In key commodity markets, limited supply faces the risk of a recession

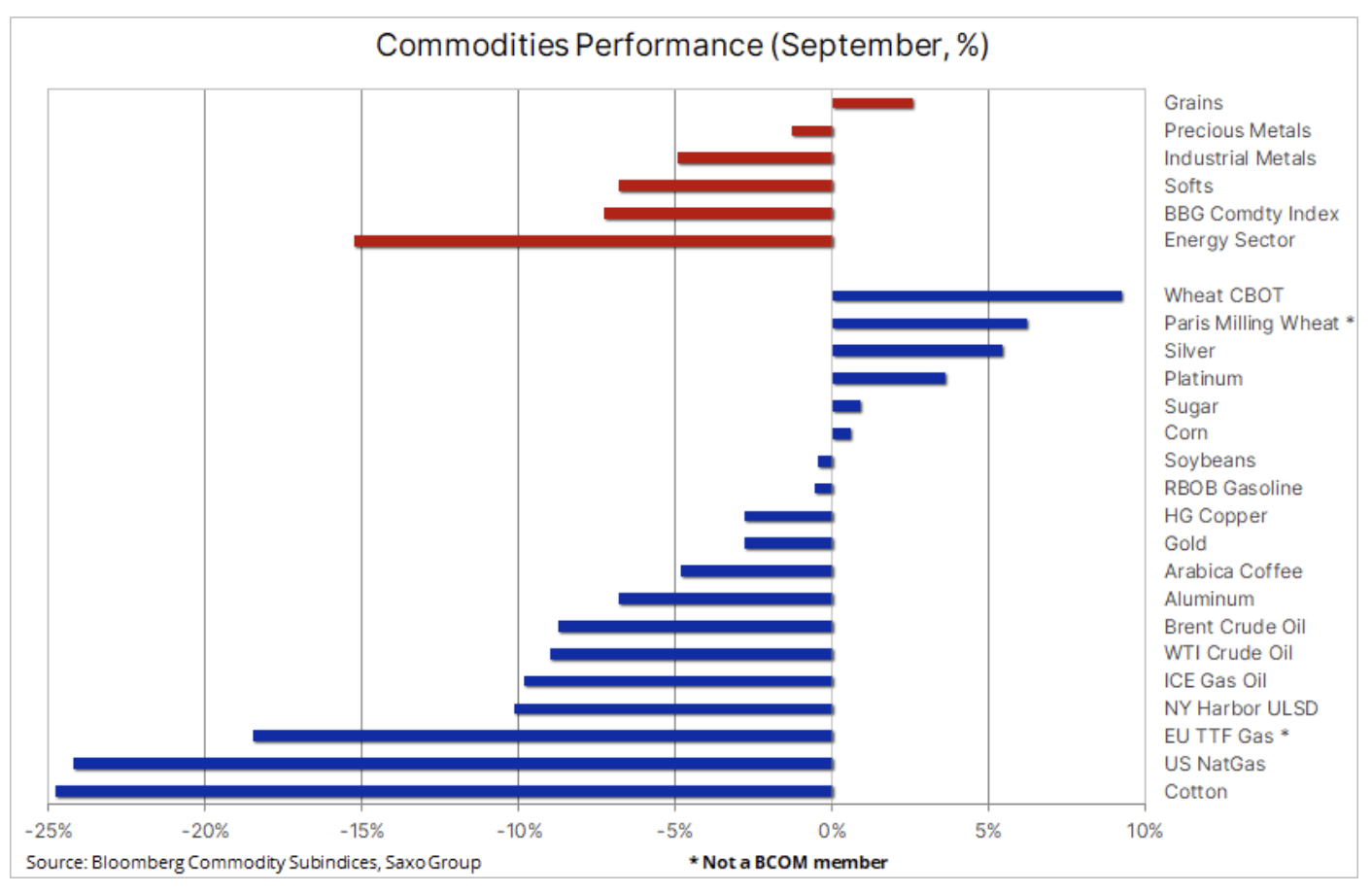

The commodities sector fell in September, with weakening driven by growth-driven sectors such as energy and industrial metals in response to worsening global growth outlook. In addition, we witnessed a month of turmoil in the financial markets driven by increasing geopolitical concerns as well as the FOMC-driven dollar strengthening and yield gains triggering financial stability concerns. However, the limited supply of a number of critical raw materials due to lack of investment, sanctions or the weather still provides some support.

The deterioration in forecasts was mainly due to China's weakness caused by protracted lockdowns and the fact that Europe is still struggling with its historic energy crisis. In addition, we witnessed a month-long turmoil in the financial markets as a result of the sharp strengthening of the dollar and the strong rise in bond sell-off yields in anticipation of further rate hikes by central banks led by the US Federal Reserve.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Fed rate hike

While the strength of the US economy and the level of inflation continue to support the aggressive policies of the US Federal Reserve, it is important to understand the impact of its actions on the global economy as several countries and regions are already experiencing a sharp slowdown. A slowdown that was in many cases accelerated by US inflation exports via its rapidly appreciating currency. This, coupled with rising US Treasury yields, further strained local currencies, creating a potential vicious circle.

With the real effective dollar exchange rate at its highest since 1986 and US government bond yields rising sharply, the impact on global bond markets is evident as yields go up and currencies depreciate, resulting in increased volatility in these countries - from Great Britain and the European Union to China and emerging markets - where rates are being raised (despite much worse local conditions).

All these events are rapidly driving us towards the pinnacle of aggressive politics Federal Reservewhen the dollar and yields plateau before plunging back down again. It is not known if something will break before FOMC will change rhetoric, but the risks to financial stability, as we saw last week in the UK, are real and could affect the outlook for a range of commodities, in particular investment metals such as gold and silver.

The commodities sector continues to signal limited supply despite a significant correction

Numerous areas of uncertainty, reflected by persistent volatility and a decline in liquidity, will continue to drive most commodity prices until the end of this year. While the signs of an impending recession are becoming more and more evident, the sector is unlikely to suffer serious damage before accelerating again in 2023. Recent FOMC actions and the associated dollar strengthening have brought the market a step closer to the hawkish peak that could be reached in 2022. the last quarter of XNUMX When this happens, the associated pounding of the dollar and US Treasury yields may alleviate some of the current market difficulties, and investors will focus again on the numerous supply problems.

Our forecast of stable and even potentially higher prices, primarily with respect to the current high price niches for key commodities across all three sectors: energy, metals and agricultural products, is based on sanctions, production cost inflation, unfavorable weather conditions, low investment appetite and the continued limited supply of many key raw materials, from diesel and gasoline to grains and industrial metals.

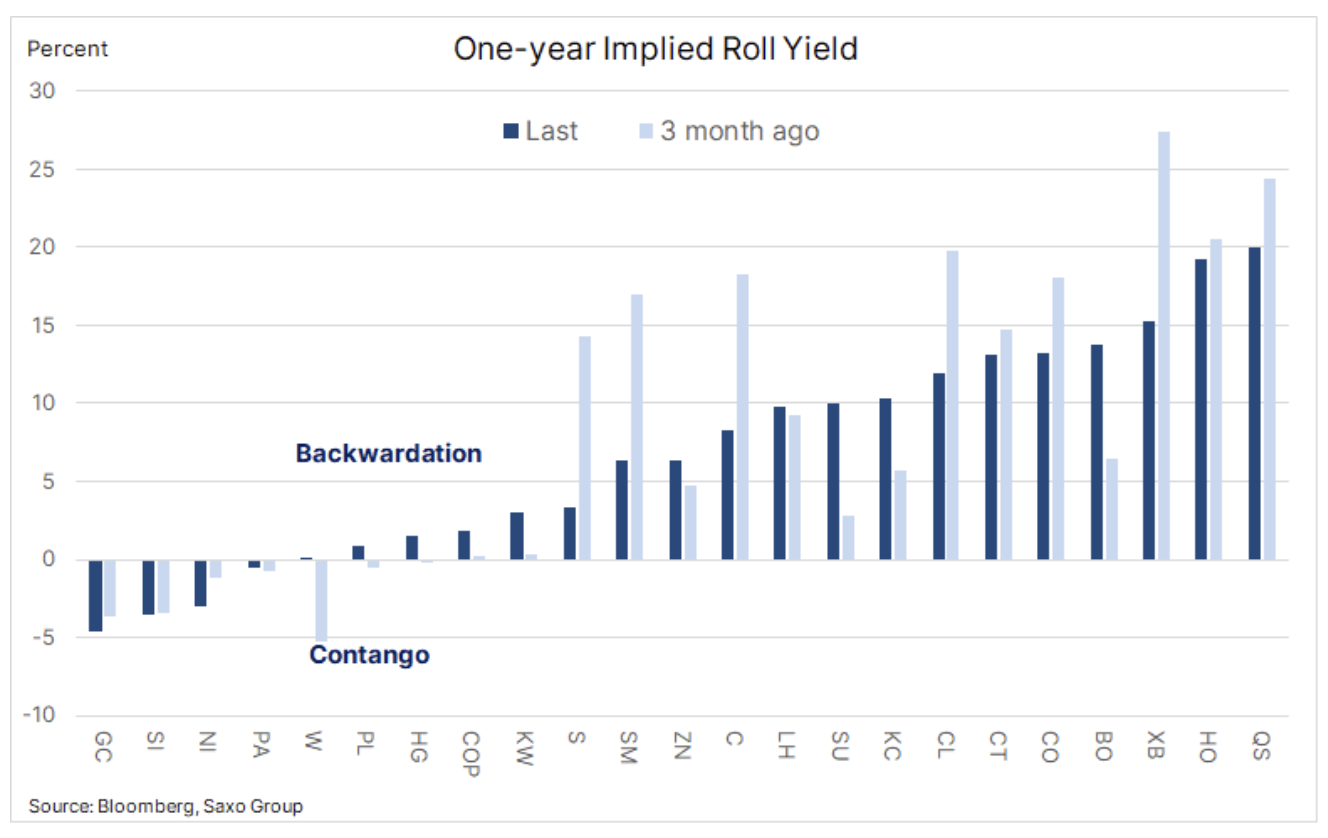

After individual commodities revised their latest peaks - from 12% for key food commodities including corn, wheat, coffee and sugar to 77% for nickel - dynamic sales fueled by concerns about economic growth and demand under normal circumstances would relax the market situation. However, given the price spread between the futures contract with the nearest expiry date and the one that expires in 12 months, we still see that most markets are still dealing with deportation - a measure of how aggressively traders bid on prices to ensure immediate execution. .

Wheat - concerns about exports from Ukraine

The grain sector grew for the second month in a row, mostly in terms of wheat listed on the Chicago and Paris stock exchanges, both of which were supported by the lingering risk of an escalation of the conflict in Ukraine that threatened the UN-backed grain export corridor through the Black Sea. Exports from Ukraine amounted to 0,9 million tonnes in August, or about 2,7 million tonnes below last year's level, and this deficit may increase even more in September - usually the busiest month for Ukrainian exports (4,6 million tonnes last year). year).

While Russia is likely to see a record wheat harvest, Ukrainian President Volodymyr Zelensky has warned that Moscow is preparing the ground to try to disrupt exports from Ukraine, the second key supplier of high-quality wheat to the world market. December's wheat contract on the Chicago Stock Exchange hit more than $ 9 a bushel on Friday, well below the peak of $ 13,63 seen just after the start of the Russian invasion, but still well above the five-year average of less than $ 6 a bushel .

Gold finds new buyers

Gold rebounded from key support at $ 1, a 618% retracement of the 50-2018 rally line, with investor attention now focusing on the critical resistance zone of $ 2020-1, which is the starting point for the last bearish move. Although the rate will continue to be set by global bond and USD yields as simultaneous indicators, the market is doing relatively well. Gold is backed by geopolitical concerns - one of which concerns Putin's nuclear threat - and investors increasingly concerned about the hawkish actions of the FOMC and how it could break the currency and bond markets. Speculative investors hold a rare net short position in COMEX gold futures, and any further appreciation will cover the short, while aggregate equity fund holdings have fallen to their 680-month low, a level at which it could there will be fresh demand as soon as the technical and / or fundamental forecasts become more optimistic.

Aluminum is gaining ground on the wave of concerns about supplies from Russia

Meanwhile, silver has found relative support in the form of a booming industrial metals sector. This started with a record price increase aluminum material in one session after the publication of the report that mentioned that London Metal Exchange considers whether and under what circumstances it may prohibit the clearing of the Russian metal through the stock exchange. The sudden jump - which was also followed to some extent by zinc, nickel and copper - pulled the sector out of the three-month low. Any such move by the LME to block supplies from Russia could have significant repercussions on world metals markets given their importance, including China as an important supplier.

After much of the rebound from July to August has been eliminated copper HG managed to re-establish some support in the region of $ 3,25 per pound. However, at this stage, the prospect of a stronger recovery depends on the effective breaking of the resistance at $ 3,52 per pound and then $ 3,70 per pound.

The results in the oil market are starting to hesitate

Petroleum it was heading for the first (albeit small) weekly increase in five weeks, but also the first quarterly decline since Q2020 1. The market remains at the mercy of forces pulling prices in opposite directions. While the strong dollar, soaring yields and sustained lockdowns in major Chinese cities have raised demand concerns, supply risks remain a supportive topic. The market started to focus on this aspect again last week, when OPEC + announced that a planned meeting with Russia will discuss the demand for Moscow's XNUMX million barrels / day cut - a reduction that is likely to contribute little, as they are already producing below the target limit. In addition, sanctions against Russia, the impending EU embargo and discussion on the price cap, the final US suspension of oil sales from strategic reserves, and new US sanctions restricting Iran's oil exports may further reduce the downside risk.

All of this led us to believe that the crude oil market low could be hit sooner rather than later, and Brent crude would then return to a range closer to $ 95 than the current $ 85 per barrel.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)