The raw material price correction may end soon

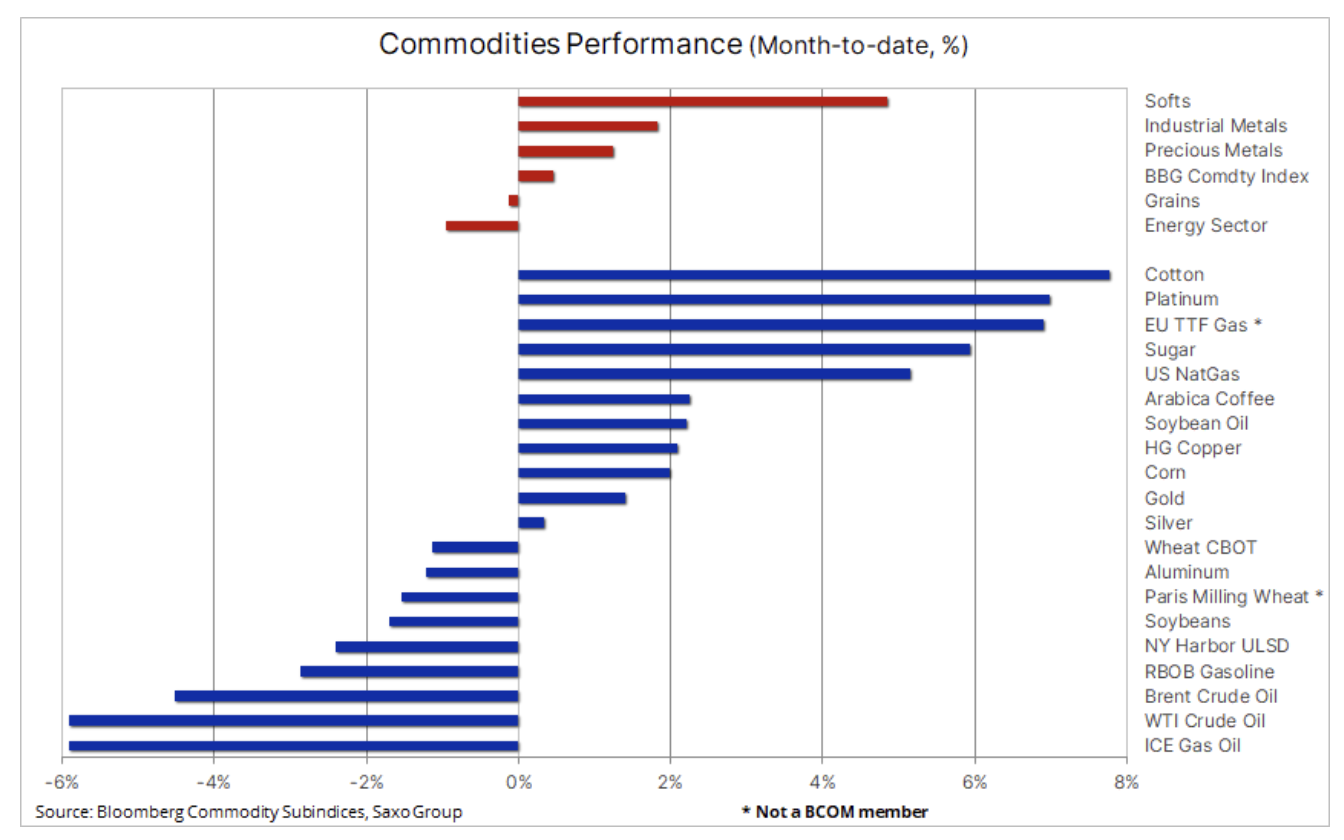

The correction, which started in March for some commodities, has increasingly shown signs of reversal since late July, fueled by recent solid economic data, a weak dollar and signals that inflation may have already peaked. With the overall position adjustments now over, investors are once again focusing on supply, which remains constrained in many cases, thus providing continued support, in particular in the energy and key agricultural products sectors.

According to the Bloomberg commodity indexes, industrial metals fell by 41%, cereals by 31% and energy by 27% during the correction period. The main reason for this dramatic correction after a record series of strong gains was shifting market focus from limited supply to concerns about demand.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Aside from the projected economic slowdown in China due to its 'zero Covid' policy and the housing crisis that struck industrial metals, the most important factor was how central banks around the world made efforts to contain galloping inflation by forcing a decline in economic activity by aggressive monetary tightening. The process is underway, but recent solid economic data, the weakening of the dollar and signs that inflation may have already peaked, supported markets after weeks and in some cases months of strong price declines that were associated with aggressive long position closings by traders as well as the wave of sales initiated by macroeconomic funds seeking protection against the economic downturn.

With the overall position adjustments now over, investors are once again focusing on supply, which remains constrained in many cases, thus providing further support, but also causing problems for sellers looking for even lower prices in anticipation of a recession and decline in demand.

The deportation remains high despite concerns about economic growth

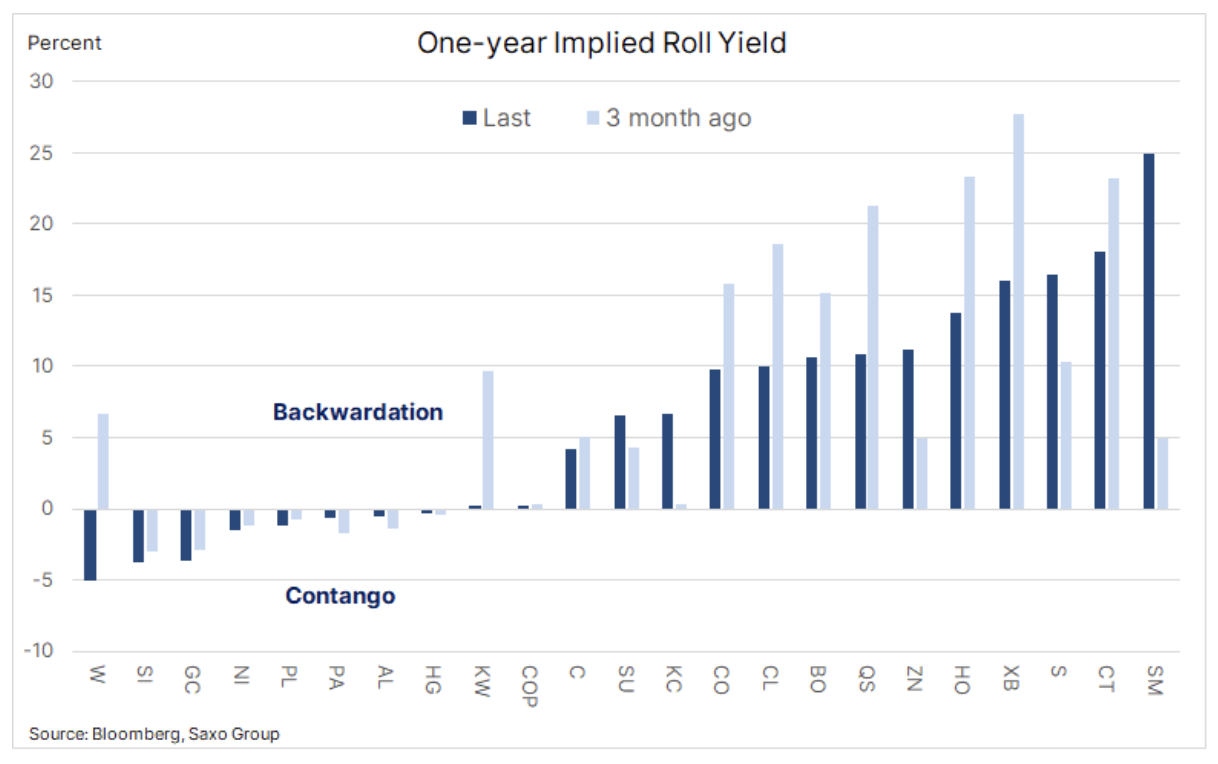

Changes in the immediate (spot) prices of raw materials, observed on the basis of futures contracts with the nearest expiry date, rarely give us a full picture of the fundamentals, because price action is often determined by speculative investors driven by technical prices and funds focusing on macroeconomic events, as opposed to the individual situation fundamental. As a result, there was a period of aggressive selling, in part due to a reduction in the bulls' position, but also due to increased sales from funds seeking hedge against an economic downturn.

An economic slowdown or, at worst, a recession would normally result in a surplus of raw materials as demand weakens and production lags behind the decline in demand. However, in the last three months of sales, the cost of raw materials with immediate delivery showed a healthy premium over the price of raw materials for later delivery. The chart below shows the percentage spread between the price of the futures contract with the nearest expiry date and the price of the XNUMX-month forward contract, and while supply has increased slightly, it is still small for most commodities, particularly in the energy and agricultural products sectors. This is a signal that the sell-off in the market was based more on expectations than on reality, which may indicate the possibility of a strong recovery once the forecasts for economic growth stabilize.

Petroleum

Downward trend with respect to WTI and Brent crude oil prices it has shown signs of reversal over the past few months as the market adjusts its outlook for demand amid further concerns about supply and who will be able to meet future demand. The rebound from below USD 95 for Brent crude oil and USD 90 for WTI oil this week was driven by signs of easing inflation in the US, lowering the potential peak of Fed funds rates and thus improving the outlook for economic growth. Weaker dollar and increasing demand were also important factors, particularly in the United States, where gasoline prices at stations fell below $ 4 a gallon for the first time since March.

also International Energy Agency (IEA) raised its estimates of global consumption by 380 kb / d, arguing that dynamically rising gas prices coupled with high electricity demand prompted utility companies to switch from expensive gas to fuel products. Simultaneously OPEC may find it difficult to increase production in the coming months due to limited production reserves. While there have been niches of weaker demand in recent months, we do not expect them to have a significant impact on our broadly upward trend. Supply-side uncertainty remains too great to ignore, particularly given the looming deadline for the release of oil from US strategic reserves and the imposition of an EU embargo on Russian oil. With this in mind, we maintain our forecast for the third quarter (USD 95-115).

Gold (XAU / USD)

After the recent siege gold saw an increase for the fourth consecutive week, supported by a weaker dollar after lower-than-expected US CPI and PPI readings contributed to lower expectations of a potential ceiling for rate hikes by Fed. However, the growing risk appetite, visible in the form of dynamically rising stock prices and bond yields on a weekly basis, has so far not allowed for a decisive attack on the key resistance level above $ 1 / oz, and the recent reduction of fund positions and the low total number of open futures contracts on COMEX points out that the market is looking for a new, decisive impulse. In our opinion, this new market optimism regarding the degree of effective containment of inflation remains overly optimistic, and in the light of numerous concerns about the geopolitical situation, we see no reason to deviate from our long-held constructive view of gold as a hedge and instrument of diversification.

Gold found support on the 1-day moving average line ($ 783); to avoid another round of liquidation of long positions in the short term, it needs to stay at $ 1. While some resistance is slightly above $ 760, gold needs to break significantly above $ 1 to gain the momentum to attract new buyers to futures in the form of exchange funds and cash management.

Industrial metals (copper)

Since its fall in July to its lowest level in 20 months copper it rebounded by around 18%, thus supporting the overall recovery in the overall industrial metals sector, which was hit hardest by the recent correction. Additional support was provided by the weakening of the dollar, data confirming the strength of the US economy, declining concerns about the forecasted demand in China, and last but not least, production disruptions in Asia, Europe and South America, potentially limiting supply as stocks monitored by stock exchanges remain at their lowest level in a decade. This has forced speculative investors to cut back on the recently created short positions.

There is potential to improve the outlook for demand in China, and BHP has announced that it has made a bid to acquire OZ Minerals and its assets primarily focused on nickel and copper - the latest in a series of global acquisitions to secure supplies of metals essential for the energy transition. Due to its high electrical conductivity, copper is used in every electronic device we use, from smartphones to medical equipment. It already underpins existing electricity grids and is crucial to the electrification process that will be needed in the coming years to reduce the demand for fossil fuel energy.

After a temporary recovery in copper prices in early June as China began to loosen lockdown restrictions, the rally quickly lost momentum and copper fell below key support before finally stabilizing after finding support at $ 3,14 / lb, an abolition of 61,8. 2020% from the 2022-3,70 rally line. The price has risen sharply since then, but may slow down temporarily after finding resistance in the region of USD XNUMX / lb. We maintain a long-term upside outlook for copper and lean towards a buying strategy on weakness rather than selling on a strengthening.

Agricultural commodities

The cereals sector hit a five-week high ahead of Friday's publication of the US Department of Agriculture's supply and demand report. The Bloomberg cereal index continued to rise after a 28% correction from June to July; Wheat and maize took the lead last week in response to the weakening dollar, as well as the hot and dry weather in the United States and another heatwave in Europe, which raises concerns over harvest and production. Critical heat and droughts for crops just before the upcoming harvest made investors especially eagerly awaited for a report on estimated global demand and supply in agricultural markets (WASDE, World Agricultural Supply and Demand Estimates); research indicates price support due to the prospect of lower harvests lowering expectations about the level of available stocks ahead of the coming winter.

READ: How to invest in metals and agricultural commodities? [Guide]

In the case of cotton, which rose 8% this month, investor concerns about economic growth and demand, especially in China, spilled over to the global supply problem as heatwaves in the US and China worsened production outlook. Friday's WASDE report was predicted to show that lower US production pushed closing stocks down by approximately 10% to 2,2 million bales, the lowest level in 11 years.

Arabica coffee, showing a downtrend since February, also posted a steady rise after rebounding from a key support below $ 2 / lb last month. Consistent support in the form of worries about production in South America has again materialized in the last few weeks, as the current season's harvest may turn out to be the lowest since 2014. Drought and cooling in Brazil negatively affected last season's inflorescences, and severe frosts in July 2021 - in the period of high costs of agricultural inputs, in particular fertilizers - prompted farmers to cut coffee trees. Colombia, another leading producer, also saw a reduction in harvest due to too much rainfall.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)