Gold and copper in focus as strengthening continues

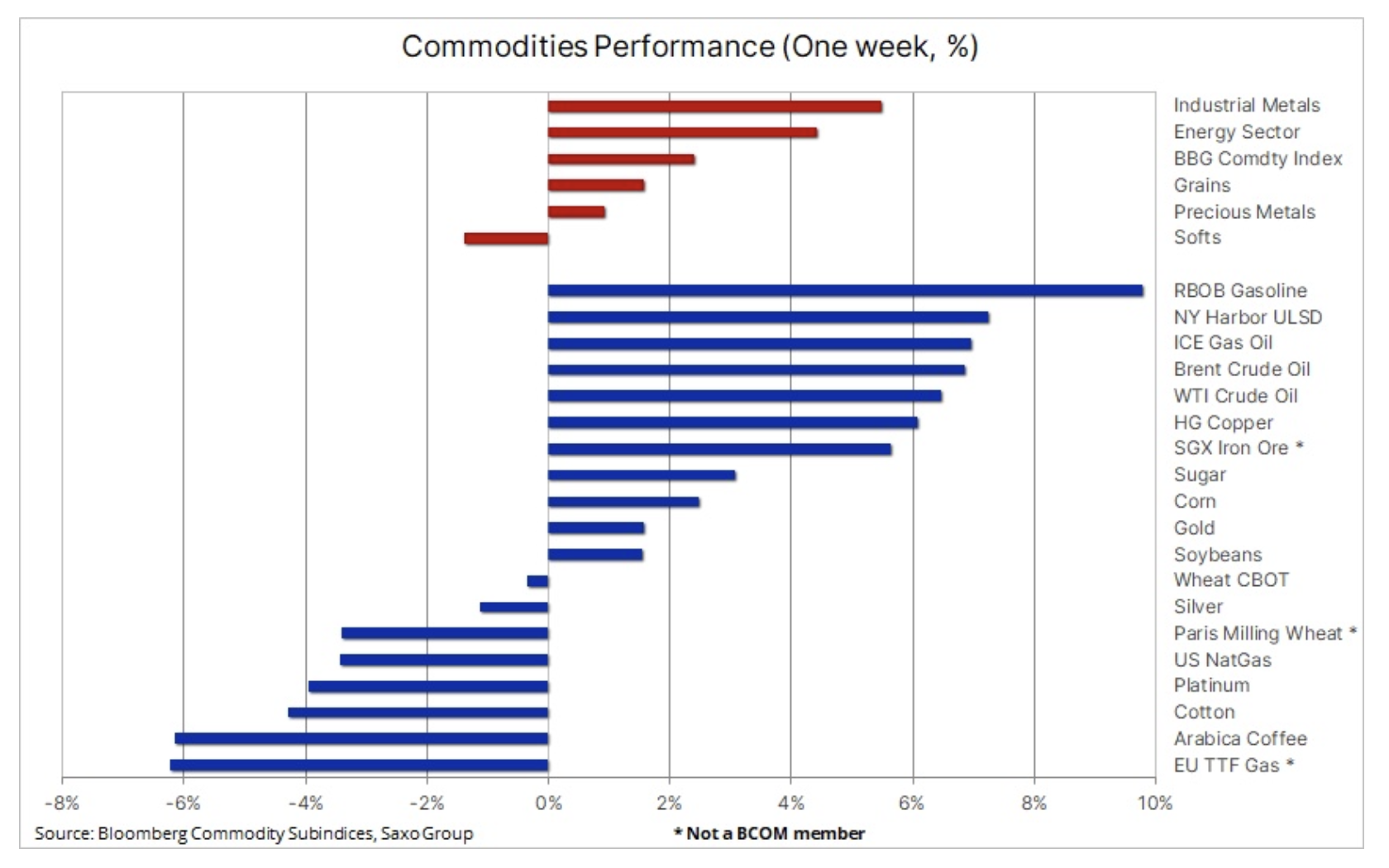

The Bloomberg Commodity Index was up 2,4% last week, making up for some of the losses seen in early January. This came after the energy sector – with the exception of natural gas – joined the ongoing bull market in metals, primarily gold and copper. The main driver of the strengthening in the commodity markets was the prospect of reopening the Chinese economy, which has boosted expectations for increased demand from the world's largest consumer of commodities. In addition, risk appetite was supported by the steady and consistent decline in the value of the dollar due to a further fall in inflation in the United States, thus contributing to another downward revision of the trajectory of interest rate hikes by Fed.

The dynamic growth observed over the past few weeks – in particular in the case of gold and copper – points us in the right direction for 2023. However, while the direction is correct as such, we believe that the date of the actual change may be slightly postponed, which increases the risk of a correction even further before final consolidation. With activity in China unlikely to pick up in earnest before Chinese New Year, which kicks off later this month, the prospect of a stagnation may be the impetus for the current rally to be halted until it picks up new momentum and strength towards the end of this quarter .

In the short term, the dollar will remain a key driver, and in addition to the Chinese renminbi and AUD strengthening as the Chinese market reopens, the Japanese yen has also seen strong gains, with the next meeting Bank of Japan January 18 may turn out to be an important event in terms of risk.

According to the latest reports and rumors, the Bank of Japan will announce further changes to its yield curve control policy. At the same time, 0,50-year Japanese bonds continue to test the upper limit of the allowed trading range of XNUMX%. Widening these spreads would allow for a further narrowing of yield spreads on (gaining) Japanese and (declining) US Treasuries, thus supporting a further strengthening of the JPY and a weakening of the dollar for commodities.

There is no doubt that inflation in the US has already peaked, thanks in part to lower commodity prices in recent months. The key question for 2023 remains the feasibility of bringing it back to around 2,5%, a level that is currently being priced in as a mid- to long-term inflation target.

Russia's attempt to suppress a sovereign nation and the Western world's response to Putin's aggression remains a depressing and still unresolved situation that continues to translate into chaos in global supply chains of key raw materials, from oil, fuels and gas to industrial metals and critical agricultural products.

The imposition of an EU embargo on Russian fuel products from next month could cause more disruption than last month's oil embargo. Europe will be forced to look for other sources of diesel and gasoline, while Russia may have a problem finding buyers for its products. With Europe increasingly showing signs of narrowly avoiding recession and Chinese demand for fuel products expected to pick up, the prospect of higher oil prices is to be expected later in the year.

Copper shows excellent results

Industrial metals kicked off 2023 on a strong note thanks to copper, which surged on hopes for a potential increase in demand from China, the world's largest consumer of the metal. The factors for this strengthening were the reopening of the Chinese economy and increased political support to strengthen the economic recovery to offset the economic consequences of President Xi's "zero Covid" policy, which failed and from which China has now firmly moved away. This optimism was also fueled by a weakening dollar amid speculation that the Federal Reserve is slowing the pace of future rate hikes as inflation forecasts remain moderate.

The publicly traded VanEck Global Mining UCITS, which includes giants like BHP, Rio Tinto, Glencore, Vale and Freeport-McMoRan, is up 10,5% so far this month, its biggest gain in nine months. 40% of Glencore, 26,7% of BHP and 11% of Rio's revenue is related to copper. In addition, iron ore futures traded on the Singapore Stock Exchange traded above $125 a tonne for the first time in six months in anticipation of a strong seasonal surge in demand following the Chinese New Year celebrations.

The initial strong rise in copper prices was mainly driven by technical and speculative investors who expected demand from China to support prices in the coming months. Once this primal move is over, the real hard work will begin – it will take an increase in physical demand to sustain the rally. Profit taking can occur during this phase, offering potential buyers another opportunity to engage.

Copper, which has surged nearly 10% this month, has traded near a seven-month high, with the most recent gain coming after crossing the 3,8350-day moving average, currently supporting $4,0850 per pound. Since then, thanks to momentum and technical investment, the HG copper contract has broken through a series of resistance lines, the most recent of which was at $50 per pound, a 2022% retracement from the 4,31 sell-off line. After a move - potentially towards $4 a pound - the metal may need to cool down, allowing it to move back down to around $XNUMX a pound.

A good streak of gold continues

Gold broke out of the range to start 2023 with strong growth as a result of the positive momentum carried over from December. This supports our view that 2023 will be friendlier to investment metals, as last year's troubles - primarily the strengthening dollar and rising yields - are starting to change direction.

In addition to the aforementioned supporting factors for gold this year, we anticipate continued strong demand from central banks providing a soft lower bound in the market. In the first three quarters of last year, the World Gold Council reported that the institutional sector purchased 673 tons of the metal, the largest amount since 1967 in full years. To this must be added the 62 tonnes purchased in November and December by the People's Bank of China. In part, this demand is driven by several central banks seeking to reduce exposure to the dollar. Such "de-dollarization" and general appetite for gold should make it another solid year for gold buying by the institutional sector.

In addition, we expect a more gold-friendly investment environment to offset last year's reduction in exchange-traded fund holdings of 120 tonnes, potentially resulting in an increase of at least 200 tonnes. However, so far, despite strong gains since November, there is no sign of a recovery in demand for exchange-traded funds, usually popular with long-term investors, and the total position is still hovering around a two-year low of 2 tonnes. Therefore, the main driver of gold prices seems to be speculative, technical buys by hedge funds, which have become net buyers since early November, when a triple bottom signaled a change in the then dominant strategy of selling gold at any sign of strengthening.

In the short term, gold is increasingly in need of a correction, and this risk is supported by a decline in physical demand and traders getting used to higher prices - among others in India, where demand fell 79% in December compared to a year ago, according to Reuters. Gold has not broken below its 1-day moving average since early November, and the jump in January widened the gap even further, but with the Relative Strength Index (RSI) signaling excessive buying, a correction towards the lower end of the channel cannot be ruled out. currently at $830.

Crude oil recovers from early January losses thanks to China

Prices oil increased strongly on the wave of optimism that there will be a strong recovery in demand for crude oil and fuel products in China. At the same time, the country is moving away from its zero-Covid policy and recession fears in the US and Europe are starting to ease – despite an IMF warning that a third of the global economy will be in recession this year. The massive increase in US stocks of 19 million barrels - the largest since February 2021 - that took place earlier in the week did not have a negative impact on prices. The higher level of inventories was to be expected given the cold spell at the end of December, which reduced exports while temporarily stopping some refineries.

Despite expectations that supply will outpace demand in this quarter, keeping price increases in a subdued position, projections for the rest of the year continue to point to price support emerging as balance sheets tighten and the impact of rising demand from China and sanctions imposed on Russian fuel products. By actively managing oil supply, OPEC+ has managed to create the impression of a soft bottom under the market, thus discouraging recession-focused potential sellers from engaging too aggressively.

In the short term, we expect the risk of WTI and Brent crude breaking out of established ranges - in the case of Brent crude it could be USD 75-90 - will be limited. However, once spring arrives in the northern hemisphere, this position will change in favor of long positions.

Soft products

so-called soft products, including coffee and cotton, the only sector to record a decrease on a weekly basis. The Arabica coffee futures got off to a bad start to the new year, falling 11% year-on-year to a 2022-month low before rebounding slightly. The reason for this is the strengthening of the Brazilian real and concerns about demand, possibly combined with an increase in supply from Brazil after a difficult XNUMX season. In reaction, inventories at ICE-monitored warehouses have more than doubled since falling to their lowest level in November many years.

Simultaneously Cotton fell back to the lower end of the established range of 80-90 cents a pound after the US Department of Agriculture (USDA) increased domestic stocks in response to an increase in production and a decrease in exports. "Major consumers, including China, India and Pakistan face challenges, including a downward trend in profit margins and yarn orders, which in turn has translated into more conservative purchases of cotton fiber, the agency said.

The Bloomberg Grain Index, which has been in a wide range for the past six months but down year-on-year - primarily due to lower wheat prices amid heavy supply from the Black Sea region - received a minor boost after the USDA released its monthly report in on supply and demand. In this report, corn and soybean prices jumped after the USDA revised downward its domestic production and available inventory forecasts for the United States, suggesting that last year's drought could provide support for prices in 2023 as well. Quarterly stocks in the United States fell to a fifteen-year low for wheat, a nine-year low for corn, and a two-year low for soybeans.

In South America, the worst drought in 60 years in Argentina also led to a downward revision of the forecast for soybean and maize production, although this is partly offset by the expected strong harvest in Brazil. The only positive aspect was wheat, for which the USDA has revised its forecasts for world production upwards - including in the US, where this year's winter wheat sowing is projected to be the largest since 2015.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response