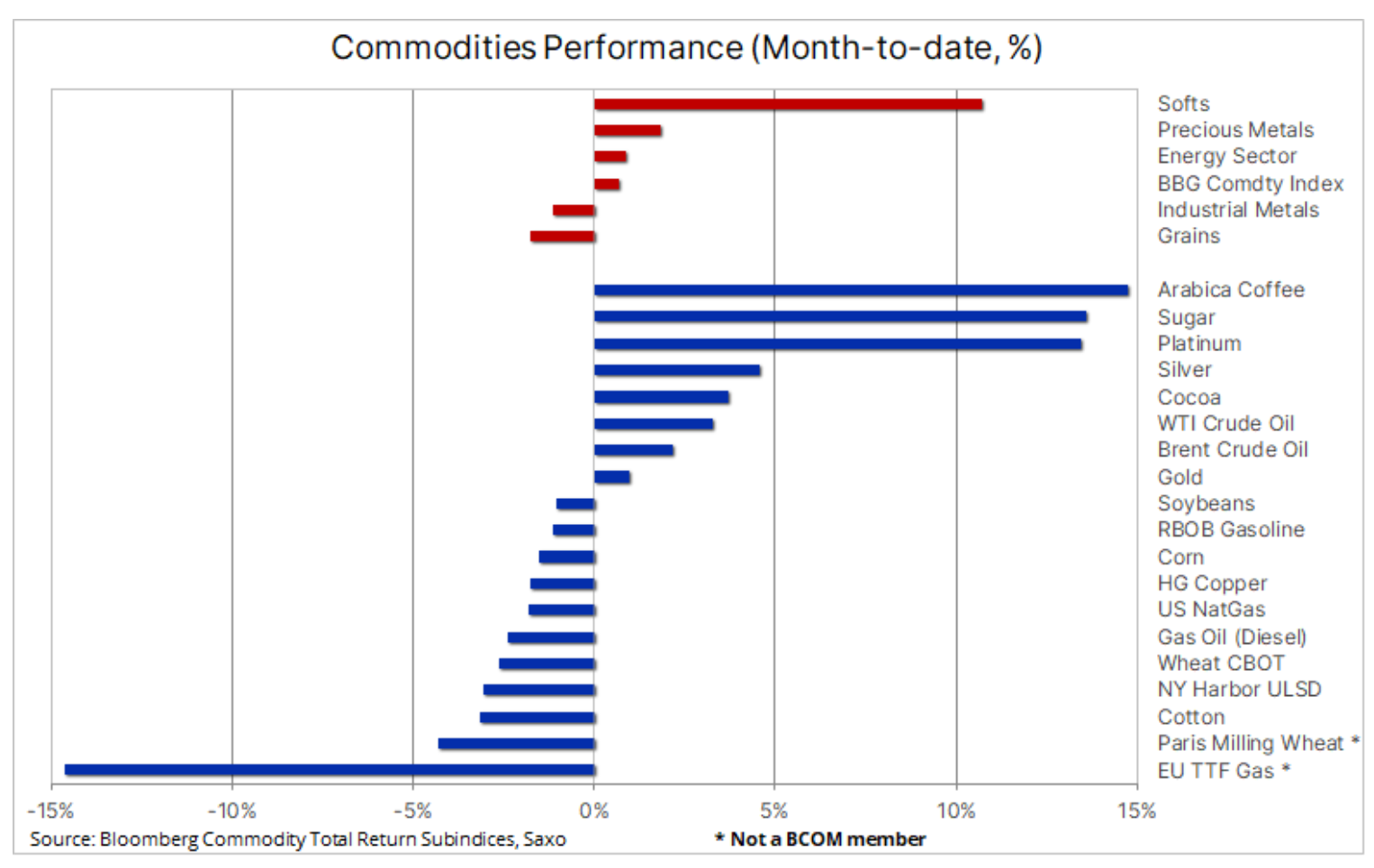

After a strong start to the month - thanks to an OPEC+ output cut supporting energy prices and lower US interest rate expectations favorable to precious metals - the commodity sector is drifting lower in response to lingering fears that economic weakness in the US and Europe could offset the positive impact of the recovery in China. Bloomberg's Bloomberg Commodity Total Return Index, which is followed by a number of key publicly traded funds and which tracks the 24 most important commodity futures, spread evenly across energy, metals and agricultural products, has held near highs this month remained unchanged and went down by 5% over the year.

In addition to the now fading gains in precious metals and energy, the index's gains were supported by a good month in soft commodity markets, led by coffee i sugar. Both of these products surged in response to supply concerns from major Asian and South American producers. Raw sugar futures traded on the New York Stock Exchange are near an 25-year high above XNUMX cents a pound after poor harvests in India and Thailand, the two top exporters of the commodity, pushed global stocks to their lowest level in a decade.

Oil prices are falling, and falling refining margins are causing concerns in the market

Petroleum posted its biggest weekly loss since last month's banking chaos-driven sell-off, while offsetting most of the gains made after OPEC+ announced production cuts on April 2. The renewed fall in prices is the result of poor economic data from the United States and lower margins on gasoline and diesel fuel, indicating a deterioration in fundamentals. This forced traders to cut long open positions after the production cut announcement, most of which were around $84,50 for oil Brent and $80 for oil WTI.

Technical sell-offs from traders seeking to close gaps after a much higher open on April 3rd - $80 Brent and $75,70 WTI - also contributed to the weakness. The big question now is whether these levels, if achieved, can be sustained, as otherwise it could trigger an additional, short-term, momentum selling wave and thus potentially force additional defensive action by OPEC.

In general terms, the last few months have been extremely difficult for traders – the market was affected by the banking crisis, then by OPEC+ production cuts, and now by constant fears about the risk of recession and its impact on demand. These concerns are evident today in the refined market, where margins have come under pressure in all key regions. The largest decreases concern diesel fuelthat powers heavy machinery such as trucks and construction equipment. Lower refining margins during the peak demand season may lead to lower refining demand and, consequently, lower demand for crude oil.

Saxo maintains its view that Brent will continue to hover around $80 in the foreseeable future in anticipation of expected, albeit lower, second-half demand growth as projected OPEC, IEA and EIA, repeated many times in recent reports on the oil market. This could drive up prices and deepen the supply deficit starting in the second half of 2023. However, the demand recovery is still very uneven, with China and the recovery in the airline industry accounting for the largest part of the expected increase.

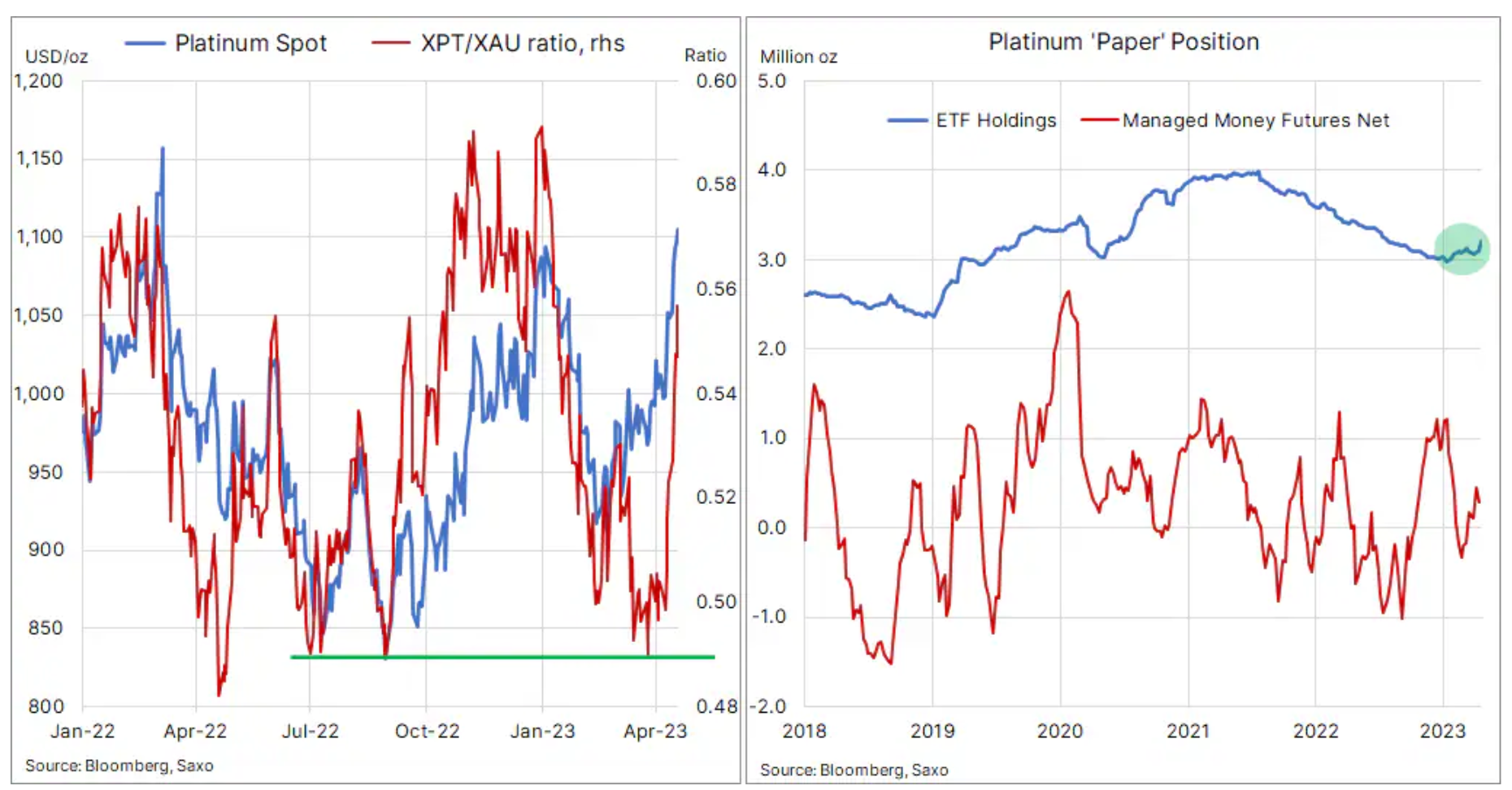

A strong increase in the price of platinum reduces the discount to gold by more than $140

The metal that recorded the best results in the last phase of the correction was platinum, used in catalysts, in green technologies based on hydrogen, in the jewelry industry and for investment purposes. Over the past month, and in particular last week, platinum has narrowed the gap to gold by over $140; Friday's break above the current support (so far resistance) level, i.e. USD 1 per ounce, contributed to this strengthening. From an investment perspective, traders often monitor the relationship between these metals to gauge their relative value. Last month, the platinum-to-gold ratio fell to the support level (100), a level where the relative strength of platinum has shown itself three times in the last year; then this ratio increased to the current level (0,49), as a result of which the price of platinum exceeded the price of gold by 0,555%.

During last week's gold price correction, the platinum price remained supported due to supply concerns from South Africa - a country facing frequent power outages - and from Russia. In addition, the World Platinum Investment Council has highlighted that the amount of white metal held by investors and speculators is extremely low. Gold has attracted speculative investors during the recent surge in prices, buying 11 gold in the five-week period ending April 114. lots, while platinum traders bought just 9. lots, as a result of which the net short position turned into a small net long position of PLN 5,6 thousand. flights.

Additional strength will be determined by platinum's ability to stay above $1 and continue to attract investors through exchange-traded funds, which have seen their biggest gains in three years.

Gas price in the EU near the minimum of the cycle due to weak demand and large LNG supplies

European benchmark price gas contract is near the cycle low of EUR 40/MWh (USD 13/MMBtu) due to weak demand and storage capacity at 57%, 20% higher than usual for this time of year. LNG imports could hit record highs in the coming weeks as exports from the US continue to grow and competition from other buyers around the world remains limited. Last week, an average of 14,3 billion cubic feet of gas entered US export terminals daily, up 18,4% year-over-year. As a result, the market is wondering whether EU warehouses will be filled before September, potentially driving spot prices down even further.

So far, however, the price of gas for the winter season 2023/2024, covering the period from October to March next year, has not yet dropped significantly, still oscillating around EUR 55/MWh. This is a sign that the market is not entirely comfortable with the fall in prices, primarily due to the expected normal winter, which would generate more demand than the last one.

Copper loses value amid concerns about economic growth

There are further publications of quarterly results of mining companies, emphasizing that the global reduction of supply on the copper market will continue in the period of further increase in consumption this metal, and the green energy transition is driving demand from the electric vehicle industry, renewable energy generation, as well as energy storage and transmission. BHP showed a 12% increase in production in the nine-month reporting period, while maintaining production forecasts for this year at an unchanged level. Rio Tinto lowered its copper production forecast due to technical problems at two mines, and the Chilean mining giant copper, Codelco, said that production in the first quarter will be lower than the annual forecast and expects production to remain at a similar level throughout next year.

Despite expectations that long-term supply will not be able to keep up with demand as the aforementioned green energy transition gains momentum, the short-term outlook for copper points to the price continuing to stay within the range as supporting factors are offset by recession concerns following the release of worse than predicted by economic data last week. As a result, the prices of High Grade and LME copper futures fell and HGc1 returned to the middle of the current $3,8-4,2 range.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)